India Bulk Oxygen Market Size, Share, Trends and Forecast by Delivery Mode, Form, Type, End User, and Region, 2025-2033

India Bulk Oxygen Market Overview:

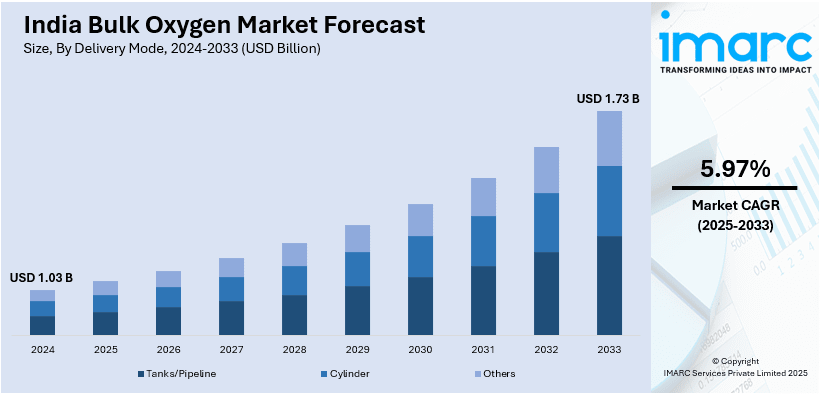

The India bulk oxygen market size reached USD 1.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.73 Billion by 2033, exhibiting a growth rate (CAGR) of 5.97% during 2025-2033. The increasing demand from healthcare, chemical, and industrial sectors, rising medical oxygen consumption, expanding steel and metal production, continual technological advancements in oxygen storage and transportation, and implementation of government initiatives supporting infrastructure and industrial development are some of the major factors augmenting India bulk oxygen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.03 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Market Growth Rate 2025-2033 | 5.97% |

India Bulk Oxygen Market Trends:

Rising Demand for Medical Oxygen Amid Healthcare Advancements

The increasing demand for medical oxygen in hospitals, clinics, and emergency healthcare services drives the India bulk oxygen market growth. The COVID-19 pandemic highlighted the critical role of oxygen supply, leading to enhanced infrastructure and government policies promoting oxygen self-sufficiency. With rising healthcare investments and the expansion of hospitals in urban and rural areas, the demand for liquid and compressed oxygen remains strong. Additionally, the growing prevalence of respiratory diseases, including COPD and asthma, is further driving medical oxygen consumption. According to an industry report, respiratory system diseases account for 15.3% of all prescriptions written for all patients in India, making it the largest disease category in the country. Significant air pollution, tobacco usage by more than 267 Million people and indoor pollution from biomass fuels are all contributing factors. This high burden of respiratory diseases directly translates into sustained demand for medical oxygen across the country. As hospitals, clinics, and home care settings continue to manage acute and chronic respiratory conditions, the bulk oxygen market in India is witnessing steady growth. These problems must be addressed by strict public health regulations, early diagnosis, and treatment compliance to reduce the crisis. Additionally, the implementation of government initiatives, such as the establishment of Pressure Swing Adsorption (PSA) oxygen plants across hospitals, has strengthened supply chains. Furthermore, continual advancements in medical oxygen storage and distribution technologies ensure efficient and uninterrupted supply. As India continues to expand its healthcare sector, the need for reliable and large-scale oxygen supply is expected to remain a key driver of market growth in the coming years.

To get more information on this market, Request Sample

Industrial Growth Fueling Bulk Oxygen Consumption

The increasing industrialization in India is significantly driving the demand for bulk oxygen, particularly in sectors such as steel manufacturing, chemicals, and oil refining. Oxygen is a crucial component in metal fabrication, welding, and refining processes, making it indispensable for industries focused on production and infrastructure development. The government’s push for self-reliance in steel and manufacturing under initiatives like “Make in India” has further amplified demand. According to an industry report, the manufacturing sector in India is poised to reach USD 1 Trillion by 2025-26. This projected growth in the manufacturing sector is also expected to drive demand for industrial gases, including bulk oxygen. Industries such as steel, chemicals, glass, and textiles rely heavily on oxygen for various production processes. As manufacturing capacity expands, so does the need for large-scale, uninterrupted oxygen supply, further strengthening the outlook for the bulk oxygen market in India. Additionally, rapid urbanization and infrastructural projects lead to a surge in industrial oxygen requirements for construction and metal processing, which is facilitating market growth. The rise in renewable energy projects, such as hydrogen fuel production, also contributes to higher oxygen consumption. Companies are investing in advanced oxygen generation and storage systems to ensure stable supply chains, which in turn is positively impacting India bulk oxygen market outlook. With continued economic expansion, industrial growth is expected to remain a strong driver for the India bulk oxygen market, ensuring a steady increase in demand for oxygen across multiple sectors.

India Bulk Oxygen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on delivery mode, form, type, and end user.

Delivery Mode Insights:

- Tanks/Pipeline

- Cylinder

- Others

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes tanks/pipeline, cylinders, and others.

Form Insights:

- Liquid Oxygen

- Compressed Oxygen

- Oxygen Gas Mixture

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid oxygen, compressed oxygen, and oxygen gas mixture.

Type Insights:

- Industrial

- Medical

The report has provided a detailed breakup and analysis of the market based on the type. This includes industrial and medical.

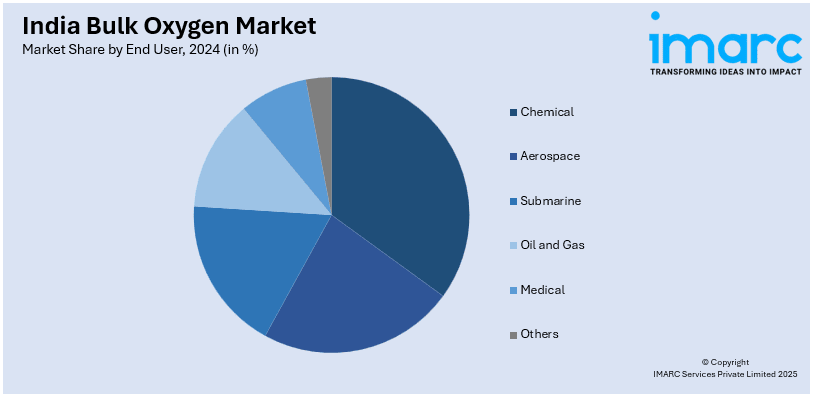

End User Insights:

- Chemical

- Aerospace

- Submarine

- Oil and Gas

- Medical

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes chemical, aerospace, submarine, oil and gas, medical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bulk Oxygen Market News:

- On March 27, 2023, Inox Air Products announced plans to establish its sixth air separation unit (ASU) at the AM/NS India Hazira facility. This expansion aims to enhance the production capacity of industrial gases, including oxygen, nitrogen, and argon, to support the steel manufacturing processes at AMNS. The initiative underscores INOX Air Products' commitment to strengthening its infrastructure and meeting the growing demands of the steel industry.

India Bulk Oxygen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Delivery Modes Covered | Tanks/Pipeline, Cylinders, Others |

| Forms Covered | Liquid Oxygen, Compressed Oxygen, Oxygen Gas Mixtures |

| Types Covered | Industrial, Medical |

| End Users Covered | Chemical, Aerospace, Submarine, Oil and Gas, Medical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India bulk oxygen market performed so far and how will it perform in the coming years?

- What is the breakup of the India bulk oxygen market on the basis of delivery mode?

- What is the breakup of the India bulk oxygen market on the basis of form?

- What is the breakup of the India bulk oxygen market on the basis of type?

- What is the breakup of the India bulk oxygen market on the basis of end user?

- What is the breakup of the India bulk oxygen market on the basis of region?

- What are the various stages in the value chain of the India bulk oxygen market?

- What are the key driving factors and challenges in the India bulk oxygen market?

- What is the structure of the India bulk oxygen market and who are the key players?

- What is the degree of competition in the India bulk oxygen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bulk oxygen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bulk oxygen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bulk oxygen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)