India Circuit Breaker Market Size, Share, Trends and Forecast by Product Type, Voltage, Technology, End-Use, and Region, 2025-2033

India Circuit Breaker Market Overview:

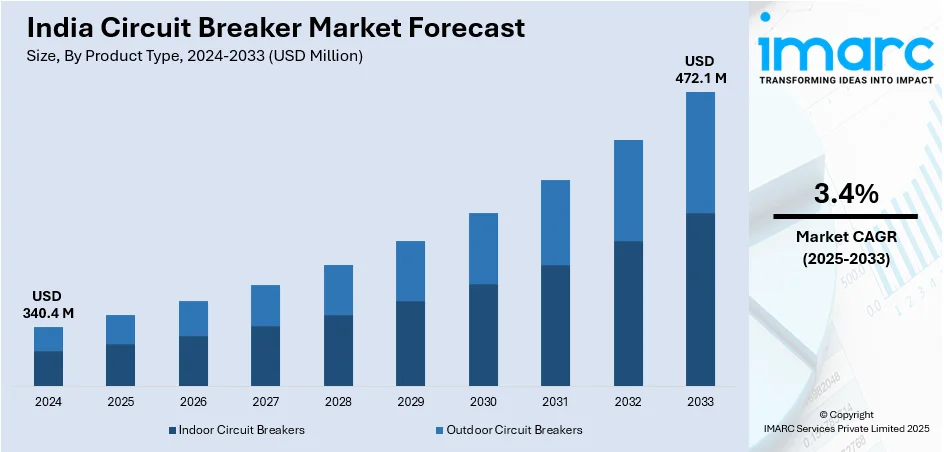

The India circuit breaker market size reached USD 340.40 Million in 2024. The market is projected to reach USD 472.06 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market growth is attributed to the expansion of electricity infrastructure, increased demand for reliable power supply, integration of smart grid technologies, rising adoption of renewable energy, and public and private investments in power and utility projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 340.40 Million |

|

Market Forecast in 2033

|

USD 472.06 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Market Insights:

- Based on product type, the market is segmented into indoor circuit breakers and outdoor circuit breakers.

- Based on voltage, the market is segmented into low voltage, medium voltage, and high voltage.

- Based on technology, the market is segmented into air, vacuum, oil, and SF6.

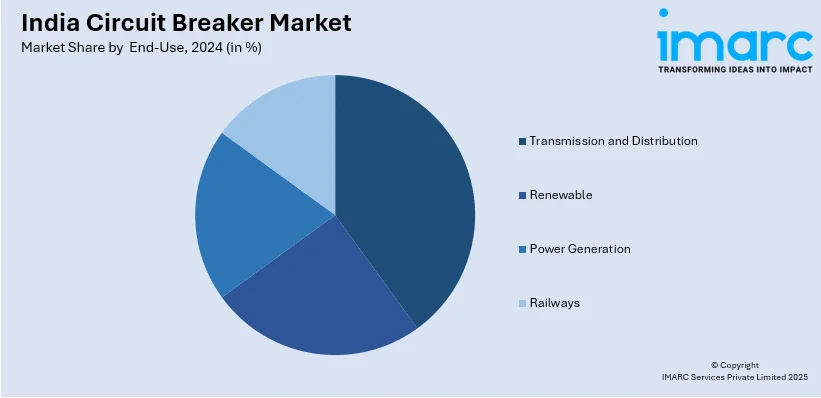

- Based on end-use, the market is segmented into transmission and distribution, renewable, power generation, and railways.

- Based on region, the market is segmented into North India, East India, West and Central India, and South India.

Market Size and Forecast:

- 2024 Market Size: USD 340.40 Million

- 2033 Projected Market Size: USD 472.06 Million

- CAGR (2025-2033): 3.40%

To get more information on this market, Request Sample

India Circuit Breaker Market Trends:

The demand of circuit breakers in India is currently being driven by several factors. The improvement of electricity infrastructure across both urban and rural regions, replacement of old electrical systems with smart grids and emergence of non-conventional energy sources have increased the adoption of circuit breakers in the country. Moreover, catalyzed by increasing economic growth and rising population, the demand of electricity has been increasing continuously in the country. Moreover, public and private expenditure towards the construction of power, sewage or water supply infrastructure have further promoted the spending on electrical infrastructure, thereby catalyzing the growth of the circuit breaker industry. Other major factors driving the market include rising urbanization rates, new application areas, increasing government support, etc.

Key Growth Drivers and Emerging Opportunities in the Market:

The Indian government’s strong focus on modernizing and expanding the power sector is a major catalyst for the India circuit breaker market growth. Initiatives like the Revamped Distribution Sector Scheme (RDSS), Saubhagya Scheme, and significant investments in smart grid and renewable energy integration are driving demand for more efficient, reliable, and safer circuit protection systems. The transition to renewable sources such as solar and wind is also opening up new application areas, as these installations require customized protection mechanisms. Furthermore, large infrastructure projects, including metro rail expansions, data centers, and industrial corridors, are increasing the need for high-performance circuit breakers. Private sector involvement and foreign direct investment (FDI) in energy infrastructure are creating a competitive landscape and spurring India circuit breaker market demand. In May 2025, India announced the development of six chip fabrication units and plans to launch its first domestically produced semiconductor chip using 28 to 90 nanometer technology by the end of 2025. This initiative targets approximately 60% of global semiconductor demand, focusing on automotive, telecom, power, and railway sectors. These developments are not only stimulating market growth but also providing small as well as large-scale manufacturers and service providers with substantial long-term business opportunities in the Indian electrical equipment space.

Challenges in the India Circuit Breaker Market:

Despite positive growth, the India circuit breaker market faces a range of challenges that can limit its expansion. As per the India circuit breaker market analysis, one of the primary hurdles is the outdated electrical infrastructure in many parts of the country, particularly in rural and semi-urban regions. These legacy systems may not be compatible with modern circuit breaker technologies, slowing down upgrade initiatives. Additionally, the high initial costs of advanced circuit breakers, particularly those designed for high-voltage or smart grid applications, can be prohibitive for small-scale utilities and municipal projects. Delays in project execution due to complex regulatory approvals and lengthy procurement cycles further hamper deployment, impacting the India circuit breaker market share. Moreover, technical skill gaps in the workforce related to installation and maintenance of modern circuit breaker systems can impact overall reliability and performance. Concerns over counterfeit or substandard products in the market also pose a risk to both safety and long-term infrastructure resilience.

India Circuit Breaker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India circuit breaker market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, voltage, technology, and end-use.

Analysis by Product Type:

- Indoor Circuit Breakers

- Outdoor Circuit Breakers

Indoor circuit breakers represent the dominant product type in 2024. Their compact design and suitability for enclosed spaces make them ideal for residential, commercial, and industrial infrastructure, especially in urban settings where space constraints are common. These breakers are widely adopted in switchgear assemblies and distribution boards due to their ease of maintenance and reliable performance. As urbanization and industrial development accelerate across India, the demand for indoor systems is expected to continue growing, especially in smart buildings and modern electrical infrastructure.

Analysis by Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

Low voltage circuit breakers hold the largest share in 2024, primarily due to their extensive use in residential buildings, commercial complexes, retail infrastructure, and light industrial applications. These breakers are crucial for protecting low voltage electrical circuits from damage caused by overloads and short circuits, ensuring safety and operational continuity. Moreover, the growth of sectors like IT parks, logistics hubs, and data centers is further accelerating adoption, as these facilities require stable and uninterrupted power supply. Technological advancements in modular circuit breakers and energy monitoring features are also contributing to their growing popularity across both urban and rural developments.

Analysis by Technology:

- Air

- Vacuum

- Oil

- SF6

Air circuit breakers are commonly used in low voltage applications, particularly in commercial and industrial buildings where safety, reliability, and cost-effectiveness are essential. These breakers use atmospheric air as the arc-quenching medium and are primarily installed in power distribution panels and motor control centers. Their ease of maintenance, relatively low cost, and effectiveness in handling moderate fault currents make them suitable for non-critical applications. With India’s booming construction and infrastructure sectors, air circuit breakers are widely deployed in shopping malls, IT parks, and public facilities.

Vacuum circuit breakers (VCBs) are emerging as a preferred technology in medium voltage systems due to their superior arc-extinguishing capabilities and minimal maintenance requirements. VCBs use vacuum interrupters to suppress arcs, making them efficient, safe, and environmentally friendly. Their adoption is increasing in power distribution networks, renewable energy projects, industrial plants, and urban substations. In India, the expansion of smart grids, urban electrification, and industrial automation has driven the demand for vacuum circuit breakers, especially in tier 1 and tier 2 cities.

Oil circuit breakers, once widely used in India’s high-voltage transmission systems, are now gradually being phased out in favor of more efficient and environmentally sustainable alternatives. These breakers use mineral oil as the arc-quenching medium, but they require regular maintenance and pose environmental and fire safety risks. Despite this, oil circuit breakers are still in use in legacy infrastructure, especially in rural and semi-urban grids where upgrades are slower due to budget or logistical constraints. Their continued presence in certain parts of the market reflects the lag in modernization across the entire power network.

SF6 (sulfur hexafluoride) circuit breakers are widely used in high-voltage applications due to their excellent arc-quenching performance and compact design. They are critical components in gas-insulated switchgear (GIS) and are preferred in space-constrained urban substations and transmission systems. In India, their usage is prominent in high-voltage substations, transmission corridors, and infrastructure projects involving metro rail and industrial zones Companies that can offer low-emission or SF6-free solutions stand to gain in the long term as environmental regulations tighten.

Analysis by End-Use:

- Transmission and Distribution

- Renewable

- Power Generation

- Railways

The transmission and distribution (T&D) segment is one of the most vital end-use sectors for circuit breakers in India. As the country works to modernize its aging grid infrastructure and expand electricity access to underserved regions, T&D investments are increasing significantly. Circuit breakers are essential in this sector for isolating faults, preventing cascading failures, and ensuring the safe and reliable flow of electricity. Furthermore, with the rise in renewable energy integration into the grid, circuit breakers that can handle high-voltage fluctuations and intermittent loads are in growing demand. This segment remains a backbone of the market, supported by both public and private sector investments.

India's rapid adoption of renewable energy sources, especially solar and wind, is driving strong demand for circuit breakers that can operate reliably in variable and distributed energy environments. Renewable power plants often operate under fluctuating voltage and current conditions, making circuit protection a critical component of system safety. Vacuum and SF6 circuit breakers are especially popular in this segment due to their ability to manage medium- to high-voltage faults effectively. Additionally, microgrids and rooftop solar installations are becoming more common, requiring smaller, efficient circuit breakers suited for distributed energy systems.

In conventional power generation, including coal, hydro, and nuclear plants, circuit breakers serve as a critical defense mechanism to protect generators, transformers, and auxiliary systems. These facilities require highly durable and fault-tolerant breakers that can withstand harsh conditions and high operational demands. In India, the refurbishment of aging power plants and the construction of new generation units are contributing to sustained demand for high-voltage and medium-voltage circuit breakers. Many of these plants are being upgraded with modern switchgear to improve efficiency and safety. As energy demand continues to grow, circuit breakers will remain an essential component of reliable power generation systems.

Regional Analysis:

- North India

- East India

- West and Central India

- South India

North India plays a significant role in the circuit breaker market, fueled by dense urbanization, expanding industrial bases, and large-scale infrastructure development. States like Delhi, Haryana, Uttar Pradesh, and Punjab are witnessing extensive upgrades in power transmission and distribution networks, driven by rising electricity demand from residential and industrial sectors. Ongoing metro rail expansions, smart city developments, and industrial corridors like the Amritsar-Kolkata Industrial Corridor (AKIC) are generating high demand for circuit protection solutions.

East India, including states such as West Bengal, Bihar, Jharkhand, and Odisha, is gradually emerging as a growth region for the circuit breaker market. Although traditionally slower in infrastructure development, the region is now experiencing rising demand due to accelerated rural electrification, mining sector growth, and investments in industrial infrastructure. Jharkhand and Odisha, in particular, are home to energy-intensive mining and metallurgical industries, requiring robust and reliable circuit protection equipment.

West and Central India represent one of the most dynamic and industrialized zones in the circuit breaker market. Maharashtra, Gujarat, Madhya Pradesh, and Chhattisgarh are hubs for manufacturing, power generation, and commercial infrastructure. Gujarat and Maharashtra, in particular, have advanced industrial ecosystems, including ports, SEZs, and logistics parks that rely heavily on stable and protected power supply networks. This drives demand for medium and high-voltage circuit breakers.

South India, comprising Karnataka, Tamil Nadu, Andhra Pradesh, Telangana, and Kerala, is one of the most mature and fastest-growing markets for circuit breakers in India. This region leads in renewable energy adoption, industrial automation, and IT infrastructure development, creating strong demand for high-performance circuit protection systems. Tamil Nadu and Karnataka, in particular, are leaders in solar and wind energy production, requiring robust circuit breaker solutions for grid integration and safety. Government focus on smart cities and electrification in rural pockets is also adding momentum to the circuit breaker demand in South India.

Competitive Landscape:

Key players in the India circuit breaker market are focusing on innovations, localization, and strategic collaboration to enhance market growth. Many manufacturers are developing advanced circuit breakers with smart features like real-time monitoring, predictive maintenance, and remote operation to cater to rising demand from smart grids and digital infrastructure. Companies are also investing in eco-friendly technologies, including SF6-free alternatives, to align with global sustainability standards. In addition, leading players are expanding their manufacturing capabilities in India to reduce costs, shorten delivery times, and benefit from government initiatives like “Make in India” and the Production Linked Incentive (PLI) scheme. Strategic partnerships with utilities, infrastructure developers, and EPC contractors further enable access to large-scale projects across power transmission, renewables, and railways, strengthening market presence.

The report provides a comprehensive analysis of the competitive landscape in the India circuit breaker market with detailed profiles of all major companies.

Latest News and Developments:

- In July 2025, Wipro Infrastructure Engineering (WIN) launched a new division, Wipro Electronic Materials, to manufacture high-performance base materials for printed circuit boards (PCBs), investing approximately INR 500 Crore (USD 60 Million) to set up a Copper Clad Laminate (CCL) facility in Karnataka. This plant will produce over 6 million sheets of copper-clad laminates annually, creating around 350 jobs and aiming to reduce India's complete dependence on imports for CCL materials.

- In July 2025, Tata Electronics of India signed a Memorandum of Understanding with Germany’s Robert Bosch GmbH to collaborate in advanced chip packaging and semiconductor manufacturing. The partnership will center on Tata Electronics’ new assembly and testing facility in Assam and its planned semiconductor foundry in Gujarat. Additionally, both firms will explore opportunities in the Indian electronic manufacturing services (EMS) sector.

- In October 2024, Amber Group’s subsidiary Ascent Circuits announced an investment of Rs 650 Crore (approximately USD 78 Million) to establish a new printed circuit board (PCB) manufacturing facility in Hosur, Tamil Nadu. The facility, to be completed in two phases, will have an annual production capacity of up to 840,000 square meters and is expected to create over 1,000 direct and indirect jobs.

- In September 2024, Karnataka’s IT Minister, Priyank Kharge, announced the launch of India’s first Printed Circuit Boards (PCB) and Supply Chain Cluster in Mysuru. The initiative aims to boost domestic PCB production and strengthen electronics manufacturing, supporting India’s broader push for self-reliance in key tech components.

India Circuit Breaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Indoor Circuit Breakers, Outdoor Circuit Breakers |

| Voltages Covered | Voltages Covered |

| Technologies Covered | Air, Vacuum, Oil, SF6 |

| End-Uses Covered | Transmission and Distribution, Renewable, Power Generation, Railways |

| Region Covered | North India, East India, West and Central India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India circuit breaker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India circuit breaker market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India circuit breaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The circuit breaker market in India was valued at USD 340.40 Million in 2024.

The India circuit breaker market is projected to exhibit a CAGR of 3.40% during 2025-2033, reaching an estimated value of USD 472.06 Million by 2033.

Demand is driven by accelerated expansion of electricity infrastructure, the shift to smart grid systems, growing adoption of renewable power generation (solar and wind), replacement of outdated equipment, and strong public and private investment in electrification, railways, commercial and industrial power projects.

Indoor circuit breakers dominate in 2024 due to their suitability for residential, commercial, and industrial settings, especially in space-constrained urban environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)