India Cleaning Services Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India Cleaning Services Market Overview:

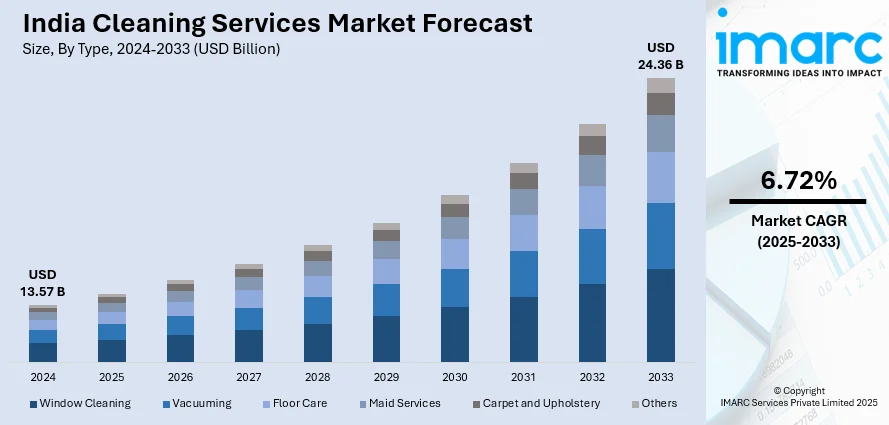

The India cleaning services market size reached USD 13.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.36 Billion by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033. The market is being driven by rapid urbanization, growing health and hygiene awareness, expansion of commercial and institutional infrastructures, rising disposable incomes among middle-class households, inflating demand for outsourced maintenance, and the entry of tech-enabled and specialized service providers offering convenient, professional, and scalable cleaning solutions across sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.57 Billion |

| Market Forecast in 2033 | USD 24.36 Billion |

| Market Growth Rate 2025-2033 | 6.72% |

India Cleaning Services Market Trends:

Rapid Urbanization and Rising Disposable Income

One of the strongest drivers catalyzing the cleaning services industry in India is the rapid pace of urbanization coupled with an expanding in disposable incomes in the middle class. According to reports, by 2036, 600 million individuals are expected to reside in urban areas. With millions flocking from rural to urban belts in the pursuit of better jobs and education, Indian cities are experiencing high population density and infrastructure needs. This influx has resulted in the growth of high-rise residential apartments, gated communities, corporate complexes, shopping complexes, and public transport terminals—all of which require regular and professional cleaning facilities in order to ensure hygiene and aesthetics. At the same time, the higher disposable income levels have resulted in a change in behavior among consumers. Urban Indian consumers of today are more likely to outsource household work, such as housekeeping, deep cleaning, and pest control, so that they can save time and enjoy improved standards of hygiene. They are more ready to pay for convenience, quality, and reliability—fundamental value propositions of professional cleaning services.

To get more information on this market, Request Sample

Expansion of Commercial Real Estate and Institutional Infrastructure

Another driver of the Indian cleaning services industry is the rapid development of commercial real estate and institutional infrastructure in the country. India has seen a building boom in the last decade, especially in the commercial and institutional space, such as IT parks, co-working facilities, schools, hospitals, retail centers, airports, and hospitality locations. This expansion has made for a strong and consistent demand for professional cleaning services because such big establishments must have periodic, high-quality upkeep to keep running efficiently and meet regulatory requirements. For instance, IT parks and BPO facilities in particular, cities like Bengaluru, Hyderabad, Gurugram, and Pune function 24/7, calling for 24/7 janitorial and maintenance services. Equally, the proliferation of upscale malls, chain hotels, and multiplexes in Tier 1 and Tier 2 cities has generated specialized cleaning needs involving not only general maintenance, but also floor polishing, facade cleaning, washroom hygiene, and odor control systems. The healthcare and education industries also need cleaning programs that adhere to high health, safety, and environmental standards. Most institutions now subcontract these duties to third-party cleaning companies that provide scalable and adjustable solutions.

India Cleaning Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Window Cleaning

- Vacuuming

- Floor Care

- Maid Services

- Carpet and Upholstery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes window cleaning, vacuuming, floor care, maid services, carpet and upholstery, and others.

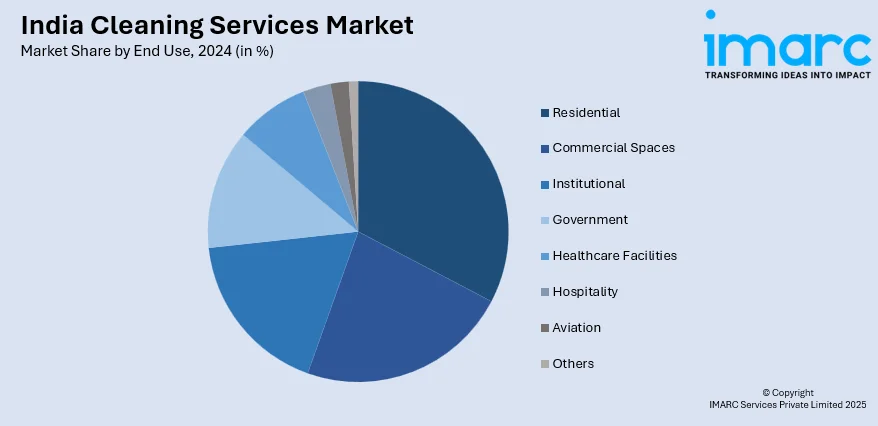

End Use Insights:

- Residential

- Commercial Spaces

- Institutional

- Government

- Healthcare Facilities

- Hospitality

- Aviation

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial spaces, institutional, government, healthcare facilities, hospitality, aviation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cleaning Services Market News:

- March 2025: Urban Company introduced 'Insta Maids' in Mumbai, offering cleaning, cooking, and mopping services within 15 minutes at an introductory rate of INR 49 per hour. The service aims to provide quick, on-demand domestic help, with partners receiving benefits like free health and accidental insurance.

- February 2024: LG Electronics announced a USD 4 million investment to launch 200 self-laundry service centers across India in 2024, starting with Galgotias University in Greater Noida. The initiative targeted university students and aimed to address propelling the inflating demand for convenient, tech-driven laundry solutions.

India Cleaning Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Window Cleaning, Vacuuming, Floor Care, Maid Services, Carpet and Upholstery, Others |

| End Uses Covered | Residential, Commercial Spaces, Institutional, Government, Healthcare Facilities, Hospitality, Aviation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cleaning services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cleaning services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cleaning services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cleaning services market in India was valued at USD 13.57 Billion in 2024.

The India cleaning services market is projected to exhibit a CAGR of 6.72% during 2025-2033, reaching a value of USD 24.36 Billion by 2033.

India’s cleaning services market is driven by increasing urbanization, changing lifestyles, and a growing preference for professional maintenance solutions. Rising awareness about hygiene, heightened post-pandemic cleanliness needs, and the expansion of organized service providers offering eco-friendly and tech-enabled solutions are further shaping the demand for cleaning services across residential and commercial spaces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)