India Button Cell Market Size, Share, Trends and Forecast by Letter Code Type, Package Size, Application, and Region, 2025-2033

India Button Cell Market Overview:

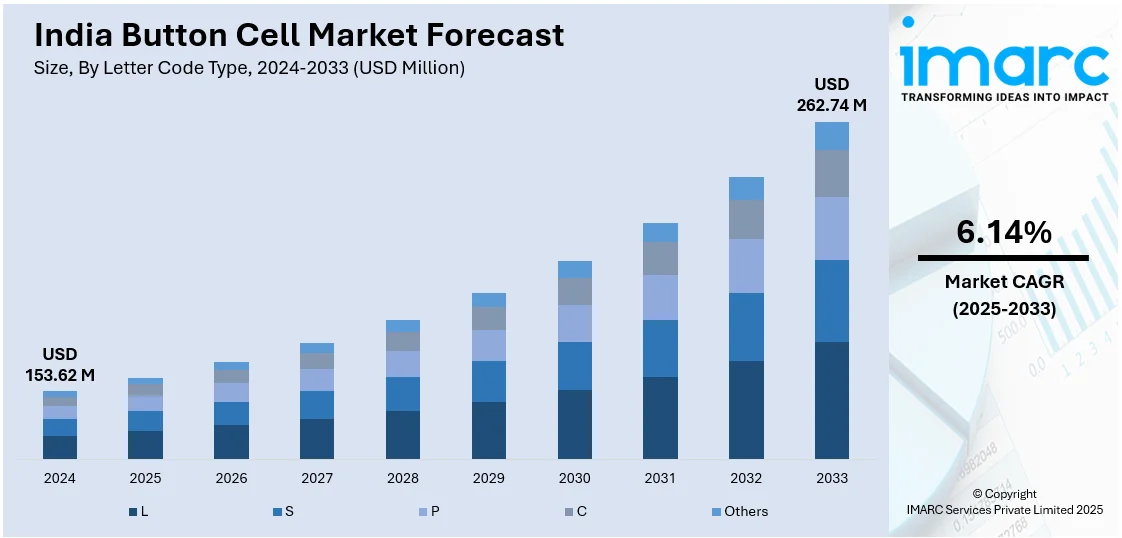

The India button cell market size reached USD 153.62 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 262.74 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. The market is driven by increasing demand for portable electronics, such as wearables, hearing aids, and medical devices. Besides this, the expanding consumer electronics sector, advancements in battery technology, and the growing adoption of IoT devices are further propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 153.62 Million |

| Market Forecast in 2033 | USD 262.74 Million |

| Market Growth Rate 2025-2033 | 6.14% |

India Button Cell Market Trends:

Growing Demand for Wearable Electronics

The surge in wearable electronics is emerging as a key driver for the India button cell market, as compact and energy-efficient batteries are essential for devices like smartwatches, fitness trackers, and health-monitoring gadgets. With an increasing emphasis on fitness and lifestyle trends, India's wearable electronics market is projected to hit USD 9,034.4 by 2033, largely fueled by smartwatch sales and healthcare devices. In 2024, the market witnessed 119.0 million wearable units in India, as reported by International Data Corporation's (IDC’s) India Monthly Wearable Device Tracker. This expanding market not only boosts the demand for button cells in consumer electronics but also in healthcare wearables such as hearing aids, glucose monitors, and other personal medical devices that require reliable, long-lasting power sources. The enduring performance of button cells, capable of supporting continuous operation over extended periods, makes them indispensable in powering these compact yet crucial devices.

To get more information on this market, Request Sample

Increased Use in IoT Devices and Consumer Electronics

The expanding usage of Internet of Things (IoT) devices and the broader consumer electronics sector is a key driver behind the growth of the India Button Cell market. IoT devices such as smart home products, remote controls, wireless sensors, and smart toys require small, efficient batteries for continuous operation, making button cells an ideal choice due to their compact size, high energy density, and long-lasting power for low-drain applications. The India IoT market, valued at USD 1.4 billion in 2024, is projected to reach USD 3.6 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033. As IoT connections in India are expected to exceed 700 million by 2025, the demand for button cells will continue to rise, particularly in urban areas. Additionally, the Indian consumer electronics market, including products like remote controls, hearing aids, cameras, and calculators, is further driving the use of button cells. These small, battery-efficient devices increasingly rely on button cells for their long-lasting power capabilities.

India Button Cell Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on letter code type, package size, application, and region.

Letter Code Type Insights:

- L

- S

- P

- C

- Others

The report has provided a detailed breakup and analysis of the market based on the letter code type. This includes L, S, P, C, and others.

Package Size Insights:

- 4

- 5

- 6

- 7

- 9

- 10

- Others

A detailed breakup and analysis of the market based on the package size have also been provided in the report. This includes 4, 5, 6, 7, 9, 10, and others.

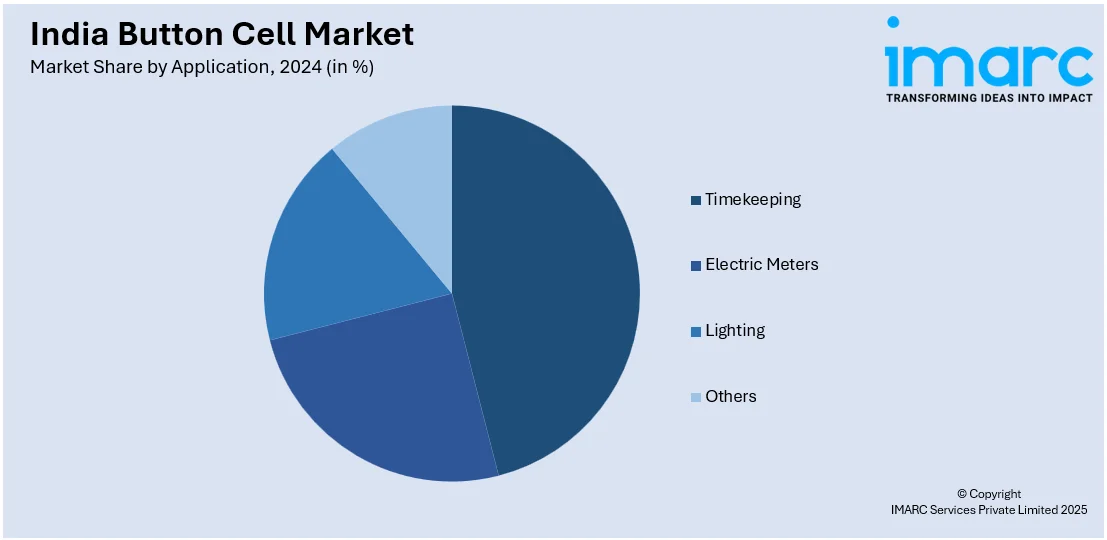

Application Insights:

- Timekeeping

- Electric Meters

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes timekeeping, electric meters, lighting, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Button Cell Market News:

- March 2025: The Government of India approved an INR 2,681 crore (USD 2.7 billion) plan to boost the manufacturing of electronic components, including button cells. This initiative aims to enhance production in sectors such as telecommunications, automotive, and energy.

- September 2024: Crossbeats, an Indian wearable brand, is expanding globally to capitalize on the growing demand for smartwatches and wireless audio devices. The company aims to strengthen its presence in markets like the Middle East, Europe, and Southeast Asia, leveraging its innovative product portfolio and competitive pricing. This strategic move seeks to enhance Crossbeats' market share and brand recognition internationally, contributing to its overall growth in the competitive wearable technology sector.

- August 2024: Indian wearable manufacturers are adopting innovative strategies to expand, focusing on advanced health-tracking features, enhanced battery life, and competitive pricing. Companies like Noise and boAt have begun integrating AI-driven health insights and expanding into international markets to boost sales. These efforts aim to differentiate products and sustain growth amid increasing competition and market saturation.

India Button Cell Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Letter Code Types Covered | L, S, P, C, Others |

| Package Sizes Covered | 4, 5, 6, 7, 9, 10, Others |

| Applications Covered | Timekeeping, Electric Meters, Lighting, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India button cell market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India button cell market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India button cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India button cell market was valued at USD 153.62 Million in 2024.

The India button cell market is projected to exhibit a CAGR of 6.14% during 2025-2033, reaching a value of USD 262.74 Million by 2033.

The India button cell market is driven by expanding consumer electronics, wearable devices, and remote sensors. Rising demand for portable medical instruments, hearing aids, and smart gadgets also fuels growth. Innovations in compact energy storage, increased focus on long shelf-life batteries, and rising exports further support expanding production and distribution across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)