India Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2025-2033

India Children’s Entertainment Centers Market Size and Share:

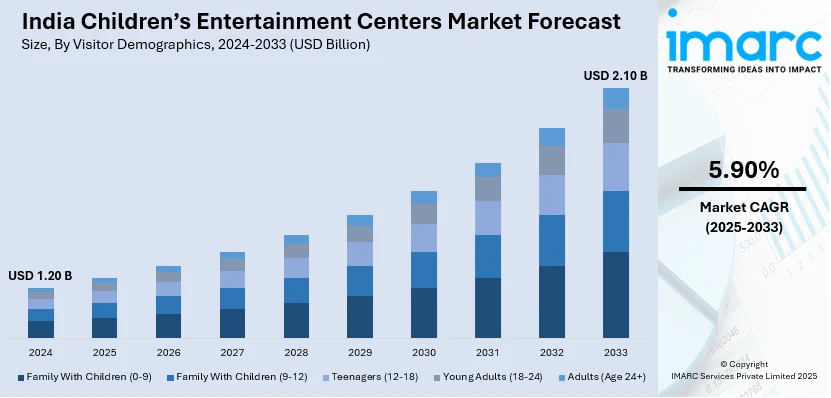

The India children’s entertainment centers market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.10 Billion by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The inflating disposable incomes, rapid urbanization, rising popularity of themed entertainment and edutainment attractions, growing demand for indoor recreation, increase in family-oriented leisure are some of the factors contributing positively to the India children’s entertainment centers market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 2.10 Billion |

| Market Growth Rate 2025-2033 | 5.90% |

India Children’s Entertainment Centers Market Trends:

Rise of Digital and Virtual Reality (VR) Experiences

One of the key trends influencing the market is the rapid growth of digital and virtual reality (VR) experiences. With technology becoming increasingly accessible children's entertainment centers are incorporating cutting-edge technologies such as VR and augmented reality (AR) into their services. VR gaming experiences enable children to be immersed in interactive environments making their overall entertainment experience more engaging. These technology advancements entertain while also bringing educative advantages in the form of simulations and interactive learning spaces. Additionally, virtual gaming areas including the most advanced games and e-sporting systems have gained immense popularity among kids. Parents too are attracted toward these centers because they provide entertainment as well as learning opportunities. With the increased usage of technology and more screen time for children, the market is likely to be propelled further by the need for high-tech immersive entertainment in the coming years. These tech-driven innovations and evolving consumer expectations are creating a positive India children's entertainment centers market outlook.

To get more information on this market, Request Sample

Themed and Edutainment Attractions

Another important trend in the Indian children's entertainment centers market is the increasing popularity of themed entertainment and edutainment attractions. The centers increasingly include educational components in their activities offering kids entertaining experiences that also enhance learning and skill-building. Themed entertainment attractions including those revolving around popular cartoons, superheroes or fantasy realms have been on the rise. These are the themes that develop exciting and immersive spaces in which children are able to engage with characters they love as they learn about creative play and educational activities. There is also growing demand for centers that marry learning with fun providing activities such as art and craft classes, science shows, and interactive storytelling sessions. Firms such as the Malpani Group, the innovative power behind Imagicaaworld Parks, recently announced their 4.56 hectares envisioned Entertainment Hub initiative along the Sabarmati Riverfront in Ahmedabad. The park will combine attractions both inside and outside, featuring a Ferris wheel, a themed food plaza, and hosting global franchises such as KidZania, which offers role-playing activities for kids, and Dave & Buster’s, which provides advanced gaming experiences. With these expansion strategies, the Malpani Group seeks to position Imagicaaworld as a top brand in the Indian entertainment sector, providing distinctive, immersive experiences along with a commitment to inclusivity, innovation, and excellence. Parents are more interested in centers that offer fun along with educational value, hence these hybrid destinations are extremely popular. This growing preference for blended learning and entertainment experiences is significantly boosting the India children's entertainment centers market share.

Hybrid Indoor-Outdoor Formats

Hybrid indoor-outdoor formats are becoming a prominent trend in India’s children’s entertainment centers market. These formats merge amusement parks, interactive gaming zones and educational hubs within a single integrated space offering a more diverse and engaging experience for both children and their parents. Indoor sections often include VR games, soft play zones and edutainment activities while outdoor areas feature rides, open-air performances and nature-based exploration. This combination allows operators to cater to a wider age range and keep children entertained regardless of weather conditions. Developers are also incorporating food courts, themed retail spaces and birthday party venues to boost footfall and encourage longer stays. This all-in-one model supports family outings promotes repeat visits and aligns with the growing demand for experiential entertainment.

India Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family With Children (0-9)

- Family With Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

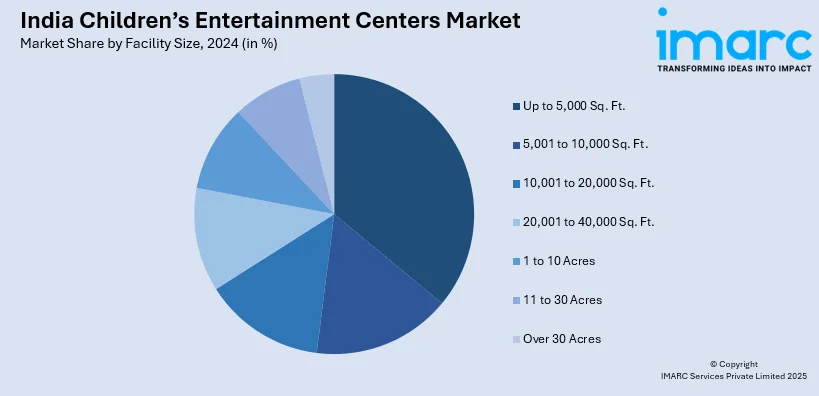

Facility Size Insights:

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

The report has provided a detailed breakup and analysis of the market based on the activity area. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Children’s Entertainment Centers Market News:

- In June 2024, Imagination Edutainment India, supported by Shah Rukh Khan, announced its plans to expand KidZania indoor theme parks in major Indian cities. The business has recently introduced 'KidZania Neighborhood' which is designed for children aged 1 and 6 years old.

- In August 2024, Smaaash Entertainment Pvt Ltd announced the launch of an industry-first web-based booking engine, allowing easy online reservations for bowling and cricket. The platform has generated over INR 10 million in sales and attracted 11,000 active users within three months. Exclusive offers aim to enhance customer engagement and streamline the gaming experience.

India Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family With Children (0-9), Family With Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India children’s entertainment centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India children’s entertainment centers market was valued at USD 1.20 Billion in 2024.

The India children’s entertainment centers market is projected to exhibit a CAGR of 5.90% during 2025-2033, reaching a value of USD 2.10 Billion by 2033.

The India children's entertainment market is driven by rising disposable incomes, increased screen time, and growing demand for digital content across platforms like streaming services, apps, and games. Educational and interactive content is gaining popularity among parents. Additionally, advancements in technology, brand licensing, and global expansion of franchises contribute to market growth, along with increased spending on toys, events, and themed attractions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)