India Cement Clinker Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, End-Use Industry, and Region, 2025-2033

India Cement Clinker Market Overview:

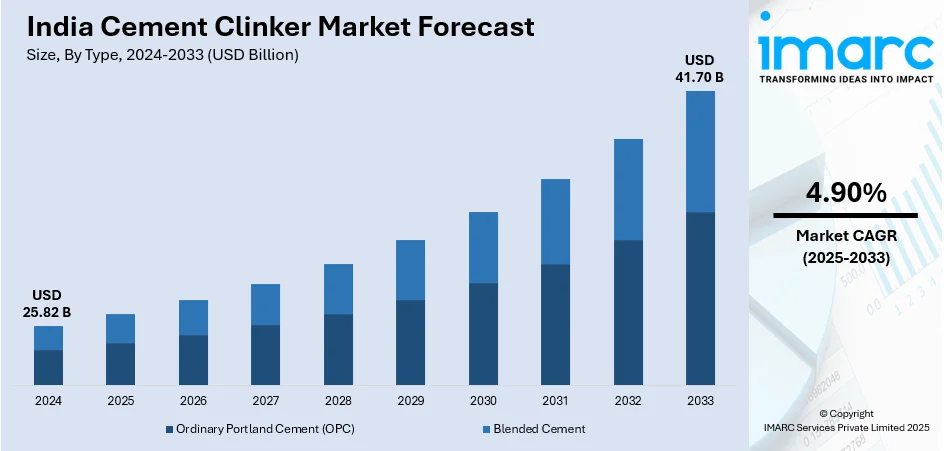

The India cement clinker market size reached USD 25.82 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.70 Billion by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The expansion of clinker production capacity and the adoption of advanced grinding technologies are driving the cement clinker market by ensuring consistent supply, optimizing production efficiency, reducing costs, and enhancing sustainability, enabling manufacturers to meet the growing infrastructure and catalyzing construction demand while strengthening the market competitiveness and long-term growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.82 Billion |

| Market Forecast in 2033 | USD 41.70 Billion |

| Market Growth Rate (2025-2033) | 4.90% |

India Cement Clinker Market Trends:

Expansion of Clinker Production Capacity

The rising infrastructure development, urbanization, and construction efforts in India play a vital role in driving the market. The need for cement is increasing in residential, commercial, and industrial areas, requiring greater clinker production to maintain a steady supply. Consequently, cement producers are investing in new production facilities and expanding plants to enhance their market presence and boost operational efficiency. By increasing capacity, businesses can serve regions with high demand while enhancing energy efficiency and reducing production expenses. The strategic growth of clinker production also improves supply chain logistics, decreasing reliance on clinker imports and alleviating transportation-related inefficiencies. A prominent illustration of this trend is the growth by JK Cement, which launched a new production line at its Panna Plant in 2024. This advancement increased the plant's clinker production capability to 6.6 MTPA, meeting the rising cement demand throughout Uttar Pradesh, Bihar, and Central India. The amount of Rs. An investment of 2850 Cr not only guarantees a steady supply of clinker but also incorporates energy-saving and sustainable production methods. In addition to satisfying market needs, this growth has a notable socio-economic effect, generating new job opportunities and enhancing local economic activity. By increasing clinker production capacity, cement producers are strengthening their capability to address India's long-term requirements for construction and infrastructure development. With rapid urbanization and government initiatives for extensive infrastructure developments, such strategic expansions will be vital in influencing the future of the cement clinker market, guaranteeing reliable supply and sustainable growth.

To get more information on this market, Request Sample

Adoption of Advanced Grinding Technologies

Cement manufacturers are investing in cutting-edge solutions such as vertical roller mills (VRM) to enhance efficiency, reduce energy consumption, and improve clinker quality. VRMs offer significant advantages over conventional grinding systems, including lower power requirements, reduced maintenance costs, and higher operational reliability. The integration of high-efficiency classifiers in these mills further optimizes raw material and coal grinding, ensuring consistent product quality while minimizing waste. For instance, in 2024, UltraTech Cement placed an order with Gebr. Pfeiffer for the installation of VRMs at three new clinker production lines. This investment aims to improve grinding efficiency and ensure sustainable operations by reducing energy consumption. The collaboration between Gebr. Pfeiffer’s German and Indian subsidiaries enhances the availability of spare parts and maintenance support, further optimizing long-term operational performance. As sustainability regulations tighten and energy costs fluctuate, cement manufacturers are prioritizing advanced technologies to maintain competitiveness. The shift toward VRMs and other energy-efficient grinding solutions is reshaping clinker production, enabling manufacturers to meet growing construction demand while adhering to environmental and cost-efficiency goals, thus driving overall market growth.

India Cement Clinker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, distribution channel, application, and end-use industry.

Type Insights:

- Ordinary Portland Cement (OPC)

- Blended Cement

The report has provided a detailed breakup and analysis of the market based on the type. This includes ordinary Portland cement (OPC) and blended cement.

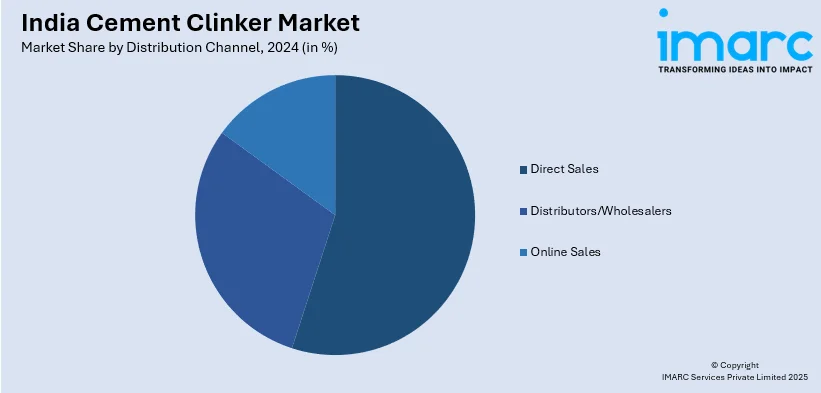

Distribution Channel Insights:

- Direct Sales

- Distributors/Wholesalers

- Online Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales, distributors/wholesalers, and online sales.

Application Insights:

- Residential

- Commercial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and infrastructure.

End-Use Industry Insights:

- Construction

- Manufacturing

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction and manufacturing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cement Clinker Market News:

- In June 2024, JK Cement launched a new 2 MTPA clinker grinding facility at its Prayagraj Plant in Uttar Pradesh. This expansion increased the company's overall capacity from 22 MTPA to 24 MTPA, catering to the growing demand in Eastern Uttar Pradesh.

- In April 2024, Star Cement began production at its new clinker line in Lumshnong, Meghalaya. The new line had a production capacity of 3.3 Billion tons per annum (Mta). This addition expanded the company’s existing integrated cement plant in Lumshnong and complemented its grinding units in other locations.

India Cement Clinker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ordinary Portland Cement (OPC), Blended Cement |

| Distribution Channels Covered | Direct Sales, Distributors/Wholesalers, Online Sales |

| Applications Covered | Residential, Commercial, Infrastructure |

| End-Use Industries Covered | Construction, Manufacturing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cement clinker market performed so far and how will it perform in the coming years?

- What is the breakup of the India cement clinker market on the basis of type?

- What is the breakup of the India cement clinker market on the basis of distribution channel?

- What is the breakup of the India cement clinker market on the basis of application?

- What is the breakup of the India cement clinker market on the basis of end-use industry?

- What is the breakup of the India cement clinker market on the basis of region?

- What are the various stages in the value chain of the India cement clinker market?

- What are the key driving factors and challenges in the India cement clinker market?

- What is the structure of the India cement clinker market and who are the key players?

- What is the degree of competition in the India cement clinker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cement clinker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cement clinker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cement clinker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)