India Circuit Breakers and Switches Market Size, Share, Trends and Forecast by Product Type, Voltage Rating, Distribution Channel, Application, and Region, 2025-2033

India Circuit Breakers and Switches Market Overview:

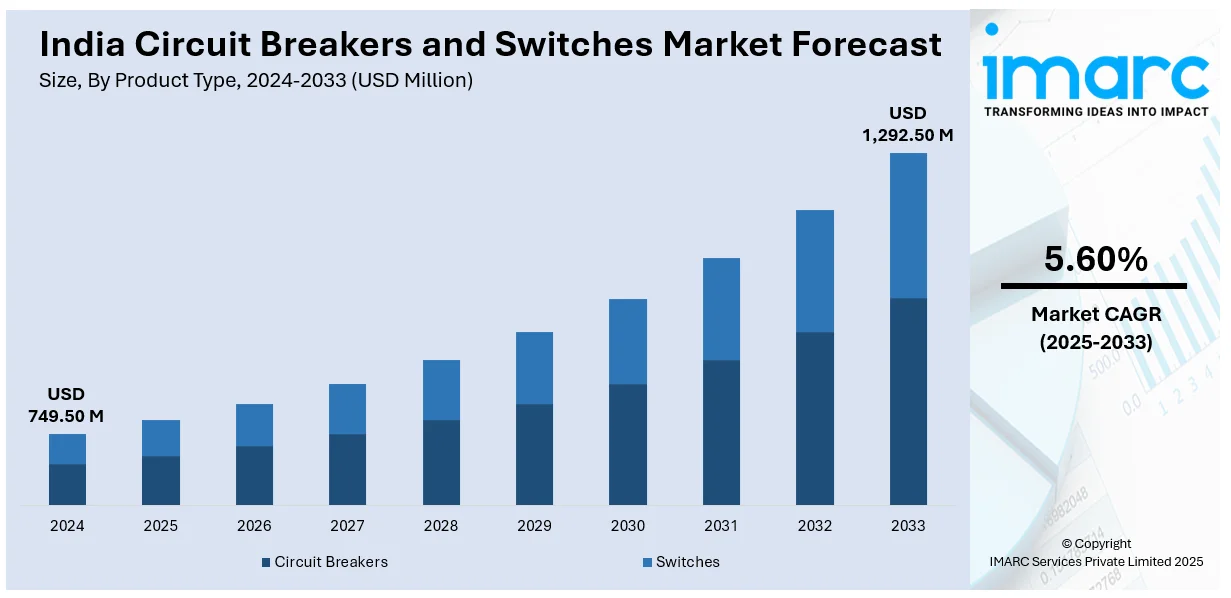

The India circuit breakers and switches market size reached USD 749.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,292.50 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. Increasing electricity demand, infrastructure expansion, and renewable energy integration are propelling the market growth. Key drivers include the government’s focus on rural electrification, smart city initiatives, and modernization of grid infrastructure. The rise of industrialization and urbanization, coupled with growing awareness about electrical safety, further stimulating the market growth. Additionally, the shift towards energy-efficient and eco-friendly solutions, adoption of electric vehicles, and the expansion of industrial automation is boosting the India circuit breakers and switches market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 749.50 Million |

| Market Forecast in 2033 | USD 1,292.50 Million |

| Market Growth Rate 2025-2033 | 5.60% |

India Circuit Breakers and Switches Market Trends:

Increasing Demand for Electricity

The exploding population and increasing industrial operations have put the existing power grid under tremendous pressure from burgeoning demand for electricity. With urbanization and industrialization on a continued growth spurt, a reliable power supply is increasingly the need of the hour, thus fueling the increased demand for switches and circuit breakers. They assist in safeguarding the electrical system from issues such as overloads and short circuits and ensure that all goes smoothly. In metropolitan cities, where demand is more, there's a need to enhance the electric grid with enhanced protection systems. Further, the growing demand for electricity has stepped up the necessity for quality protection systems such as circuit breakers and switches, which is propelling a positive India circuit breakers and switches market growth. Mirroring the trend, India's power consumption rose by almost 7% in March 2025 as against the corresponding month in 2024 due to the increasing temperatures and usage of cooling devices, highlighting the increased pressure on the power grid and the resulting need for strong electrical protection systems.

To get more information on this market, Request Sample

Integration of Renewable Energy

India is actively engaged in integrating renewable energy, which is fueling the demand for circuit breakers and switches. India has made different plans, such as achieving 500 GW of renewable energy by 2030, which implies additional solar panels and wind turbines will be installed on the grid. These renewable forms of energy may be intermittent, so it is essential to ensure that there is good protection schemes to maintain the grid stable. Switches and circuit breakers are required in order to prevent damage and ensure that renewable power can be safely utilized. More solar and wind power added translates to increased demands for these protection schemes. Other than this, the demand for renewable energy and the requirements of efficient circuit breakers and switches are supporting the market growth.

Integration of Renewable Energy

India is actively engaged in integrating renewable energy, which is fueling the demand for circuit breakers and switches. India has made different plans, such as achieving 500 GW of renewable energy by 2030, which implies additional solar panels and wind turbines will be installed on the grid. These renewable forms of energy may be intermittent, so it is essential to ensure that there is good protection schemes to maintain the grid stable. Switches and circuit breakers are required in order to prevent damage and ensure that renewable power can be safely utilized. More solar and wind power added translates to increased demands for these protection schemes. Other than this, the demand for renewable energy and the requirements of efficient circuit breakers and switches are supporting the market growth.

India Circuit Breakers and Switches Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, voltage rating, distribution channel, and application.

Product Type Insights:

- Circuit Breakers

- Low Voltage (LV)

- Medium Voltage (MV)

- High Voltage (HV)

- Switches

- Isolators/Disconnectors

- Load Break Switches (LBS)

- Transfer Switches

- Smart Switches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes circuit breakers (low voltage, medium voltage, high voltage) and switches (isolators/disconnectors, load break switches, transfer switches, and smart switches).

Voltage Rating Insights:

- Low Voltage (Up to 1 kV)

- Medium Voltage (1 kV–36 kV)

- High Voltage (Above 36 kV)

A detailed breakup and analysis of the market based on the voltage rating have also been provided in the report. This includes low voltage (Up to 1 kV), medium voltage (1 kV–36 kV), and high voltage (Above 36 kV).

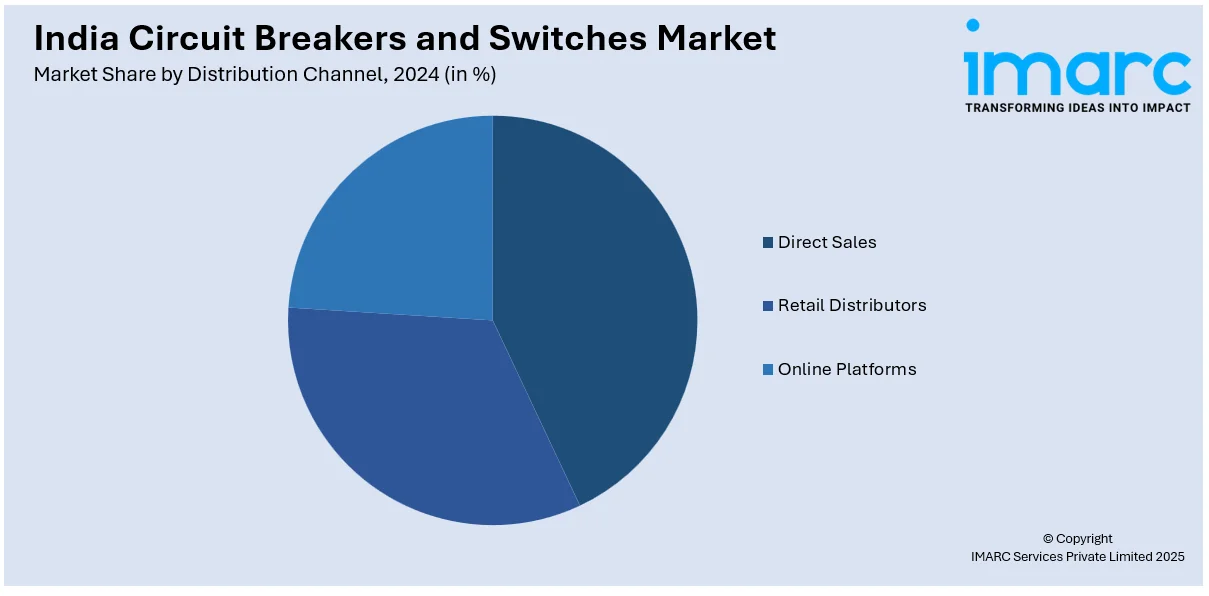

Distribution Channel Insights:

- Direct Sales

- Retail Distributors

- Online Platforms

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, retail distributors, and online platforms.

Application Insights:

- Residential

- Commercial

- Industrial

- Utilities

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and utilities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Circuit Breakers and Switches Market News:

- In 2024, Schneider Electric India introduced the MasterPact MTZ air circuit breaker, featuring IoT connectivity for predictive maintenance and energy optimization. This innovation aims to enhance operational efficiency and reduce downtime in industrial applications.

India Circuit Breakers and Switches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Voltage Ratings Covered | Low Voltage (Up to 1 kV), Medium Voltage (1 kV–36 kV), High Voltage (Above 36 kV) |

| Distribution Channels Covered | Direct Sales, Retail Distributors, Online Platforms |

| Applications Covered | Residential, Commercial, Industrial, Utilities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India circuit breakers and switches market performed so far and how will it perform in the coming years?

- What is the breakup of the India circuit breakers and switches market on the basis of product type?

- What is the breakup of the India circuit breakers and switches market on the basis of voltage rating?

- What is the breakup of the India circuit breakers and switches market on the basis of distribution channel?

- What is the breakup of the India circuit breakers and switches market on the basis of application?

- What is the breakup of the India circuit breakers and switches market on the basis of region?

- What are the various stages in the value chain of the India circuit breakers and switches market?

- What are the key driving factors and challenges in the India circuit breakers and switches market?

- What is the structure of the India circuit breakers and switches market and who are the key players?

- What is the degree of competition in the India circuit breakers and switches market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India circuit breakers and switches market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India circuit breakers and switches market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India circuit breakers and switches industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)