India Coffee Pods and Capsules Market Size, Share, Trends and Forecast by Type, Packaging Material, Distribution Channel and Region, 2025-2033

India Coffee Pods and Capsules Market Size and Share:

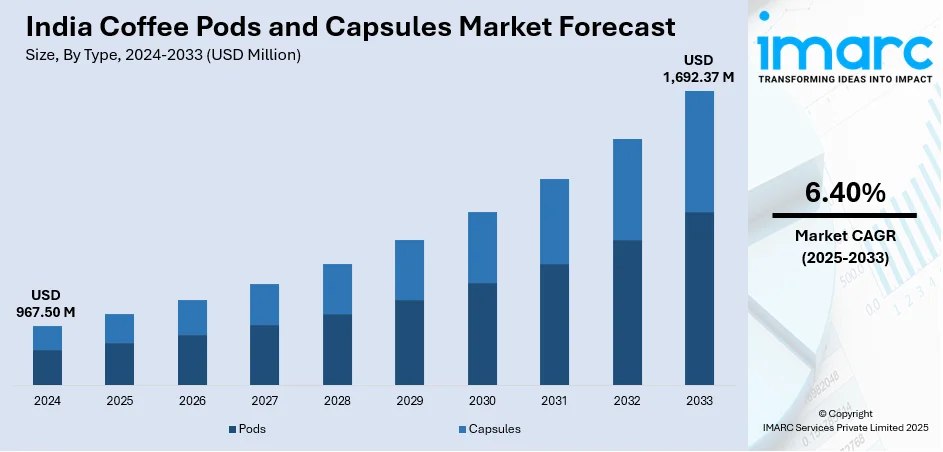

The India coffee pods and capsules market size reached USD 967.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,692.37 Million by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. The India coffee pods and capsules market share is propelled by the growth of urbanization, growing disposable income, and shifting consumer preferences for convenience. Increased demand for premium coffee experience, as well as the growth in e-commerce platforms, is also impelling market expansion. Additionally, the growing coffee culture and brand awareness contribute to rising product consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 967.50 Million |

| Market Forecast in 2033 | USD 1,692.37 Million |

| Market Growth Rate (2025-2033) | 6.40% |

India Coffee Pods and Capsules Market Trends:

Shift Toward Premium and Specialty Coffee

One of the major trends in the India coffee pods and capsules market outlook is the rising demand for specialty and premium coffee. As Indian consumers are becoming more sophisticated in their coffee consumption, they are turning to higher-quality coffee. The trend is driven by the developing coffee culture, as an increasing number of consumers demand barista-style, artisanal coffee experiences at home. Capsules and coffee pods present a ready and easy way of consuming premium-quality coffee without much brewing complication. With manufacturers having a mix of specialty offerings available, including flavored, single-origin, organic coffees, there is greater demand for premium options in the market. Such trends are led strongest by working professionals and city dwellers with the urban millennials taking the forefront in this market segment. The presence of rich, varied coffee options in capsules and pods is fueling market growth, underpinning the more evolved coffee culture in India.

To get more information on this market, Request Sample

Expansion of E-commerce and Online Retail

Another important trend influencing the India coffee capsules and pods market growth is the increasing popularity of e-commerce and online retailing channels. Currently, as per industry reports, India's online retail market is worth USD 70 billion and contributes to around 7% of the nation's total retailing sector, and therefore, it provides huge opportunities for growth. As digitalization has increased and internet penetration has grown, more Indian consumers are looking for online purchases of coffee capsules and pods. E-commerce websites have a broader choice of products, allowing consumers to browse through numerous brands, tastes, and subscription services with ease. Online shops also offer lower prices, deals, and door delivery, simplifying the purchasing process for consumers to acquire their favorite coffee brands. Subscription programs are becoming increasingly popular, offering consumers regular supply of their preferred coffee pods or capsules, to meet the surging demand for convenience. This trend is also being fueled by the growth of international coffee chains and domestic startups that are targeting convenience-oriented, tech-savvy consumers. With e-commerce growing, online retailing is likely to emerge as an even larger distribution channel for coffee pods and capsules in India.

India Coffee Pods and Capsules Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, packaging material, and distribution channel.

Type Insights:

- Pods

- Capsules

The report has provided a detailed breakup and analysis of the market based on the type. This includes pods and capsules.

Packaging Material Insights:

- Conventional Plastic

- Bioplastics

- Fabric

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging material. This includes conventional plastic, bioplastics, fabric, and others.

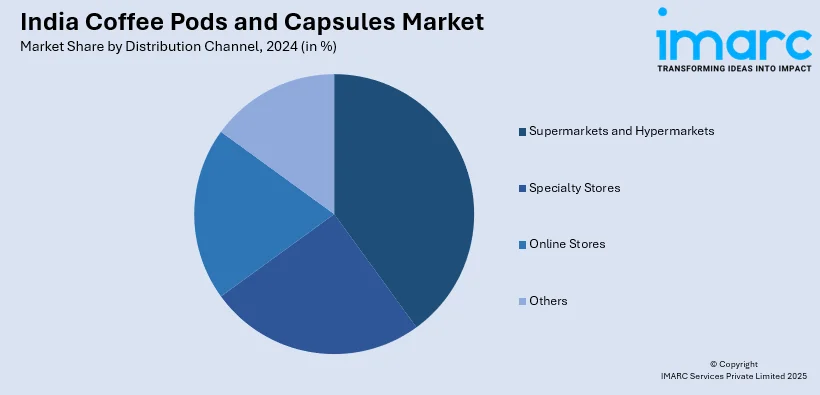

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Coffee Pods and Capsules Market News:

- In August 2024, specialty coffee brand Blue Tokai Coffee secured a USD 35 million investment in a round spearheaded by Verlinvest, with contributions from current investors Anicut Capital and A91 Partners.

- In June 2024, Nespresso revealed its plans to enter the Indian market by the end of 2024, signifying a strategic shift to capitalize on the growing coffee industry in the area. Aiming to launch its inaugural boutique store in Delhi and grow into additional major cities, Nestlé’s distinctive premium brand is establishing groundwork to enhance its market standing in the nation.

India Coffee Pods and Capsules Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pods, Capsules |

| Packaging Materials Covered | Conventional Plastic, Bioplastics, Fabric, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India coffee pods and capsules market performed so far and how will it perform in the coming years?

- What is the breakup of the India coffee pods and capsules market on the basis of type?

- What is the breakup of the India coffee pods and capsules market on the basis of packaging material?

- What is the breakup of the India coffee pods and capsules market on the basis of distribution channel?

- What is the breakup of the India coffee pods and capsules market on the basis of region?

- What are the various stages in the value chain of the India coffee pods and capsules market?

- What are the key driving factors and challenges in the India coffee pods and capsules market?

- What is the structure of the India coffee pods and capsules market and who are the key players?

- What is the degree of competition in the India coffee pods and capsules market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India coffee pods and capsules market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India coffee pods and capsules market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India coffee pods and capsules industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)