India Chlorine Market Size, Share, Trends and Forecast by Form, Application, End Use Industry, and Region, 2026-2034

India Chlorine Market Overview:

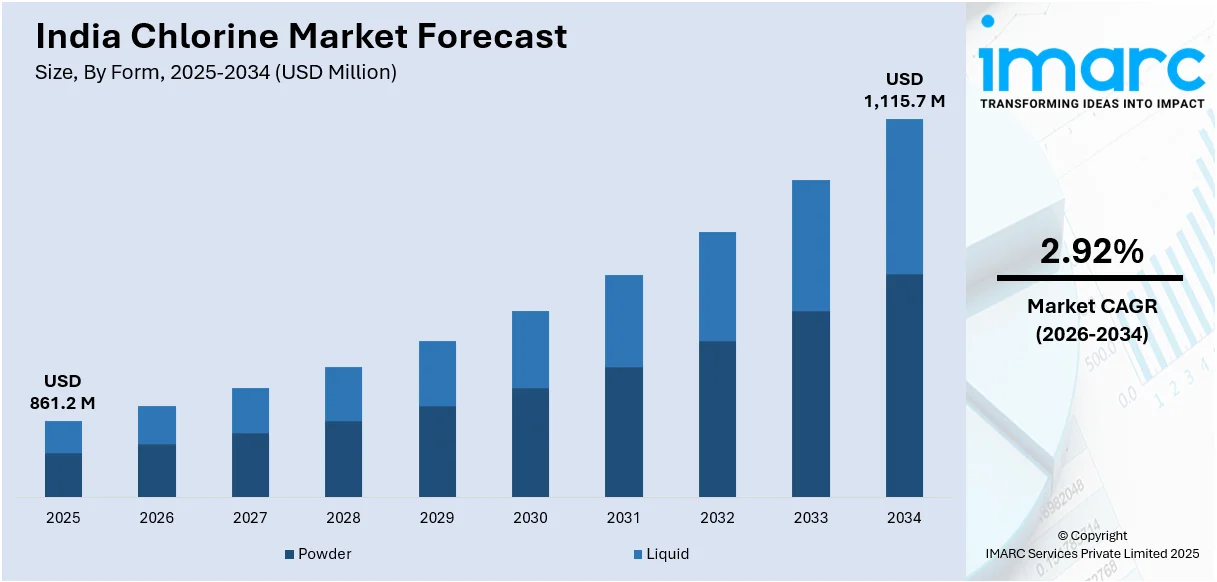

The India chlorine market size reached USD 861.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,115.7 Million by 2034, exhibiting a growth rate (CAGR) of 2.92% during 2026-2034. The India chlorine market is driven by expanding chemical manufacturing, increasing demand for PVC production, advancements in water treatment infrastructure, government initiatives for sanitation and potable water supply, rising pharmaceutical sector applications, and the escalating need for chlorine-based disinfectants in industrial and municipal water purification processes across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 861.2 Million |

| Market Forecast in 2034 | USD 1,115.7 Million |

| Market Growth Rate 2026-2034 | 2.92% |

India Chlorine Market Trends:

Expansion of the Chemical Manufacturing Sector

India's chlorine market is progressing, fueled by the fast-paced growth of India's chemical manufacturing industry. As per reports, India is the 6th largest producer of chemicals in the world. Chlorine is an important raw material in the manufacturing of many chemicals, such as polyvinyl chloride (PVC), solvents, agrochemicals, etc. With the rapid industrialization and infrastructure development, the demand for these chemicals is increasing, which directly escalates the consumption of chlorine. Government's efforts to build India as an international hub of petrochemicals and chemicals production are accelerating the chlorine industry further. Initiatives like the Production Linked Incentive (PLI) program and investment along industrial corridors are inducing the building of new units for chemical manufacturing, which has elevated the chlorine demand. A growing number of domestic and international demand for chlorinated products is also strengthening the market's ascending trend. In addition, innovation in technology used for producing chlorine and global sustainability trends are influencing the market dynamics. Firms are capitalizing on energy-efficient chlor-alkali facilities to increase production levels while reducing their footprint on the environment. With the chemical manufacturing industry booming, India's market for chlorine is expected to experience steady growth, playing a pivotal role in India's industrial sector.

To get more information on this market Request Sample

Advancements in Water Treatment Infrastructure

India's chlorine market is witnessing substantial development on account of rising water treatment facilities. Chlorine is an important contributor to the purification of water, providing safe and drinkable water to millions. With the government actively encouraging water treatment programs, the consumption of chlorine has picked up. Initiatives and schemes for enhancing water quality and availability further augment chlorine consumption in municipal and industrial sectors. The Open Government Data (OGD) Platform India, a storehouse of government data, brings out the volume of water treatment operations, indirectly pointing toward the propelling demand for chlorine. The focus on water treatment processes directly drives the India chlorine market. As industries and municipalities expand their water purification activities, the demand for chlorine as a disinfectant keeps increasing. Government-initiated projects like Jal Jeevan Mission and AMRUT have greatly boosted chlorine purchases for mass-scale water sanitation. Stricter water quality standards and urbanization patterns also drive steady chlorine demand.

India Chlorine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on form, application, and end use industry.

Form Insights:

- Powder

- Liquid

The report has provided a detailed breakup and analysis of the market based on the form. This includes powder and liquid.

Application Insights:

Access the comprehensive market breakdown Request Sample

- EDC/PVC

- Isocyanates and Oxygenates

- Chloromethanes

- Solvent and Epichlorohydrin

- Inorganic Chemicals

- Others

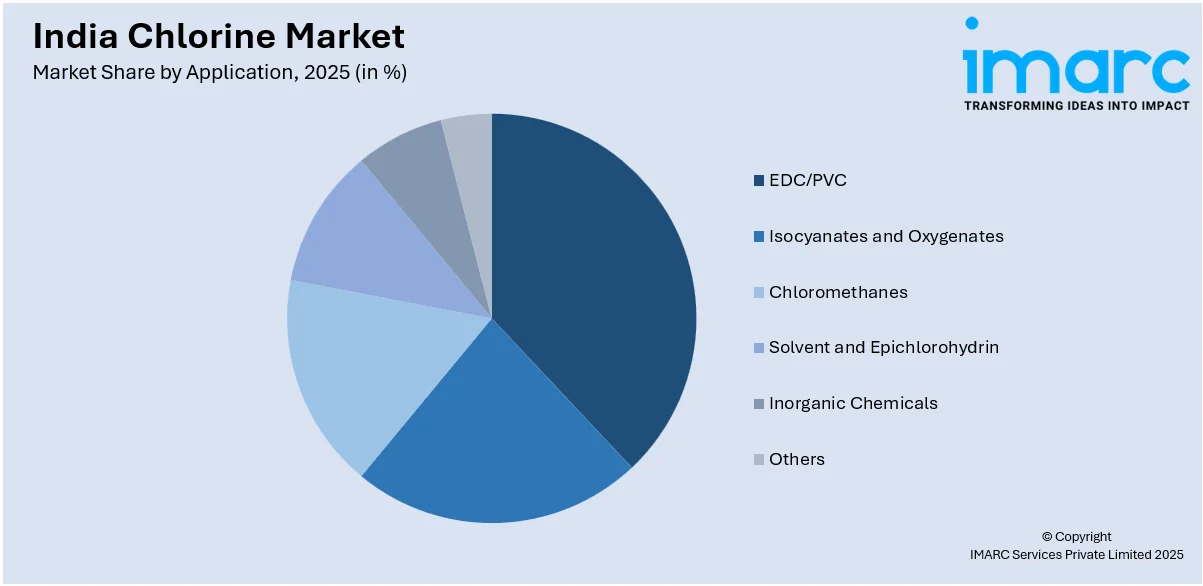

The report has provided a detailed breakup and analysis of the market based on the application. This includes EDC/PVC, isocyanates and oxygenates, chloromethanes, solvent and epichlorohydrin, inorganic chemicals, and others.

End Use Industry Insights:

- Water Treatment

- Pharmaceuticals

- Chemicals

- Pulp and Paper

- Plastics

- Pesticides

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes water treatment, pharmaceuticals, chemicals, pulp and paper, plastics, pesticides, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chlorine Market News:

- December 2024: ABB launched the ChloroStar™ series of chlorine analyzers to improve efficiency and accuracy in water treatment. These analyzers benefit India's chlorine industry by maximizing chlorine consumption in purification processes, providing improved resource management. Their use at water treatment plants has improved demand for chlorine-based disinfection solutions.

- April 2024: Sun Meets Water On-site Chlorine Generation (SuMeWa|OCG) is a sun-powered system for decentralized drinking water disinfection, which generates a chlorine stock solution from a Sodium Chloride (NaCl) brine, rendering manual chlorine handling unnecessary and enhancing safety and efficiency.

India Chlorine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Powder, Liquid |

| Applications Covered | EDC/PVC, Isocyanates and Oxygenates, Chloromethanes, Solvent and Epichlorohydrin, Inorganic Chemicals, Others |

| End Use Industries Covered | Water Treatment, Pharmaceuticals, Chemicals, Pulp and Paper, Plastics, Pesticides, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chlorine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chlorine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chlorine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chlorine market in India was valued at USD 861.2 Million in 2025.

The India chlorine market is projected to exhibit a CAGR of 2.92% during 2026-2034, reaching a value of USD 1,115.7 Million by 2034.

The growth of the India chlorine market is driven by increasing demand for water treatment, rising industrialization, and expanding chemical manufacturing sectors. The growth of infrastructure and construction, along with the need for disinfectants and sanitizers, further boosts chlorine demand. Additionally, the agricultural sector's use of chlorine-based products for pest control and growing awareness about hygiene also contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)