India Bread Improvers Market Size, Share, Trends and Forecast by Type, Ingredient, Application, Form, and Region, 2025-2033

India Bread Improvers Market Overview:

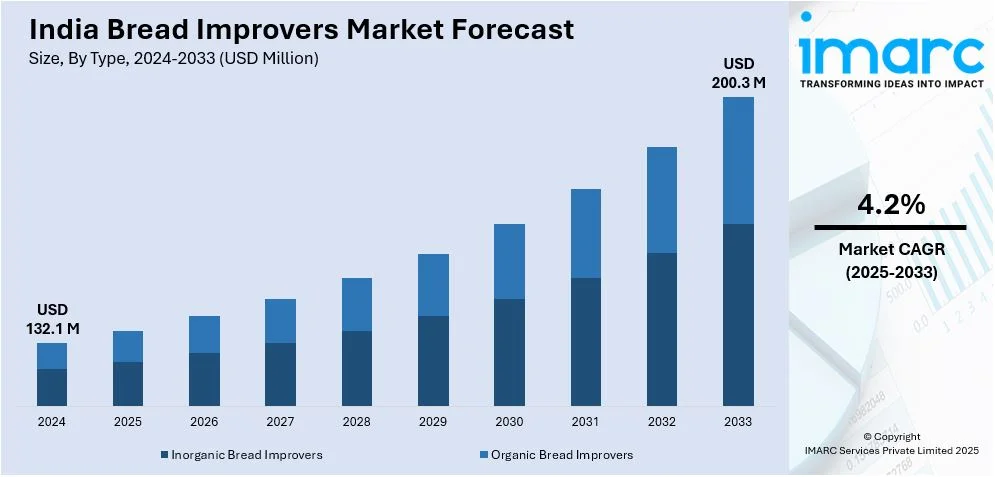

The India bread improvers market size reached USD 132.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 200.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The market share is expanding, driven by the rising usage of bread improvers in the food processing industry to achieve consistent product quality, along with the expansion of retail channels, which is enhancing the accessibility of items.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 132.1 Million |

| Market Forecast in 2033 | USD 200.3 Million |

| Market Growth Rate 2025-2033 | 4.2% |

India Bread Improvers Market Trends:

Increasing applications in food processing sector

Rising applications in the food processing sector are offering a favorable India bread improvers market outlook. As food processing companies are expanding their product lines to meet rising user demand for packaged and convenience food items, the need for bread improvers is growing. Bread improvers help enhance dough stability, refine texture, and extend shelf life, making them essential in large-scale food processing operations. Manufacturers use bread improvers to achieve consistent product quality, especially when manufacturing bread in bulk. The increasing trend of fortified bread items is also driving the demand for clean-label and enzyme-based improvers for catering to health-conscious choices. Additionally, bread improvers enable faster production cycles by enhancing dough elasticity and fermentation control, ensuring uniformity in taste and appearance. As processed food product consumption rises, food processing firms adopt bread improvers to increase manufacturing efficiency. According to the data published on the official website of the IBEF, the food processing sector in India is projected to hit USD 735.5 Billion, with a CAGR of 8.8% from 2023 to 2032.

To get more information on this market, Request Sample

Expansion of retail channels

The expansion of retail channels is impelling the India bread improvers market growth. According to the Retailers Association of India (RAI), retailers in the country noted a 5% increase in January 2025 in comparison to January 2024. Supermarkets, hypermarkets, and convenience stores are broadening their bakery sections, offering a variety of packaged bread, buns, and specialty bakery items. This rising shelf presence is encouraging manufacturers to refine product quality, shelf life, and consistency using bread improvers. Additionally, the adoption of online grocery platforms is enhancing the distribution of bakery items, creating the need for bread improvers that boost freshness during storage and transportation. Retailers are also focusing on expanding private-label bakery brands, which rely on bread improvers to maintain uniform texture, taste, and appearance across large batches. As consumer demand for premium, gluten-free, and specialty bread rises, retail channels promote innovative bakery offerings that require advanced improvers for better volume and structure. This broadening of retail networks enhances item availability, enabling bakery brands to utilize bread improvers to meet evolving consumer preferences and ensure product consistency in diverse retail environments.

India Bread Improvers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, ingredient, application, and form.

Type Insights:

- Inorganic Bread Improvers

- Organic Bread Improvers

The report has provided a detailed breakup and analysis of the market based on the types. This includes inorganic bread improvers and organic bread improvers.

Ingredient Insights:

- Emulsifiers

- Enzymes

- Oxidizing Agents

- Reducing Agents

- Others

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes emulsifiers, enzymes, oxidizing agents, reducing agents, and others.

Application Insights:

.webp)

- Bread

- Cakes

- Pastries

- Others

The report has provided a detailed breakup and analysis of the market based on the applications. This includes bread, cakes, pastries, and others.

Form Insights:

- Powder

- Granular

- Liquid

A detailed breakup and analysis of the market based on the forms have also been provided in the report. This includes powder, granular, and liquid.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bread Improvers Market News:

- In August 2024, Corbion, a well-known food and biochemicals company, purchased the bread improver division from Novotech, strengthening its strategy in the Indian market. This transaction represented a crucial move in the firm’s plan to provide functional solutions that aimed to address a wider variety of user needs and preferences. By incorporating this business into its portfolio, the company intended to offer a broader array of solutions to its customers, enhancing its market presence and ability to deliver outstanding value and diversity in India.

- In July 2023, Sterningredients India, the prominent food ingredient manufacturer, unveiled its new SIPA line, including the Indian flatbread improver for white flour. It was uniquely designed for South Indian Parotta/ Malabar Parotta. It aimed to enhance the quality, texture, workability, and stretchability of dough.

India Bread Improvers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inorganic Bread Improvers, Organic Bread Improvers |

| Ingredients Covered | Emulsifiers, Enzymes, Oxidizing Agents, Reducing Agents, Others |

| Applications Covered | Bread, Cakes, Pastries, Others |

| Forms Covered | Powder, Granular, Liquid |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bread improvers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bread improvers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bread improvers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India bread improvers market was valued at USD 132.1 Million in 2024.

The India bread improvers market is projected to exhibit a CAGR of 4.2% during 2025-2033, reaching a value of USD 200.3 Million by 2033.

The India bread improvers market is driven by growing demand for better texture, taste, and shelf life in bakery products. Rising interest in convenient and high-quality baked goods, along with evolving consumer preferences and improved baking techniques, is encouraging wider use of bread improvers across commercial and artisan bakeries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)