India Calcium Carbonate Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Calcium Carbonate Market Overview:

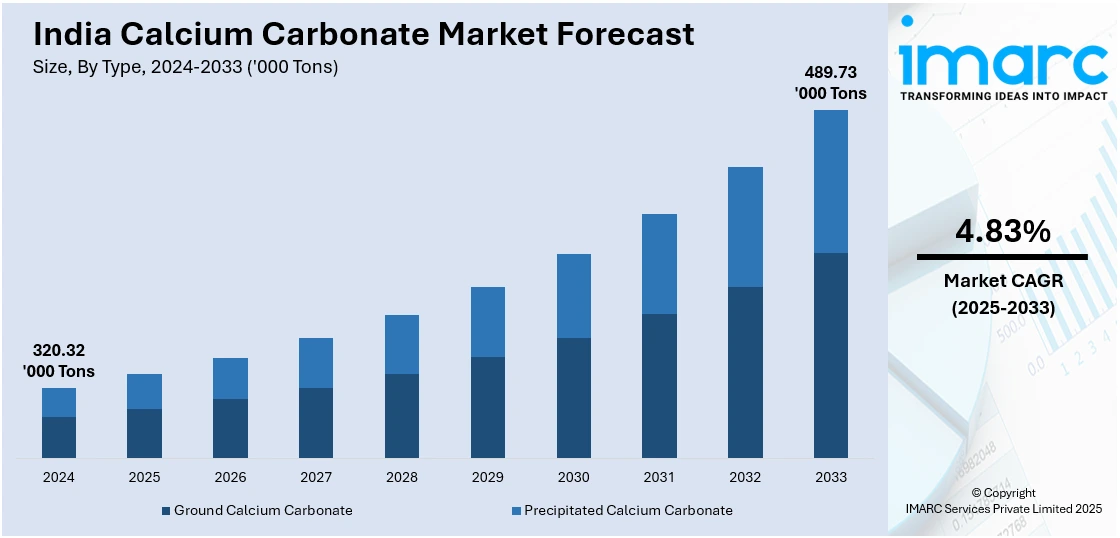

The India calcium carbonate market size reached 320.32 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 489.73 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 4.83% during 2025-2033. The market is driven by rising demand from the paper, plastics, and construction industries, increasing use in pharmaceuticals and food processing, and the growing adoption of nano-calcium carbonate in high-performance applications. Additionally, expanding infrastructure projects and government support for domestic manufacturing are further augmenting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 320.32 Thousand Tons |

| Market Forecast in 2033 | 489.73 Thousand Tons |

| Market Growth Rate 2025-2033 | 4.83% |

India Calcium Carbonate Market Trends:

Increased Demand in the Paper Industry

Calcium carbonate is a vital component in paper manufacturing, acting as a cost-effective filler and coating agent that enhances brightness, opacity, and smoothness, essential for high-quality printing and writing materials. Despite the global shift toward digital media, India's paper industry remains robust, driven by the rising demand for paper-based packaging solutions, particularly with the expansion of e-commerce. The Indian paper industry accounts for approximately 5% of global production, generating around INR 80,000 crores in revenue. Additionally, India’s per capita paper consumption stands at 15-16 kg, highlighting significant growth potential. The booming e-commerce sector has fueled a surge in demand for corrugated packaging, directly increasing the consumption of calcium carbonate in paper production. As sustainability gains importance, the paper industry’s reliance on calcium carbonate as an eco-friendly alternative to wood-based fillers continues to strengthen. These factors collectively drive the increasing demand for calcium carbonate, solidifying its role in India's evolving paper manufacturing sector.

To get more information on this market, Request Sample

Expansion in the Plastics and Construction Industries

Calcium carbonate plays an important role in the plastics sector serving as a cost-effective filler that enhances the strength, durability, and thermal properties of plastic products. In addition to this, it is also widely used in the construction industry to improve the workability and longevity of concrete. The widespread usage of calcium carbonate in these sectors is fueled by India's growing infrastructure development and manufacturing investments. In 2023, the Asia-Pacific region, including India, accounted for over 37.34% of global calcium carbonate market revenue, with steady growth anticipated. The Plastic Export Promotion Council (PLEXCONCIL) has set an ambitious target to boost India’s plastic exports to $25 billion by 2027, supported by government-backed plastic park schemes, which provide up to 50% funding or a maximum of ₹40 crore ($5 million) per project. Furthermore, India's Budget 2024-25 allocates ₹10 lakh crore ($120.16 billion) under PM Awas Yojana Urban 2.0 to support housing for 1 crore urban poor and middle-class families, boosting calcium carbonate demand in construction materials. The increasing reliance on plastics across packaging, automotive, and electrical industries further amplifies its demand as a filler, reinforcing its indispensable role in India's industrial growth.

India Calcium Carbonate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

The report has provided a detailed breakup and analysis of the market based on the type. This includes ground calcium carbonate and precipitated calcium carbonate.

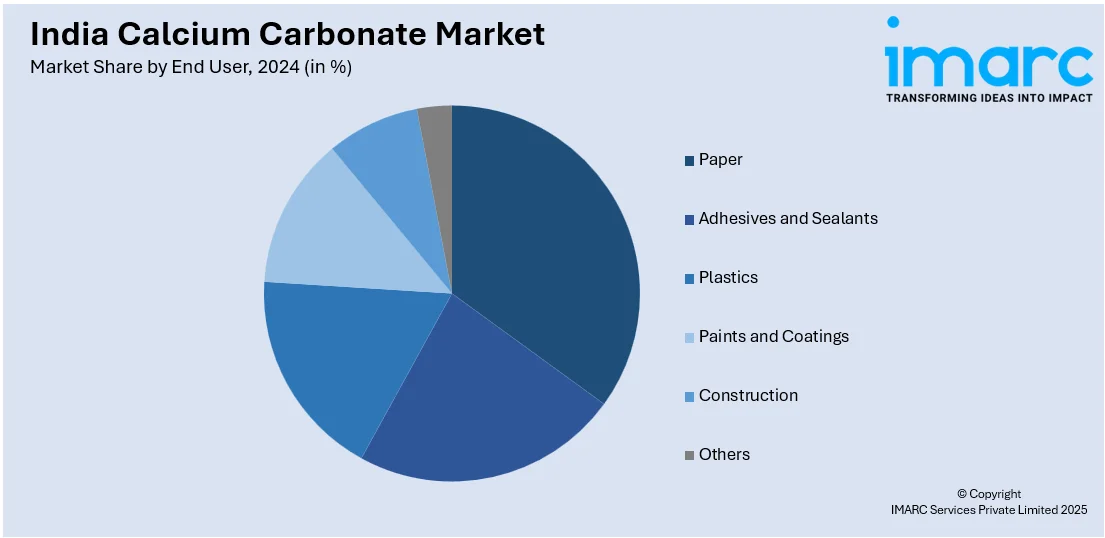

End User Insights:

- Paper

- Adhesives and Sealants

- Plastics

- Paints and Coatings

- Construction

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes paper, adhesives and sealants, plastics, paints and coatings, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Calcium Carbonate Market News:

- October 2024: Akums Drugs introduced its new product Famotidine, Calcium Carbonate, and Magnesium Hydroxide to the Indian market, catering to Antacids, Antiflatulents, and Antiulcerants. This invention was a step toward offering high-quality healthcare solutions to clients, expanding the company's product line, and favorably impacting its growth trajectory.

- April 2023: Omya India, a leading producer of calcium carbonate, announced a $25 million investment to enhance its advanced calcium carbonate plant in Gujarat. This investment aimed to expand the plant's capacity and improve efficiency, reinforcing Omya India's commitment to meeting the growing demand for high-quality calcium carbonate products in the region.

India Calcium Carbonate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ground Calcium Carbonate, Precipitated Calcium Carbonate |

| End Users Covered | Paper, Adhesives and Sealants, Plastics, Paints and Coatings, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India calcium carbonate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India calcium carbonate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India calcium carbonate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India calcium carbonate market size reached 320.32 Thousand Tons in 2024.

The India calcium carbonate market is expected to reach 489.73 Thousand Tons by 2033, exhibiting a CAGR of 4.83% during 2025-2033.

The India Calcium Carbonate Market growth is driven by rising demand in industries such as paper, plastics, paints, and construction, along with increased investment in infrastructure and manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)