India Ceramic Tiles Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Ceramic Tiles Market Summary:

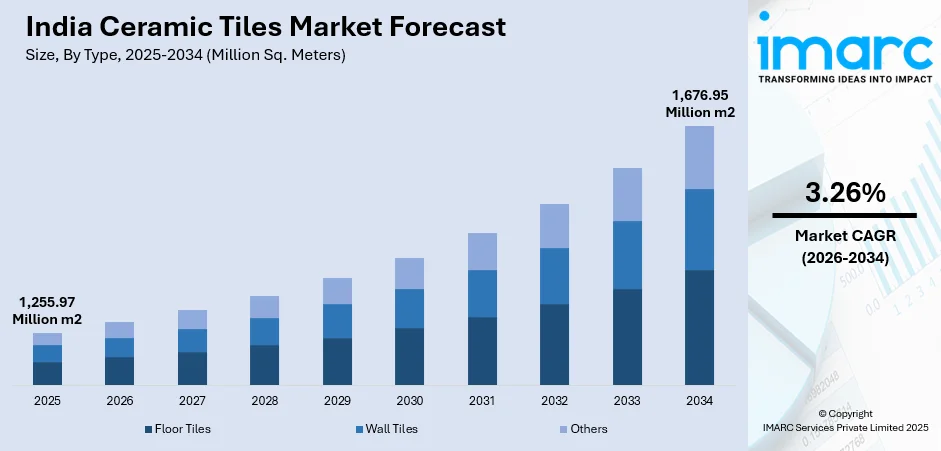

The India ceramic tiles market size reached 1,255.97 Million Sq. Meters in 2025 and is projected to reach 1,676.95 Million Sq. Meters by 2034, growing at a compound annual growth rate of 3.26% from 2026-2034.

The India ceramic tiles market is experiencing sustained growth driven by accelerating urbanization, rising disposable incomes, and increasing demand for aesthetically appealing, durable, and low-maintenance flooring and wall solutions. The increasing number of residential as well as commercial constructions, as well as the government plans to provide more affordable housing and infrastructure development, is helping the demand growth. Innovations taking place in tile manufacturing technology, such as digital printing and better glazing, are helping improve product quality and variety. The increasing desire for high-quality and custom-made tiles, as well as the shift towards more sustainable building materials, is adding to the India ceramic tiles market share.

Key Takeaways and Insights:

-

By Type: Floor tiles dominate the market with a share of 52% in 2025, driven by widespread applications in residential and commercial spaces, superior durability, low maintenance requirements, and diverse aesthetic options meeting varied consumer preferences.

-

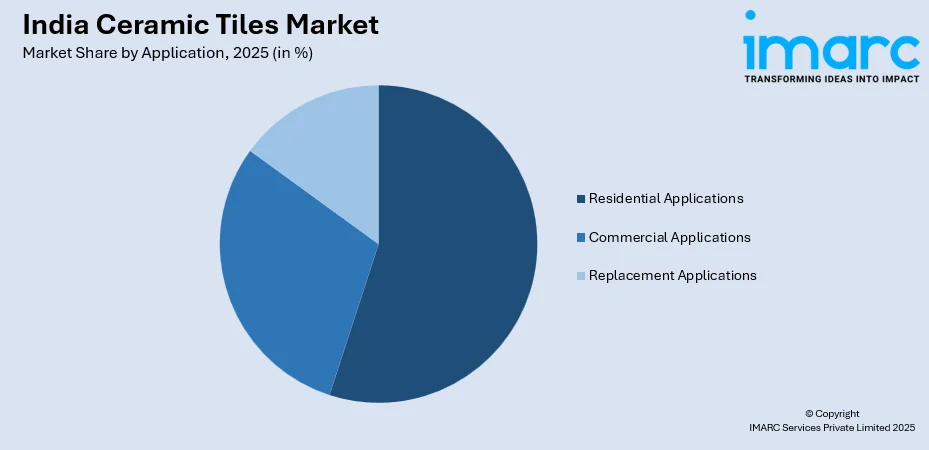

By Application: Residential applications lead the market with a share of 55% in 2025, supported by accelerating urbanization, increasing home renovation activities, rising middle-class incomes, and growing consumer preference for stylish, durable flooring solutions.

-

By Region: West and Central India represents the largest segment with a market share of 28% in 2025, owing to the presence of major manufacturing hubs, robust real estate development, and significant industrial growth across Gujarat and Maharashtra.

-

Key Players: The market for ceramic tiles in India has moderately competitive intensity, where the market share of organized players was significant. The key domestic market players compete with regional players regarding pricing and customizations, dominated by large portfolios, advanced technology, and wider distribution networks. Some of the key players include Florim Ceramiche, Monalisa Group, Porcelanosa, RAK Ceramics, Asian Granito India Ltd., Kajaria Ceramic Ltd., Nitco Limited, Orient Bell Limited, Prism Johnson Ltd., Simpolo Ceramics Pvt Ltd., Somany Ceramics Ltd., Sunhearrt Ceramik, and Varmora Granito Pvt Ltd.

To get more information on this market Request Sample

The India ceramic tiles market continues to evolve as the construction sector expands across urban and semi-urban regions. Morbi in Gujarat, housing over 1,500 ceramic factories, serves as the production epicenter, contributing majorly 80% of the country's ceramic output and exporting to over 163 countries worldwide. The region has witnessed significant investments in capacity expansion and technological upgrades, with manufacturers adopting energy-efficient kilns and digital printing technologies. Government programs including Pradhan Mantri Awas Yojana-Urban 2.0, with its commitment to construct 1 crore affordable homes backed by INR 10 lakh crore investment, are creating sustained demand for quality flooring and wall solutions. The Smart Cities Mission, channeling over INR 1.64 lakh crore into urban renewal projects, further accelerates tile consumption in public infrastructure, transit hubs, and residential complexes.

India Ceramic Tiles Market Trends:

Preference for Large-Format and Designer Tiles

Indian customers are shifting towards large format tiles such as 1600 x 3200mm with the aim of building seamless and architecturally expansive interiors. This tendency is the expression of changing aesthetic values in residential and commercial areas as houseowners and designers want to find modern aesthetics and reduce the amount of grout lines. Manufacturers are replying with the more developed digital printing which is replicating natural materials such as marble and wood with high accuracy. In March 2025, Somany Ceramics unveiled its Everstone, Eternastone, and Harmony glazed vitrified suites in 800×1600mm dimensions at its StyleConclave event in New Delhi.

Sustainability and Eco-Friendly Manufacturing

The manufacturing process in the ceramic tiles industry is also being impacted by environmental awareness, which forces the companies to consider renewable energy sources and production processes that are more resource-efficient. Manufacturers are finding it easier to lower their dependency on freshwater resources using recycled water systems and other methods of conservation. Meanwhile, sustainability standards and green building certifications are stimulating the demand for tiles manufactured in eco-friendly ways, which supports the significance of the greener operations in supporting the brand name and popularity among institutional and commercial customers.

Digital Transformation and Advanced Manufacturing Technologies

The ceramic tiles sector is changing the world with technological innovation in terms of digital inkjet printing, 3D surface texturing, and automated production technologies. These technologies help manufacturers to create rather detailed and customer-oriented design, minimize the manufacturing process, and lower the costs of production. Carbon emissions have been cut down by about 20 percent with energy-saving roller kilns that have waste-heat recovery systems and artificial intelligence control. In November 2024, Kajaria Ceramics inaugurated a 15,000 square feet Experience Centre in Chennai, featuring dedicated display zones showcasing advanced glazed vitrified tiles and integrated bathware solutions.

Market Outlook 2026-2034:

The India ceramic tiles market is positioned for sustained growth throughout the forecast period, supported by robust construction activity, infrastructure development initiatives, and evolving consumer preferences for premium flooring solutions. Expansion of tier-II and tier-III cities, coupled with increasing renovation activities in established urban centers, will drive consistent demand. Manufacturers are expected to focus on product innovation, capacity expansion, and sustainability initiatives to capture emerging opportunities. The market size was estimated at 1,255.97 Million Sq. Meters in 2025 and it is expected to reach 1,676.95 Million Sq. Meters by 2034, reflecting a compound annual growth rate of 3.26% over the forecast period 2026-2034.

India Ceramic Tiles Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Floor Tiles | 52% |

| Application | Residential Applications | 55% |

| Region | West and Central India | 28% |

Type Insights:

- Floor Tiles

- Wall Tiles

- Others

Floor tiles dominate the market with a share of 52% of the total India ceramic tiles market in 2025.

Floor tiles maintain market leadership due to their extensive applications across residential, commercial, and industrial spaces. Their superior durability, resistance to wear and moisture, and low maintenance requirements make them the preferred choice for high-traffic areas. The segment benefits from continuous technological improvements in glazing techniques and surface treatments that enhance both functionality and aesthetics. Advances in digital printing technology enable manufacturers to offer diverse designs replicating natural materials, meeting varied consumer preferences across price points.

The increasing focus on home renovation and personalized interior design is boosting demand for premium floor tile options such as polished and glazed vitrified tiles. Rapid urbanization in tier-II and tier-III cities is widening the consumer base, while sustained expansion in commercial sectors, including retail, hospitality, and healthcare, is generating steady demand. In parallel, manufacturers are upgrading production capabilities to cater to evolving preferences for durable and outdoor-grade tiles, supporting both domestic infrastructure needs and international market opportunities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential Applications

- Commercial Applications

- Replacement Applications

Residential applications lead the market with a share of 55% of the total India ceramic tiles market in 2025.

The residential segment dominates the India ceramic tiles market, driven by accelerating urbanization and the growing middle-class population seeking stylish, durable, and low-maintenance flooring solutions. According to government projections, approximately 40% of India's population is expected to reside in urban areas by 2030, creating sustained demand for residential construction materials. Ceramic tiles have become the preferred choice for bathrooms, kitchens, living rooms, and exterior applications due to their versatility and aesthetic appeal.

Government-led affordable housing programs are playing a vital role in driving growth within the residential construction segment by increasing the overall demand for housing and associated building materials. At the same time, rising disposable incomes in major metropolitan areas are encouraging homeowners to undertake lifestyle-driven renovation and refurbishment projects. This shift is leading to greater spending on premium and designer tile options, particularly for high-usage spaces such as kitchens and bathrooms, as consumers place stronger emphasis on aesthetics, durability, and long-term value.

Regional Insights:

- North India

- West and Central India

- South India

- East India

West and Central India holds the largest share with 28% of the total India ceramic tiles market in 2025.

West and Central India dominates the market largely due to Morbi in Gujarat, which has emerged as a globally significant hub for ceramic tile manufacturing. The region benefits from a dense concentration of production facilities, a well-established skilled workforce, and a strong export-oriented ecosystem. Ongoing infrastructure development, including integrated industrial parks with dedicated utilities and logistics support, is further strengthening the region’s manufacturing capabilities and competitiveness, reinforcing its leadership position in both domestic and international ceramic tile markets.

Strategic proximity to major ports such as Mundra and Kandla supports cost-efficient exports by strengthening connectivity to international markets. Improved freight infrastructure has enhanced logistics efficiency and streamlined the movement of goods across regions. In parallel, strong real estate activity, industrial expansion, and the growth of retail and hospitality sectors in Maharashtra and Gujarat continue to sustain regional demand. Ongoing policy support and investment promotion initiatives by the Gujarat government are further reinforcing the ceramics industry’s development and long-term growth prospects.

Market Dynamics:

Growth Drivers:

Why is the India Ceramic Tiles Market Growing?

Accelerating Urbanization and Infrastructure Development

India’s accelerating pace of urbanization is reshaping demand for construction materials, with ceramic tiles increasingly preferred for flooring and wall applications across residential and commercial developments. The steady shift toward urban living is driving sustained demand for housing, commercial complexes, and public infrastructure, all of which require durable and visually appealing building materials. Urban renewal initiatives, smart city development, and large-scale transport infrastructure projects are further reinforcing tile demand. Additionally, the expansion of metro networks, airports, and organized retail spaces is supporting consistent adoption of ceramic tiles in high-traffic environments where performance and aesthetics are critical.

Government Housing and Construction Initiatives

Government programs promoting affordable housing and sanitation infrastructure are creating sustained demand for ceramic tiles across India. For instance, in December 2025, the Delhi Development Authority (DDA) introduced the Karmayogi Housing Scheme–2025 aimed at government employees. Under this initiative, the scheme brochure is scheduled for release on December 19, coinciding with the opening of the registration process. The project involves the development of 1,169 residential units across 1 BHK, 2 BHK, and 3 BHK configurations, with eligible government employees offered purchase discounts of up to 25 percent. Additionally, the Swachh Bharat Mission's continued focus on sanitation infrastructure drives demand for bathroom tiles and sanitaryware across rural and urban areas. These initiatives ensure predictable consumption patterns even during periods of economic uncertainty, providing manufacturers with stable order pipelines.

Rising Disposable Incomes and Consumer Lifestyle Preferences

Rising affluence among India’s expanding middle class is reshaping household spending behavior, with greater emphasis on home aesthetics and interior design. Consumers are increasingly allocating discretionary income toward home improvement projects and upgrading from basic tile options to premium and designer variants. Preferences are shifting toward large-format tiles, wood-finish surfaces, and textured designs that enhance visual appeal. Renovation activity is gaining momentum in established residential areas, influenced by evolving lifestyle aspirations and design trends, while the availability of flexible home improvement financing is further encouraging investment in quality flooring and wall solutions across price segments.

Market Restraints:

What Challenges the India Ceramic Tiles Market is Facing?

Volatile Energy Costs and Raw Material Prices

Fluctuating energy prices continue to pose a major challenge for ceramic tile manufacturers, as fuel expenses form a substantial component of overall production costs. Rising and unpredictable energy costs compress profit margins and complicate pricing strategies, forcing manufacturers to carefully balance cost pass-through with market competitiveness. In addition, variability in raw material availability and transportation expenses further strains operating economics across the ceramic tile value chain.

Competition from Unorganized Sector and Imports

The ceramic tiles market remains fragmented, with numerous unorganized manufacturers competing alongside established brands. These smaller players often benefit from lower overheads and flexible pricing, intensifying competition in price-sensitive segments. At the same time, imports from low-cost manufacturing countries add further pressure on domestic pricing, challenging organized players to differentiate through quality, branding, and distribution rather than cost alone.

Infrastructure Limitations in Manufacturing Clusters

Despite strong industrial expansion, several ceramic manufacturing hubs continue to face infrastructure-related challenges. Limitations in road connectivity, inconsistent power supply, and constrained water availability increase operating costs and disrupt production efficiency. These issues are particularly challenging for smaller manufacturers that lack the financial capacity to invest in captive utilities, alternative logistics solutions, or large-scale infrastructure upgrades.

Competitive Landscape:

The India ceramic tiles market exhibits a moderately competitive landscape, with organized players holding significant market share while competing alongside numerous regional manufacturers. Leading domestic companies dominate through extensive product portfolios spanning floor tiles, wall tiles, vitrified tiles, and sanitaryware solutions. Key players maintain competitive advantages through advanced manufacturing technologies including digital inkjet printing, automated production systems, and energy-efficient kilns. Strategic investments in capacity expansion, distribution network strengthening, and brand building differentiate market leaders. Sustainability initiatives, including solar energy adoption and water recycling systems, are becoming competitive differentiators among organized manufacturers seeking institutional and export contracts.

Some of the key players are:

- Florim Ceramiche

- Monalisa Group

- Porcelanosa

- RAK Ceramics

- Asian Granito India Ltd.

- Kajaria Ceramic Ltd.

- Nitco Limited

- Orient Bell Limited

- Prism Johnson Ltd.

- Simpolo Ceramics Pvt Ltd.

- Somany Ceramics Ltd.

- Sunhearrt Ceramik

- Varmora Granito Pvt Ltd.

Recent Developments:

-

In February 2025, Simpolo Tiles & Bathware inaugurated a new 7,000 square feet display centre in Chennai, enhancing its presence in South India. The center showcases premium products including the Strong X surface and Ricco 2.0 collection, aiming to provide superior shopping experiences for homeowners and industry professionals.

-

In August 2024, KPG Roofings announced the launch of India's first local manufacturing facility for ceramic roof tiles in Gujarat. This initiative aligns with the Make in India campaign, aiming to reduce import dependency, improve affordability, create employment opportunities, and support the local economy.

India Ceramic Tiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Sq. Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Tiles, Wall Tiles, Others |

| Applications Covered | Residential Applications, Commercial Applications, Replacement Applications |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Florim Ceramiche, Monalisa Group, Porcelanosa, RAK Ceramics, Asian Granito India Ltd., Kajaria Ceramic Ltd., Nitco Limited, Orient Bell Limited, Prism Johnson Ltd., Simpolo Ceramics Pvt Ltd., Somany Ceramics Ltd., Sunhearrt Ceramik, Varmora Granito Pvt Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India ceramic tiles market reached a volume of 1,255.97 Million Sq. Meters in 2025.

The India ceramic tiles market is expected to grow at a compound annual growth rate of 3.26% from 2026-2034 to reach 1,676.95 Million Sq. Meters by 2034.

Floor tiles dominated the market with a 52% share in 2025, driven by their widespread applications in residential and commercial spaces, superior durability, diverse design options, and low maintenance requirements across price segments.

Key factors driving the India ceramic tiles market include accelerating urbanization and infrastructure development, government housing initiatives such as PMAY-Urban 2.0, rising disposable incomes, increasing home renovation activities, and growing demand for premium aesthetic flooring solutions.

Major challenges include volatile natural gas prices affecting production costs, intense competition from unorganized sector manufacturers and imports, infrastructure limitations in manufacturing clusters, and price sensitivity in rural and semi-urban markets limiting premium product penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)