India Bulldozer Market Size, Share, Trends and Forecast by Type, Product Type, Operating Weight, Horsepower, Flywheel Power, Blade Type, Engine Capacity, End-Use Industry, and Region, 2025-2033

India Bulldozer Market Overview:

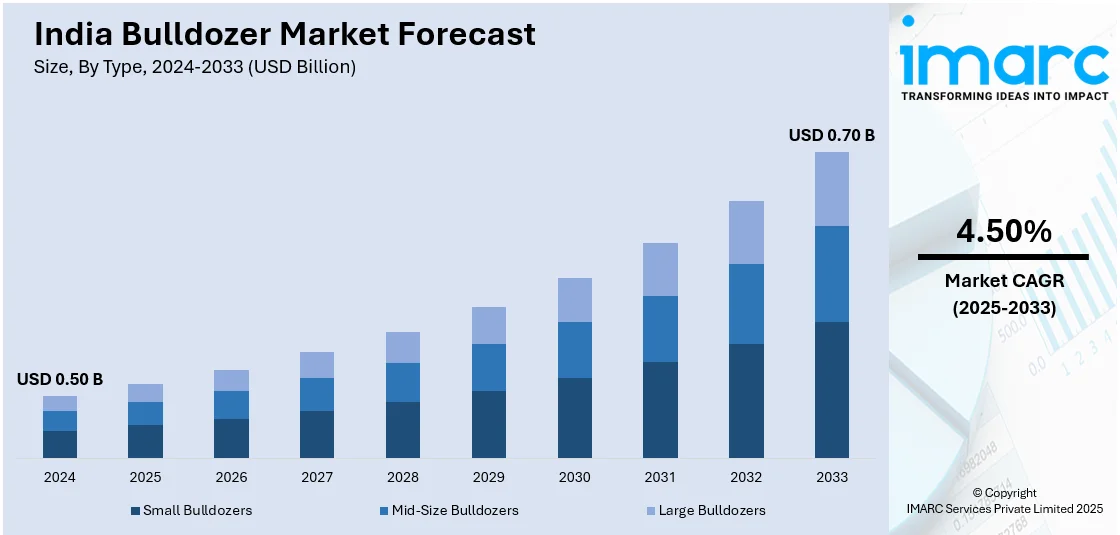

The India bulldozer market size reached USD 0.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.70 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is experiencing significant growth driven by rising infrastructure projects, mining activities and government investments in highways, railways, and urban development. Growing mechanization in mining and construction, along with financing options and rental services, is driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.50 Billion |

| Market Forecast in 2033 | USD 0.70 Billion |

| Market Growth Rate 2025-2033 | 4.50% |

India Bulldozer Market Trends:

Rising Infrastructure Development

India’s rapid infrastructure expansion is significantly driving demand for bulldozers across construction, mining and land development sectors. Government initiatives like Bharatmala, Sagarmala and Smart Cities Mission are accelerating large-scale projects in highways, railways, ports and urban development. These initiatives are fueling India bulldozer market growth as construction firms and contractors seek efficient earthmoving equipment for excavation, grading and site preparation. Additionally, rising investments in metro rail projects, airport expansions and rural road development under PM Gati Shakti are further boosting bulldozer adoption. For instance, in February 2025, the NCRTC received over Rs 2,900 crore in the Union Budget 2025-26 for the Regional Rapid Transit System (RRTS). This 82-km corridor connects Sarai Kale Khan in New Delhi to Modipuram in Meerut allowing commuters to travel between Delhi and Meerut South in just 40 minutes. Consequently, the demand for technologically advanced fuel-efficient bulldozers with GPS tracking and automated controls is increasing, improving productivity and operational efficiency. Growing public-private partnerships (PPPs) and financing options for heavy machinery procurement are also expanding market accessibility. With sustained infrastructure investments and modernization in construction machinery, the India bulldozer market outlook remains strong, offering significant growth opportunities.

To get more information on this market, Request Sample

Growth in Mining and Quarrying

The expansion of coal, metal, and limestone mining in India is significantly driving demand for heavy equipment, including bulldozers. The government’s focus on self-reliance in mineral production, backed by policy reforms like commercial coal mining auctions and ease of mining approvals, is increasing excavation and material handling activities. Large-scale mining projects, particularly in Odisha, Jharkhand, and Chhattisgarh, require advanced bulldozers for site preparation, overburden removal, and transportation of extracted materials. Additionally, private sector investments in iron ore and bauxite mining are further boosting equipment procurement. India's mining sector is experiencing significant growth, driven by increasing production volumes and government initiatives to enhance domestic resource extraction. According to the report published by the Press Information Bureau, India's coal production reached a record 997.826 Million Tons in 2023-24, up 11.71% from the previous year. During 2024, coal supplies totaled approximately 963.11 Million Tons. The Ministry of Coal launched initiatives to boost domestic coking coal production aiming for 140 Million Tons by 2030. The shift towards automated, GPS-enabled bulldozers is improving operational efficiency and reducing downtime. The rising demand for sustainable mining practices is also encouraging the use of fuel-efficient and hybrid bulldozers. With continuous expansion in India’s mining sector and growing mechanization, India bulldozer market share is expected to increase steadily in the coming years.

India Bulldozer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, product type, operating weight, horsepower, flywheel power, blade type, engine capacity, and end-use industry.

Type Insights:

- Small Bulldozers

- Mid-Size Bulldozers

- Large Bulldozers

The report has provided a detailed breakup and analysis of the market based on the type. This includes small bulldozers, mid-size bulldozers, and large bulldozers.

Product Type Insights:

- Crawler Bulldozers

- Wheeled Bulldozers

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes crawler bulldozers, wheeled bulldozer, and others.

Operating Weight Insights:

- Less Than 10,000 KG

- 10,000-30,000 KG

- 30,000 KG-1,85,000 KG

- More Than 1,85,000 KG

A detailed breakup and analysis of the market based on the operating weight have also been provided in the report. This includes less than 10,000 kg, 10,000-30,000 kg, 30,000 kg-1,85,000 kg, and more than 1,85,000 kg.

Horsepower Insights:

- Less Than 150 HP

- 151-260 HP

- 261-500 HP

- More Than 500 HP

A detailed breakup and analysis of the market based on the horsepower have also been provided in the report. This includes less than 150 HP, 151-260 HP, 261-500 HP, and more than 500 HP.

Flywheel Power Insights:

- Less Than 85 KW

- 85-200 KW

- More Than 200 KW

A detailed breakup and analysis of the market based on the flywheel power have also been provided in the report. This includes less than 85 KW, 85-200 KW, and more than 200 KW.

Blade Type Insights:

- U-Blade

- Semi-U

- Sigma-4

- Others

A detailed breakup and analysis of the market based on the blade type have also been provided in the report. This includes U-Blade, Semi-U, Sigma-4, and Others.

Engine Capacity Insights:

- Less Than 5L

- 5L-10L

- More Than 10L

A detailed breakup and analysis of the market based on the engine capacity have also been provided in the report. This includes less than 5L, 5L-10L, and more than 10L.

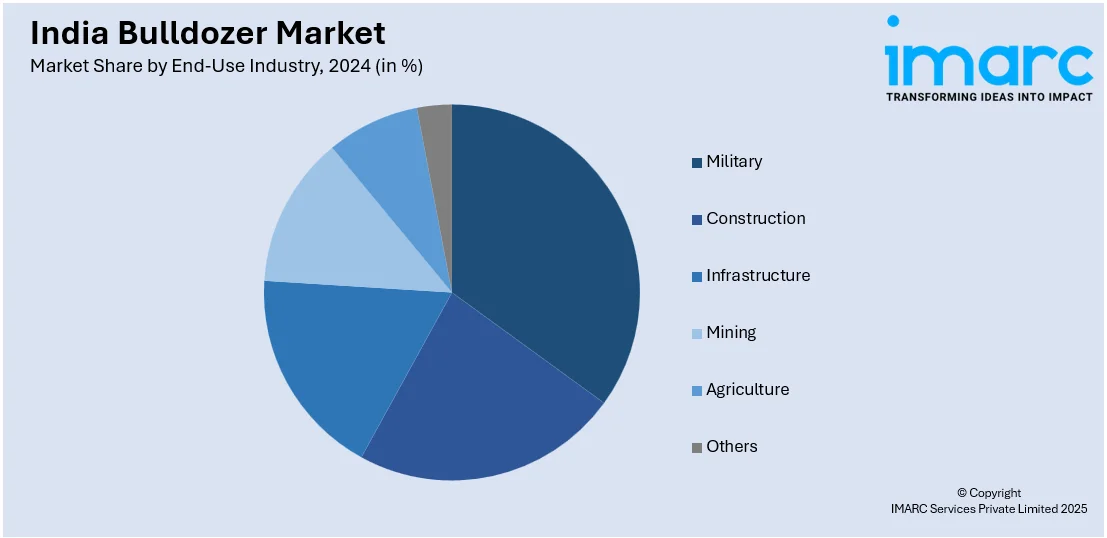

End-Use Industry Insights:

- Military

- Construction

- Infrastructure

- Mining

- Agriculture

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes military, construction, infrastructure, mining, agriculture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bulldozer Market News:

- In January 2025, India's CSIR-CIMFR successfully completed the initial trial of the dozer push mining method at the Adani-operated PEKB coal mine in Chhattisgarh. This innovative technique enhances safety and efficiency, utilizing automated machinery for drilling and blasting. Further trials will refine the method, potentially revolutionizing mining practices in India.

- In December 2024, BEML Ltd launched the BD475-2 Dozer, India's largest crawler dozer, powered by a 950 HP engine. Developed in-house, it features a 30-litre Cummins engine and a capacity of 25.6 cubic meters. This advanced machine underscores India's engineering prowess and commitment to self-reliance in the heavy equipment sector.

India Bulldozer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Small Bulldozers, Mid-Size Bulldozers, Large Bulldozers |

| Product Types Covered | Crawler Bulldozers, Wheeled Bulldozers, Others |

| Operating Weights Covered | Less Than 10,000 KG, 10,000-30,000 KG, 30,000 KG-1,85,000 KG, More Than 1,85,000 KG |

| Horsepowers Covered | Less Than 150 HP, 151-260 HP, 261-500 HP, More Than 500 HP |

| Flywheel Powers Covered | Less Than 85 KW, 85-200 KW, More Than 200 KW |

| Blade Types Covered | U-Blade, Semi-U, Sigma-4, Others |

| Engine Capacities Covered | Less Than 5L, 5L-10L, More Than 10L |

| End-Use Industries Covered | Military, Construction, Infrastructure, Mining, Agriculture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India bulldozer market performed so far and how will it perform in the coming years?

- What is the breakup of the India bulldozer market on the basis of type?

- What is the breakup of the India bulldozer market on the basis of product type?

- What is the breakup of the India bulldozer market on the basis of operating weight?

- What is the breakup of the India bulldozer market on the basis of horsepower?

- What is the breakup of the India bulldozer market on the basis of flywheel power?

- What is the breakup of the India bulldozer market on the basis of blade type?

- What is the breakup of the India bulldozer market on the basis of engine capacity?

- What is the breakup of the India bulldozer market on the basis of end-use industry?

- What is the breakup of the India bulldozer market on the basis of region?

- What are the various stages in the value chain of the India bulldozer market?

- What are the key driving factors and challenges in the India bulldozer market?

- What is the structure of the India bulldozer market and who are the key players?

- What is the degree of competition in the India bulldozer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bulldozer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bulldozer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bulldozer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)