India Bubble Tea Market Size, Share, Trends and Forecast by Product Type, Flavor, Distribution Channel, and Region, 2025-2033

India Bubble Tea Market Overview:

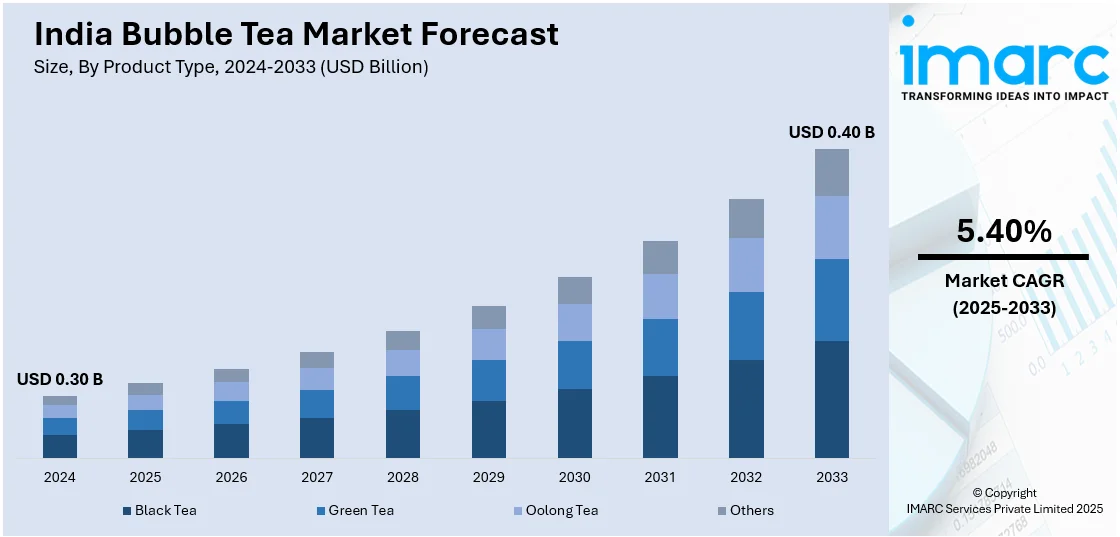

The India bubble tea market size reached USD 0.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.40 Billion by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The growth is primarily driven by urban youth, localized flavors, health-conscious options, and franchising, along with an increased focus on sustainability and digital engagement.

Market Insights:

- Based on region, the market is segmented into North India, South India, East India, and West India.

- Based on product type, the market is segmented into black tea, green tea, oolong tea, and others.

- Based on flavor, the market is segmented into fruit, taro, strawberry, and classic coffee.

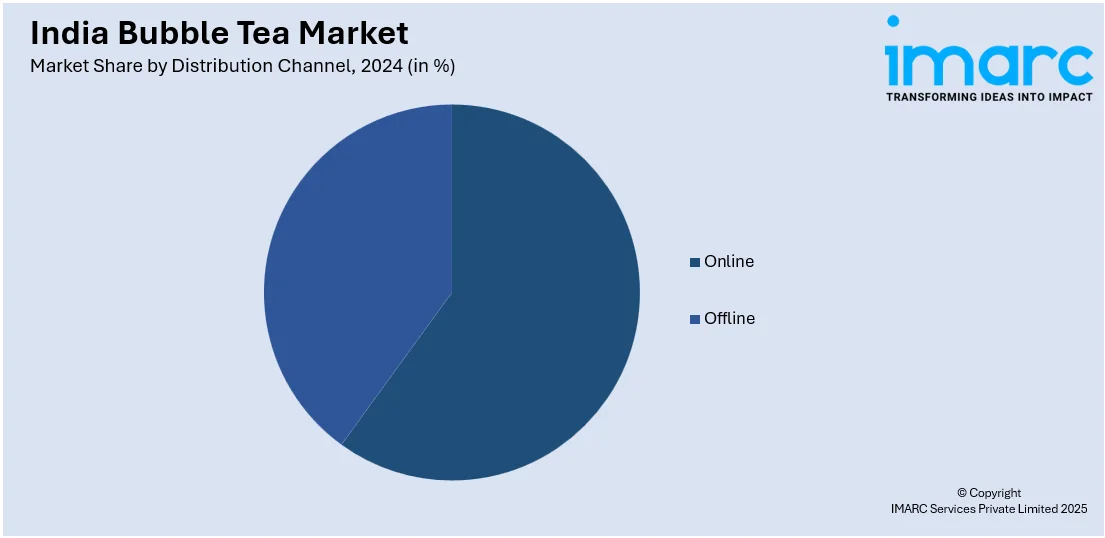

- Based on distribution channel, the market is segmented into online and offline.

Market Size and Forecast:

- 2024 Market Size: USD 0.30 Billion

- 2033 Projected Market Size: USD 0.40 Billion

- CAGR (2025-2033): 5.40%

India Bubble Tea Market Trends:

Fusion Flavors and Local Ingredients

Fusion flavors are playing a central role in attracting Indian consumers to bubble tea. The India bubble tea market growth is being driven by experimentation with local ingredients that resonate with regional tastes. Players are infusing classic Indian flavors such as masala chai, rose, mango and lychee into traditional bubble tea recipes creating a hybrid experience that appeals to a broader audience. For instance, in March 2025, Easy Boba launched 'Desi Boba Fest' a limited-time summer event blending iconic Indian beverages with bubble tea. Featuring flavors like Shikanji, Aam Panna and Kullhad Chai the festival aims to evoke nostalgia while catering to diverse dietary preferences. The initiative highlights innovation within India’s bubble tea market. This localization strategy is helping brands penetrate deeper into tier 2 and tier 3 cities where familiarity with these ingredients increases acceptance. Limited-time seasonal menus featuring mango during summer or saffron in festive periods are also boosting footfall. By blending novelty with nostalgia bubble tea is emerging as both a trend-driven and culturally adapted beverage. As a result, more consumers are making repeat purchases strengthening brand loyalty and helping expand the India bubble tea market share in a highly competitive beverage segment.

To get more information on this market, Request Sample

Rising Focus on Sustainability

Sustainability is becoming a key differentiator in the bubble tea space especially among younger environmentally conscious consumers. Brands are shifting to biodegradable cups, compostable lids and reusable metal or bamboo straws to align with changing consumer expectations. Several bubble tea outlets now offer incentives for customers who bring their own containers reinforcing ecofriendly habits and reducing single-use plastic consumption. These changes are not only improving brand perception but are also influencing purchase decisions especially in urban areas where awareness of environmental issues is growing. Packaging innovations like plant-based plastics and recyclable PET materials are also being explored to minimize environmental impact without compromising product quality. For instance, in September 2024, Easy Boba unveiled its commitment to sustainability with recyclable sealed PET cans and biodegradable rice straws aiming to reduce waste in the bubble tea industry. Founder Adnan Sarkar emphasizes eco-friendly practices aligning product innovation with environmental stewardship catering to the growing consumer demand for sustainable packaging solutions. This shift is gradually redefining brand value in the market. Businesses focusing on sustainable practices are witnessing increased customer loyalty and are likely to contribute significantly to the expanding India bubble tea market share.

Bubble Tea’s Emerging Role in the Health and Wellness Industry

With health-conscious consumers becoming more prevalent, bubble tea is evolving beyond a trendy sugary drink to a more health-focused beverage, further contributing to the bubble tea market size in India. Companies are adding functional ingredients like collagen, adaptogens, and probiotics to cater to this shift in demand. This allows bubble tea to offer a wider range of benefits, such as improved digestion, healthier skin, and reduced stress levels. The increasing demand for immunity-boosting beverages also aligns with the post-pandemic consumer mindset, driving innovation in the market. By introducing new wellness-oriented flavors and ingredients, the bubble tea market is successfully tapping into the broader health and wellness trend, allowing consumers to indulge while still prioritizing their well-being, adding to the bubble tea market demand in India.

Digital Innovations Shaping the Future of the Bubble Tea Experience

Digital innovations is playing a crucial role in reshaping how consumers interact with bubble tea brands. The use of AI-powered systems and contactless ordering is transforming the customer experience, enabling greater customization and convenience. The integration of augmented reality (AR) and QR code-based ordering systems allows consumers to explore flavor combinations and track their bubble tea orders digitally. These innovations not only provide a modern and efficient shopping experience but also enhance safety in the post-pandemic era, and create a positive India bubble tea market outlook. Moreover, as e-commerce platforms continue to grow, bubble tea brands are extending their reach beyond traditional brick-and-mortar stores, offering subscription services and home delivery options. This dual focus on physical and digital channels is driving the market's expansion, particularly in urban areas and tier-2 cities where the convenience factor is highly valued.

Some of the other key factors shaping the market include:

- Functional ingredient integration: Functional ingredients like probiotics, collagen, and adaptogens are becoming popular in bubble tea to enhance the health benefits, as per the India bubble tea market forecast. Probiotics are added to improve gut health, while collagen is included for skin rejuvenation. Adaptogens like ashwagandha are being incorporated to promote stress relief and overall wellness.

- Immunity-boosting blends aligned with post-pandemic wellness demand: Post-pandemic, consumers are increasingly seeking immunity-boosting ingredients in their beverages. Bubble tea shops are adding ingredients like ginger, turmeric, lemon, and honey, which are known for their immune-supportive properties, to cater to health-conscious customers seeking preventive health benefits.

- Contactless and AI-powered ordering: According to the India bubble tea market analysis, the growing adoption of AI-powered ordering systems and contactless technology is transforming the bubble tea experience. Augmented reality (AR) menus and QR code-based ordering allow customers to customize their bubble tea selections from the comfort of their phones, improving convenience and safety, especially in the post-COVID era.

- Blockchain transparency in sourcing: Consumers are increasingly looking for transparency in sourcing ingredients, and blockchain technology is helping brands ensure the traceability of their supplies. Brands are using blockchain to track the origin of organic tapioca pearls and ethically sourced tea leaves, giving customers confidence in their product choices and propelling the India bubble tea market demand.

- Bubble tea-inspired desserts: Bubble tea-inspired desserts are gaining popularity, offering new ways to enjoy the flavors of bubble tea in other forms. Boba ice cream, waffles, and falooda are popular innovations, giving consumers a sweet, creamy treat while incorporating chewy tapioca pearls for an added texture element.

- Alcoholic bubble tea variants: Alcoholic versions of bubble tea are emerging, particularly in nightlife settings. Chai-boba cocktails and other alcohol-infused bubble tea beverages cater to younger consumers looking for a fusion of familiar drinks and the bubble tea experience, expanding the market’s reach into bars and clubs and promoting the bubble tea market growth in India.

- Region-specific innovations: Brands are adapting bubble tea flavors to regional preferences by introducing unique, localized variations. Examples include filter coffee pearls for Indian consumers, mishti doi (sweetened yogurt) teas for Bengali tastes, and kahwa boba for consumers in Kashmir, catering to regional taste profiles and preferences.

- Labor skilling gaps in boba barista certification and specialty beverage training: As the bubble tea market grows, there is a gap in skilled labor, particularly for boba baristas and beverage specialists. To address this, specialized training and certification programs are emerging, ensuring that employees have the necessary expertise to prepare high-quality beverages and maintain consistency.

India Bubble Tea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, flavor, and distribution channel.

Product Type Insights:

- Black Tea

- Green Tea

- Oolong Tea

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes black tea, green tea, oolong tea, and others.

Flavor Insights:

- Fruit

- Taro

- Strawberry

- Classic Coffee

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes fruit, taro, strawberry, and classic coffee.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bubble Tea Market News:

- In July 2025, Third Wave Coffee expanded its menu with the official launch of Bobbles, a dedicated range of bubble tea available nationwide at all outlets. The new lineup includes nine flavors catering to both popping boba and chewy boba, reflecting a growing trend in India’s bubble tea market.

- In May 2025, Easy Boba launched India's first Boba Tower Challenge, introducing a 3.5-liter tower of bubble tea. This initiative taps into the growing demand for participatory food experiences, particularly among younger consumers. With over 20 outlets across India, Easy Boba is positioning itself as a leader in the expanding bubble tea market.

- In February 2025, Easy Boba, India's leading bubble tea chain launched a new Loyalty Card program, rewarding customers with a free drink after their 4th visit and free merchandise after the 8th. Currently operating 20 outlets across Mumbai, Pune, and Gujarat, the brand plans further expansions to enhance its presence in India.

- In February 2025, Boba Bhai, India's largest Korean fusion food brand, launched packaged bubble tea on Blinkit, marking a first for the Indian market in quick commerce. Featuring unique flavors and shelf-stable packaging, the initiative aims to make bubble tea more accessible while catering to diverse consumer preferences.

- In August 2024, Frozen Bottle launched its Boba Bar in Bengaluru, offering a variety of bubble tea flavors and customizations across 100+ stores in India. Using sustainable packaging, the brand aims to redefine beverage experiences.

- In September 2024, The Tea Planet, India’s first bubble tea manufacturer, announced its projection of a INR 50 Crore (USD 6.03 Million) turnover for 2024, with INR 25 Crore (USD 3.02 Million) expected solely from bubble tea sales. The company revealed that its offerings, including popping boba, tapioca, and premixes, are all locally produced under the ‘Made in India’ initiative.

India Bubble Tea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Black Tea, Green Tea, Oolong Tea, Others |

| Flavors Covered | Fruit, Taro, Strawberry, Classic Coffee |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bubble tea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bubble tea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bubble tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bubble tea market in India was valued at USD 0.30 Billion in 2024.

The India bubble tea market is projected to exhibit a CAGR of 5.40% during 2025-2033, reaching a value of USD 0.40 Billion by 2033.

The market is driven by changing youth preferences, rising interest in fusion beverages, and the novelty of customizable drink formats. The trend of lifestyle-oriented cafés and demand for Instagram-worthy food experiences add to its appeal. Increasing urban footfall in malls and food courts further boosts the visibility and trial of bubble tea among younger consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)