India Chiller Market Size, Share, Trends and Forecast by Product Type, End Use and Region, 2025-2033

India Chiller Market Size and Share:

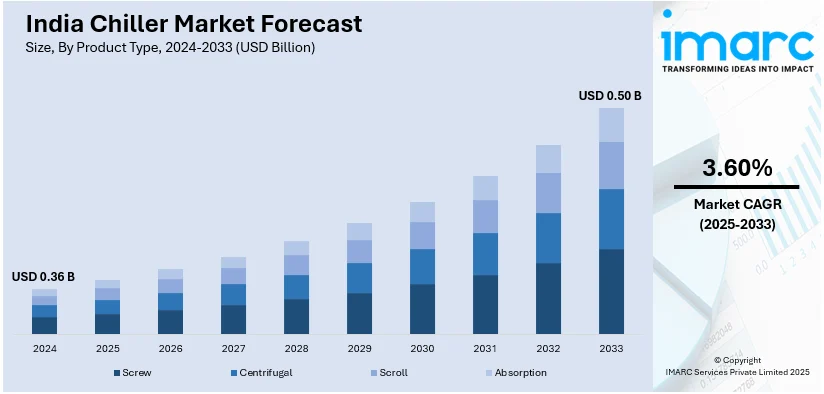

The India chiller market size reached USD 0.36 Billion in 2024. The market is expected to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market growth is attributed to high growth in the food and beverages sector, surging demand for energy-efficient and green solutions, rapid industrialization and urbanization, and energy conservation policies facilitated by the government.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into screw, centrifugal, scroll, and absorption.

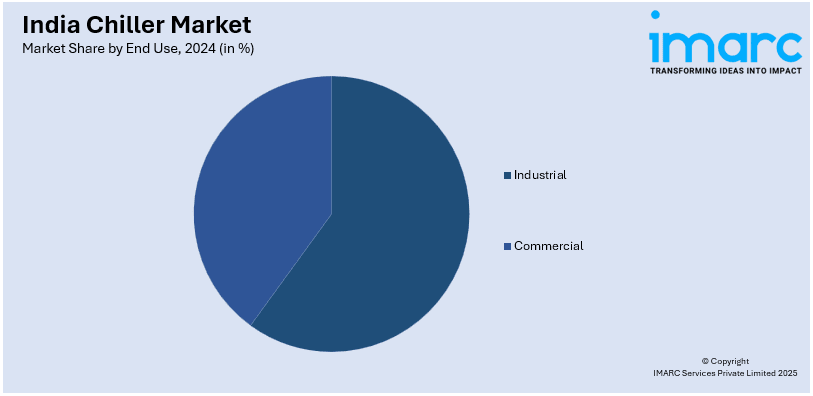

- On the basis of end use, the market has been divided into industrial and commercial.

Market Size and Forecast:

- 2024 Market Size: USD 0.36 Billion

- 2033 Projected Market Size: USD 0.50 Billion

- CAGR (2025-2033): 3.60%

India Chiller Market Trends:

Increasing Adoption of Energy-Efficient and Eco-Friendly Chillers

One of the dominant trends influencing the India chiller market outlook, is the increasing use of energy-efficient and eco-friendly chillers. As per industry reports, the Global Cooling Pledge secured commitments from more than 70 nations and 60 non-state entities, with the goal of reducing cooling-related emissions by 68% by 2050. By 2035, climate finance is expected to reach $300 billion annually, tripling due to substantial investment in energy-efficient cooling technologies in developing countries. Hence, as energy prices increase and climate change awareness rises, companies and industries alike are gravitating toward chillers that conserve energy and help reduce the carbon footprint. The sustainability focus by the government, with regulations like the Energy Conservation Building Code (ECBC) and the Bureau of Energy Efficiency (BEE) norms, is promoting the adoption of high-efficiency chillers that meet such regulations. Chillers using low-global-warming-potential (GWP) refrigerants like R-32 and natural refrigerants like ammonia are being launched by manufacturers, which are less harmful to the environment when compared with conventional refrigerants. In addition, advances in technology, including variable-speed compressors and intelligent control systems, enable the optimization of energy consumption and lower operating costs. This drive toward energy-efficient and environmentally friendly chillers will continue to grow as companies aim to enhance their sustainability profile while lowering long-term operating costs.

To get more information on this market, Request Sample

Growing Demand from the Food and Beverage Industry

The Indian chiller market growth is fueled by the expanding food and beverage sector. With the accelerated growth of the food processing industry, demand for efficient cooling technologies to help store products and sustain safety levels has grown enormously. Chillers find widespread application in the food and beverages sector for applications like refrigeration, storage, and transportation purposes to maintain products such as dairy, meat, and packaged foods at the right temperatures. With increasing demand from consumers for fresh, processed, and packaged food products, the need for efficient, high-performance chillers also increases. Also, increasing popularity of pre-cooked meals, frozen foods, and drinks in urban areas further enhanced the demand for refrigeration systems. Companies in this industry are making investments in high-tech chillers that provide rapid cooling, improved temperature control, and food safety regulations. This movement is likely to continue to support the chiller market's growth in India.

Advanced Technology Integration and Digitalization

The market is driven by advanced technology integration and digitalization in chillers. Advanced chillers are now incorporating Internet of Things (IoT) features, artificial intelligence, and machine learning algorithms to improve performance and lower operational expenditure. Such intelligent chillers are capable of automatically modifying cooling parameters according to real-time scenarios, anticipating maintenance needs, and offering sophisticated analytics on energy consumption patterns. The trend of digitalization is especially useful for huge commercial and industrial sites were accurate temperature management and energy efficiency matter significantly. Remote monitoring functionality provides facility managers with the ability to monitor chiller performance remotely, facilitating predictive maintenance and minimizing downtime. As industries grow more technologically advanced and require more efficient operations, the adoption of digitally enabled chiller systems is anticipated to keep expanding in different industries in India.

Customization and Modular Design Solutions

The market is experiencing a sharp trend towards customization and modular design solutions to address varied industrial needs. Companies are creating modular chiller units that can be scaled up or down with ease according to the needs of cooling capacity, enabling companies to maximize their investment and operating expenses. These modular solutions provide installation flexibility and can be designed to meet space limitations and performance requirements. Customization applies to applications specific to process chilling to produce pharmaceuticals, precision chilling for data centers, and temperature-controlled applications for cold storage facilities. Modularity is also extending to facilitate simpler maintenance and part replacement, lowering overall life cycle expenses. In response to more advanced Indian industries with specialized requirements for cooling solutions, manufacturers are developing innovative modular designs that provide efficiency along with flexibility.

Some of the other market trends include,

- IoT and Smart Integration Capabilities: Networked chillers are transforming facilities management by monitoring in real time and enabling predictive maintenance. Smart systems leverage sensors and data analytics to maximize performance and avert expensive failures. Remote diagnostic capabilities allow technicians to detect problems before they escalate into major issues, cutting maintenance expenses and system downtime by a large margin.

- Supply Chain Localization Strategies: Indian businesses are increasingly looking towards local sourcing in an effort to develop supply chain resilience against externalities in the global supply chain. Local production of components cuts reliance on imports and ensures competitive pricing. This trend of localization also ensures quicker delivery times and improved after-sales support for customers in various locations.

- Workforce Upskilling and Training Programs: The sophistication of today's chiller systems demands special technical expertise and high-end operating capabilities. Training initiatives are centered on digital interfaces, IoT connectivity, and complex control systems characterizing equipment today. Manufacturers are committing to in-depth training programs to empower technicians to adequately maintain and optimize technology-intensive systems.

- Regional Climate Adaptation Features: Manufacturers are developing chillers specifically designed for India's diverse climate conditions, including coastal humidity and tropical heat. These systems feature corrosion-resistant materials and enhanced durability to withstand extreme weather conditions. Regional customization ensures optimal performance across different geographical zones and environmental challenges.

- Health and Safety Enhancement Technologies: Modern chiller systems now feature antimicrobial coatings and better air filtration in an effort to enhance healthier indoor spaces. Such features are especially essential in healthcare facilities as well as commercial areas where air quality is paramount. Better safety measures and materials minimize the risk of contamination and enhance overall system cleanliness.

- Circular Economy and Sustainability Practices: The sector is adopting recycling, reuse, and environmentally responsible end-of-life management for chiller materials and components. The manufacturers are creating systems using recyclable materials and conducting take-back activities for retired equipment. The circular solution decreases environmental footprint while generating new business opportunities with component refurbishment and material recovery.

- Renewable Energy Integration Solutions: Chillers are being combined with solar-based and hybrid cooling systems to cut energy expenditures and carbon emissions. These synergistic systems pair classical cooling technology with clean power sources for increased sustainability. Solar-assisted chillers and hybrids embody the cooling future of greener cooling technology.

- Advanced Post-Installation Service Models: The market is moving towards total service packages incorporating remote diagnostics, subscription-based maintenance, and extended warranties. Such service advancements minimize the total cost of ownership and maximize system performance during the life cycle of the equipment. Predictive maintenance and proactive service provision are becoming standard fare in the high-end segment of the market.

Growth, Opportunities, Challenges in the India Chiller Market:

- Growth Drivers: The market is primarily driven by rapid industrialization and urbanization across the country, leading to increased demand for cooling solutions in manufacturing and commercial sectors. Government initiatives promoting energy efficiency through policies like the Energy Conservation Building Code (ECBC) and Bureau of Energy Efficiency (BEE) norms are accelerating market adoption. The expanding food and beverage industry, coupled with growing consumer preference for fresh and processed foods, continues to fuel significant demand for advanced chiller systems.

- Market Opportunities: Significant opportunities exist in the development of eco-friendly chillers using natural refrigerants and low-global-warming-potential technologies to meet environmental regulations. The integration of IoT, artificial intelligence, and smart monitoring systems presents lucrative prospects for manufacturers to differentiate their products and capture premium market segments. Rural electrification and infrastructure development in tier-2 and tier-3 cities offer untapped markets for chiller manufacturers seeking geographic expansion.

- Market Challenges: High investment costs and complex installation requirements can deter small and medium enterprises from adopting advanced chiller systems. Skilled technician shortage and lack of specialized training programs pose significant challenges for proper system maintenance and operation. Fluctuating raw material prices and supply chain disruptions can impact manufacturing costs and product pricing strategies for market players.

India Chiller Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and end use.

Product Type Insights:

- Screw

- Centrifugal

- Scroll

- Absorption

The report has provided a detailed breakup and analysis of the market based on the type. This includes screw, centrifugal, scroll, and absorption.

End Use Insights:

- Industrial

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end use. This includes industrial, and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chiller Market News:

- In September 2025, Shree Refrigerations Limited (SRL) partnered with Canada-based Smardt Chillers to introduce advanced oil-free magnetic bearing chillers for India’s fast-growing data center cooling market. The collaboration, managed through SRL’s subsidiary Trezor Technologies, will handle sales, installation, and after-sales services, while Smardt provides technical support and training. This strategic alliance is expected to contribute 10–15% of SRL’s revenues within three years, expanding its portfolio beyond defense and positioning it strongly in the country’s USD 1.9 billion data center cooling segment.

- In November 2024, Climaveneta Climate Technologies announced an investment of approximately USD 47 million to establish a 23,000 m² manufacturing facility in Narasapura near Bengaluru, India. The new plant will produce a range of central air-conditioning equipment, including screw chillers, magnetic levitation chillers, and heat pumps, positioning it as a significant export hub.

- In May 2024, Carrier Air conditoning & Refrigeration Limited ("Carrier India") has launched 30 RB Air-Cooled Modular Scroll Chiller, which is made in India. This device is designed to meet the ever-changing demands of the Indian industry, setting new standards for cooling dependability and efficiency and enhancing industries like metro, MES, railroads, and more.

India Chiller Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Screw, Centrifugal, Scroll, Absorption |

| End Uses Covered | Industrial, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chiller market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chiller market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chiller industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chiller market in India was valued at USD 0.36 Billion in 2024.

The India chiller market is projected to exhibit a CAGR of 3.60% during 2025-2033, reaching a value of USD 0.50 Billion by 2033.

The India chiller market is primarily driven by the rising need for energy-efficient HVAC systems in commercial and industrial applications, expanding construction activity, and growing usage in data centers and healthcare institutions. Technological advancements and government focus on green building initiatives are further boosting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)