India Commercial Kitchen Appliances Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2026-2034

India Commercial Kitchen Appliances Market Overview:

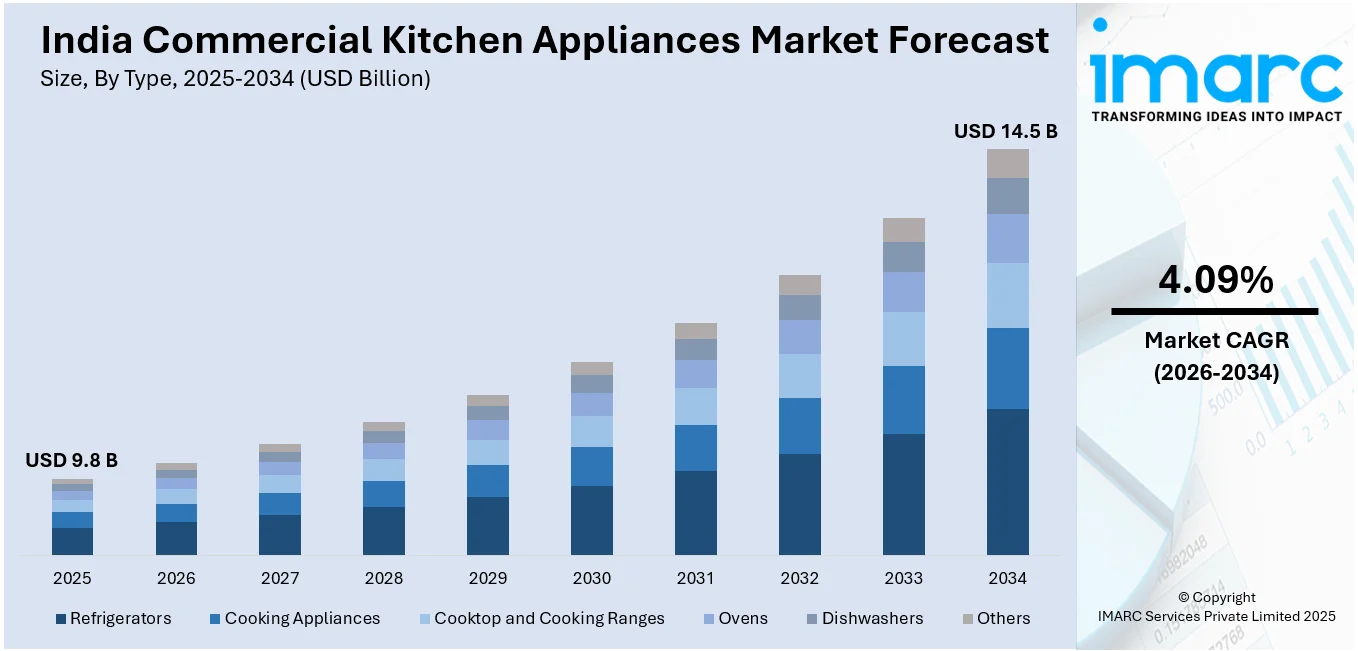

The India commercial kitchen appliances market size reached USD 9.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 14.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.09% during 2026-2034. The market is driven by the expansion of food service chains, cloud kitchens, and quick-service restaurants (QSRs). Rising demand for energy-efficient and automated appliances, government sustainability initiatives, and the need for cost-effective operations further expand the India commercial kitchen appliances market share. Increasing consumer dining-out trends and technological advancements also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.8 Billion |

| Market Forecast in 2034 | USD 14.5 Billion |

| Market Growth Rate 2026-2034 | 4.09% |

India Commercial Kitchen Appliances Market Trends:

Rising Demand for Energy-Efficient Commercial Kitchen Appliances

The growing demand for energy-efficient equipment due to increasing operational costs and environmental concerns is creating a positive India commercial kitchen appliances market outlook. Restaurants, hotels, and catering businesses are prioritizing appliances with high energy ratings to reduce electricity consumption and lower overhead expenses. Manufacturers are introducing induction cooktops, convection ovens, and steamers that use advanced technology to optimize energy usage. Government initiatives, such as the Bureau of Energy Efficiency (BEE) star ratings, further encourage businesses to adopt sustainable appliances. Additionally, the rise in quick-service restaurants (QSRs) and cloud kitchens has amplified the need for cost-effective, high-performance kitchen equipment. The food services sector in India is expected to expand to USD 7.76 Trillion by 2028. Market share of Quick Service Restaurants (QSRs) is likely to grow from 27% to 4–5%, respectively. Organized players are forecast to corner 52.9% of the market, driven by the rise of cloud kitchens and an increasing inclination for high-efficiency kitchen equipment. According to a future forecast within the hospitality sector, the most recent report suggested that the restaurant and food service sector would have 10.3 million new jobs available for the year 2028, subsequently, predicting a 20% growth in the number of times a consumer dines out, both of which implies great potential for the India commercial kitchen appliances market growth. As sustainability becomes a key focus, businesses are investing in appliances that offer long-term savings while minimizing carbon footprints. This trend is expected to accelerate as more enterprises recognize the financial and ecological benefits of energy-efficient solutions.

To get more information on this market Request Sample

Growth of Smart and Automated Kitchen Appliances

Automation and smart technology are transforming India’s commercial kitchen appliances market, driven by the need for efficiency and consistency in food preparation. According to a research report published by the IMARC Group, the India home automation market size reached USD 3.56 Billion in 2024. The market is expected to reach USD 13.64 Billion by 2033, exhibiting a growth rate (CAGR) of 16.10% during 2025-2033. Smart appliances, such as IoT-enabled ovens, automated fryers, and programmable dishwashers, are gaining traction in commercial kitchens. These devices offer remote monitoring, precision cooking, and reduced manual intervention, enhancing productivity in high-volume food service operations. The expansion of cloud kitchens and QSR chains has further enhanced the demand for automated solutions that ensure faster service and standardized food quality. Additionally, AI-powered inventory management systems integrated with kitchen appliances help optimize ingredient usage and reduce waste. As digital transformation reshapes the food industry, businesses are increasingly adopting smart kitchen technologies to improve operational efficiency and customer satisfaction. This trend is projected to grow as automation becomes more accessible and affordable for small and mid-sized enterprises.

India Commercial Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, distribution channel, and application.

Type Insights:

- Refrigerators

- Cooking Appliances

- Cooktop and Cooking Ranges

- Ovens

- Dishwashers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerators, cooking appliances, cooktop and cooking ranges, ovens, dishwashers, and others.

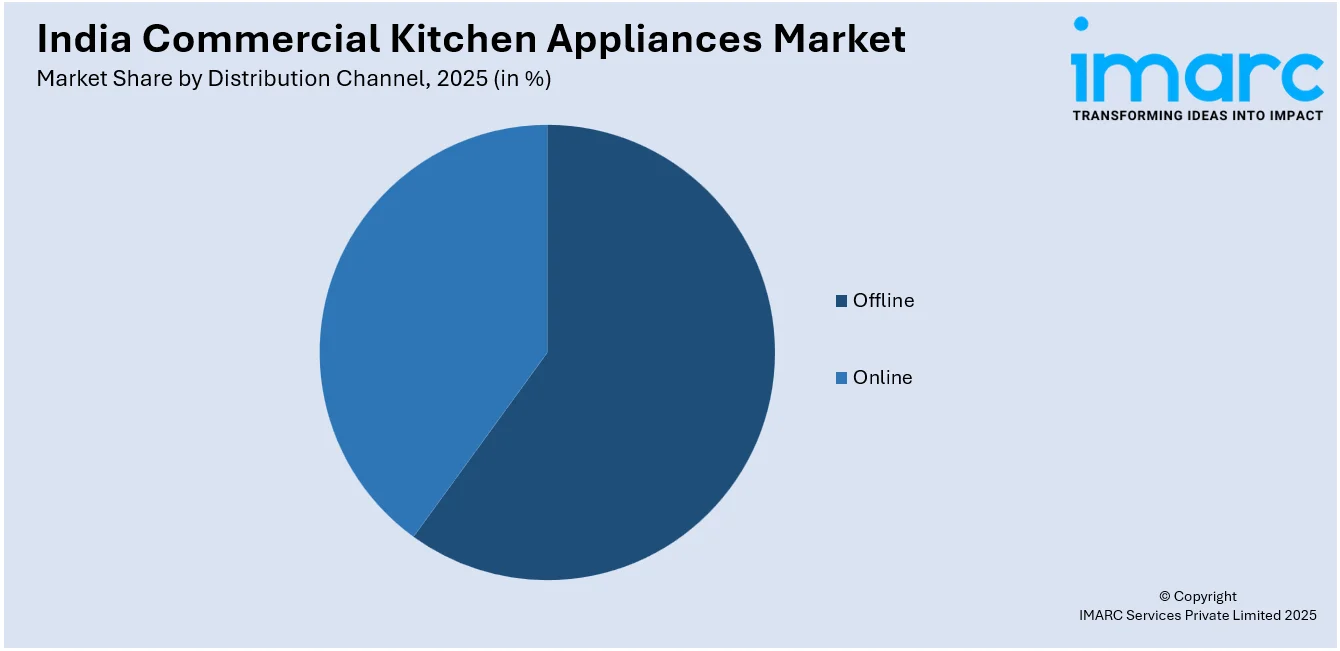

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Application Insights:

- Quick Service Restaurant (QSR)

- Railway Dining

- Institutional Canteen

- Resort and Hotel

- Hospital

- Full Service Restaurant (FSR)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes quick service restaurant (QSR), railway dining, institutional canteen, resort and hotel, hospital, full service restaurant (FSR), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Commercial Kitchen Appliances Market News:

- November 20, 2024: Swiggy launched a service in India to help restaurants procure kitchen equipment with access to a range of commercial appliances including freezers, chillers, cookers, deep fryers, and microwaves to its restaurant partners. Available via the Swiggy Owner app, the service connects restaurants with vetted vendors to simplify sourcing and also reduce costs.

- September 06, 2024: UNOX launched its first experiential UNOX Lounge in Bengaluru in association with Unique Steel Products, Kitchen Whiz. This venue is intended to showcase its latest-in-tech ovens, including combi, convection, and speed ovens. The lounge showcases live demos for chefs and hospitality professionals to perform practical assessments of high-performance kitchen equipment. Targeting India's growing premium food service market, the lounge aims to promote the adoption of innovative commercial kitchen appliances in restaurants, hotels, and catering businesses.

India Commercial Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Refrigerators, Cooking Appliances, Cooktop and Cooking Ranges, Ovens, Dishwashers, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Quick Service Restaurant (QSR), Railway Dining, Institutional Canteen, Resort and Hotel, Hospital, Full Service Restaurant (FSR), Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India commercial kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the India commercial kitchen appliances market on the basis of type?

- What is the breakup of the India commercial kitchen appliances market on the basis of distribution channel?

- What is the breakup of the India commercial kitchen appliances market on the basis of application?

- What is the breakup of the India commercial kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the India commercial kitchen appliances market?

- What are the key driving factors and challenges in the India commercial kitchen appliances?

- What is the structure of the India commercial kitchen appliances market and who are the key players?

- What is the degree of competition in the India commercial kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India commercial kitchen appliances market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India commercial kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India commercial kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)