India Cloud Infrastructure as a Service Market Size, Share, Trends and Forecast by Type, Solution, Enterprises, End User, and Region, 2025-2033

India Cloud Infrastructure as a Service Market Overview:

The India cloud infrastructure as a service market size reached USD 3.18 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.78 Billion by 2033, exhibiting a growth rate (CAGR) of 21.47% during 2025-2033. The India cloud infrastructure as a service market share is expanding, driven by the increasing artificial intelligence (AI) applications that require notable computing power and large data storage, along with ongoing collaborations between companies and government agencies to develop modern solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.18 Billion |

| Market Forecast in 2033 | USD 20.78 Billion |

| Market Growth Rate 2025-2033 | 21.47% |

India Cloud Infrastructure as a Service Market Trends:

Growing adoption of AI

The rising adoption of AI is offering a favorable India cloud infrastructure as a service market outlook. AI applications require substantial computing power and scalable resources, which cloud infrastructure as a service solution provides efficiently. Cloud platforms enable organizations to run complex AI models, machine learning (ML) algorithms, and data analytics without investing heavily in on-premises infrastructure. This adaptability enables businesses to adjust resources according to demand, optimizing costs and improving performance. Additionally, cloud service providers supply tailored AI tools and frameworks that simplify the creation, deployment, and administration of AI-focused solutions. Companies in areas like healthcare, finance, and retail are utilizing AI-oriented insights via cloud platforms to optimize decision-making, streamline processes, and enhance customer experiences. Moreover, government agencies are wagering on AI applications, which is fueling the market growth. According to PIB, with the endorsement of the IndiaAI Mission in 2024, the Indian government designated INR 10,300 Crore for five years to refine AI capabilities. A central objective of this mission was to create a top-tier shared computing facility that featured 18,693 graphics processing units (GPUs), positioning it as one of the most expansive AI computing infrastructures worldwide.

.webp)

To get more information on this market, Request Sample

Increasing need for data centers

The rising need for data centers is propelling the India cloud infrastructure as a service market growth. Businesses require robust infrastructure to manage growing data volumes and support digital transformation. Data centers provide the foundation for cloud infrastructure as a service solution by offering network connectivity. As organizations are expanding their digital operations, they rely on cloud infrastructure as a service platform to handle data processing, backup, and application hosting without the need for extensive physical infrastructure. Cloud providers leverage data centers to deliver reliable and flexible services that allow businesses to adjust resources as per requirements. The rise in data-intensive applications, such as the Internet of Things (IoT) devices, further catalyzes this demand. As businesses continue investing in digital transformation through collaborations, cloud providers are expanding data center capacity to meet the growing storage and computing requirements. In September 2024, Yotta Data Services teamed up with the Telangana Government to create a state-of-the-art high-performance GPU-oriented AI supercomputer in a specially designed high-density liquid-cooled data center located in Hyderabad, India. The campus featured a dedicated GPU cloud infrastructure that offered access to advanced computing resources. The extensive range of AI services via a self-service portal, inculcating platform as a service (PaaS) and infrastructure as a service, was made available, which was customized to fulfill the requirements of research facilities, businesses, governmental entities, startups, and educational organizations.

India Cloud Infrastructure as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, solution, enterprises, and end user.

Type Insights:

- Public

- Private

The report has provided a detailed breakup and analysis of the market based on the type. This includes public and private.

Solution Insights:

- Network as a Service

- Disaster Recovery as a Service

- Managed Hosting Services

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes network as a service, disaster recovery as a service, and managed hosting services.

Enterprises Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprises. This includes small and medium enterprises and large enterprises.

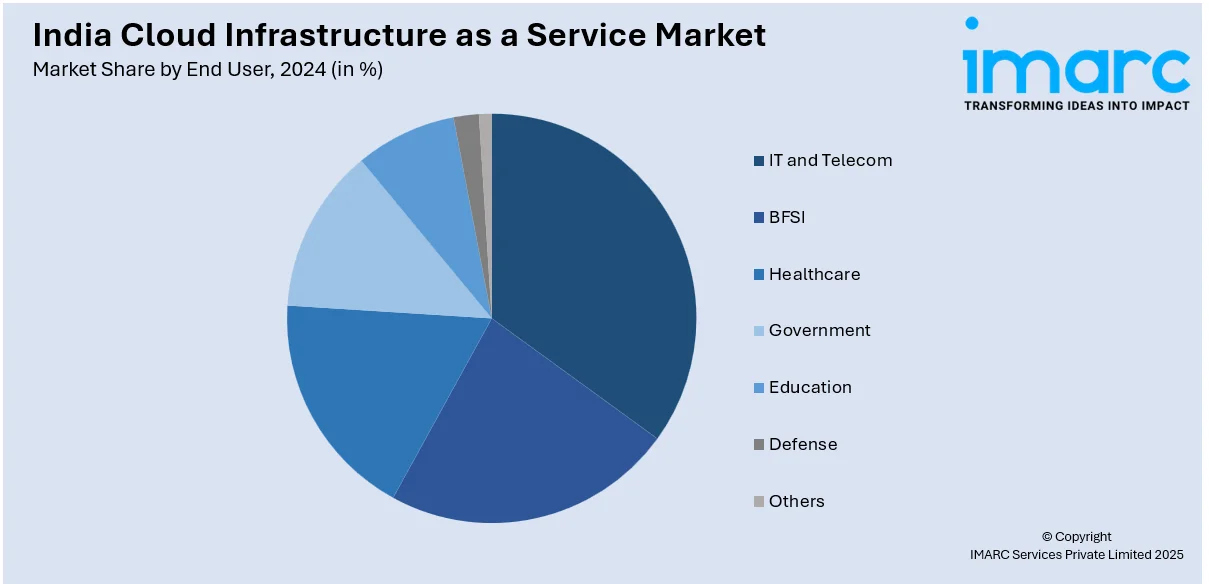

End User Insights:

- IT and Telecom

- BFSI

- Healthcare

- Government

- Education

- Defense

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes IT and telecom, BFSI, healthcare, government, education, defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cloud Infrastructure as a Service Market News:

- In January 2025, Amazon Web Services (AWS) revealed its intention to invest USD 8.3 Billion in cloud infrastructure in Maharashtra, India. The firm aimed to enhance cloud computing capacity in the country to satisfy the increasing customer demand for cloud services nationwide.

- In December 2024, UK-based cloud provider Civo introduced a sovereign cloud region in Mumbai, India. The launch was a component of a USD 25.52 Million investment in the nation. Civo intended to provide cloud-native solutions from the facility, including Kubernetes, infrastructure-as-a-service, and PaaS, along with other services.

India Cloud Infrastructure as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Public, Private |

| Solutions Covered | Network as a Service, Disaster Recovery as a Service, Managed Hosting Services |

| Enterprises Covered | Small and Medium Enterprises, Large Enterprises |

| End Users Covered | IT and Telecom, BFSI, Healthcare, Government, Education, Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cloud infrastructure as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cloud infrastructure as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cloud infrastructure as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India cloud infrastructure as a service market was valued at USD 3.18 Billion in 2024.

The India cloud infrastructure as a service market is projected to exhibit a CAGR of 21.47% during 2025-2033, reaching a value of USD 20.78 Billion by 2033.

The market is driven by the increasing adoption of AI applications, which require substantial computing power and large data storage, along with ongoing collaborations between companies and government agencies to develop modern solutions. Additionally, the rise in demand for data centers, as businesses continue their digital transformation, is further propelling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)