India Building Facade Market Size, Share, Trends and Forecast by Material Type, Product Type, Application, End User, and Region, 2026-2034

India Building Facade Market Summary:

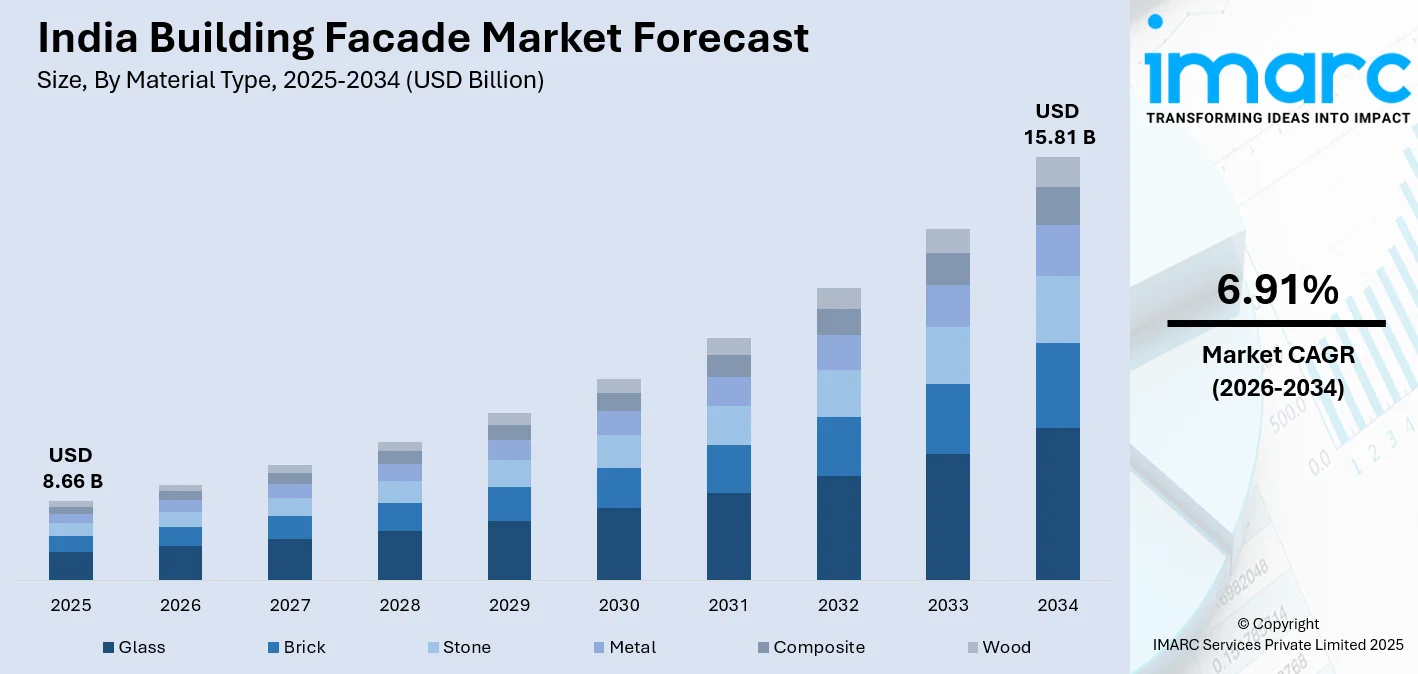

The India building facade market size was valued at USD 8.66 Billion in 2025 and is projected to reach USD 15.81 Billion by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

At present, India's market is experiencing robust expansion, driven by accelerating urbanization, commercial real estate development, and increasing architectural sophistication across metropolitan centers. Apart from this, the market encompasses diverse material solutions and installation systems that address aesthetic aspirations, energy efficiency mandates, and structural performance requirements across residential, commercial, and institutional construction segments, thereby expanding the India building facade market share.

Key Takeaways and Insights:

- By Material Type: Glass dominates the market with a share of 31% in 2025, favored for natural lighting, modern aesthetics, and energy-efficient glazing technologies.

- By Product Type: Cladding systems lead the market with a share of 25% in 2025, offering versatile installation methods and superior weather protection capabilities.

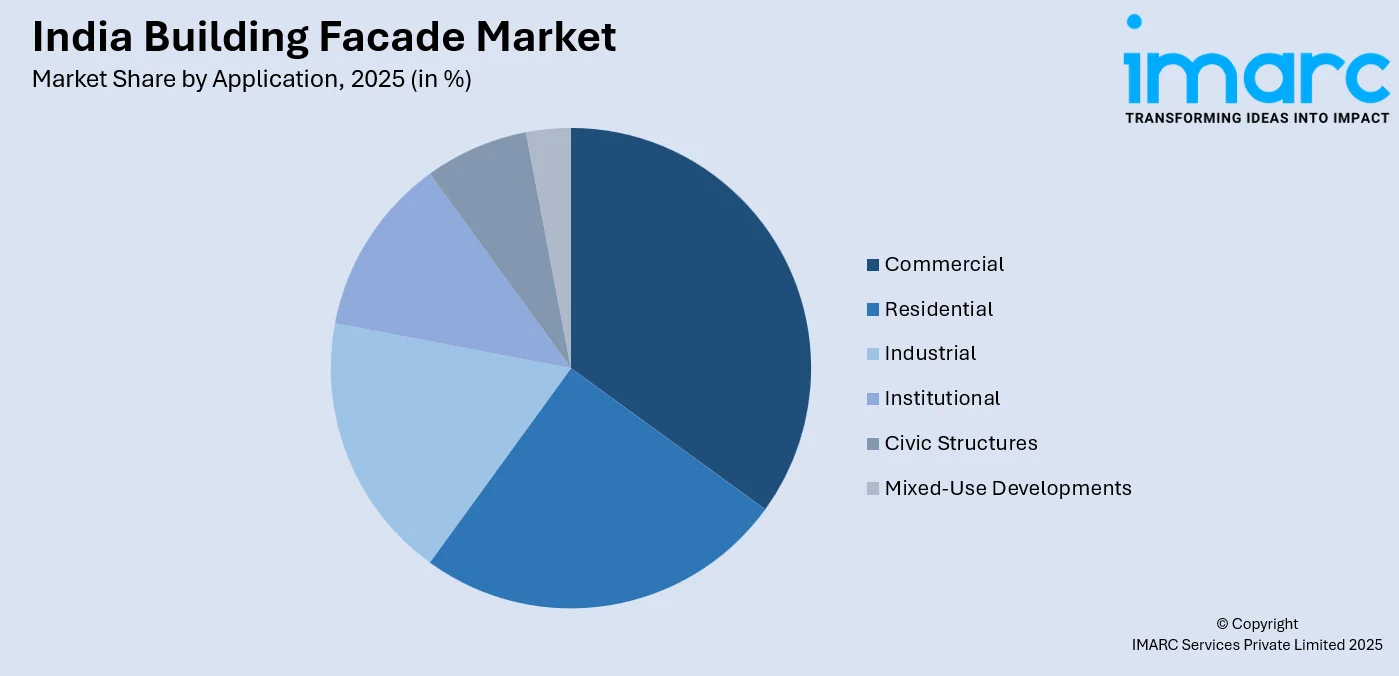

- By Application: Commercial represents the largest segment with a market share of 33% in 2025, reflecting corporate office expansion and retail infrastructure development.

- By End User: Real estate developers lead the market with a share of 32% in 2025, as project initiators driving material selection and facade specification decisions.

- By Region: North India holds the leading position with a market share of 29% in 2025, concentrated around Delhi-NCR's commercial construction boom and infrastructure megaprojects.

- Key Players: The competitive landscape demonstrates moderate consolidation with established international facade specialists competing alongside regional manufacturers and emerging domestic players across premium and mid-market segments.

To get more information on this market Request Sample

The market's trajectory reflects India's architectural evolution from traditional construction methods toward contemporary facade solutions that balance visual appeal with functional performance. Apart from this, metropolitan areas are witnessing heightened demand for sophisticated facade systems as commercial developers seek differentiation through distinctive building envelopes, while residential projects increasingly incorporate premium facade materials to enhance property valuations. Moreover, government infrastructure initiatives and smart city developments are creating substantial opportunities for innovative facade technologies that meet stringent energy codes and environmental standards. The integration of sustainable materials, advanced glazing technologies, and modular installation systems is reshaping market dynamics, with developers prioritizing solutions that deliver lifecycle cost advantages alongside aesthetic distinction. In 2025, Aludecor, the nation's leader in metal façade products, unveiled Alubreeze Metal Louvers, an expertly designed metal shading solution that can greatly reduce solar heat gains, minimize HVAC demands, and enhance design appeal simultaneously. Alubreeze is the nation's first locally designed and produced metal sun-louver system. Constructed from aluminium and completed on India’s sole roller-coating lines to provide pre-set angles of 30°, 45°, and 90°, Alubreeze aims to reduce direct solar heat in glazed structures, lower air-conditioning demands, and add sculptural dimension to otherwise flat glass facades.

India Building Facade Market Trends:

Integration of Energy-Efficient Glazing Technologies

The market is experiencing accelerated adoption of high-performance glazing solutions incorporating low-emissivity coatings, thermal insulation properties, and solar heat gain control mechanisms. Developers are specifying double-glazed and triple-glazed units that reduce cooling loads while maintaining natural light transmission, addressing both operational cost concerns and environmental compliance requirements. This trend is particularly pronounced in commercial developments where building owners seek Green Building Council certifications and occupants demand comfortable indoor environments with reduced energy consumption. In 2025, BPTP, a real estate firm in North India, introduced GAIA Residences at Amstoria 102. This project is the first residential development featuring a glass façade along the Dwarka Expressway. The project is under development in three stages. BPTP aims to generate Rs 6500 crores in revenue from a Rs 3000 crore investment in the project.

Shift Toward Prefabricated and Modular Facade Systems

Construction timelines are driving increased preference for factory-manufactured facade assemblies that enable rapid on-site installation and quality consistency. Prefabricated panels and unitized systems allow developers to compress project schedules while minimizing weather-related delays and labor dependencies. The modular approach is gaining traction in high-rise commercial towers where precision engineering and construction speed directly impact project economics, with manufacturers establishing specialized production facilities to serve growing demand for customized prefabricated solutions. In 2025, The Zak World of Façades India 2025 will take place in Mumbai on October 10, 2025, at the Jio World Convention Centre. This one-day international conference and exhibition is a notable component of the global Zak World of Façades series, which has successfully concluded more than 195 editions in 47 countries. The event is solely focused on façade design, engineering, and sustainable building envelope options.

Growing Demand for Sustainable and Locally-Sourced Materials

Environmental consciousness and regulatory frameworks are influencing material selection toward sustainable alternatives including recycled composites, responsibly-sourced timber, and low-carbon manufacturing processes. A newly built wooden residence in Goa by Architecture Discipline asserts it is India’s first mass timber house, featuring a framework made of glued laminated portal frames and charred wood cladding panels. The natural wood interiors contrast with black granite flooring and a minimalist approach to interior design and furnishings that emphasizes space and views of the Arabian Sea. Moreover, architects and developers are increasingly evaluating facade materials based on embodied carbon footprints, recyclability characteristics, and lifecycle environmental impacts. This sustainability focus extends beyond material composition to encompass installation efficiency and long-term maintenance requirements, with green building rating systems incentivizing facade choices that contribute to overall project sustainability credentials.

Market Outlook 2026-2034:

The forecast period anticipates sustained expansion driven by urban infrastructure development, rising disposable incomes enabling premium residential construction, and corporate real estate investment across Tier-I and Tier-II cities. Smart city initiatives and metro rail connectivity projects will catalyze commercial and mixed-use development requiring sophisticated facade solutions, while hospitality sector recovery and retail modernization programs create additional demand channels. The market generated a revenue of USD 8.66 Billion in 2025 and is projected to reach a revenue of USD 15.81 Billion by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034. Technological advancement in facade engineering, coupled with increasingly stringent building energy codes, will elevate market sophistication and value proposition.

India Building Facade Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Type |

Glass |

31% |

|

Product Type |

Cladding Systems |

25% |

|

Application |

Commercial |

33% |

|

End User |

Real Estate Developers |

32% |

|

Region |

North India |

29% |

Material Type Insights:

- Glass

- Brick

- Stone

- Metal

- Composite

- Wood

Glass dominates with a market share of 31% of the total India building facade market in 2025.

Glass facades have emerged as the predominant choice across India's evolving architectural landscape, driven by their capacity to create visually striking building envelopes while delivering functional benefits including natural daylighting, thermal performance, and acoustic insulation. The material's versatility accommodates diverse design philosophies from minimalist contemporary aesthetics to complex parametric geometries, enabling architects to realize distinctive visual identities for commercial landmarks and residential towers. Advanced glass manufacturing technologies now deliver products incorporating low-emissivity coatings, solar control properties, and self-cleaning surfaces that address India's challenging climatic conditions while reducing long-term maintenance burdens.

The glass segment's market leadership reflects broader construction industry trends toward transparency, visual connectivity, and environmental performance. Commercial office developers specify expansive glass facades to attract multinational tenants seeking modern workspace environments, while luxury residential projects leverage floor-to-ceiling glazing as a premium differentiator commanding price premiums. Manufacturing capacity expansion by both international glass producers and domestic manufacturers has improved product availability and competitive pricing, making sophisticated glazing solutions accessible across broader market segments. The integration of smart glass technologies offering dynamic tinting capabilities and energy generation through building-integrated photovoltaics represents the next evolution, positioning glass as a multifunctional building system rather than merely an aesthetic choice.

Product Type Insights:

- Prefabricated Facades

- Modular Facades

- Cladding Systems

- Unitized Systems

- Rain Screen Systems

- Custom Designs

The Cladding Systems lead with a share of 25% of the total India building facade market in 2025.

Cladding systems have secured market leadership through their exceptional versatility, weather protection capabilities, and compatibility with diverse architectural expressions across residential, commercial, and institutional building typologies. These systems encompass a comprehensive range of material options including metal panels, fiber cement boards, natural stone veneers, and composite panels that can be configured to achieve virtually any aesthetic vision while providing critical building envelope protection. The installation methodology allows for integration with insulation layers and moisture barriers, creating complete facade assemblies that address India's varied climate zones from humid coastal regions to arid interior landscapes.

The cladding systems category's prominence stems from its capacity to balance performance requirements with budget considerations across different market segments. Economical fiber cement cladding serves cost-sensitive residential developments, while premium metal composite panels satisfy high-end commercial projects demanding distinctive appearances and long-term durability. Recent innovations in cladding technologies include photocatalytic surface treatments offering self-cleaning properties, enhanced fire-resistant formulations meeting stringent safety codes, and rapid-installation systems reducing construction timelines. The segment's growth trajectory remains robust as manufacturers introduce increasingly sophisticated products incorporating recycled content, improved thermal performance, and extended warranty programs that address lifecycle cost concerns increasingly influencing specification decisions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Institutional

- Civic Structures

- Mixed-Use Developments

Commercial exhibits a clear dominance with a 33% share of the total India building facade market in 2025.

Commercial applications command the largest market share, reflecting India's dynamic office real estate sector, retail infrastructure expansion, and hospitality industry development concentrated across major metropolitan centers. Corporate office buildings represent the primary demand driver, with multinational corporations and domestic conglomerates investing in iconic headquarters featuring distinctive facade treatments that reinforce brand identities and attract talent in competitive employment markets. The commercial segment encompasses Grade-A office towers commanding premium rentals, suburban office parks serving technology companies, and renovated heritage structures converted to contemporary commercial use, each requiring specialized facade solutions addressing unique architectural and performance criteria.

Shopping malls, hotel developments, and entertainment complexes constitute additional commercial applications driving facade market growth, with developers specifying visually compelling envelope treatments to differentiate properties in competitive consumer markets. These projects typically feature complex facade geometries, extensive glazing for visual merchandising, and integrated lighting systems creating distinctive nighttime identities. Commercial projects generally accommodate higher facade budgets compared to residential applications, enabling specification of premium materials, sophisticated engineering solutions, and custom architectural features. The segment's outlook remains positive supported by office space absorption in technology hubs, organized retail expansion into Tier-II cities, and hospitality sector investment anticipating tourism recovery and business travel resumption.

End User Insights:

- Architects and Designers

- Construction Companies

- Real Estate Developers

- Building Owners and Managers

- Government and Regulatory Bodies

- Consultants and Engineers

Real estate developers lead with a share of 32% of the total India building facade market in 2025.

Real estate developers occupy the dominant end-user position as primary decision-makers controlling project budgets, material specifications, and facade system selection throughout the development lifecycle. These entities range from large publicly-listed development corporations executing integrated townships and commercial complexes to specialized boutique developers focusing on luxury residential or niche commercial segments. Developers' facade decisions balance multiple considerations including initial capital costs, anticipated property valuations, target buyer preferences, competitive differentiation, and long-term maintenance implications, with premium developments allocating substantial budgets toward distinctive facade treatments that command market premiums.

The developer segment's procurement approaches vary significantly across project scales and market positioning, with luxury developers engaging international facade consultants and specifying imported premium materials, while volume housing developers prioritize cost-effective solutions from domestic manufacturers meeting baseline performance standards. Developers increasingly recognize facade systems as critical value drivers rather than mere aesthetic choices, with sophisticated envelope solutions contributing to energy efficiency credentials, tenant satisfaction, and asset marketability. Growing awareness of green building benefits and potential rental premiums is influencing developers to specify higher-performance facade systems despite elevated initial costs, particularly in commercial developments targeting multinational corporate tenants with stringent sustainability requirements. IMARC Group predicts that the India real estate market is projected to attain USD 1,264.00 Billion by 2034.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India building facade market in 2025.

North India's market leadership stems from the Delhi-NCR region's position as India's political capital and major commercial hub, generating sustained demand for sophisticated facade solutions across government buildings, corporate headquarters, and luxury residential developments. The region encompasses rapidly expanding satellite cities including Gurugram, Noida, and Greater Noida, where commercial real estate development and high-rise residential construction create substantial facade market opportunities. Delhi-NCR's architectural landscape increasingly features contemporary glass and metal facades replacing traditional masonry construction, driven by developer aspirations for modern aesthetics and corporate tenant preferences for international-standard office environments.

Beyond Delhi-NCR, North India's facade market benefits from substantial construction activity across Punjab, Haryana, and Uttar Pradesh, where urbanization, infrastructure investment, and rising affluent populations support demand across residential and commercial segments. The region's extreme temperature variations between summer and winter necessitate facade solutions offering thermal insulation and climate control capabilities, influencing material selection toward high-performance glazing and insulated cladding systems. Government infrastructure projects including smart city developments in Lucknow, Kanpur, and Chandigarh are creating additional market opportunities, while the region's established manufacturing base and proximity to raw material sources support competitive pricing and supply chain efficiency.

Market Dynamics:

Growth Drivers:

Why is the India Building Facade Market Growing?

Accelerating Urban Developments and Metropolitan Expansion

India's rapid urban population growth is fundamentally reshaping construction demand patterns, with metropolitan areas experiencing unprecedented vertical development to accommodate residential and commercial space requirements within constrained geographic footprints. According to the Economic Survey 2023-24, it is anticipated that by 2030, over 40 percent of India's population will reside in urban regions. This estimate has been derived from analyses and documents from NITI Aayog. Census projections indicate continuing rural-to-urban migration concentrating populations in major cities, driving high-rise construction that inherently requires sophisticated facade solutions for structural, aesthetic, and performance reasons. This urbanization phenomenon extends beyond traditional metros into emerging Tier-II and Tier-III cities developing modern skylines, with local developers increasingly adopting contemporary facade systems to compete for corporate tenants and affluent residents. The vertical construction imperative creates sustained facade market demand as building heights escalate and architectural complexity increases to differentiate properties in competitive real estate markets.

Rising Energy Efficiency Mandates and Green Building Adoption

Regulatory frameworks increasingly mandate enhanced building energy performance through codes specifying minimum thermal insulation values, solar heat gain limitations, and overall energy consumption targets that directly influence facade system selection. The CII Indian Green Building Council (IGBC) launched the 22nd edition of the Green Building Congress in 2024. The Congress took place at the Bangalore International Exhibition Centre. The Energy Conservation Building Code sets stringent requirements for commercial buildings, compelling developers to specify high-performance glazing, insulated cladding systems, and weather-sealed envelope assemblies that minimize thermal transfer and reduce mechanical cooling loads. Beyond regulatory compliance, voluntary green building certifications including LEED and GRIHA have gained market traction, with developers pursuing ratings to attract environmentally-conscious tenants and command rental premiums. These certification systems award substantial credits for facade performance characteristics, incentivizing investment in advanced envelope technologies that deliver measurable energy savings and environmental benefits.

Growing Affluence and Premium Residential Demand

Expanding middle and upper-middle class populations with enhanced purchasing power are driving demand for premium residential properties featuring contemporary aesthetics and international-standard amenities, with distinctive facade treatments serving as visible differentiators in competitive housing markets. In 2025, Sumadhura Group announced its plans to unveil six high-end residential projects in East and North Bengaluru by FY 2026, aiming for a total revenue potential of ₹10,000 crore and an overall saleable area exceeding 8 million sq. ft. Covering both residential and plotted development areas, this represents the Group’s most significant launch to date and an important milestone in its growth journey. Luxury apartment developments increasingly incorporate full-height glazing, imported stone veneers, and sophisticated cladding systems that signal quality and exclusivity to discerning buyers willing to pay substantial premiums for distinctive architectural expressions. This affluence-driven demand extends beyond luxury segments into mid-market residential projects where developers leverage facade upgrades as cost-effective mechanisms to enhance perceived value and accelerate sales velocity. The aspirational nature of residential purchasing decisions in India's status-conscious culture amplifies the importance of visually impressive building exteriors, sustaining facade market growth across diverse price points and geographic markets.

Market Restraints:

What Challenges the India Building Facade Market is Facing?

High Initial Capital Investment Requirements

Sophisticated facade systems command substantial upfront costs that strain project budgets, particularly for developers operating under tight margin constraints or serving price-sensitive market segments. Premium glazing solutions, imported materials, and complex installation systems can represent significant percentages of total construction costs, creating financial barriers that limit adoption despite long-term performance benefits and lifecycle cost advantages.

Skilled Labor Shortages and Installation Complexity

Advanced facade systems require specialized installation expertise and precision workmanship that remains scarce across India's construction labor market, leading to quality inconsistencies, project delays, and elevated installation costs. The shortage of trained facade contractors capable of executing complex curtain wall systems, precision cladding installations, and waterproofing details constrains market expansion, particularly outside major metropolitan centers with established specialty contractor communities.

Material Import Dependencies and Supply Chain Vulnerabilities

Premium facade components including specialized glazing, aluminum extrusions, and high-performance sealants often require imports, exposing projects to currency fluctuations, customs delays, and geopolitical supply chain disruptions. These dependencies create cost uncertainties and procurement challenges that complicate project planning and budget management, with developers sometimes defaulting to readily-available domestic alternatives despite performance compromises.

Competitive Landscape:

The India building facade market exhibits moderate competitive intensity characterized by diverse participant categories ranging from established international facade specialists to regional manufacturers and emerging domestic players. International corporations leverage technical expertise, global supply chains, and established reputations to secure premium commercial projects, while domestic manufacturers compete through cost advantages, local market knowledge, and responsive customer service across mid-market segments. The competitive landscape is fragmenting as new entrants identify niche opportunities in specialized materials, sustainable solutions, and value-engineered systems serving cost-conscious developers. Strategic partnerships between material suppliers, fabricators, and installation contractors are becoming increasingly common as market participants seek to offer integrated solutions addressing the full scope of facade requirements. Competitive differentiation increasingly centers on technical capabilities, project execution track records, and ability to deliver customized solutions meeting specific architectural visions and performance requirements.

Recent Developments:

- In August 2025, Odisha Mining Corporation (OMC) has unveiled an innovative project that combines cutting-edge technology with architectural creativity. The OMC, in partnership with DFI, initiated the development of a cutting-edge corporate headquarters and commercial facility. Located on the Chennai-Kolkata highway, this premier site covers six acres and features a 500-meter-long frontage. The complex of three towers includes a conference center, auditorium, art gallery, meeting spaces, corporate offices, and rented areas for private or public companies. Nonetheless, the project’s most unique aspect is its moving façade, which enhances sun exposure on the southwest side.

India Building Facade Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Glass, Brick, Stone, Metal, Composite, Wood |

| Product Types Covered | Prefabricated Facades, Modular Facades, Cladding Systems, Unitized Systems, Rain Screen Systems, Custom Designs |

| Applications Covered | Residential, Commercial, Industrial, Institutional, Civic Structures, Mixed-Use Developments |

| End-Users Covered | Architects and Designers, Construction Companies, Real Estate Developers, Building Owners and Managers, Government and Regulatory Bodies, Consultants and Engineers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India building facade market size was valued at USD 8.66 Billion in 2025.

The India building facade market is expected to grow at a compound annual growth rate of 6.91% from 2026-2034 to reach USD 15.81 Billion by 2034.

Glass dominated the material type segment with a market share of 31% in 2025, driven by its aesthetic versatility, natural lighting benefits, and availability of high-performance thermal insulation technologies that address India's diverse climatic conditions while enabling contemporary architectural expressions.

Key factors driving the India building facade market include accelerating urbanization driving vertical construction, stringent energy efficiency mandates requiring high-performance envelope systems, growing affluence supporting premium residential demand, and smart city initiatives catalyzing sophisticated commercial development.

Major challenges include high initial capital investment requirements constraining adoption across price-sensitive segments, skilled labor shortages limiting quality execution of complex systems, material import dependencies creating cost uncertainties, and inconsistent enforcement of building codes across different municipal jurisdictions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)