India Business Information Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Business Information Market Overview:

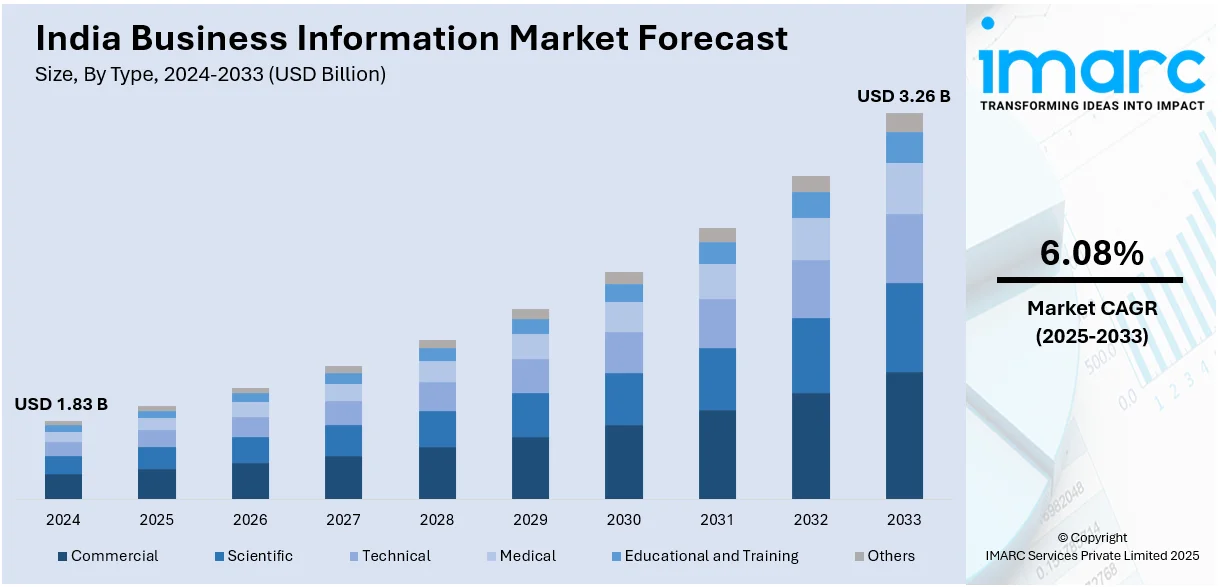

The India business information market size reached USD 1.83 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.26 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The market is driven by rapid urbanization, rising disposable incomes, thriving digital economy, government initiatives like "Make in India," increasing foreign investments, and a growing consumer base demanding innovative products across sectors, such as technology, healthcare, retail, and renewable energy (RE).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.83 Billion |

| Market Forecast in 2033 | USD 3.26 Billion |

| Market Growth Rate 2025-2033 | 6.08% |

India Business Information Market Trends:

Digital Transformation and AI Integration in Business Information Services

The India business information market growth is experiencing rapid transformation through the integration of artificial intelligence (AI) and digital transformation strategies. Companies now use AI-based analytics together with big data and machine learning (ML) to achieve improved market trend understanding along with customer and competitive insights. For instance, in March 2024, Infosys collaborated with Germany's Handelsblatt Media Group to leverage generative AI for making complex economic and financial reports more accessible. This partnership enhanced digital storytelling and information dissemination in the media industry, highlighting the growing role of AI in business intelligence. In addition to this, cloud-based solutions alongside automated processing tools help organizations streamline operations for real-time decision-making and efficiency improvements. Moreover, fintech and e-commerce businesses create a rising market need for AI systems which assess risk and detect fraud. Besides this, Indian enterprises are heavily investing in smart data solutions because of government initiatives under "Digital India." Furthermore, business intelligence systems achieve greater strength through the expansion of 5G and IoT technologies which improve data accessibility and connectivity. As a result, companies are adopting AI-driven business information services because these services have become essential for modern operations, thus enhancing the India business information market outlook.

To get more information on this market, Request Sample

Growing Demand for ESG and Sustainability Data

The increasing emphasis on environmental, social, and governance (ESG) factors is boosting the India business information market share. Organizations are actively focusing on sustainability reporting and ethical operations because it aligns with the global standards and investors' anticipations. In line with this, the Securities and Exchange Board of India (SEBI) requires Business Responsibility and Sustainability Reporting (BRSR) from listed companies that generate a demand for ESG data analytics and compliance solution sets. For example, in May 2024, SEBI issued a master circular to regulate ESG Rating Providers under the provisions of the Securities and Exchange Board of India (Credit Rating Agencies) Regulations, 1999. This move aims to standardize ESG ratings and enhance transparency in the evaluation process, further strengthening the credibility of ESG data. Moreover, third-party ESG data providers experience an increasing demand because investors, together with regulatory bodies and consumers, need transparent information about corporate sustainability initiatives. The incorporation of ESG metrics has become standard practice in business operations that include risk assessment models as well as supply chain and investment strategy development. Apart from this, data-driven information about carbon footprints along with energy efficiency and social impact assessments has become essential for business decisions as corporate social responsibility (CSR) initiatives keep expanding. As a result, the segment of business information focused on ESG is expected to experience rapid expansion in India because of increasing investor attention and regulatory demands.

India Business Information Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Commercial

- Scientific

- Technical

- Medical

- Educational and Training

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes commercial, scientific, technical, medical, educational and training, and others.

End User Insights:

.webp)

- BSFI

- Healthcare and Life Sciences

- Manufacturing

- Retail

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BSFI, healthcare and life sciences, manufacturing, retail, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Business Information Market News:

- In November 2024, L&T announced a strategic partnership with E2E Networks, acquiring a 21% equity stake. This collaboration aims to accelerate cloud and AI innovation for Indian enterprises, enhancing digital transformation and competitiveness.

- In February 2024, PwC India collaborated with Sirion to revolutionize enterprise contract management. By integrating AI-powered contract lifecycle management solutions, this alliance enhances efficiency and reduces risks for businesses, driving innovation in contract processes.

India Business Information Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | commercial, scientific, technical, medical, educational and training, others |

| End Users Covered | BSFI, healthcare and life sciences, manufacturing, retail, others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India business information market performed so far and how will it perform in the coming years?

- What is the breakup of the India business information market on the basis of type?

- What is the breakup of the India business information market on the basis of end user?

- What is the breakup of the India business information market on the basis of region?

- What are the various stages in the value chain of the India business information market?

- What are the key driving factors and challenges in the India business information?

- What is the structure of the India business information market and who are the key players?

- What is the degree of competition in the India business information market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India business information market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India business information market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India business information industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)