India Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2025-2033

India Community Cloud Market Overview:

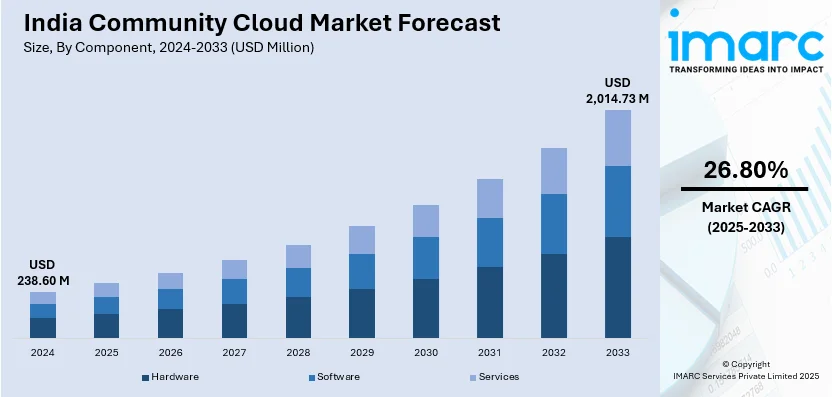

The India community cloud market size reached USD 238.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,014.73 Million by 2033, exhibiting a growth rate (CAGR) of 26.80% during 2025-2033. The growing adoption from small and medium-sized enterprises (SMEs) seeking affordable, scalable information technology (IT) solutions and significant investments from cloud service providers expanding local infrastructure, enhancing access to industry-specific platforms, and fostering collaboration through secure, cost-effective, and localized cloud services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 238.60 Million |

| Market Forecast in 2033 | USD 2,014.73 Million |

| Market Growth Rate (2025-2033) | 26.80% |

India Community Cloud Market Trends:

Growing Demand from Small and Medium-sized Enterprises (SMEs)

The increasing use of community cloud solutions by small and medium-sized enterprises (SMEs) in India reflects a broader shift towards digital infrastructure designed to enhance efficiency, agility, and competitiveness in the market. Community clouds provide SMEs with an affordable and scalable solution to access enterprise-level information technology (IT) resources without the burden of managing their own infrastructure. These platforms enable shared access to software, storage, and security features tailored to the operational needs of specific sectors or business groups, helping smaller firms streamline processes, enhance collaboration, and ensure compliance. The demand is driven by swift digitization in various sectors and the increasing recognition among SMEs of the advantages of cloud-based services. Based on information from the Ministry of Micro, Small & Medium Enterprises, as of March 2024, the total count of MSMEs recorded on the Udyam portal, which includes the Udyam Assist Platform (UAP), reached 4,00,42,875. Out of these, micro-enterprises account for 97.7% of the total, with small enterprises at 1.5%, and medium-sized enterprises at 0.8%. This growing foundation generates a significant market for community cloud providers, who are more frequently introducing SME-targeted services that emphasize user-friendliness, data security, and cost-effectiveness. With an increasing number of SMEs adopting digital tools, community cloud platforms play a crucial role in narrowing the technology gap and fostering business expansion.

To get more information on this market, Request Sample

Investments by Major Cloud Service Providers

Investments from leading cloud service providers are crucial for enhancing the community cloud market in India. These investments are hastening the growth of local cloud infrastructure, enhancing access to industry-specific cloud platforms, and allowing more organizations to move to secure, collaborative digital spaces. Providers are creating new data centers, broadening service availability, and delivering localized solutions that cater to the regulatory and performance needs of Indian businesses. A notable example is Microsoft’s announcement in 2025, to allocate $3 billion to improve its artificial intelligence (AI) and cloud computing capabilities in India. This investment encompasses constructing new cloud infrastructure and enlarging its current data center presence to cater to sectors like government, banking, manufacturing, and retail. Through this initiative, Microsoft intends to educate more than two million people in AI-related skills by 2026, thereby enhancing cloud usage by expanding the pool of qualified professionals. These extensive commitments not only cater to the rising domestic need for scalable and compliant cloud services but also establish India as a central hub for cloud and AI innovation. As international compete to expand their presence, the ecosystem for community cloud platforms becomes more mature, fostering collaboration among organizations with shared operational or regulatory needs.

India Community Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, application, and industry vertical.

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (server, networking, storage, and others), software (enterprise application software, collaboration tools software, and dashboards business intelligence software), and services (training services, maintenance and support, regulation and compliance, and consulting).

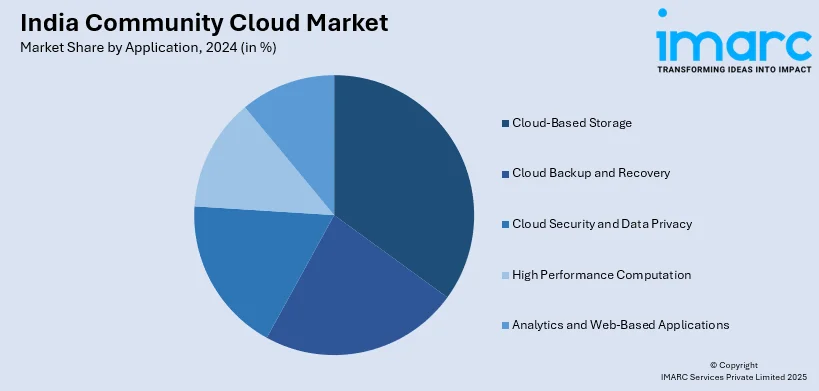

Application Insights:

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud-based storage, cloud backup and recovery, cloud security and data privacy, high performance computation, and analytics and web-based applications.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, gaming, government, healthcare, education, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Community Cloud Market News:

- In September 2024, PSB Alliance designated AWS as a cloud service provider to deliver cloud computing services to the public sector banks of India. AWS delivered its services via Managed Service Providers (MSPs) such as Orient Technologies and Hitachi Systems. The collaboration aimed to facilitate cloud integration for public sector banks and assist in their digital transformation initiatives.

- In December 2023, the RBI announced the launch of a community cloud for the financial sector to improve data security, scalability, and business continuity. The cloud facility was initially managed by IFTAS and was set to be later transferred to a separate entity owned by financial sector participants.

India Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India community cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the India community cloud market on the basis of component?

- What is the breakup of the India community cloud market on the basis of application?

- What is the breakup of the India community cloud market on the basis of industry vertical?

- What is the breakup of the India community cloud market on the basis of region?

- What are the various stages in the value chain of the India community cloud market?

- What are the key driving factors and challenges in the India community cloud market?

- What is the structure of the India community cloud market and who are the key players?

- What is the degree of competition in the India community cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India community cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India community cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India community cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)