India Chilled Beam Market Size, Share, Trends and Forecast by Cooling Capacity, Application, Installation Type, Control System, and Region, 2025-2033

India Chilled Beam Market Overview:

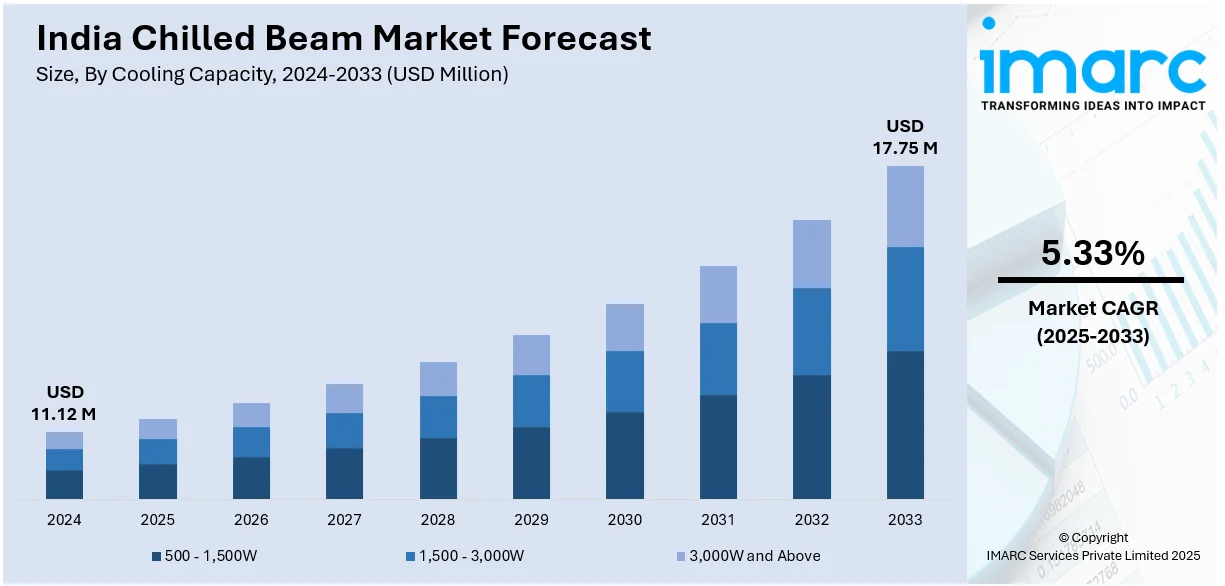

The India chilled beam market size reached USD 11.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 17.75 Million by 2033, exhibiting a growth rate (CAGR) of 5.33% during 2025-2033. The India chilled beam market is driven by increasing energy efficiency regulations, rapid commercial construction, adoption of green building standards, government initiatives promoting sustainable HVAC solutions, rising demand for thermal comfort, and heightening awareness of low-maintenance, cost-effective cooling technologies in corporate offices, healthcare, hospitality, and educational institutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.12 Million |

| Market Forecast in 2033 | USD 17.75 Million |

| Market Growth Rate 2025-2033 | 5.33% |

India Chilled Beam Market Trends:

Increasing Demand for Energy-Efficient HVAC Solutions

With energy conservation being a worldwide priority, India is also experiencing a dramatic shift toward sustainable building technologies. Chilled beam systems, which are energy-efficient, are increasingly being used as an alternative to conventional HVAC systems. Water-based systems employ water to transfer thermal energy, which is more efficient compared to air-based systems, resulting in lower energy usage and reduced operational costs. The focus on green building ratings, including the Indian Green Building Council (IGBC) and Green Rating for Integrated Habitat Assessment (GRIHA), further accelerates the implementation of chilled beam systems. Developers and owners are increasingly incorporating these systems in order to adhere to strict energy efficiency guidelines and achieve sustainability targets. This is clearly observed in verticals like IT and ITeS, where organizations give top priority to green infrastructure to stay aligned with international sustainability drives.

To get more information on this market, Request Sample

Rapid Urbanization and Expansion of Commercial Real Estate

The Indian urban scenario is changing at a fast pace with cities such as Delhi, Gurgaon, Noida, and Chandigarh seeing unprecedented growth. India is already experiencing rapid urbanization, as per industry reports, by 2036 its towns and cities will have around 600 million residents. This urban growth fuels the requirement for sophisticated HVAC systems in new office buildings, schools, hospitals, and upscale residential buildings. Chilled beam technology, providing exact thermal comfort and enhanced indoor air quality, is gaining popularity as the go-to option for such projects. North India is specifically becoming a hub for adopting chilled beams as a result of its fast-paced infrastructural growth. The sustainable building solutions trend in the region is reflected in the growing number of LEED-certified structures. Government programs encouraging energy-efficient construction practices also support this trend. Therefore, India's chilled beam market is set for tremendous growth as it complements the larger national trend of sustainable urbanization. Additionally, the intersection of energy efficiency mandates and accelerated urban growth is causing India's chilled beam market to grow, making it a critical element in the country's sustainable building profile.

India Chilled Beam Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on cooling capacity, application, installation type, and control system.

Cooling Capacity Insights:

- 500 - 1,500W

- 1,500 - 3,000W

- 3,000W and Above

The report has provided a detailed breakup and analysis of the market based on the cooling capacity. This includes 500-1,500W, 1,500-3,000W, and 3,000W and above.

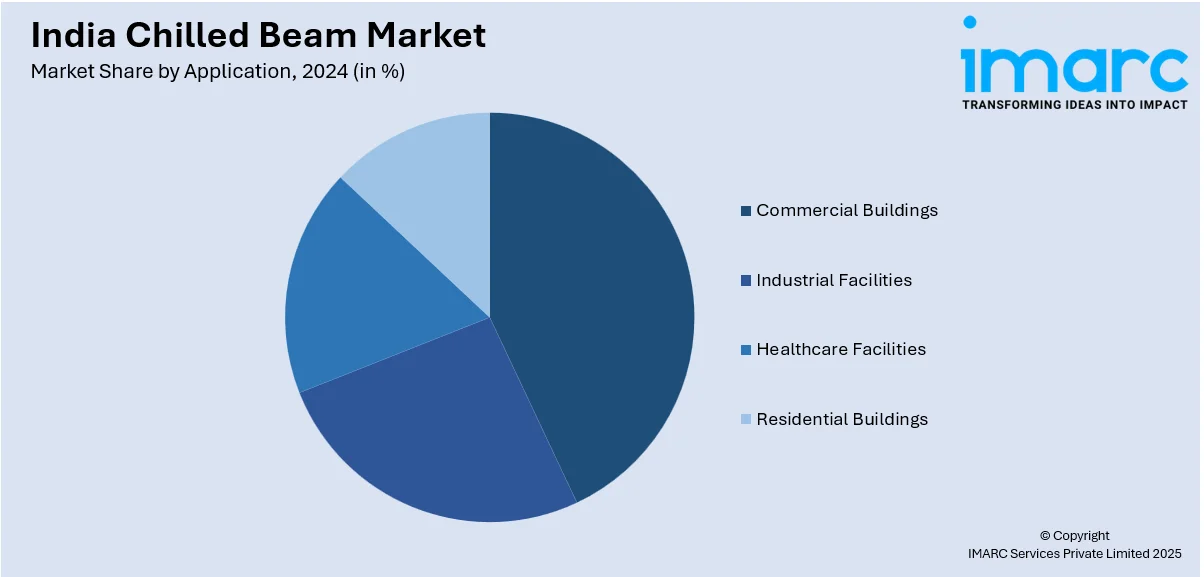

Application Insights:

- Commercial Buildings

- Industrial Facilities

- Healthcare Facilities

- Residential Buildings

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial buildings, industrial facilities, healthcare facilities, and residential buildings.

Installation Type Insights:

- Exposed Chilled Beams

- Embedded Chilled Beams

- Active Chilled Beams

A detailed breakup and analysis of the market based on the installation type have also been provided in the report. This includes exposed chilled beams, embedded chilled beams, and active chilled beams.

Control System Insights:

- Manual Control

- Automatic Control

- Smart Control

A detailed breakup and analysis of the market based on the control system have also been provided in the report. This includes manual control, automatic control, and smart control.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chilled Beam Market News:

- March 2025: Sharp Corporation re-entered the Indian air-conditioner market by launching three new series—Reiryou, Seiryo, and Plasma Chill—designed for India's extreme weather conditions. This move underscores the propelling demand for advanced cooling solutions in India, highlighting opportunities for alternative technologies like chilled beam systems.

- March 2025: Whirlpool of India launched its 2025 Air Conditioner series with 3D Cool Technology and 6th Sense Technology for customized and energy-saving cooling. This development is indicative of an increasing consumer desire for innovative and efficient cooling solutions, creating a market climate that will support the implementation of chilled beam systems in India. The focus on energy efficiency and individual comfort in these new air conditioning devices compares to the advantage provided by chilled beam systems, potentially leading to higher adoption.

India Chilled Beam Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cooling Capacities Covered | 500 - 1,500W, 1,500 - 3,000W, 3,000W and Above |

| Applications Covered | Commercial Buildings, Industrial Facilities, Healthcare Facilities, Residential Buildings |

| Installation Types Covered | Exposed Chilled Beams, Embedded Chilled Beams, Active Chilled Beams |

| Control Systems Covered | Manual Control, Automatic Control, Smart Control |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chilled beam market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chilled beam market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chilled beam industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chilled beam market in India was valued at USD 11.12 Million in 2024.

The India chilled beam market is projected to exhibit a CAGR of 5.33% during 2025-2033, reaching a value of USD 17.75 Million by 2033.

The India chilled beam market is driven by rising demand for energy-efficient cooling systems, increasing focus on green building standards, and growth in commercial real estate projects. Advancements in HVAC technology, along with supportive government initiatives promoting sustainable infrastructure, further accelerate the adoption and expansion of chilled beam solutions nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)