India Bridge Construction and Maintenance Market Size, Share, Trends and Forecast by Bridge Type, Material Used, Construction Type, Application, Maintenance Activity, and Region, 2025-2033

India Bridge Construction and Maintenance Market Overview:

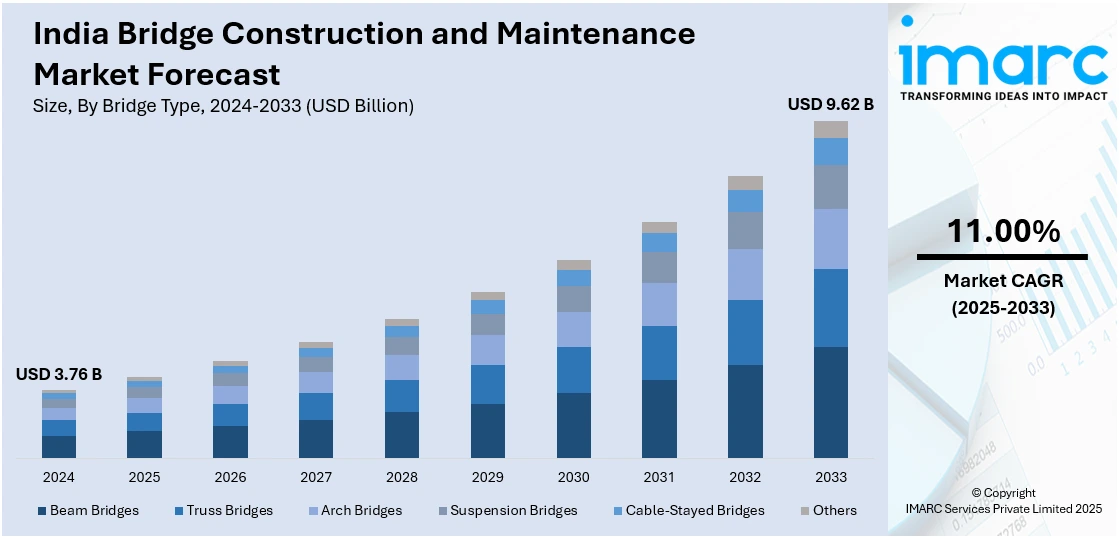

The India bridge construction and maintenance market size reached USD 3.76 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.62 Billion by 2033, exhibiting a growth rate (CAGR) of 11.00% during 2025-2033. Public infrastructure programs, integrated transport policies, and national-level expressway and port connectivity projects, along with aging structural assets, digital bridge audits, and predictive maintenance platforms, are some of the factors positively impacting the market. Adoption of remote sensing tools, strain monitoring technologies, and GIS-based inspection systems are additional factors augmenting the India bridge construction and maintenance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.76 Billion |

| Market Forecast in 2033 | USD 9.62 Billion |

| Market Growth Rate 2025-2033 | 11.00% |

India Bridge Construction and Maintenance Market Trends:

Infrastructure Investments under Government-Led Connectivity Programs

India’s central and state governments are heavily prioritizing bridge construction as part of broader transport infrastructure initiatives aimed at enhancing economic connectivity and reducing regional disparities. Programs such as Bharatmala Pariyojana, Sagarmala, and the National Infrastructure Pipeline (NIP) allocate substantial funding toward expressway linkages, rural road access, and port connectivity, each requiring robust bridge networks. These initiatives emphasize time-bound execution and quality standards, creating sustained demand for civil contractors, equipment suppliers, and engineering design services across new bridge projects. On March 22, 2025, GPT Infraprojects Limited was awarded a INR 481.11 Crore (about USD 58.5 Million) civil contract by South Eastern Railway for the construction of Bridge No. 57 over River Rupnarayan on the Howrah–Kharagpur route. The project includes the construction of the bridge, 26 spans of composite girders, elevated platforms at Kolaghat Station, and associated infrastructure such as a station building and staff quarters. The growing volume of road and rail infrastructure expansion is also driving the need for multi-modal bridge structures, including cable-stayed, cantilever, and box-girder formats suited for heavy-load transit corridors. Public-private partnerships are increasingly being used to accelerate project execution timelines, particularly in urban and border regions with complex geographies. The application of digital twin technology, GIS-based planning, and precast segmental construction methods is gaining traction for optimizing cost, quality, and project lifecycle, thereby contributing to the India bridge construction and maintenance market growth.

To get more information on this market, Request Sample

Aging Bridge Stock and Demand for Predictive Maintenance System

A significant portion of India’s bridge infrastructure, particularly on state highways and district roads, has aged beyond its design life, raising concerns about structural safety, load-bearing capacity, and lifecycle performance. Incidents of structural failure and the resulting economic disruptions have prompted government agencies to shift from reactive to proactive maintenance models. Bridge management systems (BMS) are being deployed to conduct periodic health assessments, structural audits, and risk categorization using non-destructive testing and remote sensing technologies. Asset owners and urban development authorities are increasingly investing in predictive maintenance tools that enable early detection of stress patterns, corrosion, and fatigue. Innovations in fiber-optic sensors, strain monitoring systems, and drone-based inspections are being integrated into national-level infrastructure databases for lifecycle tracking. The Ministry of Road Transport and Highways (MoRTH), through its Indian Bridge Management System (IBMS), is mandating condition surveys and inventory mapping to prioritize rehabilitation works. This digital shift is enabling data-driven planning, optimized resource allocation, and reduced downtime across critical bridge assets. On January 8, 2025, Italferr successfully completed the speed trial for the Anji Khad Cable-Stayed Bridge in Jammu & Kashmir, with trains reaching a speed of 110 km/h, confirming the bridge’s structural stability and compliance with design standards. This 473.25-meter bridge, featuring a main span of 290 meters, will be the longest cable-stayed bridge for Indian Railways, connecting tunnel T2 and T3 on the Katra-Banihal section of the Udhampur-Srinagar-Baramulla Rail Link project. Designed for a lifespan of 120 years and a maximum speed of 100 km/h, the bridge is set to enhance connectivity in the region, with commissioning expected in the coming weeks.

India Bridge Construction and Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on bridge type, material used, construction type, application, and maintenance activity.

Bridge Type Insights:

- Beam Bridges

- Truss Bridges

- Arch Bridges

- Suspension Bridges

- Cable-Stayed Bridges

- Others

The report has provided a detailed breakup and analysis of the market based on the bridge type. This includes beam bridges, truss bridges, arch bridges, suspension bridges, cable-stayed bridges, and others.

Material Used Insights:

- Concrete

- Steel

- Composite Materials

- Pre-Stressed Structures

The report has provided a detailed breakup and analysis of the market based on the material used. This includes concrete, steel, composite materials, and pre-stressed structures.

Construction Type Insights:

- New Bridge Construction

- Bridge Rehabilitation & Retrofitting

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes new bridge construction and bridge rehabilitation & retrofitting.

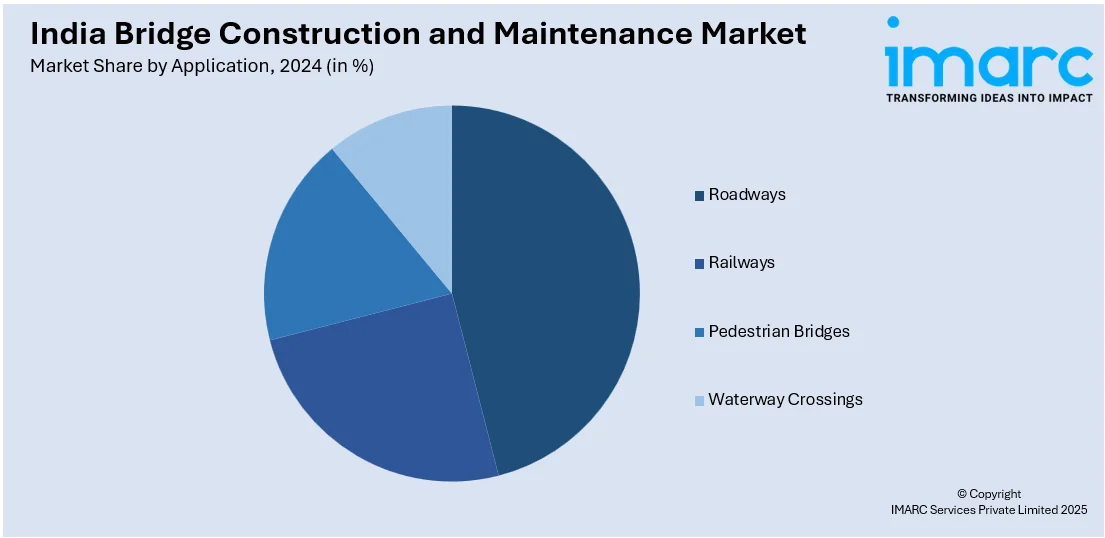

Application Insights:

- Roadways

- Railways

- Pedestrian Bridges

- Waterway Crossings

The report has provided a detailed breakup and analysis of the market based on the application. This includes roadways, railways, pedestrian bridges, and waterway crossings.

Maintenance Activity Insights:

- Structural Repairs

- Resurfacing and Coating

- Safety Enhancements

- Load Capacity Upgrades

The report has provided a detailed breakup and analysis of the market based on the maintenance activity. This includes structural repairs, resurfacing and coating, safety enhancements, and load capacity upgrades.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bridge Construction and Maintenance Market News:

- On April 6, 2025, the inauguration of the New Pamban Bridge in Tamil Nadu, India, is set to be carried out by Prime Minister Narendra Modi, marking a historic milestone in infrastructure. The 2.07-kilometer-long bridge, India’s first vertical lift sea bridge, has been completed, with a main span of 290 meters, setting a new benchmark in bridge construction in the country. The project, which has been executed by Rail Vikas Nigam Limited (RVNL), will enhance connectivity and accommodate both rail and maritime traffic, utilizing advanced engineering techniques and materials for enhanced durability and longevity.

- On April 1, 2025, the National Highways Authority of India (NHAI) closed the old Netravati Bridge on Kochi-Panvel National Highway 66 for a month to undertake its rehabilitation. During this period, two-way traffic will be permitted on the new Netravati Bridge. This development highlights the emphasis on maintaining and upgrading critical infrastructure to ensure smooth transportation and connectivity in the region.

India Bridge Construction and Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bridge Types Covered | Beam Bridges, Truss Bridges, Arch Bridges, Suspension Bridges, Cable-Stayed Bridges, Others |

| Materials Used Covered | Concrete, Steel, Composite Materials, Pre-Stressed Structures |

| Construction Types Covered | New Bridge Construction, Bridge Rehabilitation & Retrofitting |

| Applications Covered | Roadways, Railways, Pedestrian Bridges, Waterway Crossings |

| Maintenance Activities Covered | Structural Repairs, Resurfacing and Coating, Safety Enhancements, Load Capacity Upgrades |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India bridge construction and maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the India bridge construction and maintenance market on the basis of bridge type?

- What is the breakup of the India bridge construction and maintenance market on the basis of material used?

- What is the breakup of the India bridge construction and maintenance market on the basis of construction type?

- What is the breakup of the India bridge construction and maintenance market on the basis of application?

- What is the breakup of the India bridge construction and maintenance market on the basis of maintenance activity?

- What is the breakup of the India bridge construction and maintenance market on the basis of region?

- What are the various stages in the value chain of the India bridge construction and maintenance market?

- What are the key driving factors and challenges in the India bridge construction and maintenance market?

- What is the structure of the India bridge construction and maintenance market and who are the key players?

- What is the degree of competition in the India bridge construction and maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bridge construction and maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bridge construction and maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bridge construction and maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)