India Cold Chain Monitoring Solutions Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

India Cold Chain Monitoring Solutions Market Overview:

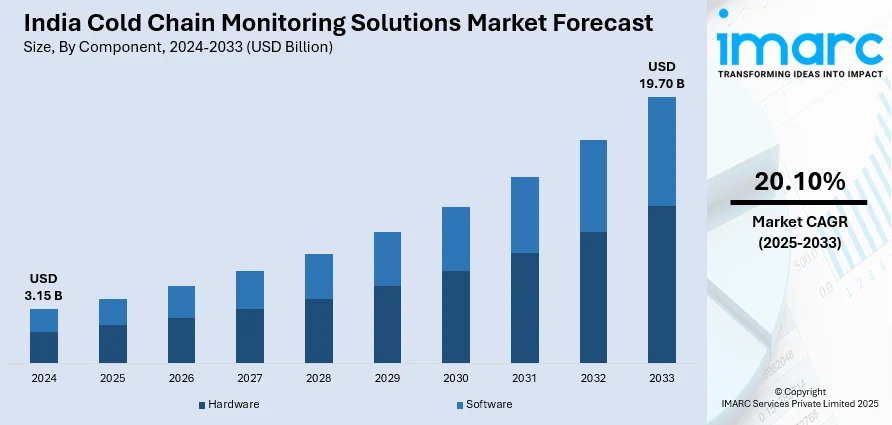

The India cold chain monitoring solutions market size reached USD 3.15 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.70 Billion by 2033, exhibiting a growth rate (CAGR) of 20.10% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of IoT and real-time monitoring systems and the rising demand for cloud-based cold chain solutions. Extensive research and development (R&D) activities are also contributing significantly to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.15 Billion |

| Market Forecast in 2033 | USD 19.70 Billion |

| Market Growth Rate (2025-2033) | 20.10% |

India Cold Chain Monitoring Solutions Market Trends:

Increasing Adoption of IoT and Real-Time Monitoring Systems

The India cold chain monitoring solutions market is witnessing a very large trend induced by the adoption of Internet of Things (IoT) technology and real-time monitoring systems in various sectors. IoT devices allow real-time monitoring to track the temperature, humidity, and other environmental parameters at the stages of loading, transportation, and storage. They play a critical role in ensuring the quality and safety of temperature-sensitive products such as pharmaceuticals, food, and beverages. For instance, in January 2024, an investment of INR 113 crore by A.P. Moller - Maersk is underway for a temperature-controlled facility covering a total area of 260,000 sq. ft in Mehsana, Gujarat, for the purpose of advanced technology, tailored racking, and strict temperature compliance for frozen foods. Using this technological upgrade, real-time data are made available to stakeholders to remotely monitor the conditions and take immediate action before the possible disruption of any of the cold storage operations. There is also an increasing demand for the best-quality perishables, which imply an even greater requirement for guaranteed efforts toward more reliable and efficient cold chain management solutions. The inclusion of IoT-based sensors in cold storage and vector transportation systems will not only improve the operational efficiency but also minimize wastage by the products due to improper temperature handling. Also, these systems are for better compliance to regulatory standards and transparency, which are not much more important in the global trade of perishable products. Most of the time, with the awareness of what benefits first real-time data are having, these really fast-acting IoT-based cold chain monitoring networks are beginning to be proven really significant investments in Indian markets for businesses to guarantee product integrity and customer satisfaction and actually raise competitiveness in the rest of the marketplace.

To get more information of this market, Request Sample

Growing Demand for Cloud-Based Cold Chain Solutions

Another prominent trend in the Indian cold chain monitoring solutions market is the increasing demand for cloud-based solutions. Cloud technology enables cold chain operators to store, process, and analyze vast amounts of data generated by IoT sensors across multiple locations. This shift to the cloud allows businesses to manage their cold chain operations more effectively, with enhanced scalability, accessibility, and cost efficiency. Cloud-based cold chain solutions provide a centralized platform for data storage and analysis, offering real-time insights into the condition of goods throughout the supply chain. For instance, REFCOLD India 2024, held in Kolkata, featured over 130 exhibitors and 10,000 visitors, showcasing energy-efficient cold chain solutions and highlighting the industry's role in addressing climate change with net-zero technologies. This flexibility allows stakeholders, from logistics providers to end customers, to access vital data anytime and anywhere, facilitating better decision-making and operational control. The ability to integrate these systems with existing enterprise resource planning (ERP) and warehouse management systems further enhances operational visibility, leading to reduced downtime, more accurate forecasting, and streamlined inventory management. As the demand for secure, flexible, and cost-effective cold chain solutions continues to rise, Indian businesses are increasingly embracing cloud-based technologies to improve overall efficiency and ensure compliance with industry standards.

India Cold Chain Monitoring Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component and application.

Component Insights:

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (sensors, rfid devices, telematics, networking devices, and others) and software (on-premises and cloud-based).

Application Insights:

- Food and Beverages

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery and Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

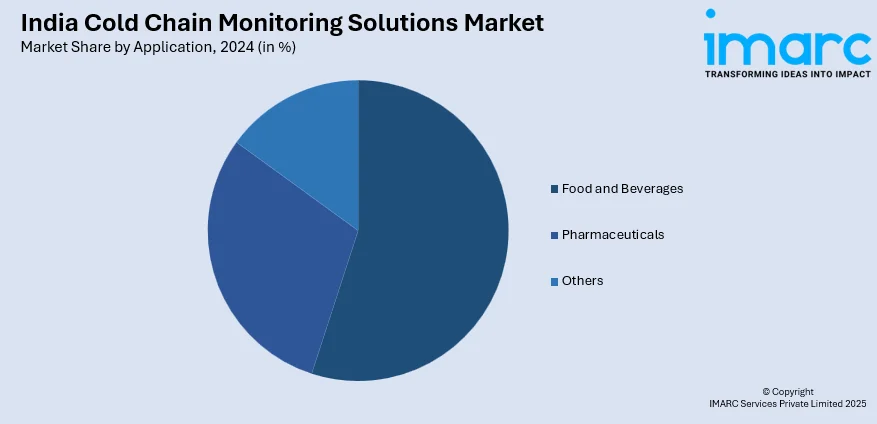

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages [fruits and vegetables, fruit pulp and concentrates, dairy products (milk , butter, cheese, ice cream, and others), fish, meat, and seafood, processed food, bakery and confectionary, and others], pharmaceuticals (vaccines, blood banking, others), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Chain Monitoring Solutions Market News:

- In October 2024, Carrier Transicold announced the launch of its Supra A and Citimax D series at REFCOLD 2024 in Kolkata, offering advanced, efficient refrigeration units for temperature-sensitive perishables, with enhanced performance, reliability, and reduced maintenance.

- In August 2024, IIT Madras-incubated Yotuh Energy announced securing a funding of ₹1.53 crore to advance cold chain logistics. This investment will aid product development, testing, operations, and team expansion. By pioneering electric refrigeration systems, Yotuh Energy aims to enhance adaptive control technology, reduce fuel usage, and promote greener, cost-efficient industry practices.

India Cold Chain Monitoring Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold chain monitoring solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold chain monitoring solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold chain monitoring solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain monitoring solutions market in India was valued at USD 3.15 Billion in 2024.

The India cold chain monitoring solutions market is projected to exhibit a CAGR of 20.10% during 2025-2033, reaching a value of USD 19.70 Billion by 2033.

Rising demand for temperature-sensitive pharmaceuticals and perishable food products is driving the India cold chain monitoring solutions market. Growth in organized retail, expansion of the healthcare sector, and the need for real-time tracking and regulatory compliance further support widespread adoption across logistics and storage networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)