India Cloud Managed Services Market Size, Share, Trends and Forecast by Service Type, Deployment Model, Organization Size, Vertical, and Region, 2026-2034

Market Overview:

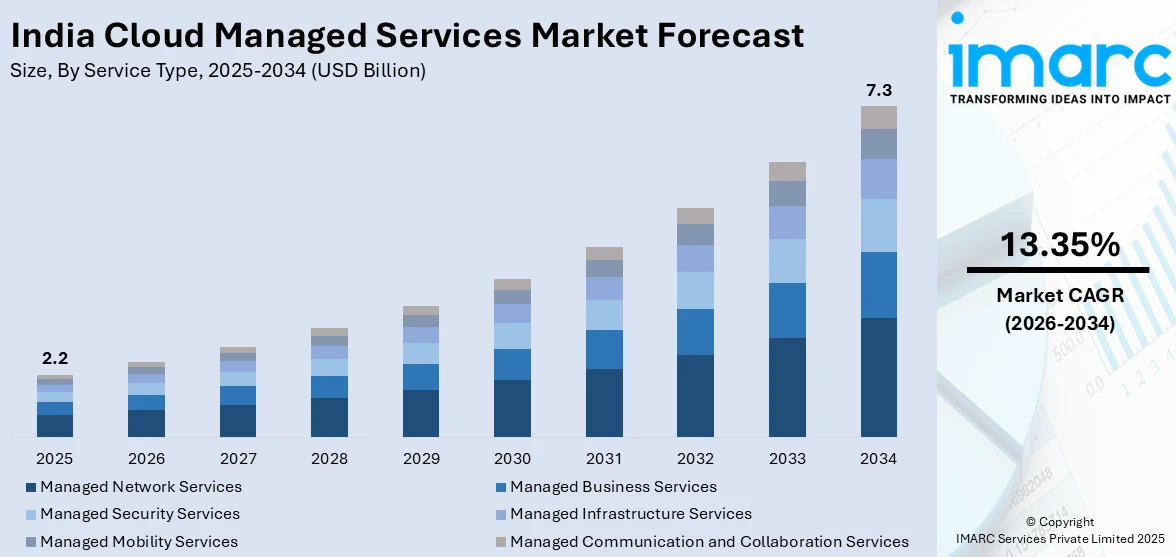

India cloud managed services market size reached USD 2.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.3 Billion by 2034, exhibiting a growth rate (CAGR) of 13.35% during 2026-2034. The increasing demand for cloud managed solutions, which facilitate remote access, collaboration, and data sharing, supporting the evolving nature of work, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.2 Billion |

|

Market Forecast in 2034

|

USD 7.3 Billion |

| Market Growth Rate 2026-2034 | 13.35% |

Cloud managed services involve the outsourcing of IT management and support for businesses' cloud-based infrastructure and applications. These services are provided by third-party service providers, who remotely monitor, optimize, and maintain the client's cloud resources. This includes tasks such as data storage, security, network operations, and application performance management. Cloud managed services aim to enhance operational efficiency, ensure scalability, and mitigate potential risks associated with cloud computing. Service providers often offer 24/7 monitoring, rapid response to issues, and proactive management to ensure optimal performance and reliability. This model allows businesses to focus on their core operations while leveraging the expertise of managed service providers to navigate the complexities of cloud environments, resulting in cost-effectiveness and improved overall IT performance.

To get more information on this market Request Sample

India Cloud Managed Services Market Trends:

The burgeoning demand for cloud managed services is fueled by several key drivers, each contributing to the robust growth of this dynamic market. Firstly, the increasing adoption of cloud computing across diverse industries serves as a pivotal catalyst. As organizations recognize the scalability, flexibility, and cost-efficiency offered by cloud solutions, the need for expert management services becomes paramount. Moreover, the escalating complexity of IT infrastructures necessitates specialized support, further propelling the cloud managed services market in India. As businesses grapple with intricate technologies, the expertise provided by managed service providers becomes invaluable. In addition to this, the relentless pace of digital transformation and the imperative to stay ahead in the competitive landscape prompt companies to leverage cloud managed services for strategic advantage. Furthermore, the growing emphasis on cybersecurity in an era of heightened threats amplifies the demand for managed services. By entrusting their cloud environments to dedicated experts, businesses can fortify their defenses against evolving cyber risks. Additionally, the ongoing evolution of cloud technologies, coupled with the need for seamless integration with existing systems, which propels organizations to engage with managed service providers, is expected to drive the market in India during the forecast period.

India Cloud Managed Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type, deployment model, organization size, and vertical.

Service Type Insights:

- Managed Network Services

- Managed Business Services

- Managed Security Services

- Managed Infrastructure Services

- Managed Mobility Services

- Managed Communication and Collaboration Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes managed network services, managed business services, managed security services, managed infrastructure services, managed mobility services, and managed communication and collaboration services.

Deployment Model Insights:

Access the comprehensive market breakdown Request Sample

- Private Cloud

- Public Cloud

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes private cloud and public cloud.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium enterprises.

Vertical Insights:

- Retail and Consumer Goods

- BFSI

- Telecom

- Government and Public Sector

- Healthcare and Lifesciences

- Manufacturing

- Energy and Utilities

- IT

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes retail and consumer goods, BFSI, telecom, government and public sector, healthcare and life sciences, manufacturing, energy and utilities, IT, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cloud Managed Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Managed Network Services, Managed Business Services, Managed Security Services, Managed Infrastructure Services, Managed Mobility Services, Managed Communication and Collaboration Services |

| Deployment Models Covered | Private Cloud, Public Cloud |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | Retail and Consumer Goods, BFSI, Telecom, Government and Public Sector, Healthcare and Lifesciences, Manufacturing, Energy and Utilities, IT, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cloud managed services market performed so far and how will it perform in the coming years?

- What is the breakup of the India cloud managed services market on the basis of service type?

- What is the breakup of the India cloud managed services market on the basis of deployment model?

- What is the breakup of the India cloud managed services market on the basis of organization size?

- What is the breakup of the India cloud managed services market on the basis of vertical?

- What are the various stages in the value chain of the India cloud managed services market?

- What are the key driving factors and challenges in the India cloud managed services?

- What is the structure of the India cloud managed services market and who are the key players?

- What is the degree of competition in the India cloud managed services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cloud managed services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cloud managed services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cloud managed services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)