India Camping Tent Market Size, Share, Trends and Forecast by Tent Type, Tent Capacity, Distribution Channel, End Use, and Region, 2025-2033

India Camping Tent Market Overview:

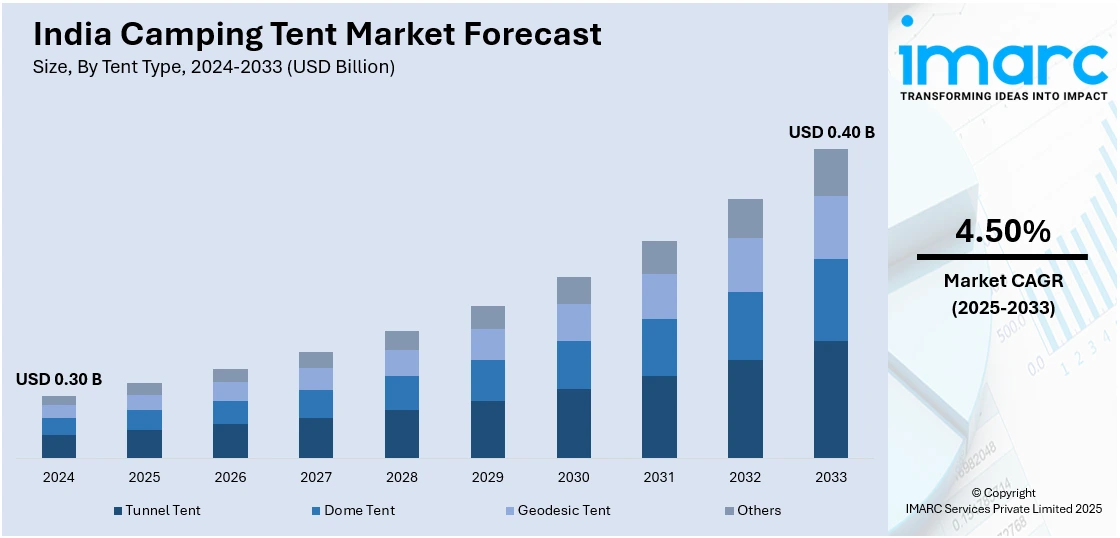

The India camping tent market size reached USD 0.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.40 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The India camping tent market is driven by increasing domestic tourism, government initiatives like Swadesh Darshan, rising adventure travel interest, expanding eco-tourism, social media influence, e-commerce availability of tents, and innovations in lightweight, weather-resistant camping gear catering to diverse consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.30 Billion |

| Market Forecast in 2033 | USD 0.40 Billion |

| Market Growth Rate 2025-2033 | 4.50% |

India Camping Tent Market Trends:

Surge in Domestic Tourism and Outdoor Recreation

The Indian camping tent market is experiencing rapid development, led by an upsurge in domestic tourism and increasing demand for outdoor activities. With around 2,509.63 million domestic tourist arrivals in 2023 compared to 1,731.01 million in 2022 (Ministry of Tourism), demand for camping equipment, especially tents, has witnessed an upward trend. Camping is picking up steam in India as tourists look for cost-effective and interactive outdoor experiences. This has generated demand for long-lasting, weatherproof, and simple-to-assemble camping tents that are compatible with varied landscapes—from the Himalayas to beach areas and woodlands. Key players are reacting with innovations like lightweight and UV-resistant materials, and easy-to-set-up models to suit diverse consumer needs. The emergence of e-commerce platforms has also provided a further impetus to the market by making camping tents of high quality available throughout the country. Moreover, rental services and companies dealing in adventure tourism increasingly make bulk purchases of tents in order to service the increasing number of campers. With India's growing tourism sector and changing travel patterns, the camping tents market is expected to grow consistently.

To get more information on this market, Request Sample

Government Initiatives Promoting Tourism and Infrastructure Development

The Indian camping tent market is experiencing considerable progress, driven by government initiatives to promote tourism and infrastructure growth. Major initiatives such as the Swadesh Darshan and PRASHAD (Pilgrimage Rejuvenation and Spiritual Heritage Augmentation Drive) schemes are driving the market landscape. The Swadesh Darshan Scheme encourages theme-based tourist circuit development, which, in turn, results in the enhancement of camping facilities in priority destinations. When infrastructure like road connectivity, sanitation, and emergency services are better, camping becomes more accessible and secure, stimulating demand for better-quality tents. The PRASHAD Scheme increases this trend even further by enriching pilgrimage centers with specialized tourist facilities, demanding temporary outdoor dwellings such as camping tents. In addition, the government's focus on sustainable tourism and eco-tourism has found resonance in the growing consumer trend toward nature-oriented experiences. With increasingly designated camping areas and well-facilitated campsites, there is a corresponding rise in demand for weatherproof, long-lasting, and quick-to-assemble tents.

India Camping Tent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on tent type, tent capacity, distribution channel, and end use.

Tent Type Insights:

- Tunnel Tent

- Dome Tent

- Geodesic Tent

- Others

The report has provided a detailed breakup and analysis of the market based on the tent type. This includes tunnel type, dome type, geodesic tent, and others.

Tent Capacity Insights:

- One Person

- Two Persons

- Three or More Persons

A detailed breakup and analysis of the market based on the tent capacity have also been provided in the report. This includes one person, two persons, and three or more persons.

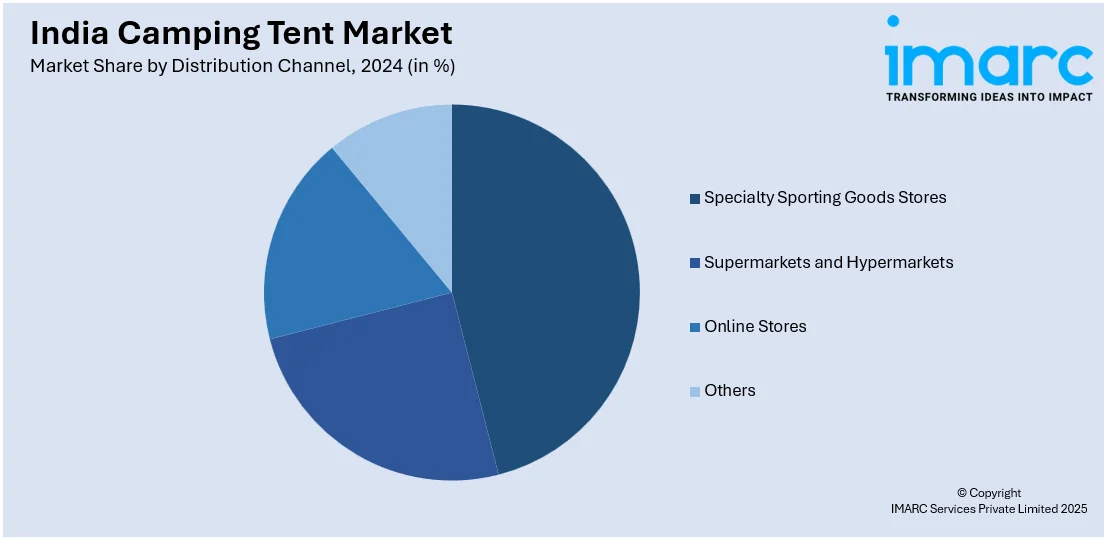

Distribution Channel Insights:

- Specialty Sporting Goods Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty sporting goods stores, supermarkets and hypermarkets, online stores, and others.

End Use Insights:

- Recreational Activities

- Military and Civil

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes recreational activities, military and civil, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Camping Tent Market News:

- January 2025: Aagman India launched high-end camping and glamping facilities for pilgrims during the Kumbh Mela, raising convenience and comfort. This move has raised awareness and demand for upscale camping facilities, drawing in more people beyond casual campers. The progress in such organized camping solutions has led to the overall development of the camping tent market in India.

- March 2024: Joytutus launched highly-ranked car-mounted tents on Amazon with advanced, waterproof, and spacious designs for outdoor camping enthusiasts. The innovation in camping convenience and comfort can bring more people to camping activities, which can make the Indian camping tent market grow as a result of rising interest in such advanced camping solutions.

India Camping Tent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tent Types Covered | Tunnel Tent, Dome Tent, Geodesic Tent, Others |

| Tent Capacities Covered | One Person, Two Persons, Three or More Persons |

| Distribution Channels Covered | Specialty Sporting Goods Stores, Supermarkets and Hypermarkets, Online Stores, Others |

| End Uses Covered | Recreational Activities, Military and Civil, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India camping tent market performed so far and how will it perform in the coming years?

- What is the breakup of the India camping tent market on the basis of tent type?

- What is the breakup of the India camping tent market on the basis of tent capacity?

- What is the breakup of the India camping tent market on the basis of distribution channel?

- What is the breakup of the India camping tent market on the basis of end use?

- What are the various stages in the value chain of the India camping tent market?

- What are the key driving factors and challenges in the India camping tent market?

- What is the structure of the India camping tent market and who are the key players?

- What is the degree of competition in the India camping tent market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India camping tent market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India camping tent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India camping tent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)