India Cargo Security and Surveillance Market Size, Share, Trends and Forecast by Security Type, Mode of Transport, Technology, End User Industry, and Region, 2025-2033

India Cargo Security and Surveillance Market Overview:

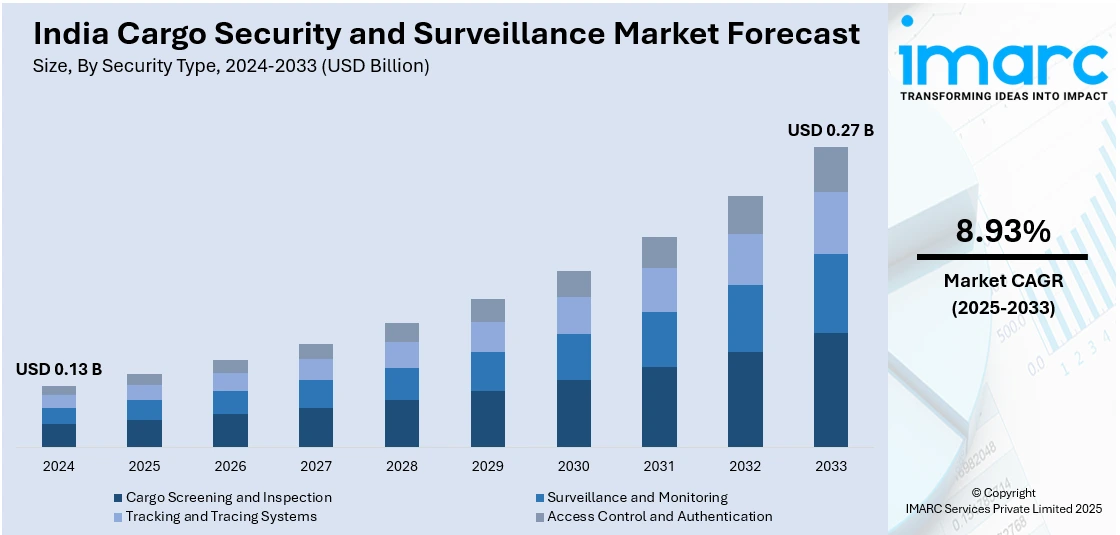

The India cargo security and surveillance market size reached USD 0.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.27 Billion by 2033, exhibiting a growth rate (CAGR) of 8.93% during 2025-2033. The market is witnessing rapid growth due to increased cargo transportation and rising need for enhanced safety and monitoring. Technological advancements in GPS tracking, RFID, and video surveillance systems and increasing demand for better security in warehouses and during transit is pushing innovations in this sector, significantly impacting India cargo security and surveillance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.13 Billion |

| Market Forecast in 2033 | USD 0.27 Billion |

| Market Growth Rate 2025-2033 | 8.93% |

India Cargo Security and Surveillance Market Trends:

Growing Adoption of Advanced Technologies

The India cargo security and surveillance market is experiencing a sharp increase in the use of sophisticated technologies like GPS tracking, RFID, and video surveillance systems. GPS tracking enables real-time location tracking of cargo ensuring goods are safely transported and minimizing the risk of theft or diversion. For instance, in December 2023, India announced its plans to launch a new app enabling live tracking of cargo across land, rail, sea, and air. Over 700 companies in logistics and manufacturing have already signed up. The initiative aims to enhance tracking, streamline operations, and lower logistics costs improving India's position in the Logistics Performance Index. RFID technology increases security by allowing for automated identification and tracking of cargo providing improved inventory control and faster access to shipment information. Video monitoring systems are becoming widespread in warehouses, transportation terminals, and along roads offering real-time observation and discouraging potential security compromise. These technologies benefit both security and operations efficiency by delivering up-to-date data and information for decision-making. While the demand for secure and efficient logistics surges integrating such cutting-edge technology is essential in order to reinforce cargo protection and maintain industry compliance.

To get more information on this market, Request Sample

Shift Toward Cloud-Based Solutions

The shift toward cloud-based solutions is becoming a key trend in the India cargo security and surveillance market. Increasingly, logistics companies are integrating cloud platforms for data storage, analysis, and remote monitoring. For instance, in April 2025, the Multi-Modal Cargo Hub (MMCH) at Jewar's Noida International Airport announced its plans to revolutionize India's logistics with operations starting later this year. Spanning 87 acres it includes a cloud-based cargo management system for efficient tracking. Designed to handle 2.5 lakh tonnes of cargo annually, it aims to boost agricultural logistics and support India's "China Plus One" strategy for global supply chains. These solutions enable real-time tracking and management of cargo across multiple locations improving the efficiency of security operations. Cloud technology allows businesses to store vast amounts of data securely and access it from any location ensuring that cargo movements are monitored continuously. Additionally, cloud-based systems support advanced data analytics providing valuable insights into cargo security, theft prevention, and operational optimization. The flexibility, scalability, and cost-effectiveness of cloud solutions are driving their adoption across the industry. As companies seek to improve operational efficiency and enhance security protocols the growth of cloud-based platforms is contributing significantly to the India cargo security and surveillance market growth.

India Cargo Security and Surveillance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on security type, mode of transport, technology, and end user industry.

Security Type Insights:

- Cargo Screening and Inspection

- Surveillance and Monitoring

- Tracking and Tracing Systems

- Access Control and Authentication

The report has provided a detailed breakup and analysis of the market based on the security type. This includes cargo screening and inspection, surveillance and monitoring, tracking and tracing systems, and access control and authentication.

Mode of Transport Insights:

- Air Cargo Security

- Maritime Cargo Security

- Rail Cargo Security

- Road Cargo Security

A detailed breakup and analysis of the market based on the mode of transport have also been provided in the report. This includes air cargo security, maritime cargo security, rail cargo security, and road cargo security.

Technology Insights:

- X-ray Scanners

- Explosive Detection Systems (EDS)

- Video Surveillance Systems

- RFID & GPS-based Tracking

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes X-ray scanners, explosive detection systems (EDS), video surveillance systems, and RFID & GPS-based tracking.

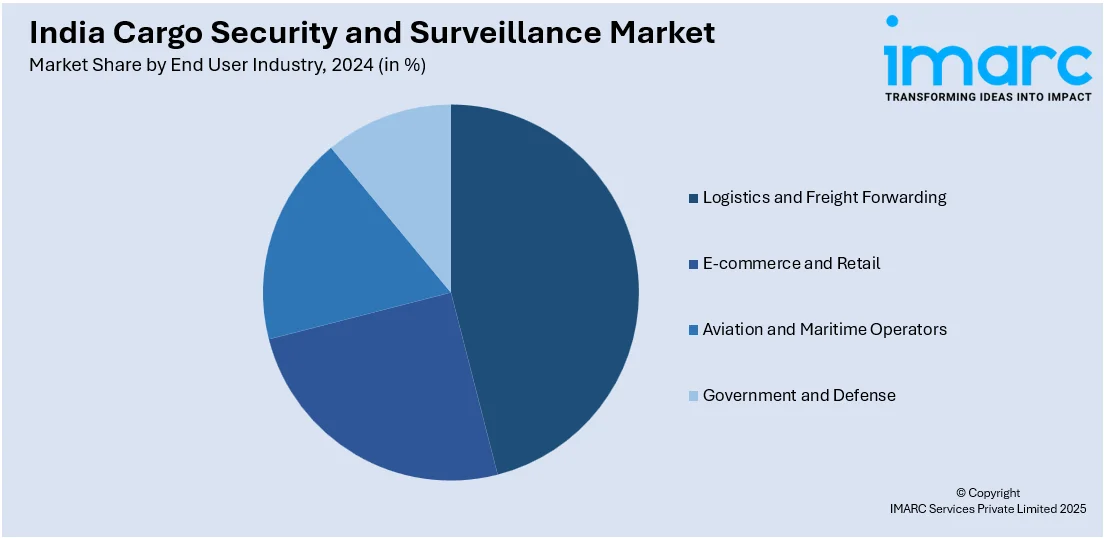

End User Industry Insights:

- Logistics and Freight Forwarding

- E-commerce and Retail

- Aviation and Maritime Operators

- Government and Defense

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes logistics and freight forwarding, e-commerce and retail, aviation and maritime operators, and government and defense.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cargo Security and Surveillance Market News:

- In April 2025, BLR Cargo and Shell India unveiled an advanced Airport Truck Management Facility (ATMF) at Kempegowda International Airport, enhancing cargo logistics. The facility includes 24/7 CCTV surveillance, automated check-ins, and tracking apps, cutting truck turnaround times from four hours to one. With 250 dedicated parking bays and improved driver amenities, the ATMF establishes new benchmarks for efficiency and sustainability in India's logistics sector.

- In March 2023, Menzies Aviation announced its partnership with Wipro to enhance its air cargo management services. The collaboration will utilize cloud-native technologies to improve efficiency, employee experience, and customer service through automation. The new system emphasizes security, offering real-time cargo tracking and integration with customer systems, while enabling advanced technologies for future warehouses.

India Cargo Security and Surveillance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Security Types Covered | Cargo Screening and Inspection, Surveillance and Monitoring, Tracking and Tracing Systems, Access Control and Authentication |

| Mode of Transports Covered | Air Cargo Security, Maritime Cargo Security, Rail Cargo Security, Road Cargo Security |

| Technologies Covered | X-ray Scanners, Explosive Detection Systems (EDS), Video Surveillance Systems, RFID & GPS-based Tracking |

| End User Industries Covered | Logistics and Freight Forwarding, E-commerce and Retail, Aviation and Maritime Operators, Government and Defense |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cargo security and surveillance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cargo security and surveillance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cargo security and surveillance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cargo security and surveillance market in India was valued at USD 0.13 Billion in 2024.

The India cargo security and surveillance market is projected to exhibit a CAGR of 8.93% during 2025-2033, reaching a value of USD 0.27 Billion by 2033.

The India cargo security and surveillance market is driven by rising concerns over theft, smuggling, and terrorism, alongside stricter regulatory compliance for cargo safety. Expanding trade volumes, growth in logistics and transportation networks, and increasing adoption of advanced tracking and monitoring technologies are further fueling market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)