India Cassava Processing Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

India Cassava Processing Market Overview:

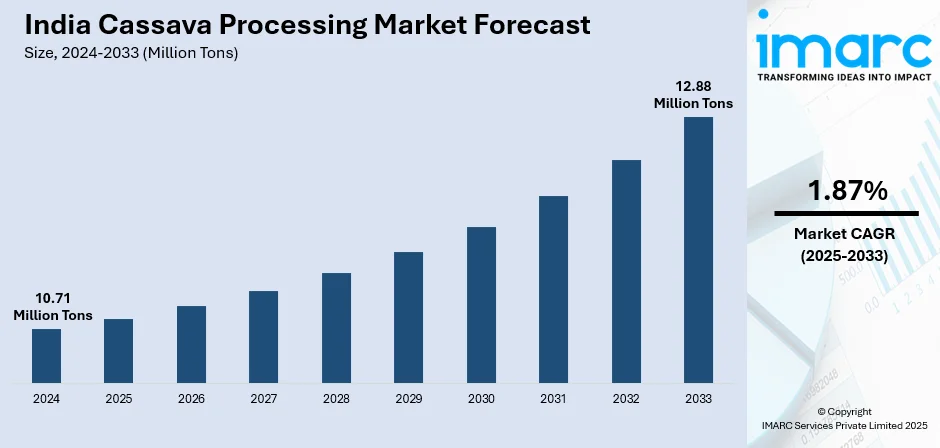

The India cassava processing market size reached 10.71 Million Tons in 2024. The market is projected to reach 12.88 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.87% during 2025-2033. Growing demand from food, starch, and biofuel industries, coupled with rising cassava-based product applications in animal feed and pharmaceuticals, is strengthening India cassava processing market share. Supportive government policies, technological advancements in processing, and export opportunities further fuel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 10.71 Million Tons |

| Market Forecast in 2033 | 12.88 Million Tons |

| Market Growth Rate 2025-2033 | 1.87% |

India Cassava Processing Market Trends:

Rising Demand for Cassava-Based Industrial Products

The India cassava processing market is seeing stronger growth from industrial applications. Beyond its traditional use in food, cassava starch has become a sought-after raw material in paper, textile, and adhesive manufacturing. This is driven by industries seeking cost-effective and versatile inputs that also support a measure of import substitution. Several domestic players are investing in expanding processing facilities to cater to these sectors, while some are focusing on specialized derivatives like modified starch for high-value industrial uses. Additionally, manufacturers are modernizing plants to improve extraction efficiency and quality consistency, which helps them meet export standards. Government encouragement for value-added agro-processing and the rising preference for plant-based binders and thickeners in industrial production are creating a steady pull for cassava derivatives. This shift is encouraging more cassava cultivation in states like Tamil Nadu and Andhra Pradesh, linking farmers directly with processors through contract farming arrangements. The overall effect is a supply chain that is becoming more integrated and commercially oriented, with industrial demand now a major driver of growth. This is further intensifying the India cassava processing market growth.

To get more information on this market, Request Sample

Expanding Role in Health and Specialty Foods

In recent years, cassava has been moving into India’s health-conscious and specialty food markets. As gluten-free diets gain traction, tapioca flour and starch have become popular alternatives for baking and food formulation. The growing urban middle class, with increased awareness of dietary sensitivities and functional foods, has created a niche but fast-expanding customer base. Cassava’s natural composition, low allergen profile, and adaptability in diverse recipes have made it a preferred ingredient in snacks, beverages, and ready-to-eat meals. Food companies are responding with innovative product lines, such as cassava-based chips, noodles, and fortified flours, often marketed with clean-label claims. Online retail platforms are amplifying this trend by offering easy access to both raw and processed cassava products, reaching health-conscious consumers nationwide. The rise of plant-forward eating and alternative carbohydrate sources, coupled with social media-driven food trends, is bringing cassava from a rural staple into urban kitchens. This consumer-driven pull is prompting processors to focus more on quality refinement, packaging innovation, and small-batch specialty production alongside bulk supply.

India Cassava Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on end use.

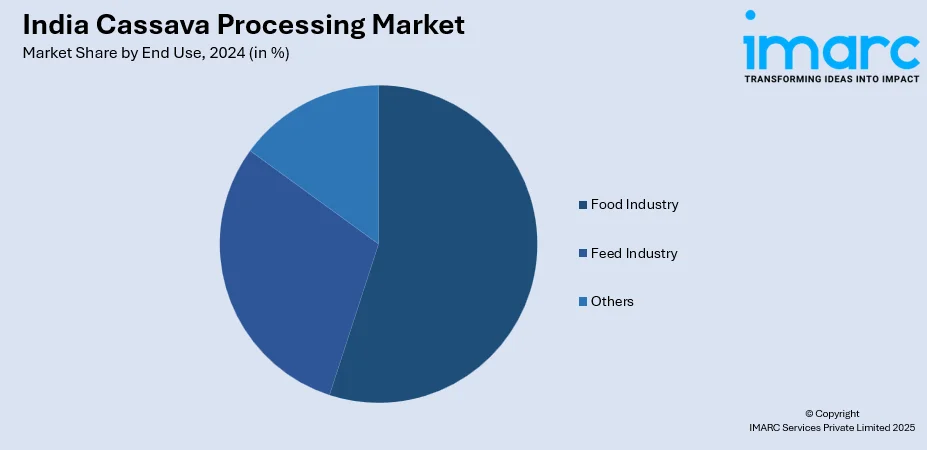

End Use Insights:

- Food Industry

- Feed Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food industry, feed industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cassava Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Food Industry, Feed Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cassava processing market performed so far and how will it perform in the coming years?

- What is the breakup of the India cassava processing market on the basis of end use?

- What is the breakup of the India cassava processing market on the basis of region?

- What are the various stages in the value chain of the India cassava processing market?

- What are the key driving factors and challenges in the India cassava processing market?

- What is the structure of the India cassava processing market and who are the key players?

- What is the degree of competition in the India cassava processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cassava processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cassava processing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cassava processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)