India Carp Market Size, Share, Trends and Forecast by Species, Product, Source, Distribution Channel, and Region, 2025-2033

India Carp Market Overview:

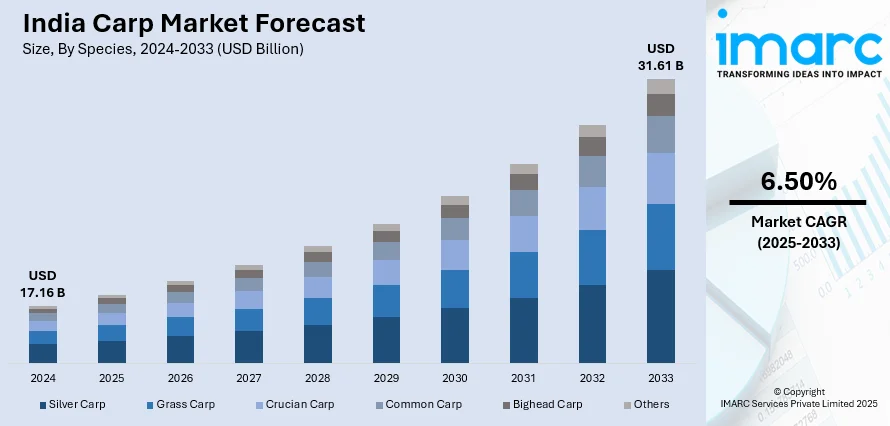

The India carp market size reached USD 17.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 31.61 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is primarily driven by elevating domestic demand, owing to shifting dietary preferences, government support for aquaculture infrastructures, favorable climatic and geographic conditions for carp farming, technological advancements in fish breeding, and private sector investments that improve production efficiency, cold chain logistics, and access to organized retail and export markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.16 Billion |

| Market Forecast in 2033 | USD 31.61 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

India Carp Market Trends:

Rising Domestic Consumption Due to Changing Dietary Patterns

One of the key drivers of the India carp market is surging domestic consumption due to changing eating habits. Conventionally, fish was a mainstay in seashore and riverine states, but lifestyle and nutrition consciousness changes in recent times have extended its popularity nationwide. Carp, as a freshwater fish that is cheap, nutritious, and easily found, is now a sought-after protein substitute among middle- and lower-class consumers. With increasing health awareness, customers are extensively inclined toward low-fat and high-protein diets. Carp is also such a nutritional type, particularly in comparison with red meat, making it an appealing choice for the health-conscious community. Furthermore, rising urbanization and the emerging trend of nuclear families have propelled the demand for easily accessible, quick-to-cook protein sources. Supermarkets and online food delivery platforms now carry cleaned and packaged carp, making it even easier for the customer.

To get more information on this market, Request Sample

Climate and Geographical Suitability for Carp Farming

Another driver of the India carp market is the beneficial climatic and geographical conditions of the country for freshwater carp fish farming. In contrast to the above-discussed drivers, which are based on consumer attitudes and government encouragement, this driver is environmental in nature—an underappreciated but fundamental pillar of aquaculture success. India has an extensive system of rivers, lakes, ponds, reservoirs, and irrigation canals that offer the best environment for freshwater fish such as carp. India has over 2.4 million hectares of fresh water underutilized for aquaculture. The water bodies experience 25°C to 30°C temperatures for the greater part of the year, a suitable temperature range for carp growth and reproduction. This renders India naturally most suitable for raising common carp species like Rohu, Catla, and Mrigal that are well adapted in these environments. In addition, most Indian states—particularly the eastern and southern ones—are endowed with ample rainfall and rich nutrient waters supporting plankton blooms, a natural food for carp. The geographic configuration also allows for a wide range of aquaculture systems, ranging from extensive pond culture in rural villages to semi-intensive and intensive ones in peri-urban areas.

India Carp Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on species, product, source, and distribution channel.

Species Insights:

- Silver Carp

- Grass Carp

- Crucian Carp

- Common Carp

- Bighead Carp

- Others

The report has provided a detailed breakup and analysis of the market based on the species. This includes silver carp, grass carp, crucian carp, common carp, bighead carp, and others.

Product Insights:

- Gutted and Headfish

- Semi-Fillets

- Fillets

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes gutted and headfish, semi-fillets, fillets, and others.

Source Insights:

- Wild Capture

- Aquaculture

The report has provided a detailed breakup and analysis of the market based on the source. This includes wild capture and aquaculture.

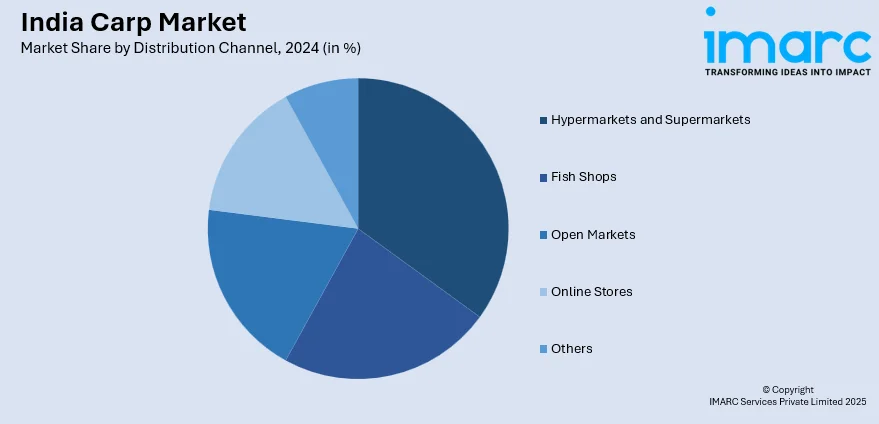

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Fish Shops

- Open Markets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, fish shops, open markets, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Carp Market News:

- November 2024: On World Fisheries Day, Varanasi officials released 75,000 Indian major carp fingerlings into the Ganga River to enhance the aquatic ecosystem and support local fishing communities. This initiative aimed to replenish fish populations, thereby improving biodiversity and providing economic benefits to fishermen.

- August 2024: The Chennai Metropolitan Development Authority (CMDA) announced that it would construct a modern fish market complex in Kolathur at an estimated cost of INR 53 crore, covering 4.5 acres. This two-story facility will house 180 shops, benefiting approximately 300 fish vendors.

India Carp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Silver Carp, Grass Carp, Crucian Carp, Common Carp, Bighead Carp, Others |

| Products Covered | Gutted and Headfish, Semi-Fillets, Fillets, Others |

| Sources Covered | Wild Capture, Aquaculture |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Fish Shops, Open Markets, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India carp market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India carp market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India carp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India carp market was valued at USD 17.16 Billion in 2024.

The India carp market is projected to exhibit a CAGR of 6.50% during 2025-2033, reaching a value of USD 31.61 Billion by 2033.

The India carp market is driven by the country’s strong aquaculture tradition, rising demand for affordable protein, and supportive government policies promoting inland fisheries. Favorable climatic conditions, expanding hatchery infrastructure, and growing consumption in both rural and urban areas continue to support carp production and market expansion across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)