India Bulk Liquid Transportation Market Size, Share, Trends and Forecast by Type of Liquid Bulk, Transportation Mode, End User Industry, and Region, 2025-2033

India Bulk Liquid Transportation Market Overview:

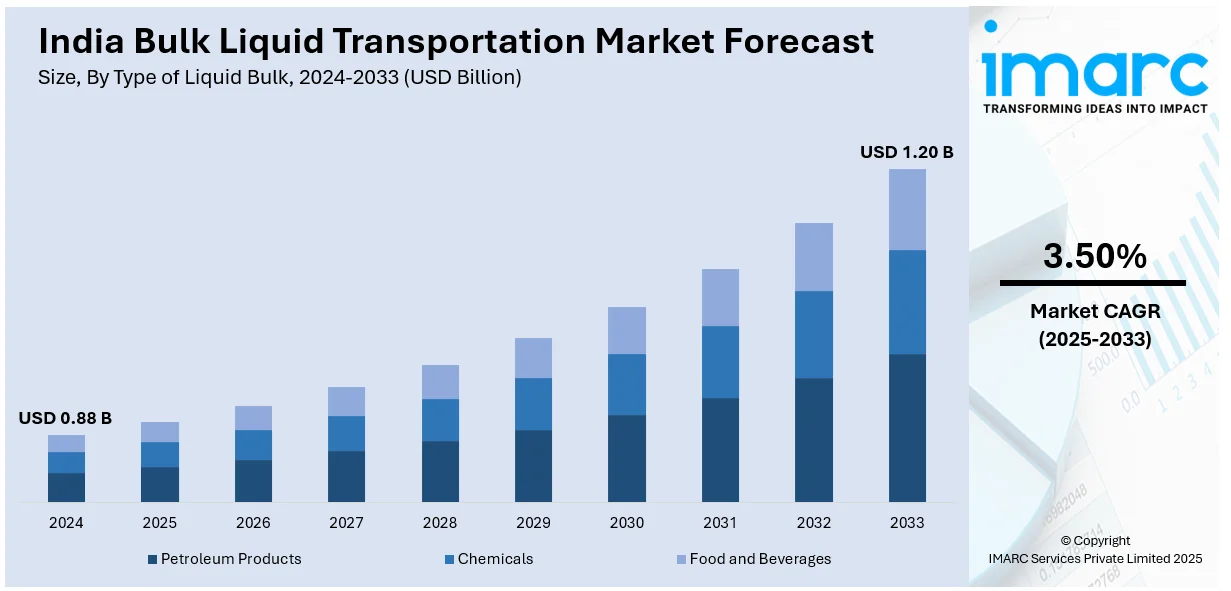

The India bulk liquid transportation market size reached USD 0.88 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.20 Billion by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The market is witnessing rapid growth, due to increased demand in sectors like chemicals, pharmaceuticals, and food processing. Growing industrial activities and improved logistics infrastructure, growing focus of companies on enhancing fleet capacities and adopting advanced technologies for safety and efficiency are expected to significantly impact the India bulk liquid transportation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.88 Billion |

| Market Forecast in 2033 | USD 1.20 Billion |

| Market Growth Rate 2025-2033 | 3.50% |

India Bulk Liquid Transportation Market Trends:

Infrastructure Development

The expansion of road and port infrastructure is playing a pivotal role in enhancing the efficiency of bulk liquid transportation in India. For instance, in July 2023, the Mormugao Port Authority (MPA) is auctioning two land parcels for bulk liquid storage terminals to generate revenue and assess demand. Covering 5,067 sqm the sites include an area near coal dumps. The port has seen revenue decline since iron ore mining ceased prompting efforts to enhance cargo operations. As industrial demand rises the need for robust and reliable logistics networks becomes crucial. Ports are increasingly upgrading their facilities including the development of specialized storage terminals to handle bulk liquids more efficiently. This includes implementing better storage capacities, advanced unloading systems, and safer transportation options. On the road front the government is investing in improving highways and dedicated freight corridors ensuring smoother and faster transit of bulk liquid shipments. These infrastructure advancements not only reduce transportation time and costs but also minimize the risk of accidents and contamination. With modernized ports and well-maintained roads, the overall logistics chain becomes more streamlined, supporting the growth of industries dependent on bulk liquid transportation.

To get more information on this market, Request Sample

Growth in Industrial Demand

The growth in industrial demand is a key driver for the expansion of the India Bulk Liquid Transportation Market. Sectors like chemicals, pharmaceuticals, and food processing are witnessing significant growth, leading to an increased need for efficient bulk liquid transport solutions. The chemical industry requires the transportation of hazardous and non-hazardous liquids, such as solvents and acids, which demand specialized vehicles and infrastructure. Similarly, the pharmaceutical industry relies on the safe and timely delivery of bulk liquids for medicine production. The food processing industry also depends on bulk liquid transport for products like oils, syrups, and concentrates. As these industries expand due to rising consumer demand and export potential, there is a growing need for enhanced logistics networks capable of handling larger volumes, ensuring safety, and meeting regulatory requirements. This industrial growth is directly fueling the demand for bulk liquid transportation services.

Rising Focus on Safety Standards

In the India Bulk Liquid Transportation Market, companies are increasingly prioritizing safety standards to address the challenges of transporting hazardous and sensitive liquids. Stricter safety regulations are being adopted, ensuring that vehicles are equipped with advanced safety features such as spill containment systems, leak-proof tanks, and fire-resistant materials. In addition, real-time monitoring through GPS and telematics is becoming standard practice to track the location, temperature, and pressure of liquid cargo, reducing the risk of accidents. Advanced technologies like automatic shut-off valves and safety alarms are being integrated into transport vehicles to prevent hazardous spills and accidents. This focus on safety not only ensures regulatory compliance but also enhances the overall reliability of bulk liquid transportation services. As safety standards improve, the India bulk liquid transportation market growth is further supported by higher industry confidence and expanding demand.

India Bulk Liquid Transportation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of liquid bulk, transportation mode, and end user industry.

Type of Liquid Bulk Insights:

- Petroleum Products

- Chemicals

- Food and Beverages

The report has provided a detailed breakup and analysis of the market based on the types of liquid bulk. This includes petroleum products, chemicals, and food and beverages.

Transportation Mode Insights:

- Road Transportation

- Rail Transportation

- Maritime Transportation

- Pipelines

- Intermodal Transport

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes road transportation, rail transportation, maritime transportation, pipelines, and intermodal transport.

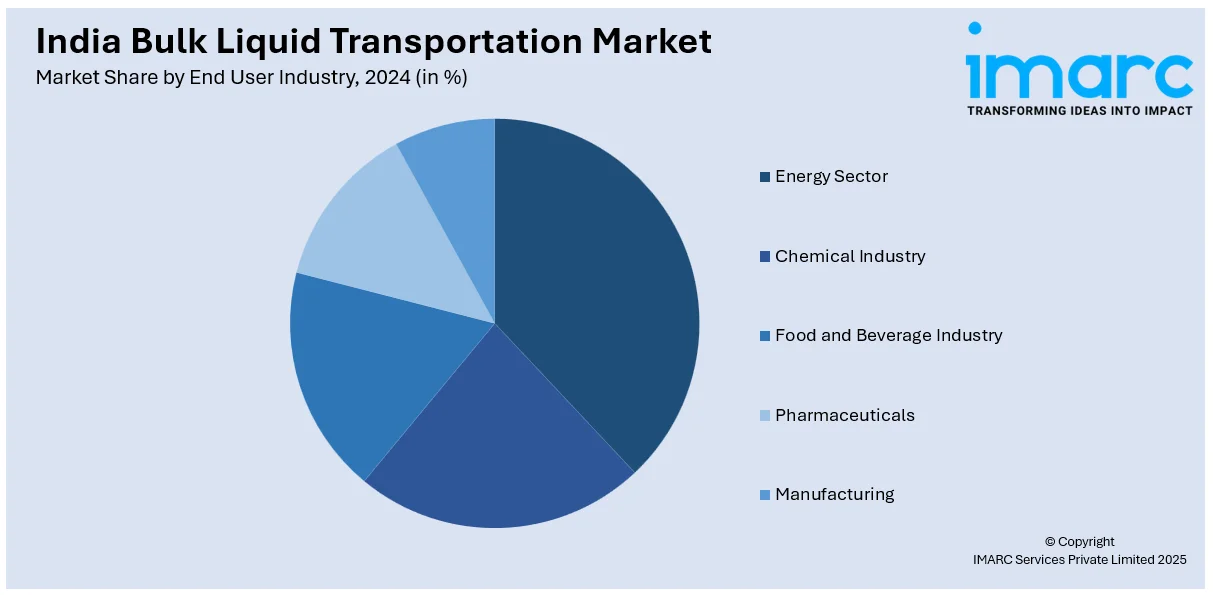

End User Industry Insights:

- Energy Sector

- Chemical Industry

- Food and Beverage Industry

- Pharmaceuticals

- Manufacturing

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes energy sector, chemical industry, food and beverage industry, pharmaceuticals, and manufacturing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bulk Liquid Transportation Market News:

- In April 2025, Indian Railways announced the launch of a new private wagon scheme to enhance logistics for the oil and gas industry. Oil companies can invest in specialized tank wagons, with Indian Railways managing operations. The initiative aims to improve efficiency, reduce logistics costs, and address previous congestion issues in freight transport.

- In January 2025, India's Hindustan Petroleum Corporation Limited received its first commissioning LNG cargo at the Chhara Port terminal in Gujarat. The 5 mtpa terminal, set to boost energy security, will begin commercial operations soon. A second-phase expansion is planned, including additional facilities for LNG unloading and storage.

India Bulk Liquid Transportation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Liquid Bulk Covered | Petroleum Products, Chemicals, Food and Beverages |

| Transportation Modes Covered | Road Transportation, Rail Transportation, Maritime Transportation, Pipelines, Intermodal Transport |

| End User Industries Covered | Energy Sector, Chemical Industry, Food and Beverage Industry, Pharmaceuticals, Manufacturing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bulk liquid transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bulk liquid transportation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bulk liquid transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bulk liquid transportation market in India was valued at USD 0.88 Billion in 2024.

The India bulk liquid transportation market is projected to exhibit a CAGR of 3.50% during 2025-2033, reaching a value of USD 1.20 Billion by 2033.

The India bulk liquid transportation market is driven by rising demand from chemical, oil & gas, and food & beverage industries, expansion of international trade, and need for safe, efficient logistics. Growth in manufacturing, improved infrastructure, adoption of ISO tanks, and regulatory focus on safe handling of hazardous liquids further boost demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)