India Child Care Services Market Size, Share, Trends and Forecast by Delivery Type and Region, 2025-2033

India Child Care Services Market Overview:

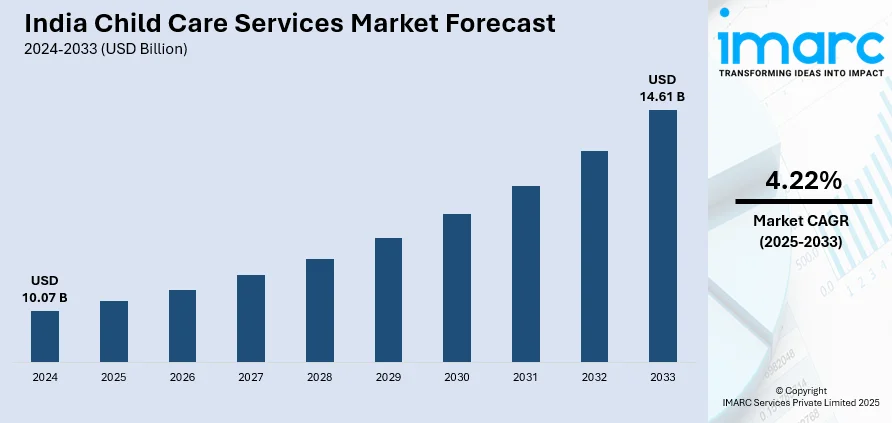

The India child care services market size reached USD 10.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.61 Billion by 2033, exhibiting a growth rate (CAGR) of 4.22% during 2025-2033. Rising dual-income households, rapid urbanization, increased awareness of the importance of early childhood development, and technological integration in care services are collectively driving the India child care services market by creating demand for structured, safe, and educational environments that cater to the evolving needs of modern Indian families.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.07 Billion |

| Market Forecast in 2033 | USD 14.61 Billion |

| Market Growth Rate 2025-2033 | 4.22% |

India Child Care Services Market Trends:

Rising Urbanization and the Shift in Family Structures

One of the most significant drivers for the child care services market in India is the rapid rate of urbanization and the consequent change in conventional family structures. With increasing families moving from rural to urban settings for work and improved living standards, the traditional joint family structure where the grandparents used to play a dominant role in the upbringing of the children—is extensively being replaced with nuclear families. In such nuclear arrangements, both parents tend to be involved in full-time jobs, with little time and resources available to organize child care at home. This shift has boosted the need for organized, professional child care services like daycares, preschools, and after-school programs. Working parents in urban areas are looking for safe and secure places that provide early childhood education, socialization, and care during their absence. Moreover, population concentration in Tier-1 cities and metropolitan cities like Mumbai, Bengaluru, and Delhi has resulted in increased awareness and accessibility of these services, which is further propelling the market growth.

To get more information on this market, Request Sample

Growing Awareness of Early Childhood Development and Education

Another compelling driver of India's child care services market is the rising consciousness about the significance of early childhood development (ECD) and foundational education. There has been a gradual change in the outlook of parents toward a child's formative years in recent years. Modern Indian parents, particularly from the millennial generation, are considerably more knowledgeable and proactive in exploring all-around development possibilities for the 0–6 age group. Supported by neuroscience and child psychology studies, early exposure to intellectual stimulus, learning languages, emotional quotient, and social interaction skills is now commonly accepted as the key to long-term educational and individual achievement. This realization has created demand for quality child care centers that extend beyond simple supervision and include curriculum-driven learning, play with interactive components, instruction in multiple languages, and Montessori-based approaches. Additionally, a growing middle class with disposable income is keen to spend money on high-end care services that provide a competitive advantage right from early days. Therefore, this rising focus on intellectual and emotional development during early years is influencing the development and growth of child care services across India.

India Child Care Services Market Segmentation:

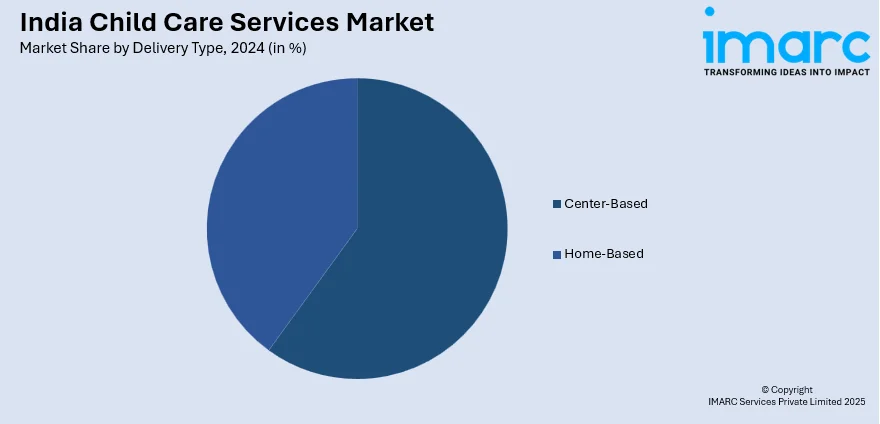

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on delivery type.

Delivery Type Insights:

- Center-Based

- Home-Based

The report has provided a detailed breakup and analysis of the market based on delivery type. This includes center-based and home-based.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Child Care Services Market News:

- December 2024: Bihar inaugurated a 100-bed modern "Matri-Shishu" (mother and child care) unit at Chhapra Sadar Hospital, constructed at a cost of INR 21 crore. This initiative enhances healthcare infrastructure for mothers and children in the region.

- July 2024: Mental health platform LiftNow India launched a mobile app aimed at supporting children's mental wellness by simulating calming natural environments and facilitating emotional reflection. This initiative integrated mental health support into digital platforms, addressing the elevating demand for comprehensive child development solutions.

India Child Care Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Delivery Types Covered | Center-Based, Home-Based |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India child care services market performed so far and how will it perform in the coming years?

- What is the breakup of the India child care services market on the basis of delivery type?

- What are the various stages in the value chain of the India child care services market?

- What are the key driving factors and challenges in the India child care services market?

- What is the structure of the India child care services market and who are the key players?

- What is the degree of competition in the India child care services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India child care services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India child care services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India child care services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)