India Cold Chain Warehousing Market Size, Share, Trends and Forecast by Type of Storage, Temperature Range, Ownership, End Use Industry, and Region, 2026-2034

India Cold Chain Warehousing Market Overview:

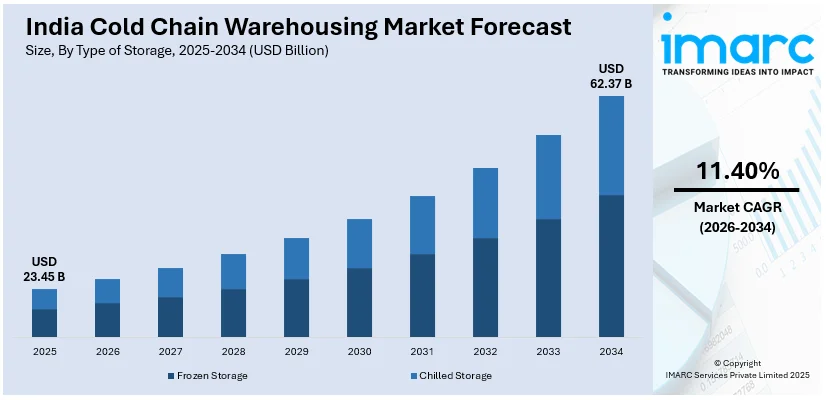

The India cold chain warehousing market size reached USD 23.45 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 62.37 Billion by 2034, exhibiting a growth rate (CAGR) of 11.40% during 2026-2034. The market is expanding steadily due to rising demand for temperature-sensitive storage across pharmaceuticals, food processing, and agriculture. Increased investment in infrastructure, growing consumer awareness about food safety, and government support for reducing post-harvest losses are further accelerating growth. The integration of advanced technologies is also enhancing operational efficiency, contributing to the evolving dynamics of the India cold chain warehousing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 23.45 Billion |

| Market Forecast in 2034 | USD 62.37 Billion |

| Market Growth Rate 2026-2034 | 11.40% |

India Cold Chain Warehousing Market Trends:

Growing Demand from Food Processing and Agriculture Sectors

India’s large-scale production of perishable goods, such as fruits, vegetables, dairy, meat, and seafood, creates a high demand for efficient cold storage. As the food processing industry expands, there is a pressing need to reduce post-harvest losses and ensure freshness during transportation and storage. Cold chain warehousing plays a critical role in extending shelf life and maintaining food quality, especially for exports. Additionally, the rise in organized retail, online grocery platforms, and changing consumption patterns has increased the need for temperature-controlled logistics. To support this, companies are investing in strategically located cold warehouses that meet food safety standards, enabling producers and retailers to manage seasonal surpluses and demand fluctuations effectively. For instance, in January 2023, The Ministry of Agriculture and Farmers Welfare launched the India Cold Chain Programme at the India Cold Chain Conclave, a one-day conference and exhibition with a focus on "Innovation & Excellence in Cold Chain," which is organized by the UN Environment Programme under the auspices of the Cool Coalition. This directly supports the need for cold storage solutions to reduce post-harvest losses, preserve perishables, and improve value chains in food processing and agri-logistics.

To get more information on this market, Request Sample

Technological Advancements and Automation

Technological innovation is transforming India’s cold chain warehousing landscape by improving efficiency, traceability, and safety. Integration of Internet of Things (IoT), real-time temperature monitoring, RFID tagging, and warehouse automation helps ensure the integrity of temperature-sensitive goods while reducing operational costs. These advancements enable predictive maintenance, automated alerts for deviations, and better inventory management, further driving the India cold chain warehousing market growth. Companies are also using data analytics and AI-driven insights to optimize storage, energy consumption, and logistics routes. Such innovations make cold chain warehousing more scalable, responsive, and attractive to industries with high compliance standards. This digital transformation is helping to bridge infrastructure gaps and elevate India’s warehousing capabilities to international benchmarks. For instance, in September 2024, Indicold, a prominent player in India’s cold chain sector, has achieved a significant milestone with the introduction of the country’s first rack-clad Automated Storage and Retrieval System (ASRS) frozen facility. Situated in the swiftly growing Ahmedabad area, this cutting-edge facility accommodates more than 7,000 pallets, symbolizing the beginning of a new phase in automated frozen storage in India.

India Cold Chain Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type of storage, temperature range, ownership, and end use industry.

Type of Storage Insights:

- Frozen Storage

- Chilled Storage

The report has provided a detailed breakup and analysis of the market based on the type of storage. This includes frozen storage and chilled storage.

Temperature Range Insights:

- Ambient

- Refrigerated

- Frozen

- Deep-Frozen

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes ambient, refrigerated, frozen, and deep-frozen.

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes private warehouses, public warehouses, and bonded warehouses.

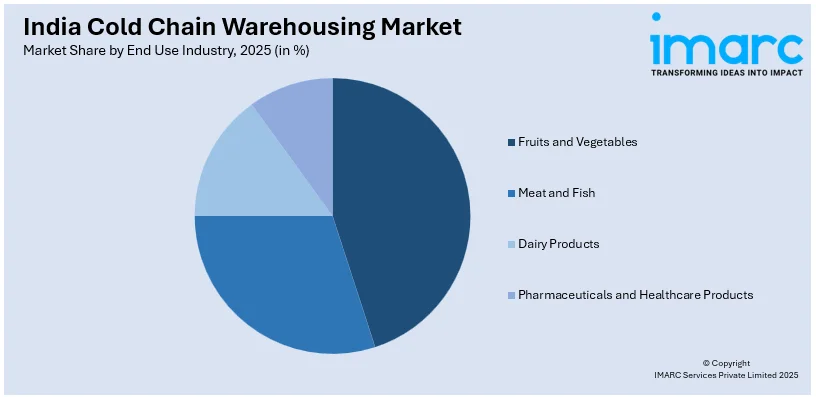

End Use Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Fruits and Vegetables

- Meat and Fish

- Dairy Products

- Pharmaceuticals and Healthcare Products

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes fruits and vegetables, meat and fish, dairy products, and pharmaceuticals and healthcare products.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Chain Warehousing Market News:

- In April 2025, Indicold opened its second, and even more ambitious, facility in Detroj, Gujarat, after creating India's first automated high-bay frozen ASRS warehouse in Dholasan earlier this year. This time, it presents a first for the country: India's first Four-Way Shuttle ASRS system for frozen storage.

- In May 2024, Celcius Logistics, a domestic aggregator offering comprehensive cold-chain solutions, announced that it had raised INR 40 crore in a pre-series B investment led by IvyCap Ventures, an existing investor. Caret Capital and Mumbai Angels are further investors.

India Cold Chain Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Storage Covered | Frozen Storage, Chilled Storage |

| Temperature Ranges Covered | Ambient, Refrigerated, Frozen, Deep-Frozen |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| End Use Industries Covered | Fruits and Vegetables, Meat and Fish, Dairy Products, Pharmaceuticals and Healthcare Products |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cold chain warehousing market performed so far and how will it perform in the coming years?

- What is the breakup of the India cold chain warehousing market on the basis of type of storage?

- What is the breakup of the India cold chain warehousing market on the basis of temperature range?

- What is the breakup of the India cold chain warehousing market on the basis of ownership?

- What is the breakup of the India cold chain warehousing market on the basis of end use industry?

- What is the breakup of the India cold chain warehousing market on the basis of region?

- What are the various stages in the value chain of the India cold chain warehousing market?

- What are the key driving factors and challenges in the India cold chain warehousing market?

- What is the structure of the India cold chain warehousing market and who are the key players?

- What is the degree of competition in the India cold chain warehousing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold chain warehousing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold chain warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold chain warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)