India Car Audio Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Sound Management, Sales Channel, and Region, 2025-2033

India Car Audio Market Overview:

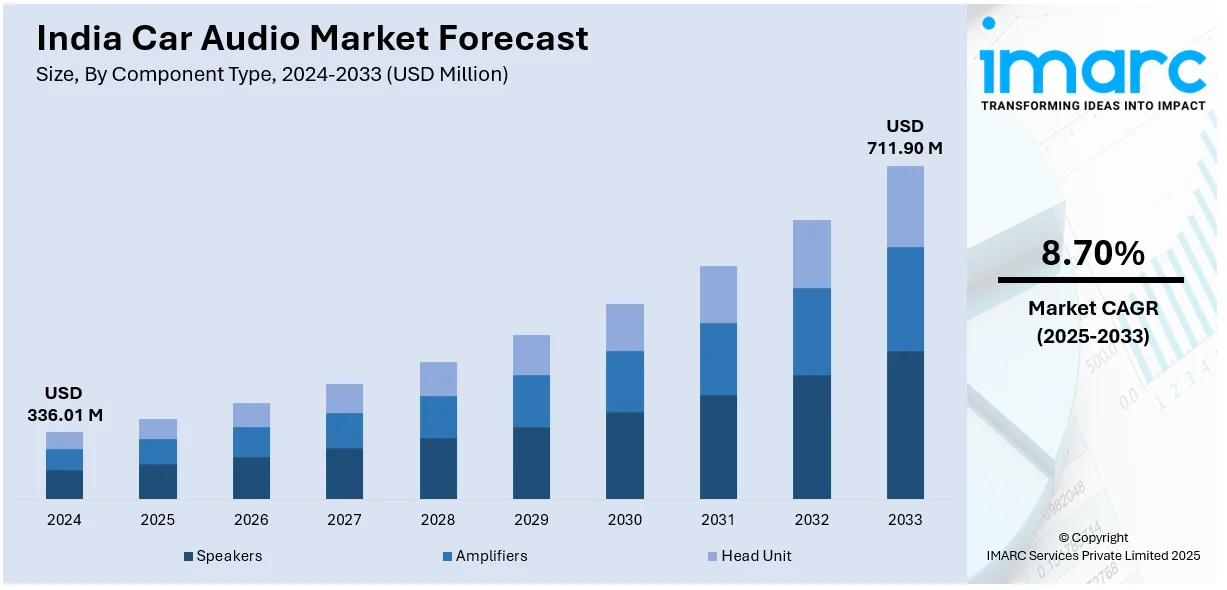

The India car audio market size reached USD 336.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 711.90 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The India car audio market share is expanding, driven by the growing need for better connectivity and entertainment, encouraging people to invest in high-quality infotainment systems, along with the rising demand for electric vehicles (EVs), creating the need for energy-efficient and reliable audio components.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 336.01 Million |

| Market Forecast in 2033 | USD 711.90 Million |

| Market Growth Rate 2025-2033 | 8.70% |

India Car Audio Market Trends:

Increasing demand for in-car entertainment

The growing demand for in-car entertainment is offering a favorable India car audio market outlook. People spend more time in their cars due to traffic and long commutes, making a good audio system essential for an enjoyable ride. People want features like Bluetooth connectivity, touchscreen controls, voice assistants, and premium sound quality to enhance their driving experience. Streaming services, podcasts, and smartphone integration further drive this demand. Additionally, younger buyers, who prioritize entertainment and connectivity, are willing to invest in high-end audio systems. This trend is not just limited to luxury cars. Mid-range and budget vehicles also come with advanced infotainment options. To meet these expectations, automakers are partnering with top audio brands to offer factory-fitted premium sound systems. In August 2024, Pioneer, the manufacturer of car audio and entertainment systems from Japan, intended to enhance its footprint in the Indian automotive sector by prioritizing collaborations with local vehicle manufacturers. The firm was recognized for the supply of automotive products, such as infotainment systems and speakers.

To get more information on this market, Request Sample

Innovations in technology

Technological advancements are impelling the India car audio market growth. People expect smart and high-quality audio systems that offer more than just basic music playback. Modern infotainment systems come with touchscreen displays, artificial intelligence (AI)-oriented voice assistants, and seamless smartphone integration, making in-car entertainment more convenient. Modern features allow drivers to access calls, navigation, and streaming services hands-free, enhancing both safety and comfort. Advanced sound technologies, such as digital signal processing (DSP), noise cancellation, and surround sound, create an immersive listening experience. Automakers are also introducing gesture controls and personalized audio settings that adapt to user preferences. With the rise of EVs, there is a greater demand for energy-efficient and powerful audio components. Moreover, as competition in the market increases, companies are investing heavily in research and engineering labs to develop next-generation audio solutions tailored for Indian roads and driving conditions. In August 2024, Harman, a prominent player in automotive electronics, launched the ‘Automotive Acoustics Experience Lab’ in Pune, India. This center was designed to transform car audio, acoustics, engineering, and research, guaranteeing that items fulfill customer demands. It encompassed around 50 engineers and research teams in India to assess, create, and verify car audio systems with unmatched accuracy.

India Car Audio Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component type, vehicle type, sound management, and sales channel.

Component Type Insights:

- Speakers

- Amplifiers

- Head Unit

The report has provided a detailed breakup and analysis of the market based on the component types. This includes speakers, amplifiers, and head unit.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicles (SUVs)

- Multi-Purpose Vehicles (MPVs)

A detailed breakup and analysis of the market based on the vehicle types have also been provided in the report. This includes hatchback, sedan, sports utility vehicles (SUVs), and multi-purpose vehicles (MPVs).

Sound Management Insights:

- Voice Recognition

- Manual

The report has provided a detailed breakup and analysis of the market based on the sound managements. This includes voice recognition and manual.

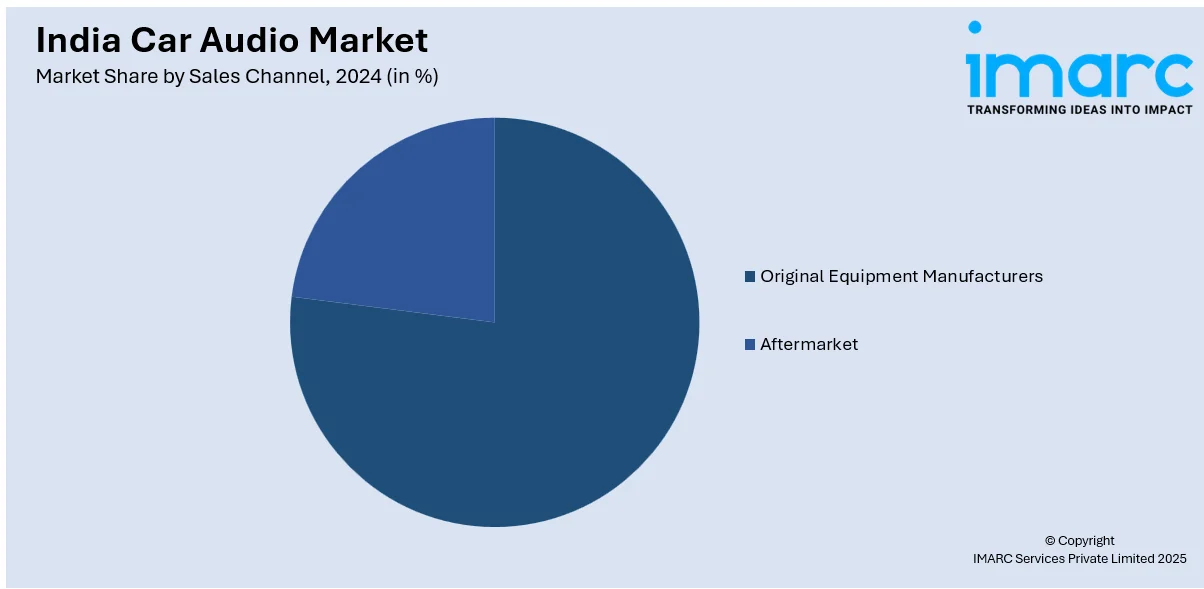

Sales Channel Insights:

- Original Equipment Manufacturers

- Aftermarket

A detailed breakup and analysis of the market based on the sales channels have also been provided in the report. This includes original equipment manufacturers and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Car Audio Market News:

- In December 2024, Mahindra, automobile manufacturing company, teamed up with Gaana, an Indian music streaming service, for in-car audio in the vehicles, BE 6e and XEV 9e. The firm intended to elevate music quality and experience, as the BE 6e and XEV 9e were the sole vehicles manufactured in India that featured Dolby Atmos. This collaboration demonstrated the dedication of providing high-quality audio experiences that aimed to satisfy the changing demands of modern users.

- In February 2024, Sony, a multinational conglomerate, unveiled a new model in its car audio visual (AV) receiver series, the XAV-AX8500, in India. The latest model, available for INR 99,990, included features like an HD touchscreen, audio personalization, and wireless Android Auto/Apple CarPlay to enhance the in-car entertainment experience. The receiver provided various audio adjustment features through its integrated DSP, enabling 5-channel processing and time alignment.

India Car Audio Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Speakers, Amplifiers, Head Unit |

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicles (Suvs), Multi-Purpose Vehicles (MPVs) |

| Sound Managements Covered | Voice Recognition, Manual |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India car audio market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India car audio market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India car audio industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car audio market in India was valued at USD 336.01 Million in 2024.

The India car audio market is projected to exhibit a CAGR of 8.70% during 2025-2033, reaching a value of USD 711.90 Million by 2033.

The India car audio market is largely influenced by the growing number of vehicle owners and a rising consumer interest in in-car entertainment. The incorporation of advanced infotainment systems and the shift toward connected cars, along with smartphone compatibility and enhanced audio experiences, are driving market expansion, particularly in urban and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)