India Car Leasing Market Size, Share, Trends and Forecast by Type, Lease Type, Service Provider Type, Tenure, and Region, 2025-2033

India Car Leasing Market Overview:

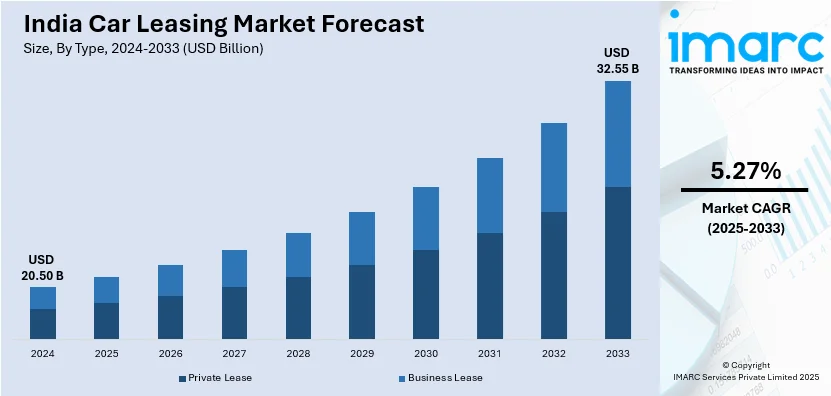

The India car leasing market size reached USD 20.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.55 Billion by 2033, exhibiting a growth rate (CAGR) of 5.27% during 2025-2033. The growth is primarily driven by rising corporate adoption, rental fleet growth, and the financial advantages offered by tax incentives.

Market Insights:

- Based on region, the market is segmented into North India, South India, East India, and West India.

- On the basis of type, the market is divided into private lease and business lease.

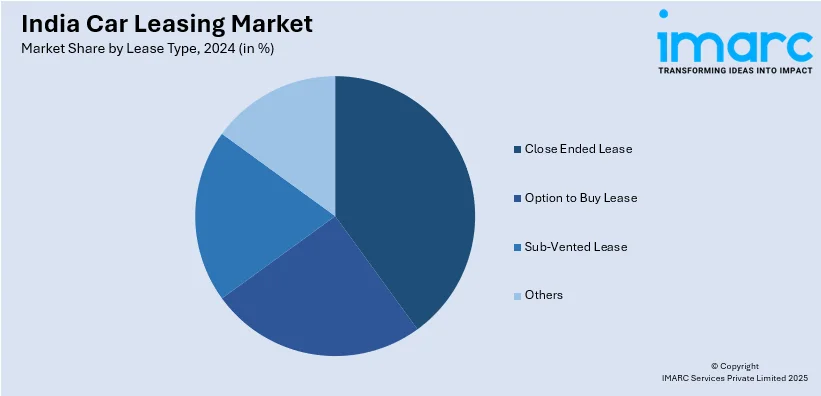

- Based on lease type, the market is segmented into close-ended lease, option to buy lease, sub-vented lease, and others.

- On the basis of service provider type, the market includes original equipment manufacturer (OEM), bank affiliated, and nonbank financial companies (NBFCs).

- Based on tenure, the market is segmented into short-term and long-term.

Market Size and Forecast:

- 2024 Market Size: USD 20.50 Billion

- 2033 Projected Market Size: USD 32.55 Billion

- CAGR (2025-2033): 5.27%

India Car Leasing Market Trends:

Expansion of Corporate and Rental Fleets

The growing demand for mobility solutions is driving the expansion of corporate and rental fleets in India’s car leasing sector. Companies are increasingly opting for leased vehicles to ensure operational efficiency, cost savings, and convenience for employees and business travelers. Leasing offers businesses the advantage of fleet upgrades without high upfront costs, making it an attractive alternative to ownership. The demand for corporate and rental fleets has risen due to the increasing preference for hassle-free transportation solutions. In February 2023, MG Motor India contributed to this trend by delivering 108 Hector SUVs to Orix India for its Rent-a-Car division. This large-scale fleet expansion strengthened leasing services, improving vehicle availability for corporate travelers and boosting India’s rental market. Orix India, as one of the largest leasing and rental service providers, enhanced its offerings, catering to business professionals and frequent travelers. As more corporations and mobility service providers expand their leased fleets, leasing is emerging as a viable alternative to vehicle ownership. The availability of modern, well-maintained vehicles encourages businesses to invest in rental solutions rather than purchasing large fleets. This trend will continue shaping the Indian car leasing market, driving its growth and positioning leasing as a preferred mobility option across industries.

To get more information on this market, Request Sample

Tax Incentives Promoting Commercial Leasing

The introduction of favorable tax policies has significantly influenced the growth of India’s car leasing market. With businesses seeking cost-effective mobility solutions, employer-sponsored car leasing is gaining traction due to financial advantages and tax benefits. Moreover, companies and employees can reduce their taxable income, by structuring lease payments as pre-tax deductions, thereby making leasing a financially attractive option. This approach helps organizations offer vehicle benefits without additional financial strain, encouraging widespread adoption. In June 2024, India introduced income tax benefits for employer-sponsored car leases, further strengthening this market trend. The policy allows companies to deduct lease rental amounts from employees’ pre-tax salaries, reducing overall taxable income. This incentive not only benefits employees by lowering their tax liability but also makes leasing more affordable compared to traditional vehicle financing. As a result, corporate leasing has become a preferred option for both employers and employees. With leasing becoming a more financially viable alternative, companies are incorporating car lease policies into their employee benefits programs. The affordability and convenience of leasing, combined with tax advantages, are encouraging businesses to shift from car ownership to flexible leasing models.

Growth in Demand for Personal Car Leasing

The car leasing industry size in India is witnessing a notable surge as consumers increasingly recognize the flexibility and convenience it offers. The shift from traditional car ownership to leasing is largely driven by the growing middle-class population, which now enjoys greater disposable income and a changing attitude toward asset ownership. Personal leasing provides a lucrative opportunity to utilize new, well-maintained vehicles without the long-term commitment or hefty upfront costs that are associated with buying a new car. As urban living becomes more congested and expensive, the India car leasing market growth is gaining traction, as owning a vehicle is seen as a burden due to parking issues, maintenance costs, and the depreciation of assets. Personal car leasing eliminates these concerns by offering easy access to a wide range of vehicles while including maintenance, insurance, and servicing in the package. This model appeals to the younger, more mobile demographic, especially in metropolitan areas, who value flexibility and are less inclined toward traditional ownership. The growing inclination toward digital platforms and online leasing services is further making car leasing more accessible and enhancing the overall India car leasing market share.

Technological Advancements Driving the Leasing Market

The increasing adoption of digital technology is revolutionizing the way car leasing companies operate in India, offering an enhanced and more efficient experience for both businesses and consumers. Technology is streamlining the leasing process, making it simpler for customers to choose vehicles, manage their leases, and even schedule maintenance. Online platforms allow users to compare different car leasing options, check availability, and complete transactions seamlessly, providing a convenient and transparent experience. Additionally, some leasing companies have started integrating telematics and IoT-enabled devices into their fleet management, enabling real-time tracking of vehicle performance, maintenance schedules, and fuel consumption. This integration provides both leasing companies and customers with valuable insights, ensuring better utilization of the fleet and reducing operational costs. Furthermore, the rise of electric vehicles (EVs) and the inclusion of EV options in leasing portfolios reflect the growing demand for eco-friendly alternatives. Car leasing companies are adapting to these changes by offering electric cars and hybrid options, catering to the environmentally conscious consumer and creating a positive India car leasing market outlook.

Some of the other key factors shaping the market include:

- OEM charging partnerships enhancing EV leasing: OEMs (Original Equipment Manufacturers) are increasingly partnering with electric vehicle (EV) charging companies to provide a seamless leasing experience. These collaborations allow leasing customers to access charging infrastructure conveniently, encouraging EV adoption by eliminating one of the major barriers to EV ownership, charging accessibility. As a result, car leasing companies are better equipped to offer fully integrated solutions, making EV leasing a more attractive and viable option.

- Corporate EV leasing driven by ESG compliance and cost-efficiency: The demand for corporate EV leasing is growing as businesses focus more on environmental, social, and governance (ESG) goals. Leasing EVs helps companies reduce their carbon footprint and improve their sustainability credentials, aligning with ESG compliance while also benefiting from cost-effective alternatives to fleet ownership. These advantages, combined with the financial incentives of EVs, are making corporate leasing a preferred choice for environmentally conscious organizations.

- All-inclusive subscription plans covering insurance, maintenance, and roadside support: Major players in the car leasing industry in India are increasingly offering all-inclusive subscription plans that encompass insurance, maintenance, and roadside support. These packages provide customers with a hassle-free experience, allowing them to enjoy a vehicle without worrying about extra costs. By bundling services, leasing companies provide added value, making the leasing model more convenient and attractive to both individuals and businesses.

- Branded platforms like Revv Select and Hyundai Subscription gaining traction: Branded platforms such as Revv Select and Hyundai Subscription are gaining significant popularity in India, offering customers flexible car subscription services. These platforms provide easy access to vehicles with no long-term commitment, allowing customers to switch cars as per their needs. The growing acceptance of these services reflects the shift toward convenience, as consumers increasingly prefer flexible options over traditional car ownership.

- AI-driven dynamic pricing and blockchain-based contract automation: AI-powered dynamic pricing models are transforming the car leasing market by offering personalized pricing based on factors like demand, vehicle type, and customer profile. Blockchain-based contract automation further streamlines the leasing process by ensuring transparency, reducing paperwork, and enhancing contract security. These technologies make the leasing experience more efficient, cost-effective, and secure, benefiting both consumers and leasing companies.

- Leased EVs at railway stations, airports, and tourism tie-ups with hotels: Leasing companies are expanding their services by offering electric vehicles (EVs) at convenient locations such as railway stations, airports, and through partnerships with hotels. These tie-ups cater to both business and leisure travelers, providing easy access to eco-friendly transportation while enhancing the customer experience. Such initiatives increase the visibility and accessibility of EVs, helping to further integrate them into everyday travel and tourism.

- GST input credit benefits through operating lease structures: India's Goods and Services Tax (GST) laws provide input credit benefits for businesses opting for operating lease structures. As per the India car leasing market analysis, this allows companies to claim tax credits on the GST paid for leasing services, thereby resulting in the lowering of the overall costs. These tax advantages make leasing an attractive option for businesses, further driving the growth of the car leasing market, especially for fleets and corporate clients.

- New formats like VR showrooms, student lease plans, and co-leasing in apartments: Innovative formats like virtual reality (VR) showrooms, student-specific lease plans, and co-leasing options in apartment complexes are resulting in a higher India car leasing market demand. VR showrooms allow customers to explore vehicles virtually, enhancing the shopping experience. Student lease plans cater to younger demographics seeking affordable and flexible vehicle options, while co-leasing in apartments offers shared leasing arrangements, increasing access to cars for urban dwellers with limited space or budget. These new formats cater to emerging needs and enhance the accessibility of leasing options.

India Car Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, lease type, service provider type, and tenure.

Type Insights:

- Private Lease

- Business Lease

The report has provided a detailed breakup and analysis of the market based on the type. This includes private lease, business lease.

Lease Type Insights:

- Close Ended Lease

- Option to Buy Lease

- Sub-Vented Lease

- Others

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes close ended lease, option to buy lease, sub-vented lease, and others.

Service Provider Type Insights:

- Original Equipment Manufacturer (OEM)

- Bank Affiliated

- Nonbank Financial Companies (NBFCs)

A detailed breakup and analysis of the market based on the service provider type have also been provided in the report. This includes original equipment manufacturer (OEM), bank affiliated, and nonbank financial companies (NBFCs).

Tenure Insights:

- Short-Term

- Long-Term

A detailed breakup and analysis of the market based on the tenure have also been provided in the report. This includes short-term and long-term.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Car Leasing Market News:

- May 2025: Tata Motors partnered with Vertelo to offer customized leasing solutions for electric commercial vehicles (EVs) in India. The collaboration will support the adoption of Tata Motors' EV range, including the Tata Ace EV for last-mile delivery and Tata Ultra and Tata Starbus for mass transit, through tailored leasing options for fleet operators. This initiative aligns with Tata Motors’ goal of promoting electric mobility and enhancing India's EV ecosystem.

- March 2025: Rilox EV launched its new division, Rilox E-Mobility, aimed at revolutionizing EV leasing in India. The company plans to deploy 2,500 electric vehicles (EVs) in its first year, expanding to 10,000 in the second year and 25,000 by the third year, with a focus on battery-swapping technology and IoT integration. This initiative aims to enhance EV accessibility for businesses, particularly in sectors with high vehicle usage, promoting sustainable transportation solutions in India.

- January 2025: Maruti Suzuki introduced a short-term leasing program for petrol and hybrid cars, easing EV adoption concerns. This initiative supports flexible mobility, enhances customer confidence in EVs, and strengthens India’s car leasing sector by integrating hybrid and conventional vehicle options into leasing services.

- August 2024: Kia India broadened its vehicle ownership offerings by introducing the Kia Subscribe plan and expanding its Kia Lease program to 14 key cities across the nation. Furthermore, Kia India collaborated with ALD Automotive Pvt Ltd to improve its leasing services, offering long-term leasing solutions for businesses that include comprehensive benefits like maintenance and insurance.

- May 2024: Mufin Green Finance partnered with Roadcast to enhance electric vehicle (EV) leasing in India by integrating GPS-enabled technology into electric three-wheelers (E3Ws). The collaboration allows Mufin to remotely monitor vehicle usage patterns, helping mitigate lease defaults and improve fund deployment through data analysis. This strategic move aims to streamline risk management in the rapidly growing EV leasing sector and improve financial sustainability in India's electric mobility ecosystem.

- May 2024: Kia India partnered with Orix to launch Kia Lease, offering flexible leasing options across six cities for Sonet, Seltos, and Carens. This initiative enhances accessibility, with monthly payments starting at INR 21, 990, thereby fueling India’s growing car leasing industry, projected to double in 4-5 years.

India Car Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Private Lease, Business Lease |

| Lease Type Covered | Close Ended Lease, Option to Buy Lease, Sub-Vented Lease, Others |

| Service Provider Type Covered | Original Equipment Manufacturer (OEM), Bank Affiliated, Nonbank Financial Companies (NBFCs) |

| Tenure | Short-Term, Long-Term |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India car leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India car leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India car leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car leasing market in India was valued at USD 20.50 Billion in 2024.

The India car leasing market is projected to exhibit a CAGR of 5.27% during 2025-2033, reaching a value of USD 32.55 Billion by 2033.

The India car leasing market is driven by growing demand for flexible mobility solutions, rising corporate adoption to reduce ownership costs, increasing urban preference for subscription-based models, and tax benefits that make leasing more attractive than traditional vehicle ownership.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)