India Catalyst Market Size, Share, Trends and Forecast by Type, Process, Raw Material, Application, and Region, 2025-2033

Market Overview:

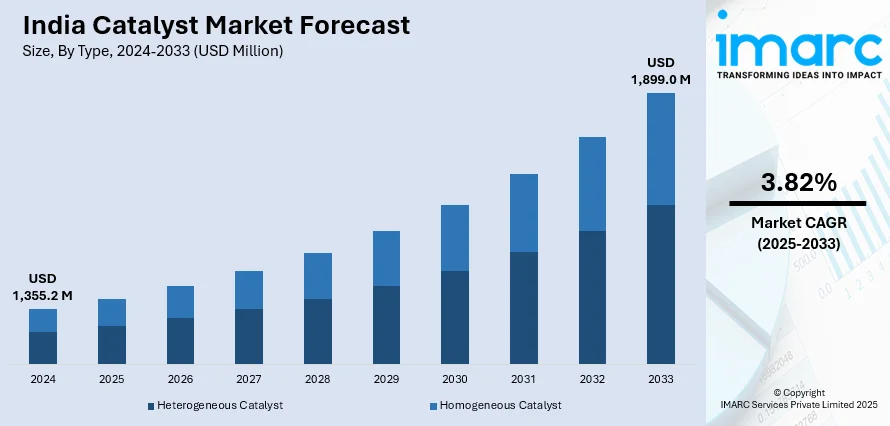

India catalyst market size reached USD 1,355.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,899.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033. The rising prevalence of new and upgraded refineries, which often require advanced catalyst technologies to improve efficiency and meet environmental standards, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,355.2 Million |

|

Market Forecast in 2033

|

USD 1,899.0 Million |

| Market Growth Rate 2025-2033 | 3.82% |

Catalyst, in a general sense, refers to a substance that increases or speeds up a chemical reaction without undergoing any permanent change itself. It facilitates the transformation of reactants into products by providing an alternative reaction pathway with lower activation energy. This enables reactions to occur more rapidly and efficiently, often making processes feasible that might otherwise be impractical. In a broader context, the term catalyst is also used metaphorically to describe something that stimulates or accelerates change or development. For instance, in the realm of business or social dynamics, a catalyst could be an event, person, or factor that triggers significant shifts or advancements. Whether in chemistry or other domains, the concept of a catalyst underscores the idea of a facilitating agent that promotes transformation and progress.

To get more information on this market, Request Sample

India Catalyst Market Trends:

The catalyst market in India is experiencing robust growth, primarily propelled by several key drivers that underscore its pivotal role in diverse industries. Firstly, the increasing demand for sustainable and environmentally friendly processes has catalyzed a surge in catalyst utilization. Furthermore, the regional push towards energy efficiency and the need to reduce greenhouse gas emissions have become instrumental in steering industries towards catalyst-driven innovations. As industries strive for cleaner and more efficient production methods, catalysts play a crucial role in facilitating these transitions. Moreover, the burgeoning automotive sector, driven by a growing population and urbanization, has become a major catalyst market driver. Stringent emission regulations in India are pushing automotive manufacturers to adopt advanced catalytic technologies to meet compliance standards. Additionally, the rising prominence of renewable energy sources has spurred developments in catalyst technologies for applications in renewable energy production. This interconnected web of drivers highlights the catalyst market's adaptability and responsiveness to evolving regional trends. In essence, the catalyst market in India is navigating a dynamic landscape, interweaving environmental concerns, industrial efficiency imperatives, and technological advancements to drive its forward momentum.

India Catalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, process, raw material, and application.

Type Insights:

- Heterogeneous Catalyst

- Homogeneous Catalyst

The report has provided a detailed breakup and analysis of the market based on the type. This includes heterogeneous catalyst and homogeneous catalyst.

Process Insights:

- Recycling

- Regeneration

- Rejuvenation

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes recycling, regeneration, and rejuvenation.

Raw Material Insights:

- Chemical Compounds

- Peroxides

- Acids

- Amines

- Others

- Metals

- Precious Metals

- Base Metals

- Zeolites

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes chemical compounds (peroxides, acids, amines, and others), metals (precious metals and base metals), zeolites, and others.

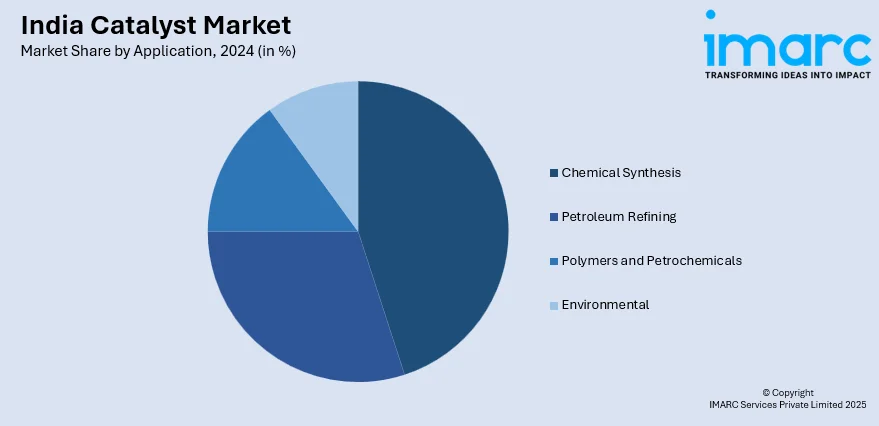

Application Insights:

- Chemical Synthesis

- Chemical Catalysts

- Adsorbents

- Syngas Production

- Others

- Petroleum Refining

- Fluid Catalytic Cracking (FCC)

- Alkylation

- Hydrotreating

- Catalytic Reforming

- Purification

- Bed Grading

- Others

- Polymers and Petrochemicals

- Ziegler Natta

- Reaction Initiator

- Chromium

- Urethane

- Solid Phosphorous Acid Catalyst

- Others

- Environmental

- Light-duty Vehicles

- Motorcycles

- Heavy-duty Vehicles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemical synthesis (chemical catalysts, adsorbents, syngas production, and others), petroleum refining (fluid catalytic cracking (FCC), alkylation, hydrotreating, catalytic reforming, purification, bed grading, and others), polymers and petrochemicals (ziegler natta, reaction initiator, chromium, urethane, solid phosphorous acid catalyst, and others), and environmental (light-duty vehicles, motorcycles, heavy-duty vehicles, and others).

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Catalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Heterogeneous Catalyst, Homogeneous Catalyst |

| Processes Covered | Recycling, Regeneration, Rejuvenation |

| Raw Materials Covered |

|

| Applications Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India catalyst market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India catalyst market?

- What is the breakup of the India catalyst market on the basis of type?

- What is the breakup of the India catalyst market on the basis of process?

- What is the breakup of the India catalyst market on the basis of raw material?

- What is the breakup of the India catalyst market on the basis of application?

- What are the various stages in the value chain of the India catalyst market?

- What are the key driving factors and challenges in the India catalyst?

- What is the structure of the India catalyst market and who are the key players?

- What is the degree of competition in the India catalyst market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India catalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India catalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India catalyst industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)