India Childcare Management Software Market Size, Share, Trends and Forecast by Solution, Deployment, End User, and Region, 2025-2033

India Childcare Management Software Market Overview:

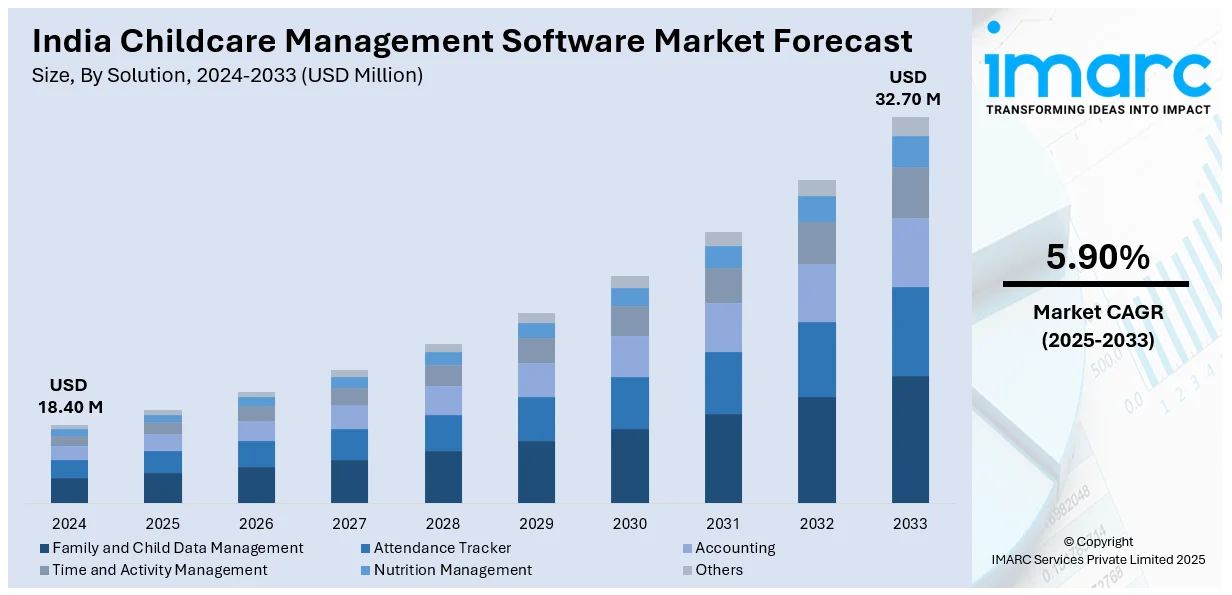

The India childcare management software market size reached USD 18.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 32.70 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The market is driven by increasing demand for early childhood education, rising adoption of digital solutions, government initiatives promoting preschool education, and growing awareness among parents. Advancements in AI, mobile applications, and cloud-based platforms further boost the India childcare management software market growth by enhancing administrative efficiency and child safety monitoring.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.40 Million |

| Market Forecast in 2033 | USD 32.70 Million |

| Market Growth Rate 2025-2033 | 5.90% |

India Childcare Management Software Market Trends:

Increasing Demand for Early Childhood Education

The rising awareness of early childhood education’s importance is a key driver for the childcare management software market in India. For instance, in March 2024, The Ministry of Women and Child Development launched a national early childhood education and care curriculum for children ages three to six as well as a national early childhood stimulation framework for children ages one to three. The Ministry emphasizes the importance of early childhood in growth and seeks to improve India's Early Childhood Care and Education (ECCE) environment, given that 85% of brain development takes place before the age of six. Parents are increasingly prioritizing structured learning environments for young children, leading to the growth of daycare centers, preschools, and early learning facilities. As more institutions emerge, the need for efficient administrative and educational management software rises. These solutions help streamline enrollment, track child progress, and enhance learning experiences, thus fueling the India childcare management software market share. Modern software solutions have become essential to meet rising organizational demands from childcare facilities with digital tools as the number of urban families employing dual wage earners continues to grow.

To get more information on this market, Request Sample

Growing Adoption of Digital Solutions and Cloud Technology

The digital transformation throughout industries has affected childcare operations by leading childcare institutions to implement cloud-based management systems. These platforms offer features like attendance tracking, real-time communication, fee management, and digital learning resources, improving overall efficiency, which is further creating a positive India childcare management software market outlook. Cloud technology ensures secure data storage, remote accessibility, and seamless integration with mobile applications. As parents seek more transparency and engagement, software with live video streaming and instant updates on child activities is gaining popularity. Indian childcare management software use is growing because of expanding Internet access and mobile device usage allowing many facilities to adopt digital solutions. For instance, in May 2024, Procare Solutions, a leader in child care management software for over 30 years, and IntelliKid Systems, a top supplier of child care enrollment and marketing software, integrated to offer a suite of marketing tools that link families looking for high-quality child care with time-constrained early childhood education centers. This occurs at a time when parents are quitting their jobs to care for young children, and about one-third of centers report operating below capacity.

India Childcare Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on solution, deployment, and end user.

Solution Insights:

- Family and Child Data Management

- Attendance Tracker

- Accounting

- Time and Activity Management

- Nutrition Management

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes family and child data management, attendance tracker, accounting, time and activity management, nutrition management, and others.

Deployment Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud-based.

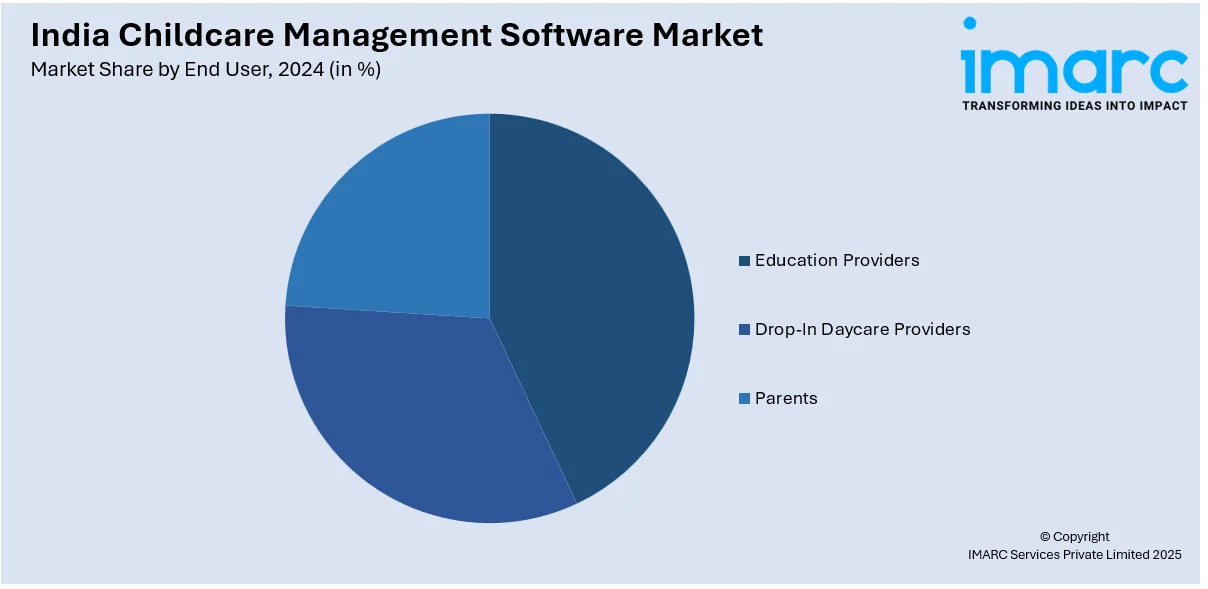

End User Insights:

- Education Providers

- Drop-In Daycare Providers

- Parents

A detailed breakup and analysis of the market based on the end users have also been provided in the report. This includes education providers, drop-in daycare providers, and parents.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Childcare Management Software Market News:

- In March 2024, Kido International, a UK-based chain providing forward-looking early childhood education to youngsters in India, the US, the UK, and China, revealed its acquisition of Amelio Early Education, a top preschool and daycare provider in India. This strategic acquisition establishes Kido as one of the rare non-franchised entities in India's early childhood education sector, providing parents and families access to its acclaimed teaching methods and top-tier operational standards.

India Childcare Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Family and Child Data Management, Attendance Tracker, Accounting, Time and Activity Management, Nutrition Management, Others |

| Deployments Covered | On-Premises, Cloud-Based |

| End Users Covered | Education Providers, Drop-In Daycare Providers, Parents |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India childcare management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India childcare management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India childcare management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The childcare management software market in India was valued at USD 18.40 Million in 2024.

The India childcare management software market is projected to exhibit a CAGR of 5.90% during 2025-2033, reaching a value of USD 32.70 Million by 2033.

Increasing demand for digitalization in daycare and preschool operations is driving adoption, as facilities look to automate attendance, billing, and parent communication. A growing focus on child safety, real-time updates, and regulatory compliance is also fueling investment. Additionally, rising enrolment in early education institutions further supports software implementation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)