India Cartridges Market Size, Share, Trends and Forecast by Preparation, Application, Material, End User, and Region, 2025-2033

India Cartridges Market Size and Share:

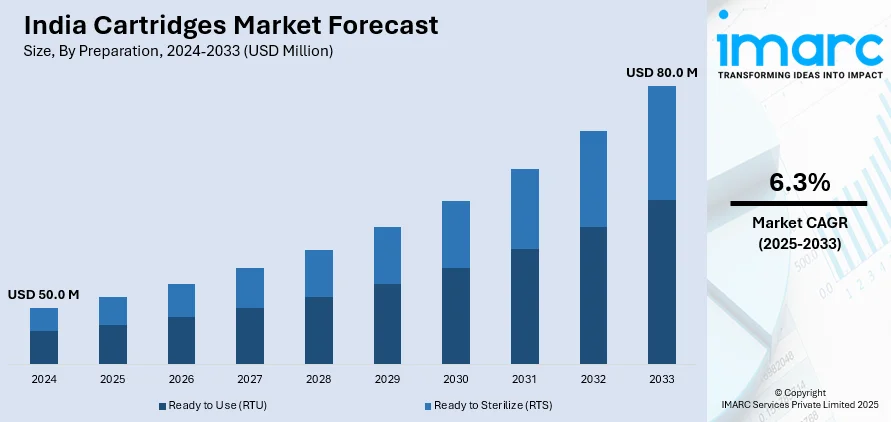

The India cartridges market size reached USD 50.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 80.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033. The market is expanding due to the rising demand in printing, healthcare, and industrial applications. The growth is also influenced by the increasing digitalization, sustainable cartridge solutions, and technological advancements, with manufacturers focusing on high-yield, refillable, and eco-friendly options to enhance efficiency and cost-effectiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.0 Million |

| Market Forecast in 2033 | USD 80.0 Million |

| Market Growth Rate 2025-2033 | 6.3% |

India Cartridges Market Trends:

Growing Demand for Ink and Toner Cartridges in the Printing Industry

The surging demand for digital and commercial printing in India is propelling the market for ink and toner cartridges, especially from sectors like education, corporate establishments, and small-scale businesses. As e-learning, remote working, and business process outsourcing (BPO) services have grown, the demand for high-quality printing solutions has also risen. For instance, as per industry reports, approximately 12.7% of full-time employees in India worked exclusively from home, further supporting the trend. Organizations are opting for economical, high-yielding cartridges to enhance operational effectiveness and lower per-page printing costs. Moreover, government digitization programs and the growth of the e-governance segment have fueled greater cartridge usage for official records. With firms transitioning to environmentally friendly printing options, demand for remanufactured and reusable cartridges is also rising. However, manufacturers are paying attention to formulating inks with greater longevity, smudge resistance, and environmentally friendly composition to meet new consumer demands. In addition, innovations in laser printing technology are creating greater demand for toner cartridges, especially in high-capacity printing segments. As companies focus on cost savings, print quality, and environmental responsibility, the market for ink and toner cartridges in India will continue to grow steadily with the changing needs of consumers and innovations in printing technologies.

To get more information on this market, Request Sample

Rising Government Support for Domestic Cartridge Manufacturing

India’s cartridge market is witnessing a shift toward domestic manufacturing, driven by government initiatives, industry investments, and sustainability efforts. The emphasis on reducing import dependency has encouraged local businesses to establish cartridge production facilities, supporting the growth of remanufactured and refillable cartridges. For instance, in October 2024, the Indian government imposed an 11% basic customs duty and a 1% cess on imported printer cartridges, ink cartridges, and toner cartridges. This move aims to stimulate domestic production by making imports more expensive, thereby encouraging local manufacturing under the 'Make in India' initiative. Moreover, manufacturers are focusing on developing high-quality, cost-effective alternatives to imported products while integrating advanced ink formulations and smart chip technology to enhance performance. The expansion of digital offices, small businesses, and e-governance programs is increasing demand for reliable, domestically produced cartridges, further incentivizing local production. Additionally, industry players are adopting eco-friendly materials and recycling programs, aligning with global sustainability goals. This transition is positioning India as a self-sufficient and competitive market, reducing reliance on imports and fostering a more sustainable cartridge industry.

India Cartridges Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on preparation, application, material, and end user.

Preparation Insights:

- Ready to Use (RTU)

- Ready to Sterilize (RTS)

The report has provided a detailed breakup and analysis of the market based on the preparation. This includes ready to use (RTU) and ready to sterilize (RTS).

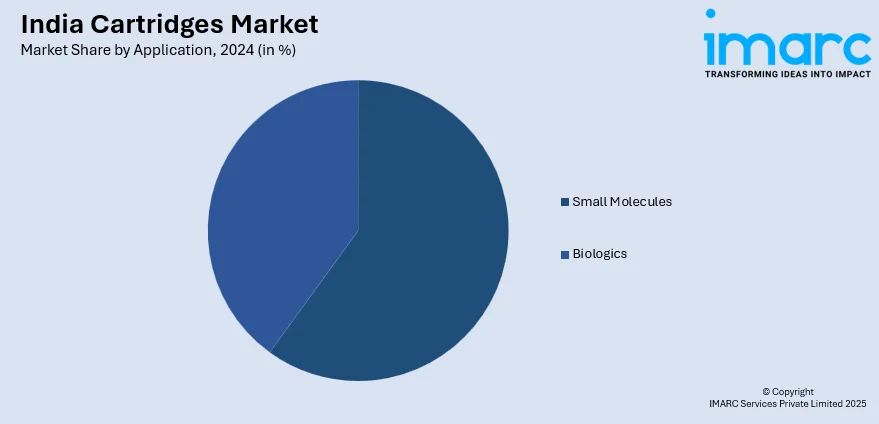

Application Insights:

- Small Molecules

- Biologics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes small molecules and biologics.

Material Insights:

- Glass

- Polymer

The report has provided a detailed breakup and analysis of the market based on the material. This includes glass and polymer.

End User Insights:

- Hospitals and Clinics

- Pharma and Biotech Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, pharma and biotech companies, contract development and manufacturing organizations (CDMOs), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cartridges Market News:

- In February 2025, Image King announced the launch of the IK 1020W, India’s first Make in India Network & WiFi laser printer, designed for seamless connectivity and cost-effective printing. It supports widely available 12A toner cartridges, ensuring chip-free operation. This innovation highlights India’s self-reliance, technological progress, and commitment to high-quality, affordable printing solutions.

- In March 2024, HP announced the launch of the OfficeJet Pro series in India, offering A3 printing, advanced security, and sustainable design. The launch includes HP 938/925 Original Ink Cartridges, ensuring professional-quality prints, reliable performance, and eco-friendly recycling, catering to SMBs and hybrid workforces.

India Cartridges Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Preparations Covered | Ready to Use (RTU), Ready to Sterilize (RTS) |

| Applications Covered | Small Molecules, Biologics |

| Materials Covered | Glass, Polymer |

| End Users Covered | Hospitals and Clinics, Pharma and Biotech Companies, Contract Development and Manufacturing Organizations (CDMOs), Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cartridges market performed so far and how will it perform in the coming years?

- What is the breakup of the India cartridges market on the basis of product?

- What is the breakup of the India cartridges market on the basis of application?

- What is the breakup of the India cartridges market on the basis of material?

- What is the breakup of the India cartridges market on the basis of end user?

- What is the breakup of the India cartridges market on the basis of region?

- What are the various stages in the value chain of the India cartridges market?

- What are the key driving factors and challenges in the India cartridges market?

- What is the structure of the India cartridges market and who are the key players?

- What is the degree of competition in the India cartridges market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cartridges market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cartridges market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cartridges industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)