India CDMO Market Size, Share, Trends and Forecast by Service Type, Type, Scale of Operation, Therapeutic Area, and Region, 2025-2033

India CDMO Market Overview:

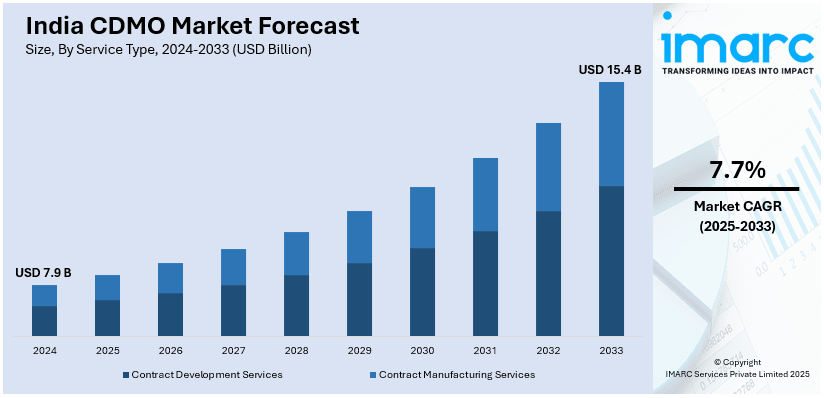

The India CDMO market size reached USD 7.9 Billion in 2024. The market is expected to reach USD 15.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.7% during 2025-2033. The market growth is attributed to increasing demand for contract manufacturing services in pharmaceuticals, particularly for complex generics, HPAPIs, and sterile injectables, strong regulatory framework and associated cost advantages, expansion of global footprint catering to markets like the U.S., Europe, and emerging economies.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of service type, the market has been divided into contract development services and contract manufacturing services.

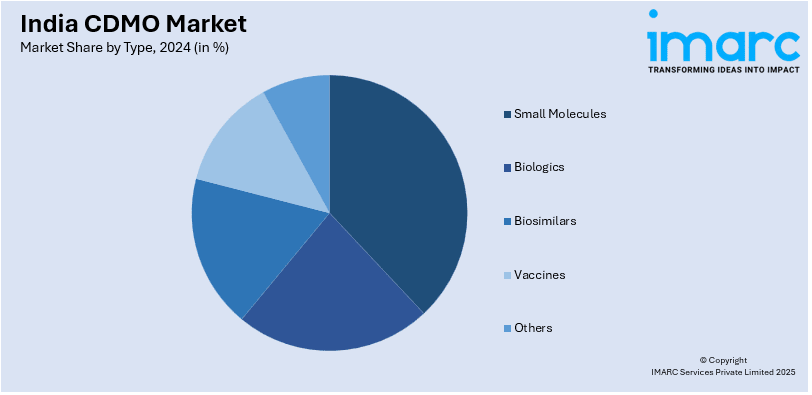

- On the basis of type, the market has been divided into small molecules, biologics, biosimilars, vaccines, and others.

- On the basis of scale of operation, the market has been divided into commercial scale and clinical scale.

- On the basis of therapeutic area, the market has been divided into oncology, cardiovascular diseases, infectious diseases, central nervous system (CNS) disorders, and others.

Market Size and Forecast:

- 2024 Market Size: USD 7.9 Billion

- 2033 Projected Market Size: USD 15.4 Billion

- CAGR (2025-2033): 7.7%

India CDMO Market Trends:

Expansion of Biologics and Biosimilars Manufacturing

The contract development and manufacturing organization (CDMO) market in India is witnessing strong growth due to the rising demand for biologics and biosimilars. As global pharmaceutical companies increasingly outsource biologic drug development and production, Indian CDMOs are investing in advanced biomanufacturing capabilities, including mammalian and microbial expression systems. The push for affordable biosimilars is driving partnerships between firms, positioning India as a key hub for cost-effective, high-quality biologics production. For instance, in December 2024, Mankind Pharma Ltd announced a strategic partnership with Innovent Biologics to license and commercialize Sintilimab in India, aiming to improve cancer treatment access by providing innovative immunotherapy solutions to address critical healthcare challenges in the region. Additionally, the expansion of state-of-the-art bioreactors, single-use technologies, and process optimization strategies is enhancing efficiency and scalability in biopharmaceutical manufacturing, thereby enriching the India CDMO market outlook. Regulatory alignment with agencies like USFDA and EMA further strengthens India’s competitive advantage in contract manufacturing. As the demand for targeted therapies, monoclonal antibodies, and gene-based treatments rises, Indian CDMOs are expected to play a critical role in supplying global markets, ensuring cost efficiency while maintaining high regulatory and quality standards.

To get more information on this market, Request Sample

Increasing Demand for End-to-End CDMO Services

Pharmaceutical companies are increasingly seeking end-to-end services from CDMOs, covering drug discovery, formulation development, clinical trial support, commercial-scale production, and regulatory compliance. This trend is driven by the need for faster time-to-market, cost-efficiency, and streamlined supply chains. Indian CDMOs are expanding their capabilities to offer comprehensive solutions, enabling global drug developers to outsource the entire product lifecycle under a single contract. The integration of AI-driven drug discovery, process automation, and real-time data analytics is further enhancing efficiency in development and manufacturing, which is also augmenting the India CDMO market share. Additionally, CDMOs are focusing on high-potency active pharmaceutical ingredients (HPAPIs), complex generics, and sterile injectables, strengthening their position as strategic outsourcing partners. For instance, in January 2024, Aragen Life Sciences announced a substantial investment of INR 20 Billion (approximately US$230.5 Million) in Telangana to bolster its drug discovery, development, and manufacturing capabilities, reflecting a strategic focus on expanding complex generics and HPAPI production. In addition, government incentives for pharmaceutical innovation, regulatory harmonization, and infrastructure development are supporting this growth. With increasing investments in R&D facilities, analytical services, and quality control, Indian CDMOs are emerging as preferred partners for global pharmaceutical companies seeking cost-effective, high-quality solutions.

Digital Transformation and Technology Integration in Manufacturing Processes

The CDMO industry in India is undergoing dramatic changes driven by digital technologies and Industry 4.0 adoption. Firms are adopting sophisticated manufacturing execution systems, predictive analytics, and IoT-enabled equipment monitoring to improve operational efficiency and product quality. Real-time data gathering and analytics capabilities are enabling better process control, shorter manufacturing cycles, and more effective compliance with regulatory requirements. Machine learning-based algorithms are being used for predictive maintenance, quality control, and yield improvement in manufacturing plants. Blockchain technology is being integrated to improve supply chain transparency and traceability, which is very important for pharmaceutical production. Cloud-based platforms enable CDMOs and their global customers to collaborate more efficiently, with real-time project monitoring and communication. Automating packaging, labeling, and quality control operations minimizes human mistakes and maximizes throughput. These technological innovations are making Indian CDMOs technologically advanced players with the capability to manage intricate manufacturing needs while remaining cost-competitive in the global marketplace.

Growth, Opportunities, and Challenges in the India CDMO Market:

- Growth Drivers: The market is propelled by several key factors including the country's established pharmaceutical manufacturing infrastructure and skilled workforce. Government initiatives such as the Production Linked Incentive (PLI) scheme and favorable regulatory policies are encouraging foreign investments and domestic expansion, which is providing boost to India CDMO market growth. the growing demand for affordable healthcare solutions globally is driving pharmaceutical companies to partner with Indian CDMOs for cost-effective manufacturing without compromising quality standards.

- Market Opportunities: Significant opportunities exist in the development of specialized manufacturing capabilities for orphan drugs and personalized medicine. The increasing focus on sustainability and green chemistry presents avenues for CDMOs to develop environmentally friendly manufacturing processes. Strategic partnerships with international biotech companies and expansion into emerging markets offer substantial growth potential for Indian CDMO players.

- Market Challenges: India CDMO market forecast indicates that the market faces challenges including intense price competition and margin pressures from global competitors. Maintaining compliance with evolving international regulatory standards requires continuous investment in infrastructure and quality systems. Supply chain disruptions and raw material price volatility pose operational challenges that can impact manufacturing timelines and profitability.

India CDMO Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service type, type, scale of operation, and therapeutic area.

Service Type Insights:

- Contract Development Services

- Preclinical Development

- Clinical Development

- Analytical and Bioanalytical Services

- Contract Manufacturing Services

- Active Pharmaceutical Ingredients (APIs) Manufacturing

- Finished Dosage Forms (FDFs) Manufacturing

- Biologics Manufacturing

- Packaging

The report has provided a detailed breakup and analysis of the market based on the service type. This includes contract development services (preclinical development, clinical development, and analytical and bioanalytical services) and contract manufacturing services (active pharmaceutical ingredients (APIs) manufacturing, finished dosage forms (FDFs) manufacturing, biologics manufacturing, and packaging).

Type Insights:

- Small Molecules

- Biologics

- Biosimilars

- Vaccines

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes small molecules, biologics, biosimilars, vaccines, and others.

Scale of Operation Insights:

- Commercial Scale

- Clinical Scale

The report has provided a detailed breakup and analysis of the market based on the scale of operation. This includes commercial scale and clinical scale.

Therapeutic Area Insights:

- Oncology

- Cardiovascular Diseases

- Infectious Diseases

- Central Nervous System (CNS) Disorders

- Others

A detailed breakup and analysis of the market based on the therapeutic area have also been provided in the report. This includes oncology, cardiovascular diseases, infectious diseases, central nervous system (CNS) disorders, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India CDMO Market News:

- In February 2025, Granules India announced the acquisition of Swiss contract development and manufacturing organization (CDMO) Senn Chemicals AG for CHF 20 Million (approximately INR 192.5 Crore). This strategic move marks Granules’ entry into the peptide therapeutics and CDMO sectors. The acquisition provides Granules with access to Senn's specialized expertise in Liquid-Phase Peptide Synthesis (LPPS) and Solid-Phase Peptide Synthesis (SPPS), as well as its established customer base across the pharmaceutical, cosmetics, amino acid derivatives, and theragnostic industries, along with its strong R&D and regulatory presence in Europe.

- In December 2024, Akums Drugs and Pharmaceuticals Limited announced a partnership with a notable global pharma company to serve as a CDMO, manufacturing and supplying oral liquid formulations for the European market. The agreement, valued at Euro 200 million, will begin in 2027, with approvals anticipated by 2026. These initiatives supports the expansion of CDMO market size in India.

India CDMO Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered |

|

| Types Covered | Small Molecules, Biologics, Biosimilars, Vaccines, Others |

| Scale of Operations Covered | Commercial Scale, Clinical Scale |

| Therapeutic Areas Covered | Oncology, Cardiovascular Diseases, Infectious Diseases, Central Nervous System (CNS) Disorders, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India CDMO market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India CDMO market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India CDMO industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India CDMO market was valued at USD 7.9 Billion in 2024.

The India CDMO market is projected to exhibit a CAGR of 7.7% during 2025-2033, reaching a value of USD 15.4 Billion by 2033.

The India CDMO market is driven by increased demand from global pharmaceutical companies seeking cost-effective outsourced development and manufacturing. The country’s skilled workforce, robust regulatory framework, and advanced biopharma infrastructure support complex drug development. Additionally, rising domestic R&D investments and favorable government incentives further accelerate growth and global competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)