India Cement Board Market Size, Share, Trends and Forecast by Product Type, Application, End-User Industry, and Region, 2025-2033

India Cement Board Market Overview:

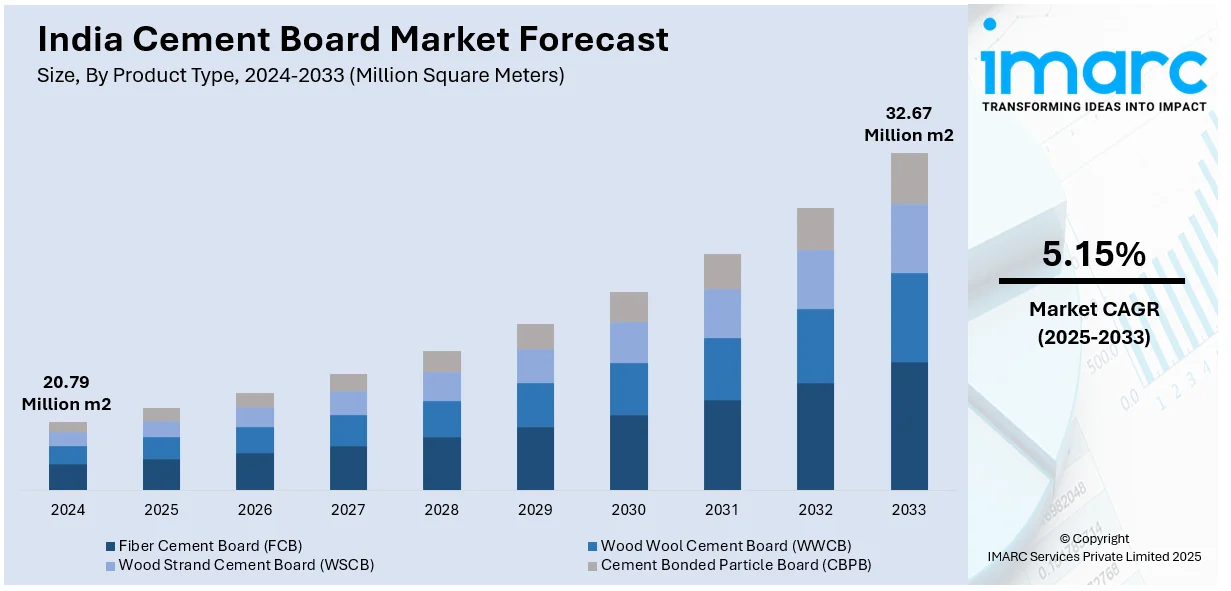

The India cement board market size reached 20.79 Million Square Meters in 2024. Looking forward, IMARC Group expects the market to reach 32.67 Million Square Meters by 2033, exhibiting a growth rate (CAGR) of 5.15% during 2025-2033. The growing demand for durable and fire-resistant construction materials, increasing adoption in residential and commercial sectors, rapid urbanization, rising infrastructure projects, government initiatives for affordable housing, and a shift toward eco-friendly and low-maintenance building solutions are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 20.79 Million Square Meters |

| Market Forecast in 2033 | 32.67 Million Square Meters |

| Market Growth Rate 2025-2033 | 5.15% |

India Cement Board Market Trends:

Rising Demand for Cement Boards in Construction

The rising emphasis on durable and ecological construction materials has resulted in increased investment in fiber cement board manufacture. With increased urbanization and infrastructure development, there is a larger demand for lightweight, fire-resistant, and moisture-resistant alternatives to conventional materials. Manufacturing increases in this sector are intended to accommodate the increased demand for residential, commercial, and industrial projects. Furthermore, advances in manufacturing technology improve productivity and product quality, making these boards more accessible to a larger market. The emphasis on cost-effective and environmentally friendly building solutions is driving large-scale production activities, assuring a consistent supply to meet the changing demands of the construction sector. This development emphasizes the growing importance of fiber cement boards in modern building systems. For example, in March 2024, Everest Industries announced its plans to invest USD 22.6 Million to establish a new production plant for fiber cement boards and wall panels in Karnataka's Chamarajanagar district. The factory spans 8.09 hectares in the Kellambali-Badanaguppe industrial region. It has an annual manufacturing capacity of 72,000 Metric Tons of fiber cement boards and 19,000 Tons of Rapicon wall panels.

To get more information on this market, Request Sample

Sports Sponsorship as a Market Expansion Strategy

In the highly competitive construction industry, companies are increasingly using major sporting events to boost brand awareness and customer engagement. Associating with popular sports, notably cricket, provides an opportunity to reach a large audience and increase market visibility. This strategy allows businesses to stand out in a crowded market while also increasing their reputation and trust with customers. Companies affiliated with sports profit from increased visibility, emotional brand association, and long-term customer memory. The rising integration of marketing activities with major athletic events demonstrates how effective this technique is in increasing brand recognition and market impact. This strategy continues to alter how businesses position themselves, guaranteeing long-term engagement and success in a competitive environment. For instance, in July 2024, Wonder Cement obtained title sponsorship rights for the India-Sri Lanka cricket series, increasing its market presence. This initiative is consistent with the Indian cement industry's practice of utilizing sports for brand promotion. Wonder Cement's association with a significant athletic event boosts its position in the competitive cement market, increasing consumer reach and industry visibility.

India Cement Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, and end-user industry.

Product Type Insights:

- Fiber Cement Board (FCB)

- Wood Wool Cement Board (WWCB)

- Wood Strand Cement Board (WSCB)

- Cement Bonded Particle Board (CBPB)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fiber cement board (FCB), wood wool cement board (WWCB), wood strand cement board (WSCB), and cement bonded particle board (CBPB).

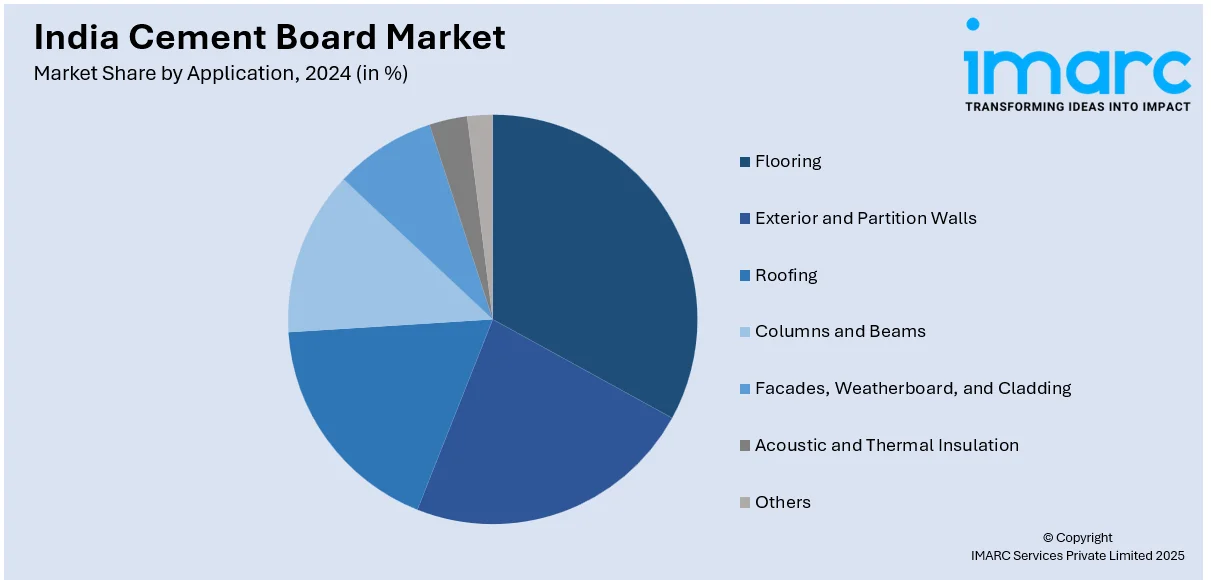

Application Insights:

- Flooring

- Exterior and Partition Walls

- Roofing

- Columns and Beams

- Facades, Weatherboard, and Cladding

- Acoustic and Thermal Insulation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flooring, exterior and partition walls, roofing, columns and beams, facades, weatherboard, and cladding, acoustic and thermal insulation, and others.

End-User Industry Insights:

- Residential

- Commercial

- Industrial and Institutional

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes residential, commercial, and industrial and institutional.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cement Board Market News:

- In February 2025, UltraTech Cement's board authorized the demerger of Kesoram Industries' cement segment, which would boost the company's market position. The agreement strengthened UltraTech's foothold in South India. Shareholders are entitled to one UltraTech share for every 52 Kesoram shares. Additionally, an INR 1,800 Crore investment plan has been approved, supporting UltraTech's expansion in India's cement sector.

- In January 2025, Nuvoco Vistas won a bidding to buy Vadraj Cement, increasing its manufacturing capacity by more than 20%. This strategic initiative increases Nuvoco's position in the Indian cement industry, hence improving supply capacities. The transaction follows the industry's consolidation trend, resulting in greater competition among key companies.

India Cement Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Square Meters |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fiber Cement Board (FCB), Wood Wool Cement Board (WWCB), Wood Strand Cement Board (WSCB), Cement Bonded Particle Board (CBPB) |

| Applications Covered | Flooring, Exterior and Partition Walls, Roofing, Columns and Beams, Facades, Weatherboard, and Cladding, Acoustic and Thermal Insulation, Others |

| End-User Industries Covered | Residential, Commercial, Industrial and Institutional |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cement board market performed so far and how will it perform in the coming years?

- What is the breakup of the India cement board market on the basis of product type?

- What is the breakup of the India cement board market on the basis of application?

- What is the breakup of the India cement board market on the basis of end-user industry?

- What are the various stages in the value chain of the India cement board market?

- What are the key driving factors and challenges in the India cement board market?

- What is the structure of the India cement board market and who are the key players?

- What is the degree of competition in the India cement board market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cement board market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cement board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cement board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)