India Bromine Market Size, Share, Trends and Forecast by Derivative, Application, End User, and Region, 2025-2033

India Bromine Market Overview:

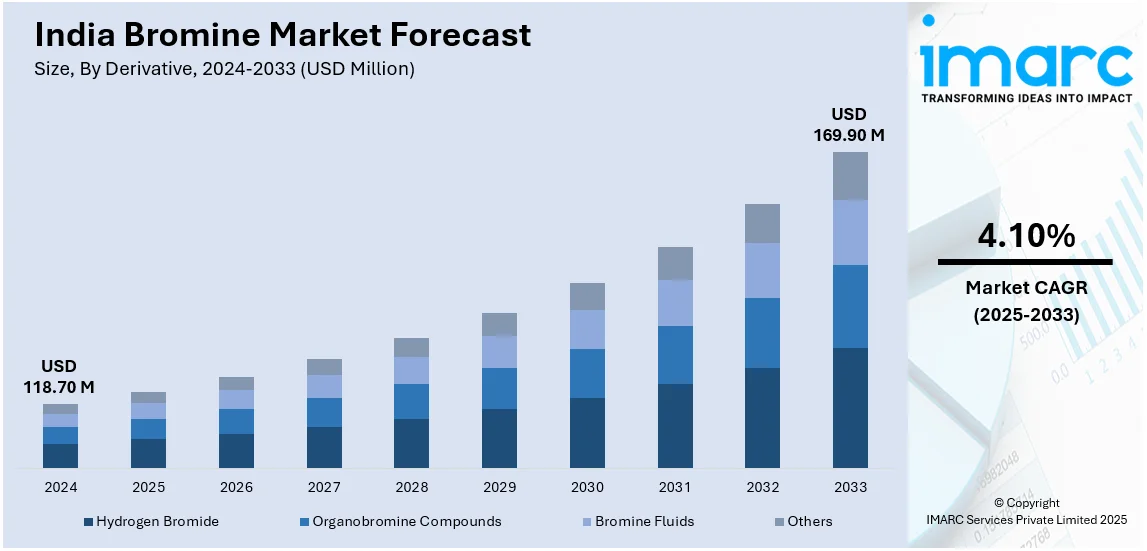

The India bromine market size reached USD 118.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 169.90 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by the increasing demand for water treatment applications, supported by government initiatives for clean water and sanitation. Additionally, the growing use of bromine-based flame retardants in construction and electronics industries, coupled with stringent fire safety regulations, further propels the India bromine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 118.70 Million |

| Market Forecast in 2033 | USD 169.90 Million |

| Market Growth Rate (2025-2033) | 4.10% |

India Bromine Market Trends:

Increasing Demand for Bromine in Water Treatment Applications

The significant rise in demand for bromine due to its extensive use in water treatment applications is majorly driving the India bromine market growth. Groundwater pollution has impacted over two million individuals in India in 2024 with the major pollutants being groundwater sources contaminated by heavy metals and arsenic. The bulk of pollution comes from the agricultural industry and the release of industrial wastewater, leading to a migration from rural areas to urban centers. As individuals become more concerned about polluted water and clean, drinkable water, bromine-based materials are more often being used as disinfectants and biocides. Bromine is particularly effective at oxidizing bacteria, algae, and other microorganisms in industrial cooling towers, swimming pools, and municipal water systems. This demand has been further fueled by the Indian government’s push for better water infrastructure and sanitation through initiatives like the Jal Jeevan Mission. The market is also propelled by the growing end-use industries like power generation, chemicals, and textiles, which require effective water treatment solutions. The increasing stringency of environmental regulations would act as a driving factor for the bromine-based products market, and there is definitely a spectrum of new opportunities in India's water treatment industry for bromine.

To get more information on this market, Request Sample

Growing Utilization of Bromine in Flame Retardants

The increasing product use in flame retardants, particularly in the construction and electronics industries is creating a positive India bromine market outlook. Brominated flame retardants (BFRs) are widely used to enhance the fire safety of materials such as plastics, textiles, and electrical components. With rapid urbanization and infrastructure development in India, the demand for flame-retardant materials in building construction has accelerated. Similarly, the booming electronics manufacturing sector, driven by initiatives including Make in India, has increased the need for bromine-based flame retardants in circuit boards and electronic devices. A research report from the IMARC Group indicates that the consumer electronics market in India was valued at USD 83.70 Billion in 2024. It is projected to grow to USD 152.59 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 6.90% from 2025 to 2033. However, the market is also facing challenges due to environmental concerns associated with certain brominated compounds, prompting manufacturers to develop eco-friendly alternatives. Despite these challenges, the flame retardant segment remains a key driver of the bromine market in India, supported by stringent fire safety regulations and the growing emphasis on consumer safety.

India Bromine Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on derivative, application, and end user.

Derivative Insights:

- Hydrogen Bromide

- Organobromine Compounds

- Bromine Fluids

- Others

The report has provided a detailed breakup and analysis of the market based on the derivative. This includes hydrogen bromide, organobromine compounds, bromine fluids, and others.

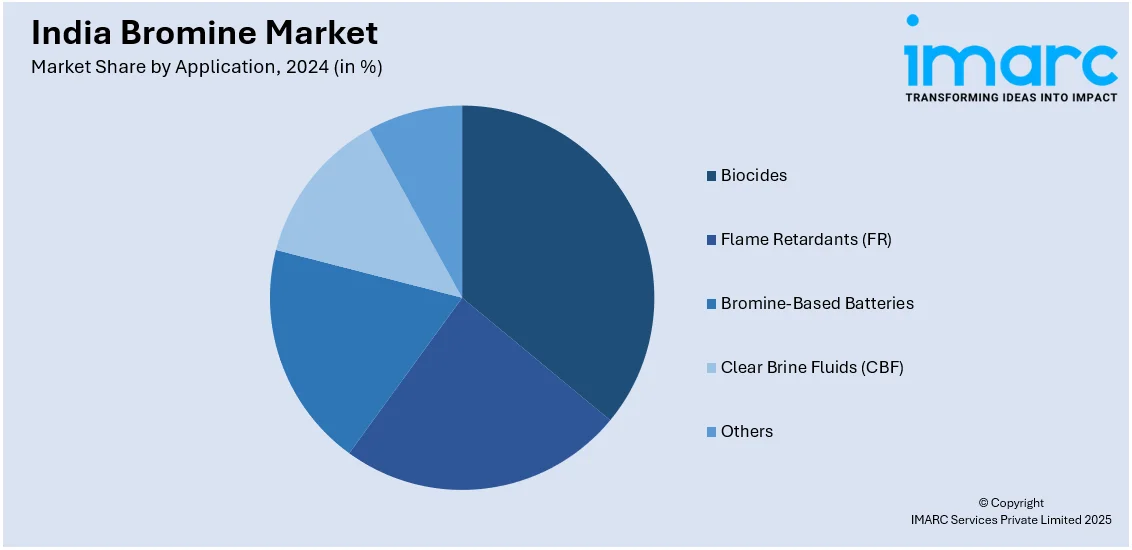

Application Insights:

- Biocides

- Flame Retardants (FR)

- Bromine-Based Batteries

- Clear Brine Fluids (CBF)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biocides, flame retardants (FR), bromine-based batteries, clear brine fluids (CBF), and others.

End User Insights:

- Chemicals

- Oil and Gas

- Pharmaceuticals

- Agriculture

- Textiles

- Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes chemicals, oil and gas, pharmaceuticals, agriculture, textiles, electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bromine Market News

- February 11, 2025, Lupin Limited (LUPIN) received approval from the USFDA for its Generic formulation of Ipratropium Bromide Nasal Solution to treat rhinorrhea associated with rhinitis. It is a significant step forward in the global pharmaceutical industry. The product, produced at Lupin’s facility in Pithampur, India, is poised to rival Boehringer Ingelheim’s Atrovent Nasal Spray, which achieved US sales of USD 22 Million in 2024. This approval further highlights the growing importance of bromine-based formulations in the pharmaceutical industry.

- June 29, 2024, SBI Mutual Fund and White Oak Group acquired a 5.67% stake in Neogen Chemicals, a major Indian manufacturer of specialty bromine and lithium-based chemicals. Despite falling prices of basic materials, including bromine and lithium, the firm reported sales of Rs. 691 Crore (approximately USD 86.375 Million) in the financial year 2024. Neogen Chemicals is also expanding into electric vehicle battery materials, focusing on manufacturing Lithium Electrolyte Salts for domestic markets.

India Bromine Market Report Coverage

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Hydrogen Bromide, Organobromine Compounds, Bromine Fluids, Others |

| Applications Covered | Biocides, Flame Retardants (FR), Bromine-Based Batteries, Clear Brine Fluids (CBF), Others |

| End Users Covered | Chemicals, Oil and Gas, Pharmaceuticals, Agriculture, Textiles, Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bromine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bromine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bromine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India bromine market was valued at USD 118.70 Million in 2024.

The India bromine market is projected to exhibit a (CAGR) of 4.10% during 2025-2033, reaching a value of USD 169.90 Million by 2033.

The India bromine market is propelled by its use in pharmaceuticals, flame retardants for electronics and construction, and water purification systems. Demand in oil and gas drilling fluids and bromine-based energy storage is rising. Market growth is further supported by stricter environmental regulations and shifting sustainability priorities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)