India Butyric Acid Market Size, Share, Trends and Forecast by Type, Distribution Channel, End Use, and Region, 2025-2033

India Butyric Acid Market Overview:

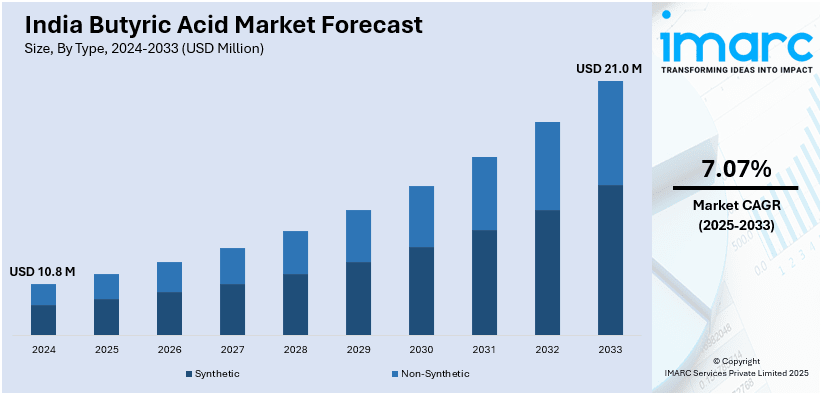

The India butyric acid market size reached USD 10.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 21.0 Million by 2033, exhibiting a growth rate (CAGR) of 7.07% during 2025-2033. The Indian butyric acid market is expanding because of rising demand for animal feed, food additives, and pharmaceuticals. Moreover, a growing understanding of gut health, improving livestock production, and the transition to sustainable, bio-based sources of butyric acid are among the prevalent drivers forming market growth and industrial uptake.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.8 Million |

| Market Forecast in 2033 | USD 21.0 Million |

| Market Growth Rate (2025-2033) | 7.07% |

India Butyric Acid Market Trends:

Growing Demand for Butyric Acid in Animal Feed

The growing emphasis on enhancing livestock health and productivity is driving the demand for butyric acid in animal feed uses. Moreover, farmers are looking for efficient feed additives that promote gut health and overall growth performance with the growth of poultry and dairy farming. Butyric acid is well known for its ability to enhance digestion, minimize intestinal disorders, and enhance immunity in animals, and hence, it is a popular choice in feed formulations. As more focus is placed on antibiotic-free animal nutrition, butyric acid is being seen as a green replacement for traditional growth promoters in the livestock industry. The growth of India's livestock sector, including poultry and dairy farming, is driving the use of butyric acid-containing feed additives. Rising fears regarding antimicrobial resistance and government policies aimed at lowering antibiotic usage in animal feed are further driving the trend. Butyric acid's efficacy in enhancing gut health without the risks of antibiotics is propelling its growing use in feed formulations nationwide. With livestock farming expanding to address the country's growing protein needs, the animal nutrition market for butyric acid will expand. Research and product development in feed-grade butyric acid will continue to influence its uptake in India's changing animal husbandry industry.

To get more information on this market, Request Sample

Expanding Industrial Applications

The rising focus on improving livestock health and productivity is increasing the demand for butyric acid in animal feed applications. As poultry and dairy farming expands, farmers are seeking effective feed additives that enhance gut health and overall growth performance. Butyric acid is widely recognized for its role in improving digestion, reducing intestinal disorders, and boosting immunity in animals, making it a preferred choice in feed formulations. With a growing emphasis on antibiotic-free animal nutrition, butyric acid is emerging as a sustainable alternative to conventional growth promoters in livestock production. In India, the expansion of the livestock sector, particularly poultry and dairy farming, is fueling the adoption of butyric acid-based feed additives. Increasing concerns over antimicrobial resistance and regulatory efforts to reduce antibiotic use in animal feed are further accelerating this trend. Butyric acid’s effectiveness in promoting gut health without the risks associated with antibiotics is driving its increasing incorporation in feed formulations across the country. In addition to animal nutrition, a new technology introduced in November 2024 is converting wastewater into biofuel, increasing demand for microbial fermentation processes where butyric acid plays a crucial role. This development is expected to expand India's butyric acid market by strengthening its industrial applications in renewable energy and sustainable biochemical production. As livestock farming scales up and industrial demand rises, the market for butyric acid in India is set to grow, supported by ongoing research and product innovations in both feed-grade and industrial applications.

India Butyric Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, distribution channel, and end use.

Type Insights:

- Synthetic

- Non-Synthetic

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic and non-synthetic.

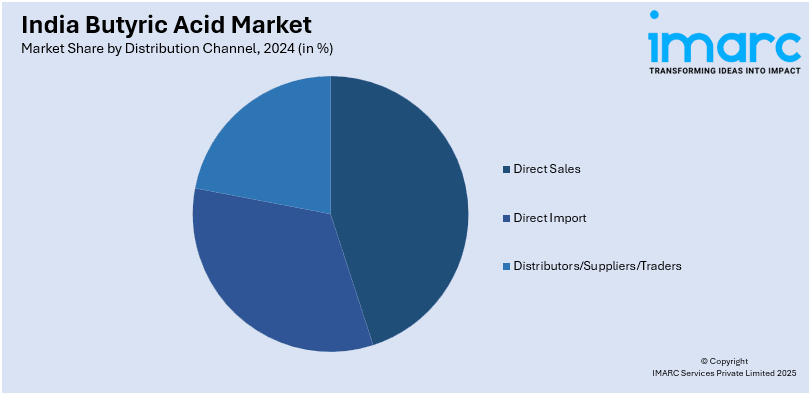

Distribution Channel Insights:

- Direct Sales

- Direct Import

- Distributors/Suppliers/Traders

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, direct import, and distributors/suppliers/traders.

End Use Insights:

- Animal Feed

- Chemical Intermediates

- Pharmaceuticals

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes animal feed, chemical intermediates, pharmaceuticals, food and beverage, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Butyric Acid Market News:

- September 2024: Farmery introduced Buffalo Ghee, rich in butyric acid, promoting gut health and immunity. This launch highlights growing consumer demand for functional dairy products, driving increased butyric acid utilization in India’s food industry. Rising awareness of digestive health is expanding market opportunities for butyric acid-based applications.

- July 2024: BUTIGEM TR, an advanced coated butyric acid product, was introduced to improve gut health in broiler chickens by ensuring targeted intestinal release. This innovation enhances feed conversion ratio (FCR), villi growth, and gut integrity, accelerating India’s butyric acid market growth amid rising antibiotic-free poultry feed demand.

India Butyric Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic, Non-Synthetic |

| Distribution Channels Covered | Direct Sales, Direct Import, Distributors/Suppliers/Traders |

| End Users Covered | Animal Feed, Chemical Intermediates, Pharmaceuticals, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India butyric acid market performed so far and how will it perform in the coming years?

- What is the breakup of the India butyric acid market on the basis of type?

- What is the breakup of the India butyric acid market on the basis of distribution channel?

- What is the breakup of the India butyric acid market on the basis of end use?

- What are the various stages in the value chain of the India butyric acid market?

- What are the key driving factors and challenges in the India butyric acid market?

- What is the structure of the India butyric acid market and who are the key players?

- What is the degree of competition in the India butyric acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India butyric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India butyric acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India butyric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)