India Cardiovascular Devices Market Size, Share, Trends and Forecast by Device Type, Application, End User, and Region, 2025-2033

Market Overview:

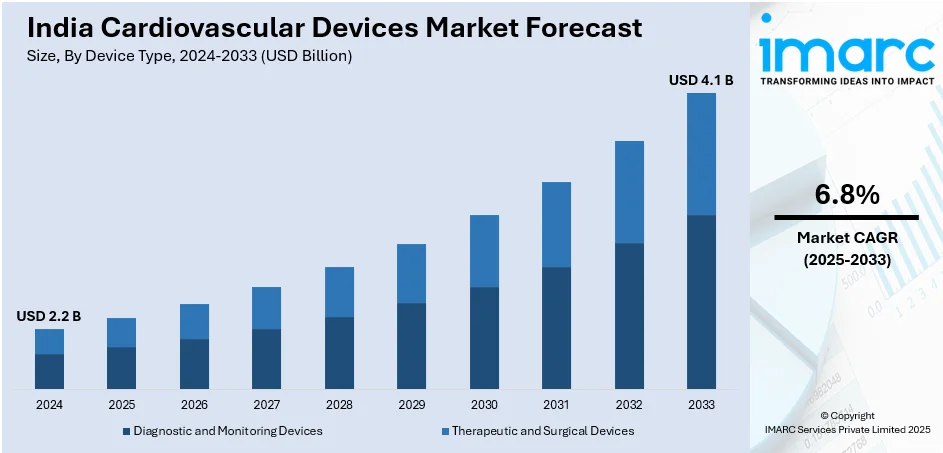

India cardiovascular devices market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The increasing prevalence of cardiovascular diseases, including coronary artery disease, heart failure, and arrhythmias, which enhances the demand for cardiovascular devices, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Market Growth Rate (2025-2033) | 6.8% |

Cardiovascular devices play a pivotal role in modern medicine, contributing to the diagnosis, treatment, and management of heart-related conditions. These innovative devices encompass a wide range of tools, from traditional staples like electrocardiograms (ECGs) and blood pressure monitors to cutting-edge technologies like implantable cardioverter-defibrillators (ICDs) and transcatheter heart valves. They empower healthcare professionals to assess cardiac function, identify abnormalities, and intervene effectively. Continuous advancements in cardiovascular device technology have led to minimally invasive procedures, reducing patient discomfort and recovery times. Moreover, wearable devices, such as smartwatches with built-in heart rate monitors, provide individuals with real-time insights into their cardiovascular health. As the prevalence of cardiovascular diseases rises, these devices not only enhance patient care but also contribute significantly to the prevention and early detection of heart-related issues, ultimately improving overall cardiac outcomes.

To get more information on this market, Request Sample

India Cardiovascular Devices Market Trends:

The cardiovascular devices market in India is propelled by several key drivers, fostering its continuous growth and innovation. Firstly, the increasing prevalence of cardiovascular diseases has created a burgeoning demand for advanced diagnostic and treatment solutions. Consequently, there is a growing emphasis on the development of cutting-edge cardiovascular devices to address evolving healthcare needs. Moreover, the aging regional population contributes significantly to the market expansion, as elderly individuals are more susceptible to cardiovascular ailments, necessitating a higher adoption of cardiovascular devices for monitoring and intervention. In addition to this, advancements in technology play a pivotal role in driving the cardiovascular devices market forward. Innovations such as wearable cardiovascular monitoring devices, minimally invasive surgical procedures, and remote patient monitoring systems have gained prominence, enhancing patient outcomes and overall healthcare efficiency. Furthermore, collaborative efforts between healthcare providers, researchers, and industry stakeholders propel R&D activities, resulting in the introduction of novel cardiovascular devices. The integration of artificial intelligence and data analytics into cardiovascular devices also augments their functionality, enabling personalized patient care and improving diagnostic accuracy. Collectively, these interconnected factors contribute to the dynamic growth of the cardiovascular devices market in India, positioning it as a vital player in the healthcare industry's evolution.

India Cardiovascular Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on device type, application, and end user.

Device Type Insights:

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring

- Others

- Therapeutic and Surgical Devices

- Cardiac Rhythm Management (CRM) Devices

- Catheter

- Stents

- Heart Valves

- Others

The report has provided a detailed breakup and analysis of the market based on the device type. This includes diagnostic and monitoring devices (electrocardiogram (ECG), remote cardiac monitoring, and others) and therapeutic and surgical devices (cardiac rhythm management (CRM) devices, catheter, stents, heart valves, and others).

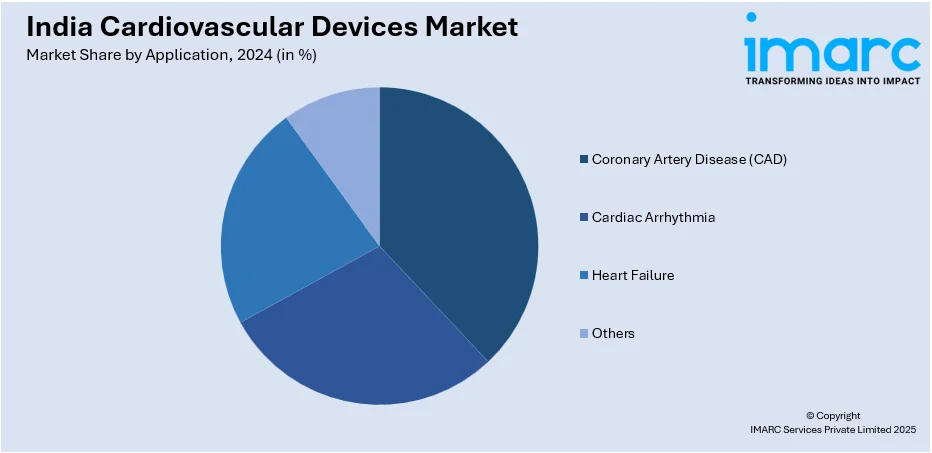

Application Insights:

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes coronary artery disease (CAD), cardiac arrhythmia, heart failure, and others.

End User Insights:

- Hospitals

- Specialty Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, specialty clinics, and others.

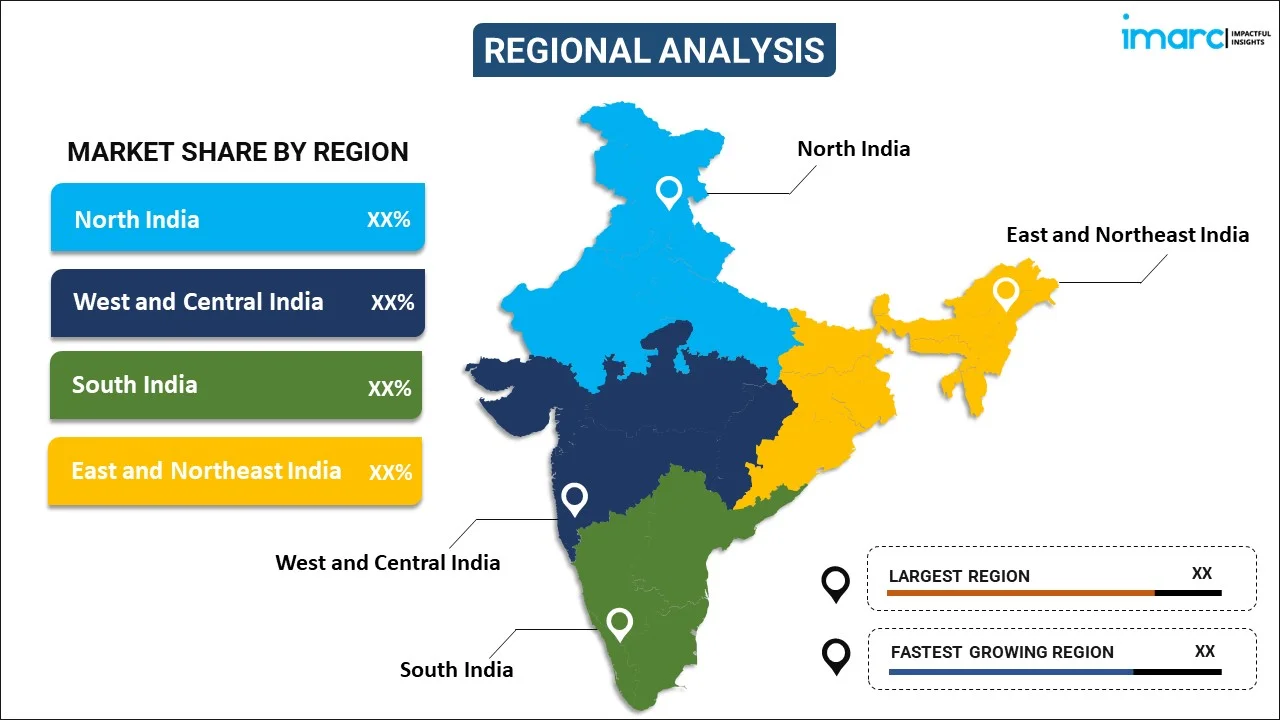

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cardiovascular Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Device Types Covered |

|

| Applications Covered | Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others |

| End Users Covered | Hospitals, Specialty Clinics, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cardiovascular devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cardiovascular devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cardiovascular devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cardiovascular devices market in the India was valued at USD 2.2 Billion in 2024.

The India cardiovascular devices market is projected to exhibit a CAGR of 6.8% during 2025-2033, reaching a value of USD 4.1 Billion by 2033.

The India cardiovascular devices market is driven by the rising prevalence of cardiovascular diseases, growing geriatric population, increasing healthcare expenditure, and advancements in minimally invasive technologies. Additionally, government initiatives to improve cardiac care infrastructure and expanding access to healthcare in rural areas are supporting the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)