India Chemoinformatics Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

India Chemoinformatics Market Overview:

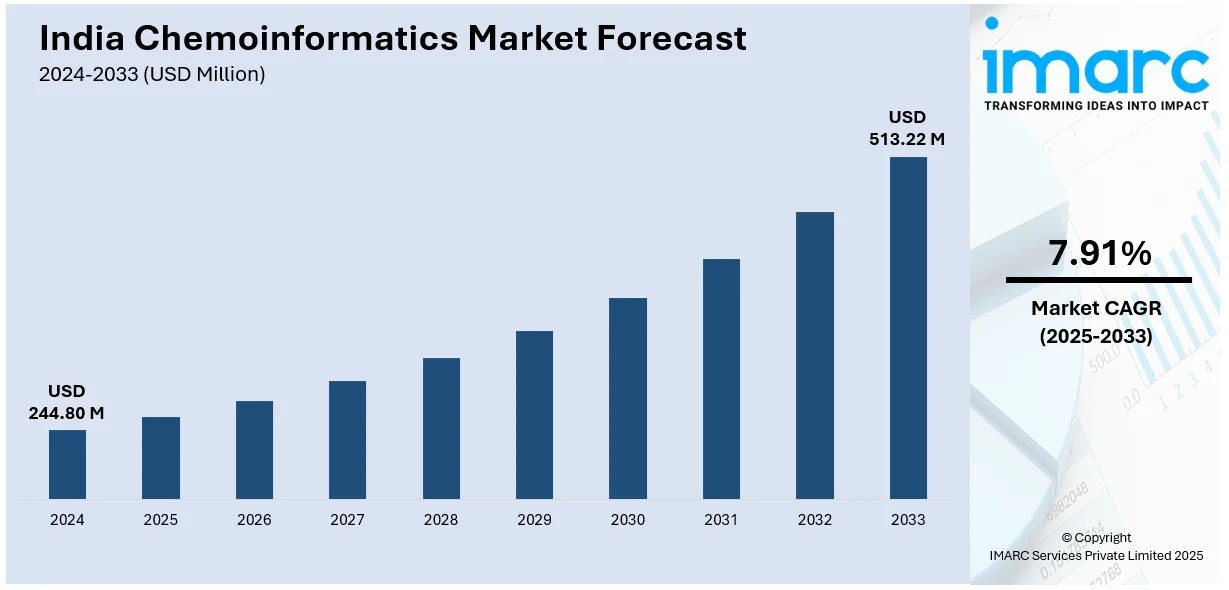

The India chemoinformatics market size reached USD 244.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 513.22 Million by 2033, exhibiting a growth rate (CAGR) of 7.91% during 2025-2033. India's chemoinformatics market growth is being boosted by advances in computational drug design, growing chemical database research, and the need for AI molecular modeling. Also, large-scale pharmaceutical R&D and the encouragement of the government for digitization in chemistry are also stimulating adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 244.80 Million |

| Market Forecast in 2033 | USD 513.22 Million |

| Market Growth Rate 2025-2033 | 7.91% |

India Chemoinformatics Market Trends:

Rising Adoption of AI in Drug Discovery

Indian pharmaceutical and biotechnology companies are increasingly applying artificial intelligence (AI) to chemoinformatics to support drug discovery. AI algorithms enable the prediction of molecular interactions, lead compound optimization, and improve screening processes with reduced time and expense in drug research. Deep learning models and neural networks support accurate molecular property predictions, increasing the efficiency of virtual screening. Artificial intelligence-based methods like generative models and reinforcement learning are further enhancing hit identification and lead optimization. Besides, partnerships among research organizations and technology companies are facilitating the establishment of AI-based chemoinformatics platforms. Government programs favoring AI adoption in healthcare and life sciences also increase industry growth. The market is observing an increase in startups providing AI-based chemical analysis solutions and enhancing drug development pipelines. AI-driven molecular dynamics simulations are increasingly being used to investigate protein-ligand interactions, facilitating targeted drug design. Additionally, the growing applications of AI in toxicology and chemical risk assessment are fueling market demand. AI models can forecast the unfavorable effects of chemicals and aid regulatory compliance. With ongoing improvements in computational capabilities and algorithmic effectiveness, AI use in chemoinformatics is likely to grow further, revolutionizing pharmaceutical research in India.

To get more information on this market, Request Sample

Expanding Chemical Databases for Research

The increasing availability of extensive chemical databases is driving advancements in chemoinformatics. These databases store detailed molecular structures, chemical properties, and biological interactions, aiding researchers in predictive modeling and molecular docking studies. Integration of cloud computing allows seamless access to vast chemical datasets, improving data-driven decision-making. Advances in database standardization and interoperability are facilitating efficient chemical information retrieval, enabling precise drug formulation and materials research. Developments in open-access and proprietary chemical repositories are further strengthening research capabilities. Pharmaceutical companies and academic institutions are investing in data curation and annotation tools to enhance the accuracy of computational predictions. Machine learning models are increasingly being trained on these databases to predict compound activity, toxicity, and stability, expediting the drug discovery process. Additionally, cheminformatics tools are enabling the rapid screening of chemical libraries for potential drug candidates. Advanced search algorithms allow researchers to identify structural similarities and functional group interactions, improving hit-to-lead conversion rates. The expansion of cheminformatics-based analytical platforms is supporting discoveries in drug formulation and material sciences. With continuous advancements in database integration and data mining, chemoinformatics is becoming a key driver in accelerating research and innovation in India’s pharmaceutical and chemical industries.

India Chemoinformatics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application.

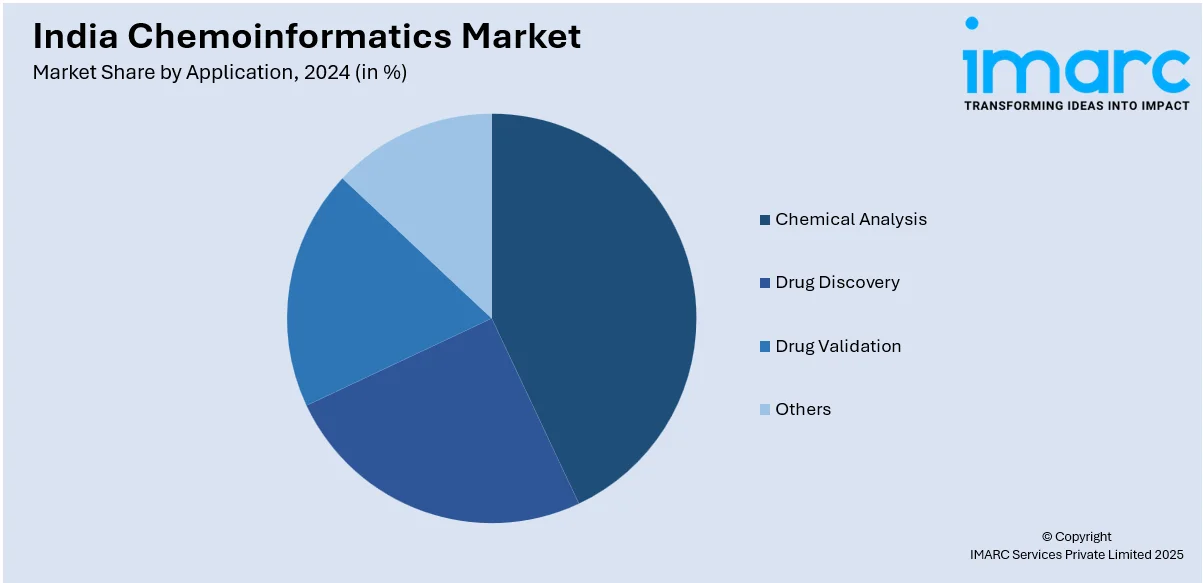

Application Insights:

- Chemical Analysis

- Drug Discovery

- Drug Validation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemical analysis, drug discovery, drug validation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chemoinformatics Market News:

- December 2024: The first Molsoft India User Group Meeting in Bengaluru marks a significant development in India's chemoinformatics sector. The event fosters industry collaboration, advances drug discovery applications, and enhances computational chemistry adoption, driving innovation and expanding Molsoft’s influence in India’s growing pharmaceutical and biotech sectors.

India Chemoinformatics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Chemical Analysis, Drug Discovery, Drug Validation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chemoinformatics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chemoinformatics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chemoinformatics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chemoinformatics market in India was valued at USD 244.80 Million in 2024.

The India chemoinformatics market is projected to exhibit a (CAGR) of 7.91% during 2025-2033, reaching a value of USD 513.22 Million by 2033.

Growth in pharmaceutical, biotech, and chemical industries' R&D drives chemoinformatics solution demand. The demand for effective drug discovery, molecular modeling, and predictive analysis increases adoption. Expansion in computational chemistry investments, AI integration into drug design, and academia-industry collaborations also supports the market growth, making it possible to conduct quicker, more affordable R&D processes in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)