India Cement Tiles Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Cement Tiles Market Overview:

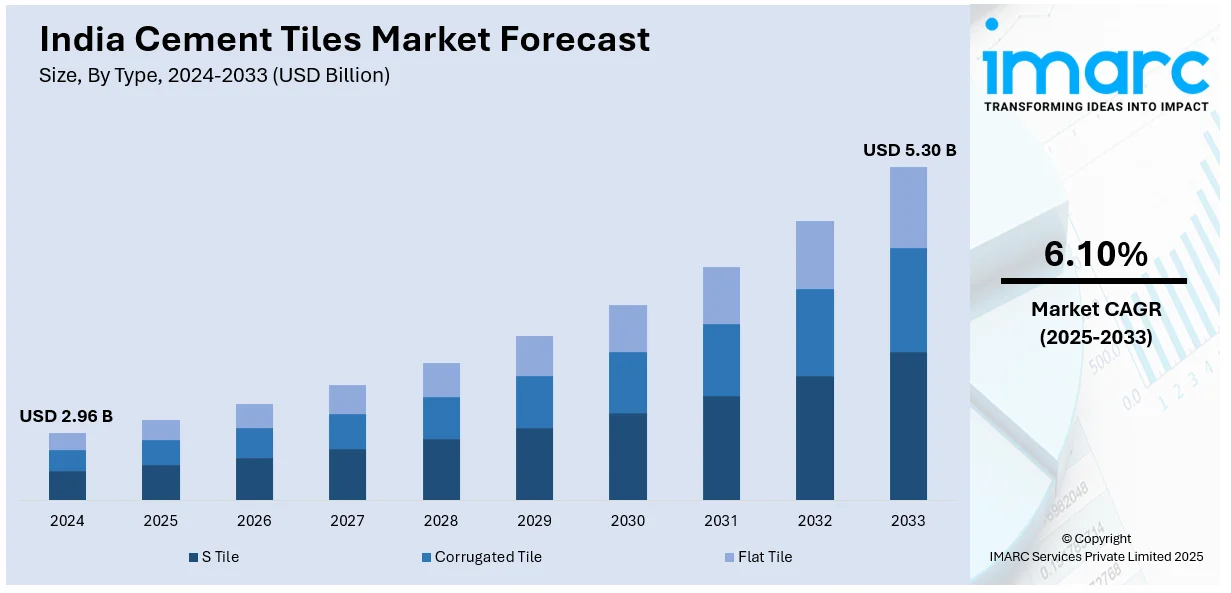

The India cement tiles market size reached USD 2.96 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.30 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The need for high-end designs and digital manufacturing developments is driving growth in India's cement tile industry. While handcrafted and designer tiles are becoming more popular, automation increases production efficiency. Additionally, growing urbanization and changing consumer tastes are boosting industrial competitiveness, opening up new markets, and spurring innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.96 Billion |

| Market Forecast in 2033 | USD 5.30 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

India Cement Tiles Market Trends:

Digital Transformation in Cement Manufacturing

The growing use of digital solutions to improve manufacturing efficiency is changing the cement tile market in India. Cement tile producers are incorporating cutting-edge technologies to streamline manufacturing procedures, lower operating costs, and boost worker productivity as the demand for premium and environmentally friendly building materials rises. Along with this, digital transformation is an essential factor in the expansion of the sector since automation and digital integration help to optimize production, reduce waste, and guarantee consistency in product quality. For example, in December 2024, Prism Johnson Limited implemented the Ramco ERP Suite for its Cement Division, marking a major step in process automation. This system integrates key functions such as manufacturing, sales, distribution, finance, procurement, and human resource management, ensuring seamless operations. The organization has improved its capacity to effectively satisfy market demand while upholding high product standards by utilizing real-time analytics, predictive maintenance, and automated workflows. The cement tile business is growing more competitive as a result of digital transformation, which increases productivity and eliminates manufacturing bottlenecks. Moreover, better supply chain management, quicker turnaround times, and enhanced quality control are all made possible by automation, which benefits both consumers and manufacturers. It is anticipated that as more businesses use comparable technologies, cement tile production will become more innovative, sustainable, and productive.

To get more information on this market, Request Sample

Growing Demand for Premium Tile Designs

The cement tiles market in India is witnessing a shift towards premium and aesthetically appealing designs. Consumers are increasingly looking for unique, handcrafted tiles that combine durability with artistic elements. Architectural trends are driving demand for tiles that reflect traditional craftsmanship while meeting modern design preferences, leading manufacturers to introduce innovative collections that cater to this growing segment. In December 2024, Bharat Floorings & Tiles launched the Shunya-Taal Collection in collaboration with HCPID. This exclusive collection merges traditional Indian design principles with contemporary aesthetics, offering a high-end range of handcrafted cement tiles. Inspired by elements like Shunya (the void) and Taal (rhythmic grace), the collection redefines flooring as a design feature rather than just a functional component. As premium tile designs gain traction, manufacturers are focusing on artistic craftsmanship, intricate patterns, and unique color palettes. This trend is expanding market opportunities, attracting architects, interior designers, and homeowners who seek customized, high-end flooring solutions. The growing demand for designer cement tiles is reshaping the industry, encouraging innovation, and strengthening India's position in the global premium tile market.

India Cement Tiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- S Tile

- Corrugated Tile

- Flat Tile

The report has provided a detailed breakup and analysis of the market based on the type. This includes S tile, corrugated tile, and flat tile.

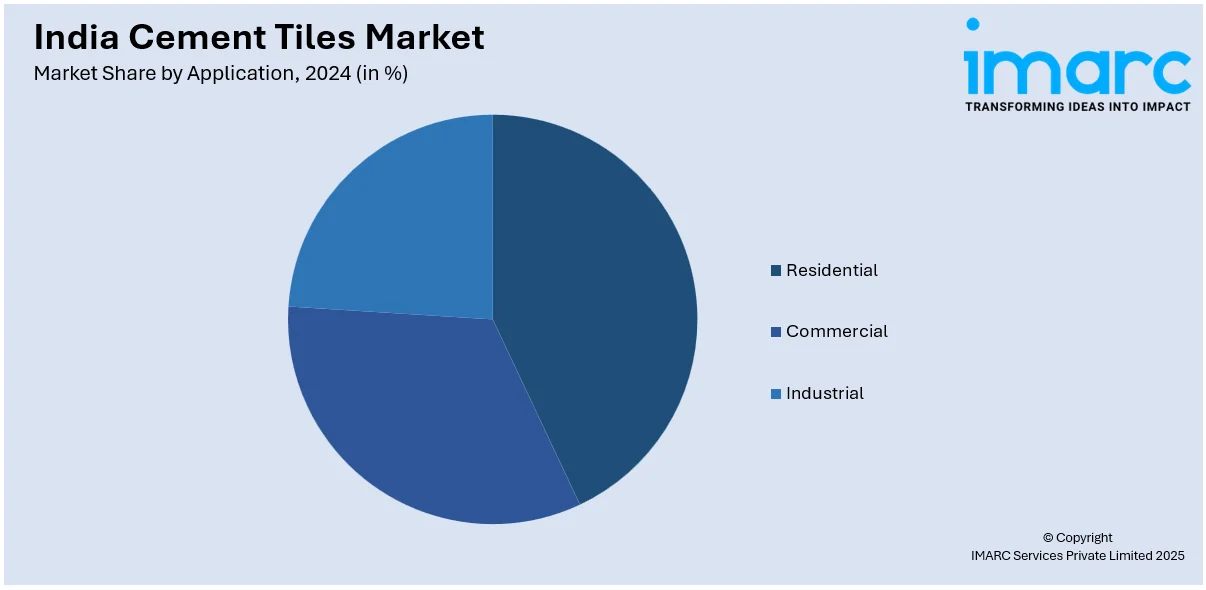

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cement Tiles Market News:

- February 2025: Shree Cement launched Bangur Marble Cement, a premium PSC cement under the Bangur Cement brand. This innovation enhances brightness and durability, strengthening India’s cement tiles market by improving quality, boosting demand for high-performance materials, and supporting construction sector growth.

- November 2024: Nuvoco Vistas Corp. Ltd. launched Nuvoco Zero M Tile Adhesive T5, a high-performance epoxy-based PU adhesive. This innovation enhances durability and versatility in cement tile installations, strengthening India’s cement tiles market by improving bonding reliability, expanding application possibilities, and supporting long-term construction quality.

India Cement Tiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | S Tile, Corrugated Tile, Flat Tile |

| Application Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cement tiles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cement tiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cement tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement tiles market in India was valued at USD 2.96 Billion in 2024.

The India cement tiles market is projected to exhibit a CAGR of 6.10% during 2025-2033, reaching a value of USD 5.30 Billion by 2033.

The India cement tiles market is driven by rapid urbanization, rising residential and commercial construction, and increasing demand for durable, eco-friendly flooring solutions. Growing renovation activities, aesthetic design preferences, and government initiatives supporting sustainable building materials further boost adoption, enhancing market growth across both urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)