India Carpets and Rugs Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2025-2033

India Carpets and Rugs Market Size and Share:

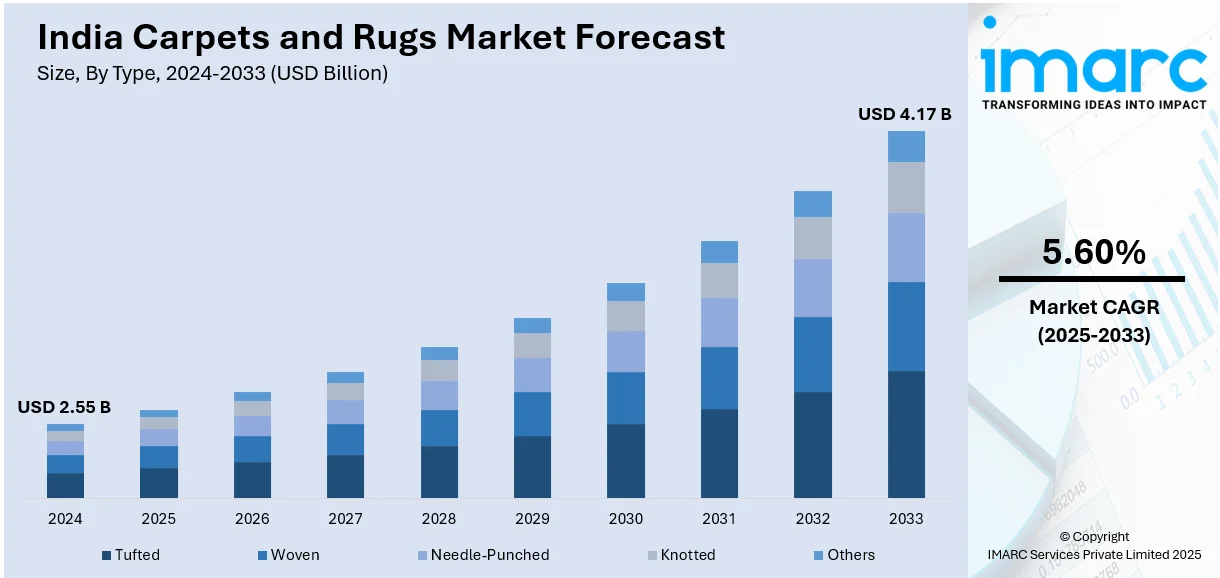

The India carpets and rugs market size reached USD 2.55 Billion in 2024. The market is expected to reach USD 4.17 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market growth is attributed to increasing urbanization as well as commercial infrastructure, which is driving demand for high-end home décor solutions. Growing consumer inclination toward eco-friendly, handmade, and locally inspired offerings also aids in market growth.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of type, the market has been divided into tufted, woven, needle-punched, knotted, and others.

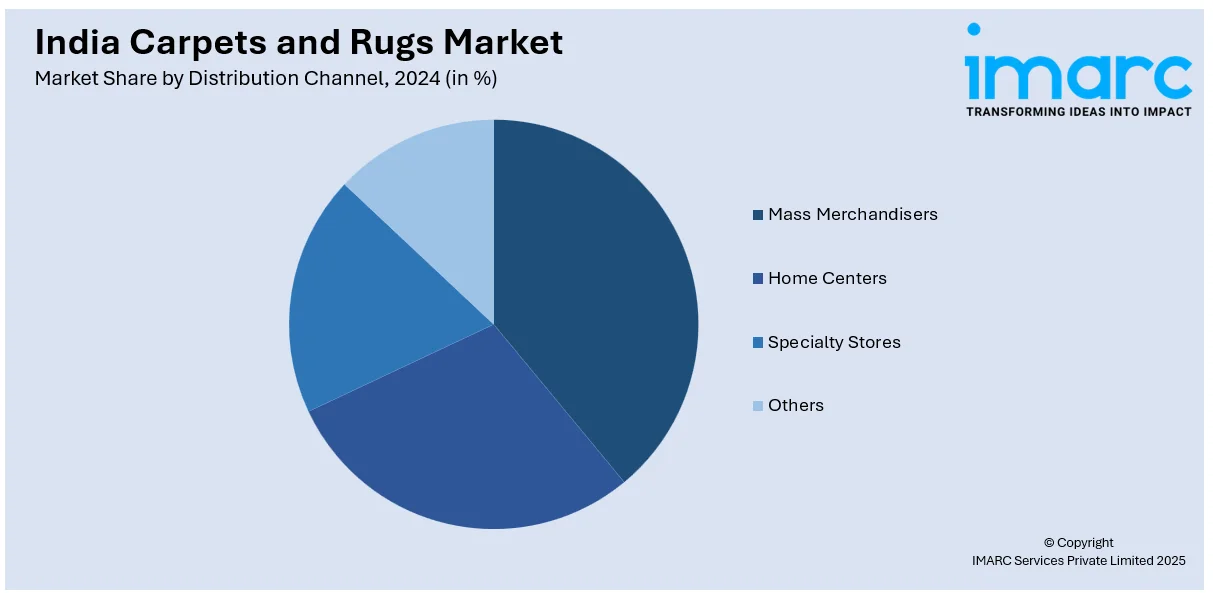

- On the basis of distribution channel, the market has been divided into mass merchandisers, home centers, specialty stores, and others.

- On the basis of application, the market has been divided into residential and commercial.

Market Size and Forecast:

- 2024 Market Size: USD 2.55 Billion

- 2033 Projected Market Size: USD 4.17 Billion

- CAGR (2025-2033): 5.60%

India Carpets and Rugs Market Trends:

Growing Preference for Sustainable and Eco-friendly Products

Demand for eco-friendly and sustainable carpets and rugs is one of the key trends driving India carpet and rugs market growth. With growing concern regarding environmental factors, consumers are increasingly shifting toward products derived from natural, renewable resources like cotton, wool, and jute. These products not only save the environment but also provide sustainability and beauty. In addition, handwoven and handmade rugs, supporting traditional craftsmanship, are becoming popular because of their distinctive designs and sustainability. Most consumers are turning towards carpets produced with eco-friendly dyes and non-toxic processes, reflecting the global movement towards sustainable living. The emergence of green consumers, along with growing government regulations to encourage sustainability, has encouraged manufacturers to invest in green manufacturing practices. For example, The Rug Republic specializes in recycled items and is the only Indian rug brand that is certified with Global Recycling Standards (GRS). They convert discarded plastic bottles into fashionable rugs with their proprietary manufacturing process. This trend is additionally complemented by online shopping sites, which help consumers easily search and buy environment-friendly carpets and rugs, leading to their growing demand in rural and urban areas as well.

To get more information on this market, Request Sample

Rise in Online Sales and E-commerce Platforms

The transition to e-commerce is a major trend that is influencing the India carpets and rugs market outlook. With growing internet usage and the increased use of e-commerce, more customers are buying carpets and rugs online. For instance, Jaipur Rugs' e-commerce sales accounted for 6% and brought in Rs 58.5 crore in 2024, according to the company report. Therefore, business houses are keen to pursue growth prospects through internet-based platforms and their extension. E-commerce websites have numerous alternatives, transparent price comparison, and doorstep delivery, which appeals to consumers today. Online retailing also allows people to access a larger variety of designs, ranging from classic Indian carpets to modern and foreign designs, satisfying customers with different tastes. Also, augmented reality (AR) functionalities on online stores enable customers to see how carpets and rugs would appear inside their homes, increasing online shopping confidence. The COVID-19 pandemic hastened the move towards digital shopping, and despite the reopening of conventional retail outlets, the trend in online shopping is ongoing. This digital shift is likely to be a key driver in the Indian carpets and rugs market.

Increasing Demand for Customized and Designer Rugs

Another trend in the Indian market for carpets and rugs is growing demand for custom and designer products. With growing consumer interest in personalizing the home, custom rugs and carpets are gaining popularity. Interior designers and homeowners are seeking unique designs that reflect personal tastes, culture, and a specific home design theme. This trend is best experienced in urban regions, where modern and high-end interior trends are in vogue. Market research has found that 33% of millennials and 23% of Gen Z plan on buying rugs in 2024, highlighting the significant market potential for customized products. Companies like Sheeltex India are focusing on customized rugs that align well with market forces, allowing the company to respond to evolving consumer needs. Additionally, the rising popularity of designer rugs, as a result of global design patterns, has also led to cross-border collaborations between local producers and international designers. The trend is also being promoted by growing disposable incomes, the rising middle class, and the inclination towards luxury home furnishings.

Smart Technology Integration in Carpet Production

Integrating automation and smart technologies in carpet manufacturing is changing the ecosystem of the industry in India. High-tech mechanized looms, CAD software, and digital printing technologies are assisting manufacturers in producing quality carpets with greater accuracy and efficiency. These technologies offer features for producing complex patterns, color duplication, and quality inspections, which were difficult to achieve using traditional technologies. Intelligent manufacturing processes also reduce production time and waste, leading to cost-effective operations with high-quality outputs. Furthermore, the adoption of Industry 4.0 concepts, including IoT-enabled machinery and data analytics, is allowing firms to optimize their production cycles and inventory control. The IT revolution is most appropriate for Indian carpet producers when exporting products to international markets, offering international-quality products at competitive rates.

Increasing Demand for Interior Design and Home Staging Services

The increasing popularity of professional interior design services and home staging has been the major demand driver propelling India carpets and rugs market growth. interior designers are more and more adopting carpets and rugs as integral components in their projects because they understand that carpets and rugs have the power to change spaces and create certain ambiances. The growth of home staging services, especially in major urban areas where there are high volumes of real estate transactions, has also increased demand for adaptable and visually attractive flooring coverings. Home designers tend to have urgent turnaround requirements and broad product lines, compelling makers to carry vast inventories and provide fast customization services. This trend is most evident in luxury residential segments and commercial facilities like hotels, restaurants, and corporate offices, where interior design is the key to establishing brand and customer experience.

Some of the other trends in the market include,

- Handmade and Traditional Carpets: The image of India as a producer of hand-knotted and tufted carpets is still strong, and artisanship is one of the major competitive strengths. Age-old traditional weaving skills are still drawing local as well as foreign buyers. Conservation of cultural heritage through carpet weaving promotes rural artisanal communities and keeps India as a world leader in handmade textiles.

- Urbanization and Housing Development: Increasing disposable incomes and demand for urban housing are fueling increased carpet and rug sales for contemporary interiors. This is supporting the carpets and rugs industry in India. Urban development with new residential complexes at a fast pace generates regular demand for flooring coverings. Increased consciousness of home appearance among urban buyers further propels market growth.

- Export-Led Demand: India remains a world leader in carpet and rug exports, with continued strong demand from the US, Europe, and the Middle East. Recognition of Indian craftsmanship and competitive prices support the firm's export performance. Foreign purchasers increasingly look for genuine handmade pieces that reflect traditional Indian creativity.

- Government Support and Schemes: Support programs such as handicraft promotion and subsidies are assisting in the increase in carpet production and exports. Government schemes benefiting rural artisans and traditional crafts offer financial support and market access. Support from policies for the handicraft industry reinforces the entire carpet and rug manufacturing chain.

- Luxury and Premiumization: There is a move towards luxury carpets, particularly among India's upper-middle class and NRIs, which is increasing demand for premium designs. The premium segment is led by growing spending power and aspiration for luxury home furnishings. Designer collaborations and limited-edition collections are offered for high-end consumers who are looking for exclusive and sophisticated products.

- Hospitality and Commercial Demand: Hotels, corporate suites, and institutions are increasingly using carpets and rugs for aesthetics and acoustics. The expanding hospitality industry demands attractive and durable floor coverings for guest rooms and public spaces. Commercial businesses acknowledge carpets as key factors in establishing professional and friendly environments.

Growth Drivers of the India Carpets and Rugs Market:

The market is experiencing robust growth driven by several key factors. The expanding middle class with rising disposable incomes is creating increased demand for home decoration and premium floor coverings. Growing urbanization and real estate development across major cities are generating consistent demand for residential and commercial carpets. The strong export performance, particularly to developed markets, to drive production and revenue growth. Government initiatives supporting traditional handicrafts and artisan communities provide policy backing, further augmenting carpets and rugs market share in India. The increasing popularity of luxury and designer carpets among affluent consumers is creating premium market segments with higher profit margins.

Opportunities in the India Carpets and Rugs Market:

Significant opportunities exist in the digital transformation of sales channels, particularly through e-commerce platforms and online marketplaces that can reach broader consumer bases. The growing trend toward sustainable and eco-friendly products presents opportunities for manufacturers to develop green product lines and capture environmentally conscious consumers. Customization and personalization services offer potential for premium pricing and customer loyalty development. International market expansion, especially in emerging economies and luxury segments of developed markets, provides substantial growth potential. The integration of smart technologies in manufacturing processes can improve efficiency, reduce costs, and enhance product quality. Partnerships with interior designers, architects, and real estate developers can create new distribution channels and market segments.

Challenges in the India Carpets and Rugs Market:

The industry faces significant challenges from increasing raw material costs, particularly for natural fibers like wool and cotton, which can impact profit margins. Competition from machine-made carpets and synthetic alternatives poses pricing pressure on traditional handmade products. Skilled artisan availability is becoming a constraint as younger generations migrate to urban areas and pursue alternative careers. As per the carpets and rugs market analysis in India, quality control and standardization remain challenging, especially for handcrafted products, which can affect export competitiveness. Fluctuating international demand and trade policy changes can impact export revenues. Environmental regulations and sustainability requirements are increasing compliance costs and necessitating investment in cleaner production technologies.

India Carpets and Rugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, distribution channel, application and region.

Type Insights:

- Tufted

- Woven

- Needle-Punched

- Knotted

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes tufted, woven, needle-punched, knotted, and others.

Distribution Channel Insights:

- Mass Merchandisers

- Home Centers

- Specialty Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mass merchandisers, home centers, specialty stores, and others.

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Carpets and Rugs Market News:

- In July 2025, home decor startup Asterlane announced its entry into carpet manufacturing, aiming to combine traditional craftsmanship with modern designs. The carpets will be produced at its Banaras facility using modern technology and skilled artisans. Asterlane plans to distribute the new range via Amazon, Flipkart, Pepperfry and its own D2C (direct-to-consumer) platform.

- In January 2025, the luxury rug and textile brand Shyam Ahuja was acquired by Jaipur Rugs. The firm will establish Shyam Ahuja as a standalone brand.

- In August 2024, Obeetee, the carpet brand from Mirzapur, unveiled its Viraasat collection that emerged from the workshops of Indian designers. The brand investigates the possibilities of carpets as platforms for storytelling through partnerships with Tarun Tahiliani, Anju Modi, Anita Dalmia, and Ashdeen Lilaowala.

India Carpets and Rugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tufted, Woven, Needle-Punched, Knotted, and Others |

| Distribution Channels Covered | Mass Merchandisers, Home Centers, Specialty Stores, and Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India carpets and rugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India carpets and rugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India carpets and rugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carpets and rugs market in India was valued at USD 2.55 Billion in 2024.

The India carpets and rugs market is projected to exhibit a CAGR of 5.60% during 2025-2033, reaching a value of USD 4.17 Billion by 2033.

People are becoming more design-conscious and seeking products that enhance the aesthetics and comfort of their living spaces. The expansion of the hospitality and real estate sectors is also driving the demand, with hotels, offices, and commercial spaces investing in high-quality floor coverings. Additionally, India’s strong tradition of carpet weaving and craftsmanship is supporting both domestic and export markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)