India Command and Control System Market Size, Share, Trends and Forecast by Platform, Solution, Application, and Region, 2025-2033

India Command and Control System Market Overview:

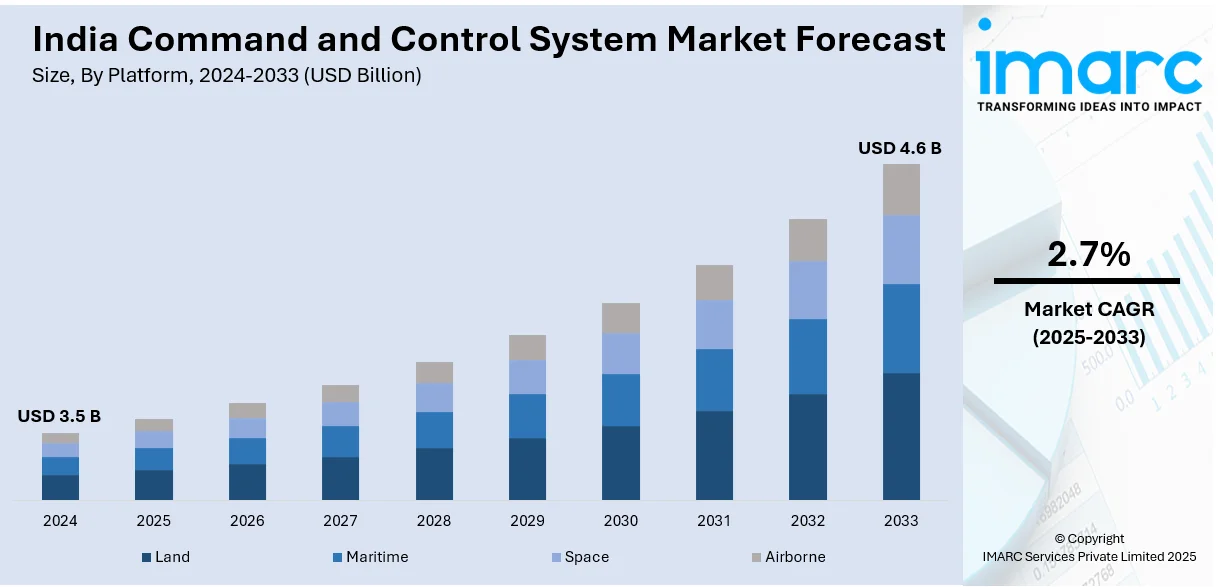

The India command and control system market size reached USD 3.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 2.7% during 2025-2033. The rising defense modernization, increasing cyber threats, growing border tensions, smart city initiatives, advancements in AI and IoT, demand for real-time situational awareness, government investments in surveillance, emergency response needs, and enhanced communication network developments are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 2.7% |

India Command and Control System Market Trends:

AI-Powered Surveillance for Smart Cities

Cities are increasingly using AI-based surveillance and command centers to improve public safety and efficiency in city administration. These solutions combine thousands of CCTV cameras located across the city, forming centralized monitoring centers that allow real-time crime detection, traffic management, and emergency response. AI-driven analytics assist officials in detecting security threats, anticipating traffic flows, and optimizing the deployment of law enforcement. The combination of IoT and AI enables the smooth exchange of data, enhancing efficiency in public safety initiatives. With the ongoing development of technology, more cities are making investments in networks of automatic surveillance to provide safer and more integrated cityscapes. The use of these smart security solutions at large indicates an increasing trend towards data-led governance and greater urban resilience against security and logistical issues. For example, in July 2024, the Nagpur Government inaugurated India's most advanced command and control center, enhancing urban surveillance and public safety. The center integrates 3,600 CCTV cameras from Nagpur Smart City and 2,200 additional cameras from metros, malls, and other locations, ensuring comprehensive city monitoring. Developed by Nagpur Smart and Sustainable Development Corporation Limited, it empowers police and traffic departments with AI-driven technology for efficient crime and traffic management.

To get more information on this market, Request Sample

Advancing Drone-Based Command and Control Solutions

India is witnessing a rapid shift toward technology-driven command and control systems, particularly in drone operations. Advanced centers equipped with real-time monitoring, remote piloting, and data analytics are being deployed to enhance operational efficiency and security. These facilities support nationwide surveillance, route optimization, and regulatory compliance, strengthening emergency response capabilities. As automation and AI-powered solutions gain traction, the integration of drones into command systems is redefining management strategies across defense, logistics, and public safety. The increasing investment in such technology reflects a broader push for seamless, data-driven decision-making processes. This movement highlights the growing reliance on intelligent control mechanisms to streamline operations, ensuring faster responses and greater situational awareness in critical industries. For instance, in November 2023, Magellanic Cloud Limited inaugurated a drone command and control center in Bengaluru, enhancing India's command and control system market. This facility provides real-time monitoring, security, compliance, and remote piloting services nationwide. Equipped with advanced data analysis tools, it optimizes drone operations, including route planning and safety measures. This initiative aligns with India's growing adoption of technology-integrated solutions for efficient management and improved emergency response capabilities.

India Command and Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on platform, solution, and application.

Platform Insights:

- Land

- Maritime

- Space

- Airborne

The report has provided a detailed breakup and analysis of the market based on the platform. This includes land, maritime, space, and airborne.

Solution Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes hardware, software, and services.

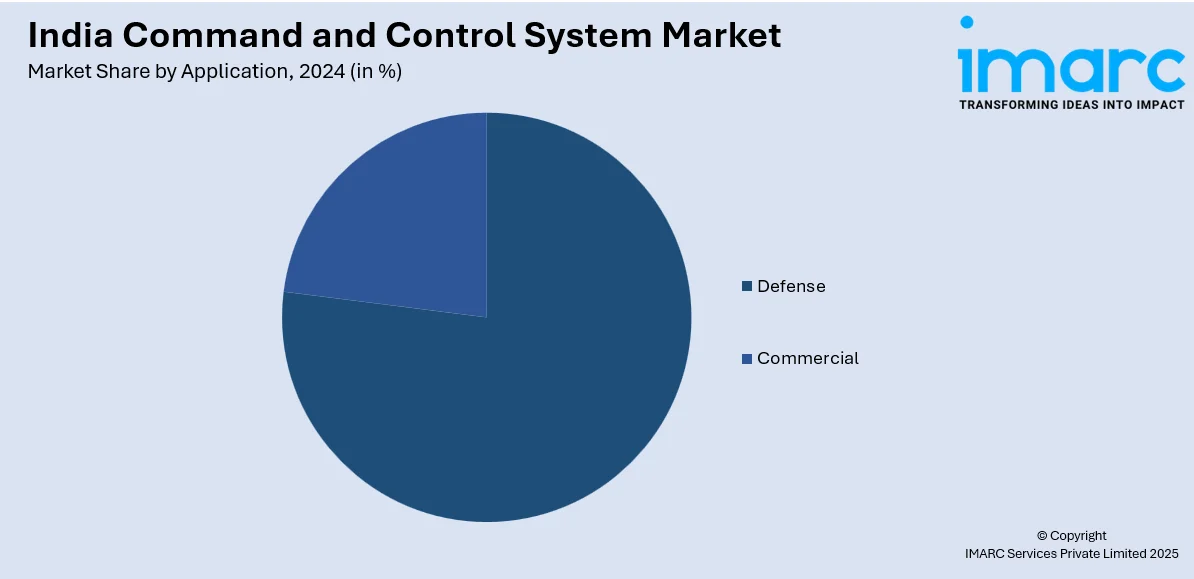

Application Insights:

- Defense

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes defense and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Command and Control System Market News:

- In April 2024, the Indian Army initiated the induction of the Akashteer Command and Control System, developed by Bharat Electronics Limited, to enhance its air defense capabilities. This automated system integrates radar and communication networks, providing real-time situational awareness and rapid response to aerial threats.

- In March 2024, Chennai Police introduced mobile command and control center vehicles to enhance urban surveillance and public safety. These vehicles are equipped with advanced AI-driven technology, including high-definition cameras and communication systems, enabling real-time monitoring and rapid response to incidents. This initiative reflects a growing trend in India's command and control system market toward mobile, technology-integrated solutions for efficient city management and improved emergency response capabilities.

India Command and Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Land, Maritime, Space, Airborne |

| Solutions Covered | Hardware, Software, Services |

| Applications Covered | Defense, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India command and control system market performed so far and how will it perform in the coming years?

- What is the breakup of the India command and control system market on the basis of platform?

- What is the breakup of the India command and control system market on the basis of solution?

- What is the breakup of the India command and control system market on the basis of application?

- What are the various stages in the value chain of the India command and control system market?

- What are the key driving factors and challenges in the India command and control system market?

- What is the structure of the India command and control system market and who are the key players?

- What is the degree of competition in the India command and control system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India command and control system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India command and control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India command and control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)