India Cloud-based Contact Center Market Size, Share, Trends and Forecast by Component, Deployment, Enterprise Size, End User, and Region, 2025-2033

India Cloud-based Contact Center Market Overview:

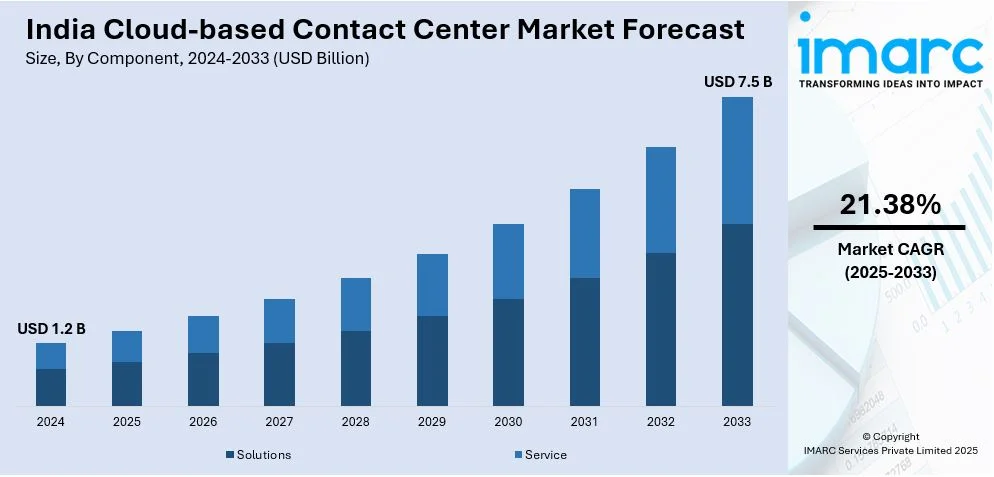

The India cloud-based contact center market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.5 Billion by 2033, exhibiting a growth rate (CAGR) of 21.38% during 2025-2033. The market is growing as a result of rising demand for omnichannel communication, AI-powered automation, and data security solutions. Moreover, companies are transitioning from on-premises models to scalable cloud platforms, prompted by digital transformation, regulatory needs, and the rising demand for better customer interaction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Market Growth Rate 2025-2033 | 21.38% |

India Cloud-based Contact Center Market Trends:

Rising Demand for Omnichannel Customer Engagement

Indian businesses are adopting cloud-based contact centers to enable seamless customer interactions through various channels. Additionally, call centers in the past used voice-centric support, but changing technology is imposing the necessity for the integration of voice, email, chat, social media, and messaging platforms. In addition, businesses are using cloud-based tools to consolidate communications to provide a consistent customer experience. The implementation of AI-driven chatbots and automation is enhancing response times and lowering operational expenses. In this context, businesses are also implementing analytics platforms to understand customer preferences and behaviors in greater detail. The Indian industry is also seeing a rise in the implementation of cloud-based contact centers among small and medium businesses, which are concentrating on scalability and cost savings. The transition from on-premises to cloud-based solutions enables companies to conduct business with increased flexibility while streamlining workforce management. Likewise, cloud-based contact center solution providers are also investing in AI and machine learning to make customer interactions more personalized. Concurrent with this, developing e-commerce, fintech, and digital services in India are also driving demand for omnichannel engagement. The capability to transition between various channels of communication without failing context is emerging as an important consideration for businesses looking to enhance customer satisfaction and loyalty.

To get more information on this market, Request Sample

Growing Focus on Data Security and Compliance

As cloud-based contact centers grow in India, companies are focusing on data security and compliance. With an increase in cyber-attacks and data breaches, companies are instituting robust security measures to ensure customer data safety. Besides this, cloud service providers are enforcing end-to-end encryption, multi-factor authentication, and AI-based threat detection to ensure security. Regulatory mechanisms like the Digital Personal Data Protection Act (DPDPA) are influencing how businesses process data, ensuring compliance is paramount for cloud deployment. Enterprises are collaborating with regional data centers to meet data localization requirements. Growing dependence on cloud technology has also resulted in innovative security protocols that counter remote working risks. Moreover, companies are prioritizing secure cloud communication to ensure customer confidence and comply with industry standards. Increasing cybersecurity threats are prompting enterprises to invest in cloud security products that protect communication channels and customer interactions. The financial industry, healthcare organizations, and government institutions are driving the adoption of compliant cloud contact center solutions. As businesses continue to move their operations to the digital space, security, and compliance are increasingly becoming top drivers of cloud adoption in India.

India Cloud-based Contact Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment, enterprise size, and end user.

Component Insights:

- Solutions

- Automatic Call Distribution

- Agent Performance Optimization

- Interactive Voice Response

- Computer Telephony Integration

- Analytics and Reporting

- Dialers

- Others

- Service

- Professional

- Managed

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (automatic call distribution, agent performance optimization, interactive voice response, computer telephony integration, analytics and reporting, dialers, and others) and service (professional and managed).

Deployment Insights:

- Public

- Private

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes public, private, and hybrid.

Enterprise Size Insights:

- Small and Medium Enterprise

- Large-Sized Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium enterprise and large-sized enterprise.

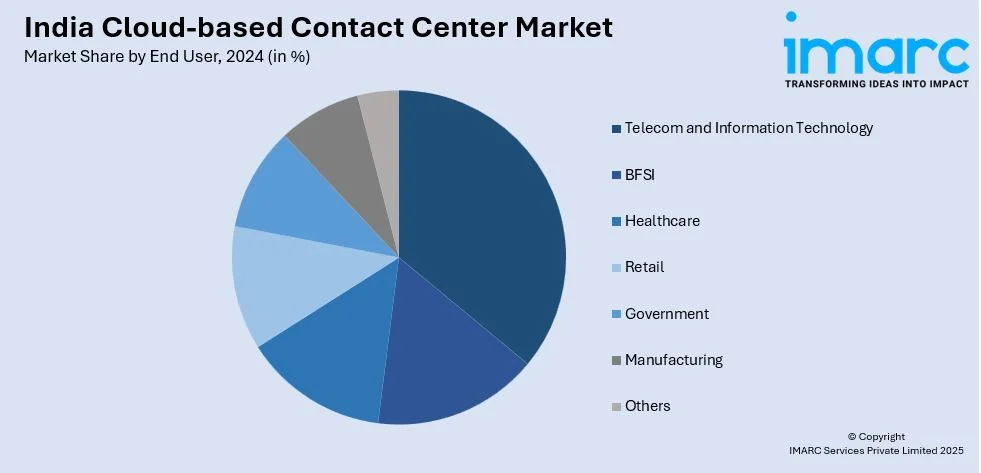

End User Insights:

- Telecom and Information Technology

- BFSI

- Healthcare

- Retail

- Government

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes telecom and information technology, bfsi, healthcare, retail, government, manufacturing, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cloud-based Contact Center Market News:

- January 2025: HCLTech expanded its partnership with Microsoft to enhance cloud-based contact centers using generative AI. By integrating Microsoft Dynamics 365 Contact Center, HCLTech improves automation, customer interactions, and service efficiency. This advancement accelerates AI-driven transformation, boosting adoption of scalable, cloud-native contact center solutions in India.

- October 2024: Vi Business partnered with Genesys to introduce AI-driven cloud-based Contact Center as a Service (CCaaS) solutions in India. This collaboration enhances omnichannel customer experiences, enabling scalable, flexible, and data-resident CX strategies. The development accelerates cloud adoption, improving customer interaction management and operational efficiency.

India Cloud-based Contact Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Public, Private, Hybrid |

| Enterprises Size Covered | Small and Medium Enterprise, Large-Sized Enterprise |

| End Users Covered | Telecom and Information Technology, BFSI, Healthcare, Retail, Government, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cloud-based contact center market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cloud-based contact center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cloud-based contact center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud-based contact center market in India was valued at USD 1.2 Billion in 2024.

The India cloud-based contact center market is projected to exhibit a CAGR of 21.38% during 2025-2033, reaching a value of USD 7.5 Billion by 2033.

India’s cloud-based contact center market is driven by growing digital transformation, the shift toward flexible and scalable cloud solutions, and the need for seamless omnichannel customer engagement. Advancements in AI-driven automation, cost efficiency, and supportive government initiatives are further encouraging businesses to adopt cloud platforms for enhanced customer service operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)