India Brakes and Clutches Market Size, Share, Trends and Forecast by Technology, Product Type, Sales Channel, End-Use Industry, and Region, 2026-2034

India Brakes and Clutches Market Overview:

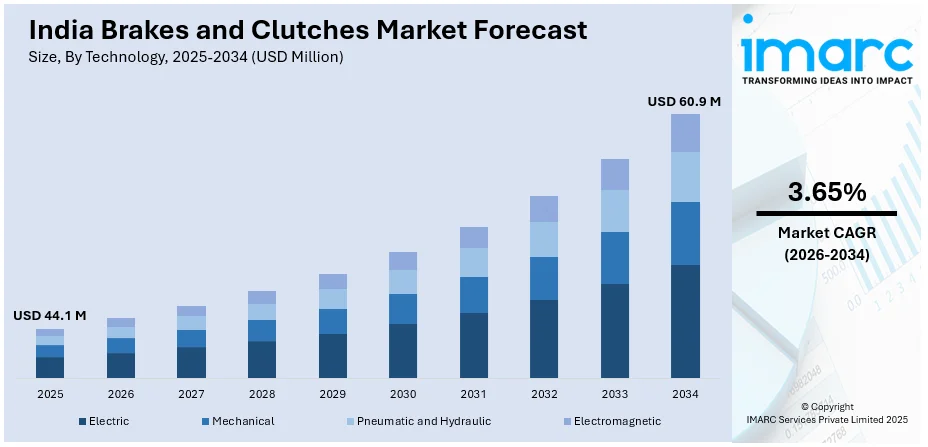

The India brakes and clutches market size reached USD 44.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 60.9 Million by 2034, exhibiting a growth rate (CAGR) of 3.65% during 2026-2034. The market is driven by rising automotive production, industrial automation, and demand for high-performance friction materials, with growth fueled by infrastructure expansion, electric vehicle (EV) adoption, and advancements in braking technologies across automotive, railway, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 44.1 Million |

| Market Forecast in 2034 | USD 60.9 Million |

| Market Growth Rate 2026-2034 | 3.65% |

India Brakes and Clutches Market Trends:

Growing Demand for High-Performance and Lightweight Materials

The India brakes and clutches market growth undergoes an important transition because of automotive technology evolution and mandatory fuel efficiency standards. Automakers select composite materials, carbon-ceramic brakes, and advanced friction materials as their choice for enhancing vehicle performance, durability, and reduced vehicle weight. In addition to this, EV penetration increases the market need for systems with regenerative braking capabilities as well as low-wear friction materials. For example, Tata Motors announced a USD 1.5 billion investment in a domestic battery manufacturing facility, aiming to enhance control over production costs and supply chains. This initiative aligns with the increasing demand for advanced braking systems compatible with EVs. Moreover, the adoption of durable heat-resistant materials now appears in industrial applications, which includes heavy machinery together with railway operations to achieve better efficiency and increased lifespan. The manufacturing industry also dedicates its resources to materials research, which develops heat-resistant and wear-resistant materials. This trend is boosting the India brakes and clutches market share, as the automotive and industrial sectors in the country are growing, supported by the sustainability and safety requirements of the government, along with rising customer demand for advanced braking and clutch systems.

To get more information on this market Request Sample

Expansion of Electric Vehicles and Regenerative Braking Systems

The fast-growing adoption of EVS in India is significantly enhancing the India brakes and clutches market outlook, driven by the rising regenerative braking system requirements. Traditional braking systems differ from regenerative braking because it enables EVs to gain kinetic energy back and helps both increase efficiency and lessen the stress on traditional friction brakes. In line with this, the growing demand for EV-specific braking systems has encouraged companies to increase their funding of brake-by-wire technology and smart braking solutions. For instance, the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme from the Indian government along with other incentives drives the integration of advanced braking technologies. According to reports, the number of public charging stations grew by 25,202 units nationwide in 2024, supporting the growing EV ecosystem. Additionally, the industrial sector of commercial vehicles explores hybrid braking components to minimize energy consumption while decreasing pollution levels. Apart from this, the growth of EV market has led manufacturers to create electronic stability control and automated braking systems for the better performance and safety of India's evolving automotive sector, thereby propelling the market forward.

India Brakes and Clutches Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on technology, product type, sales channel, and end-use industry.

Technology Insights:

- Electric

- Mechanical

- Pneumatic and Hydraulic

- Electromagnetic

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electric, mechanical, pneumatic and hydraulic, and electromagnetic.

Product Type Insights:

- Dry

- Oil Immersed

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes dry and oil immersed.

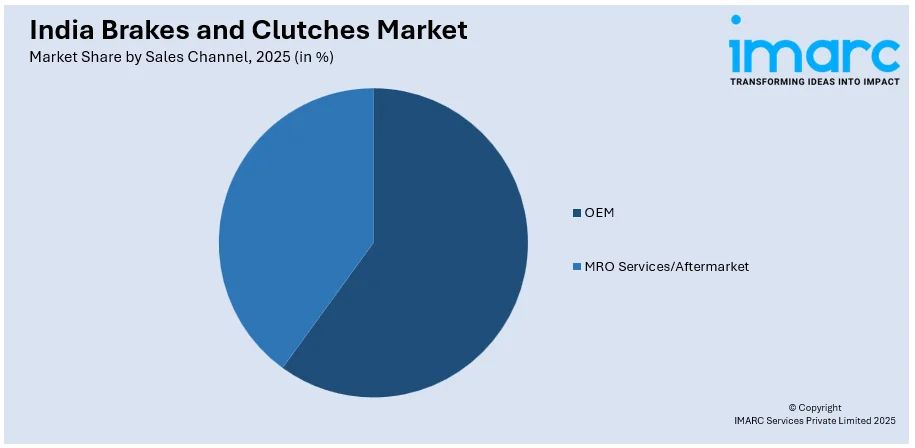

Sales Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- OEM

- MRO Services/Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and MRO services/aftermarket.

End-Use Industry Insights:

- Mining and Metallurgy Industry

- Construction Industry

- Power Generation Industry

- Industrial Production

- Commercial

- Logistics and Material Handling Industry

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes mining and metallurgy industry, construction industry, power generation industry, industrial production, commercial, and logistics and material handling industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Brakes and Clutches Market News:

- In January 2025, Advik Hi-Tech showcased advanced electric pumps and 48V ABS braking systems at the Bharat Mobility Global Expo 2025. These innovations aim to enhance performance and sustainability in electric and hybrid vehicles, aligning with India's vision for cleaner transportation.

- In June 2024, Brakes India partnered with Japan’s ADVICS, to establish a 51:49 joint venture for designing and manufacturing advanced braking systems, including ESC, for India’s light vehicle market. The collaboration involves a ₹500 crore investment in a new facility near Hosur, Tamil Nadu, expected to employ over 300 people.

India Brakes and Clutches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electric, Mechanical, Pneumatic and Hydraulic, Electromagnetic |

| Product Types Covered | Dry, Oil Immersed |

| Sales Channels Covered | OEM, MRO Services/Aftermarket |

| End-Use Industries Covered | Mining and Metallurgy Industry, Construction Industry, Power Generation Industry, Industrial Production, Commercial, Logistics and Material Handling Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India brakes and clutches market performed so far and how will it perform in the coming years?

- What is the breakup of the India brakes and clutches market on the basis of technology?

- What is the breakup of the India brakes and clutches market on the basis of product type?

- What is the breakup of the India brakes and clutches market on the basis of sales channel?

- What is the breakup of the India brakes and clutches market on the basis of end-use industry?

- What is the breakup of the India brakes and clutches market on the basis of region?

- What are the various stages in the value chain of the India brakes and clutches market?

- What are the key driving factors and challenges in the India brakes and clutches?

- What is the structure of the India brakes and clutches market and who are the key players?

- What is the degree of competition in the India brakes and clutches market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India brakes and clutches market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India brakes and clutches market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India brakes and clutches industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)