India Cold Chain Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, and Region, 2025-2033

India Cold Chain Equipment Market Overview:

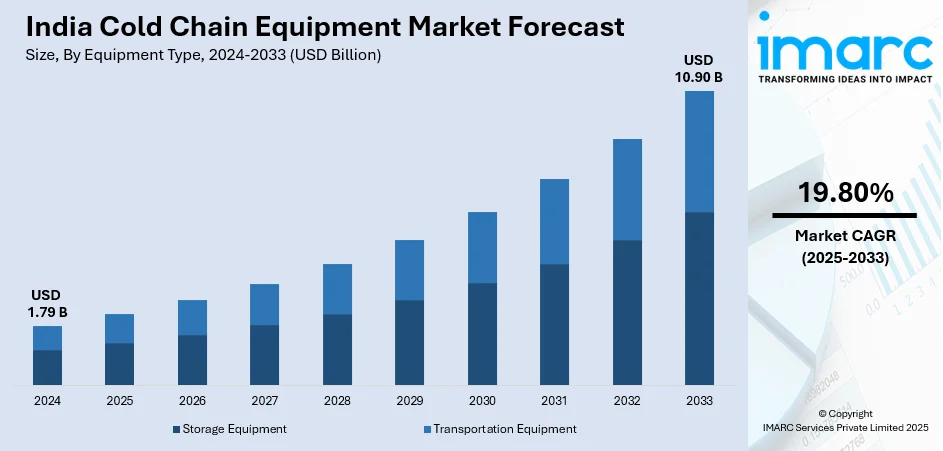

The India cold chain equipment market size reached USD 1.79 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.90 Billion by 2033, exhibiting a growth rate (CAGR) of 19.80% during 2025-2033. Rising demand for frozen foods, an expanding pharmaceutical industry, and growing e-commerce are influencing India cold chain equipment market share. Increasing processed food consumption, temperature-sensitive drug storage needs, and online grocery sales are fueling investments in advanced refrigeration, logistics, and storage infrastructure nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.79 Billion |

| Market Forecast in 2033 | USD 10.90 Billion |

| Market Growth Rate (2025-2033) | 19.80% |

India Cold Chain Equipment Market Trends:

Expanding Pharmaceutical Industry

The expanding pharmaceutical industry is significantly driving the India cold chain equipment market outlook on account of the increasing demand for storage. Temperature-sensitive drugs, vaccines, and biologics require advanced cold storage solutions to maintain efficacy and safety. Rising healthcare needs and growing pharmaceutical exports are fueling investments in cold chain infrastructure. India’s drugs and pharmaceuticals exports reached US$ 27.82 billion in FY24 and stand at US$ 14.42 billion in FY25. The COVID-19 pandemic emphasized the necessity for robust vaccine storage and transportation systems nationwide. Pharmaceutical companies are adopting advanced refrigeration technologies to meet regulatory requirements and quality standards. Biopharmaceutical research and clinical trials are expanding, requiring specialized cold storage solutions for drug samples and specimens. Government initiatives supporting vaccine production and distribution are catalyzing demand for cold chain equipment. Increasing penetration of biologics and biosimilars is further accelerating the need for reliable temperature-controlled logistics. Pharmaceutical supply chains are evolving, integrating IoT-enabled monitoring systems for real-time temperature tracking. Cold storage warehouses are expanding in major cities and healthcare hubs to support medicine distribution. Online pharmacies and e-commerce healthcare platforms require efficient cold storage solutions for timely drug delivery. Private investments and partnerships are increasing to strengthen cold chain logistics infrastructure.

To get more information on this market, Request Sample

Rising Demand for Processed and Frozen Foods

The escalating demand for processed and frozen foods is significantly strengthening the India cold chain equipment market growth. Consumers are increasingly preferring ready-to-eat (RTE) and frozen food products due to changing lifestyles and urbanization. This shift requires efficient cold storage and transportation systems to maintain food quality and safety. Supermarkets, hypermarkets, and quick-service restaurants (QSRs) are expanding, driving the demand for reliable cold chain equipment solutions. Online food delivery platforms and e-commerce grocery services are also fueling the need for temperature-controlled logistics. The growing working population is relying on frozen foods for convenience and time-saving meal options. Investments in modern refrigeration technologies are increasing to meet the rising consumption of frozen foods. In September 2024, Eggoz, a leading egg-based consumer brand in India, expanded its frozen food range with Egg Nuggetz and Burger Pattiez. These preservative-free, ready-to-cook (RTC) snacks cater to health-conscious consumers seeking quick, nutritious options, highlighting the growing demand for frozen foods. The juicy Egg Burger Pattiez is perfect for homemade burgers, while the crispy Classic Egg Nuggetz offers a flavorful snack made from farm-fresh eggs. Cold chain solutions help in preserving perishable products, reducing food wastage, and ensuring extended shelf life. Food manufacturers are upgrading storage and transportation infrastructure to comply with safety and quality standards.

India Cold Chain Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on equipment type and application.

Equipment Type Insights:

- Storage Equipment

- On-Grid

- Walk-in Coolers

- Walk-in Freezers

- Ice-Lined Refrigerators

- Deep Freezers

- Off-Grid

- Solar Chillers

- Milk Coolers

- Solar Powered Cold Boxes

- Others

- Others

- On-Grid

- Transportation Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes storage equipment [on-grid (walk-in coolers, walk-in freezers, ice-lined refrigerators, deep freezers), off-grid (solar chillers, milk coolers, solar powered cold boxes, others), and others] and transportation equipment.

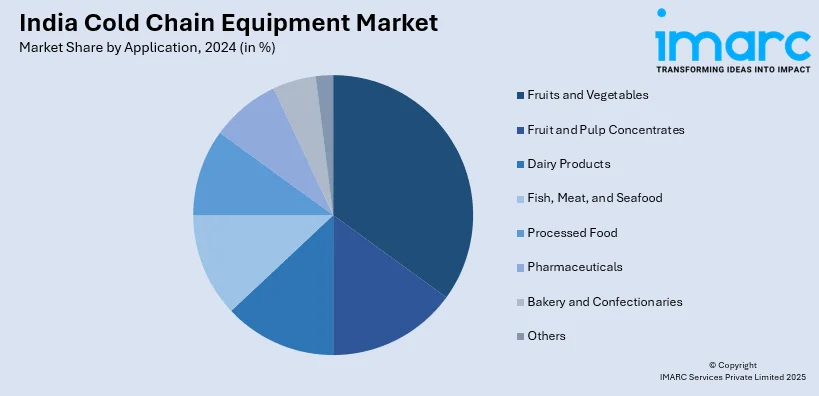

Application Insights:

- Fruits and Vegetables

- Fruit and Pulp Concentrates

- Dairy Products

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Bakery and Confectionaries

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, fruit and pulp concentrates, dairy products, fish, meat, and seafood, processed food, pharmaceuticals, bakery and confectionaries, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Chain Equipment Market News:

- In October 2024, Tata Power Trading Company Limited, a subsidiary of Tata Power, in collaboration with Singapore-based Keppel introduced sustainable Cooling-as-a-Service (CaaS) solutions in India. Supporting the Indian Cooling Action Plan (ICAP) and Smart Cities Mission, this initiative enables energy-efficient cooling without high upfront costs. It focuses on deploying District Cooling Systems (DCS) and tailored solutions for high-demand sectors like airports, IT parks, Special Economic Zones, and data centers. By optimizing cooling demand, these solutions can cut energy consumption by up to 40% and reduce carbon emissions by up to 50%.

- In March 2024, Blue Star announced to strengthen its presence in the energy-efficient deep freezers segment with the launch of a new range from 60 to 600 liters. Featuring Quadracool technology and high ambient temperature resistance, these freezers cater to dairy, frozen food, and retail sectors. Manufactured in Wada, Maharashtra, they align with the ‘Make in India’ initiative, ensuring innovation and sustainability.

India Cold Chain Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Applications Covered | Fruits and Vegetables, Fruit and Pulp Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Pharmaceuticals, Bakery and Confectionaries, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold chain equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold chain equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold chain equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain equipment market in India was valued at USD 1.79 Billion in 2024.

The India cold chain equipment market is projected to exhibit a CAGR of 19.80% during 2025-2033, reaching a value of USD 10.90 Billion by 2033.

The India cold chain equipment market is driven by growing demand for perishable goods, government initiatives supporting infrastructure development, and technological advancements enhancing efficiency and transparency. Increasing focus on safe storage and transportation of temperature-sensitive products is boosting adoption of modern cold chain solutions across food, pharmaceutical, and healthcare sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)