India Cement Additives Market Size, Share, Trends and Forecast by Type, Function, and Region, 2025-2033

India Cement Additives Market Overview:

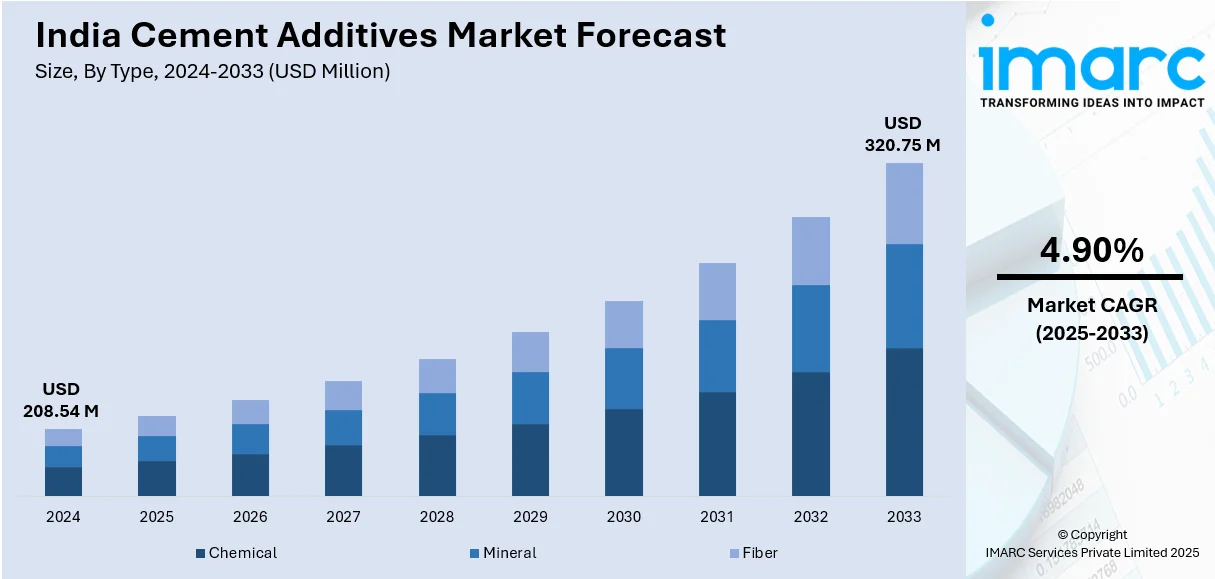

The India cement additives market size reached USD 208.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 320.75 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The increasing infrastructure development, rapid urbanization, growing demand for high-performance cement, advancements in construction technology, stringent environmental regulations, rising adoption of green building materials, expansion of the real estate sector, and government initiatives promoting sustainable and energy-efficient construction practices is expanding India cement additive market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 208.54 Million |

| Market Forecast in 2033 | USD 320.75 Million |

| Market Growth Rate 2025-2033 | 4.90% |

India Cement Additives Market Trends:

Growing Demand for Sustainable and Eco-Friendly Additives

The India cement additive market growth is driven by rapid shift towards sustainable and eco-friendly solutions due to increasing environmental concerns and regulatory pressures. Manufacturers are focusing on additives that reduce carbon emissions, enhance durability, and improve energy efficiency in cement production. Bio-based plasticizers, low-carbon pozzolanic materials, and fly ash-based additives are gaining traction. The rising adoption of green building practices and government initiatives promoting sustainable construction further fuel this trend. With urbanization and infrastructure projects accelerating, the demand for innovative, environmentally responsible cement additives is expected to grow significantly in the coming years. Notably, according to a research study published on February 11, 2025, India's urban population is expected to reach 600 million by 2036, and 75% of the country's GDP will come from urban areas.

To get more information on this market, Request Sample

Rising Adoption of High-Performance Admixtures

The Indian cement additive market is experiencing a increase in demand for high-performance admixtures that enhance workability, strength, and durability, thereby positively impacting the India cement additive market outlook. Superplasticizers, waterproofing agents, and corrosion inhibitors are increasingly being used in large-scale infrastructure projects, including highways, bridges, and high-rise buildings. These additives help optimize water usage, improve setting time, and increase the lifespan of structures. Rapid urbanization and industrialization, along with government initiatives such as Smart Cities and Housing for All, are driving this demand. Tokhan Sahu, the Union Minister of State for Housing and Urban Affairs of India, informed the Lok Sabha on December 19, 2024, that as of November 15, the Central government had disbursed ₹47,225 Crore to states and union territories under the Smart Cities Mission, of which ₹44,626 Crore had been used. 8,066 projects worth ₹1,64,669 Core had work orders issued for them; 7,352 projects, or 91% of the total, have been finished, costing ₹1,47,366 Crore. Launched in June 2015, the mission has been extended until March 31, 2025. In line with this, as construction quality standards rise, the adoption of advanced cement additives is expected to continue growing in India.

India Cement Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and function.

Type Insights:

- Chemical

- Mineral

- Fiber

The report has provided a detailed breakup and analysis of the market based on the type. This includes chemical, mineral, and fiber.

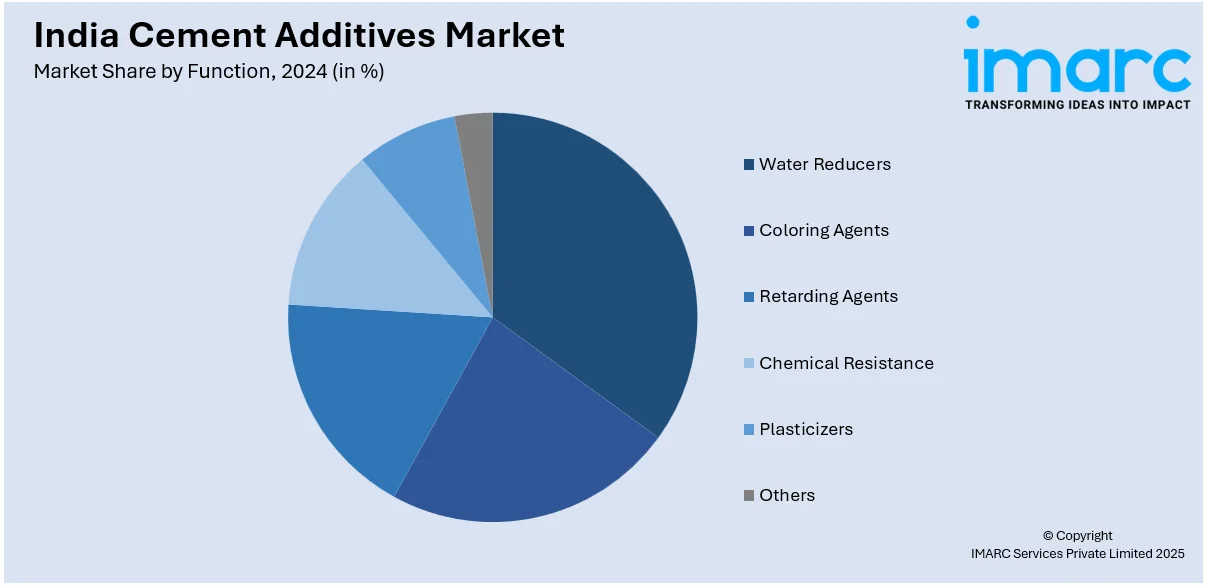

Function Insights:

- Water Reducers

- Coloring Agents

- Retarding Agents

- Chemical Resistance

- Plasticizers

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes water reducers, coloring agents, retarding agents, chemical resistance, plasticizers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cement Additives Market News:

- February 14, 2025: Saint-Gobain, a French construction materials manufacturer, has completed a USD 1.025 Billion cash deal to acquire Dubai-based construction chemicals company Fosroc that deals with a vast range of admixtures and additives for concrete and cement, marking its 34th purchase to expand its presence in the chemicals sector.

India Cement Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chemical, Mineral, Fiber |

| Functions Covered | Water Reducers, Coloring Agents, Retarding Agents, Chemical Resistance, Plasticizers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cement additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cement additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cement additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India cement additives market was valued at USD 208.54 Million in 2024.

The India cement additives market is projected to exhibit a CAGR of 4.90% during 2025-2033, reaching a value of USD 320.75 Million by 2033.

Key drivers of the India cement additives market include rapid infrastructure development and urbanization fueling demand for high-performance concrete. Government initiatives promoting green building and sustainability are also encouraging adoption of eco-friendly additives. Advancements in additive chemistry and construction technology and growing real estate and industrial construction further boost market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)