India Companion Animal Health Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, End Use, and Region, 2025-2033

India Companion Animal Health Market Overview:

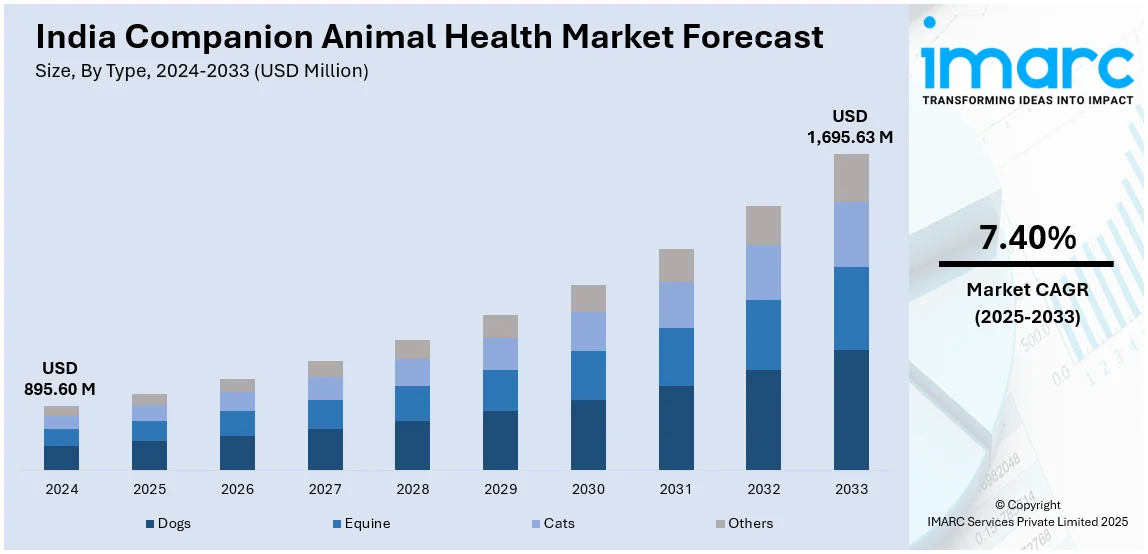

The India companion animal health market size reached USD 895.60 Million in 2024 Looking forward, IMARC Group expects the market to reach USD 1,695.63 Million by 2033 exhibiting a growth rate (CAGR) of 7.40% during 2025-2033 The growing adoption of pets and rising awareness about veterinary care are catalyzing the demand for vaccinations and preventive treatments. Besides this, the India companion animal health market share is driven by escalating demand of pet food and healthcare services, along with government initiatives like funding and regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 895.60 Million |

| Market Forecast in 2033 | USD 1,695.63 Million |

| Market Growth Rate (2025-2033) | 7.40% |

India Companion Animal Health Market Trends:

Government Initiatives and Regulations

Government initiatives and regulations are significantly influencing the India companion animal health market outlook by improving healthcare standards and disease management. Authorities are implementing policies to enhance veterinary research, ensuring better treatment options for companion animals. Stringent regulations on pet vaccines and medicines are improving the quality and safety of healthcare products. Subsidies and funding for veterinary healthcare infrastructure are expanding access to quality treatment across urban and rural areas. In October 2024, Union Minister Shri Rajiv Ranjan Singh introduced a $25 million Pandemic Fund Project to enhance animal health security in India. Supported by the G20 Pandemic Fund, this initiative aims to improve disease surveillance, laboratory infrastructure, and cross-border collaboration, strengthening veterinary healthcare systems. Moreover, government-run awareness campaigns on responsible pet adoption and disease prevention are catalyzing the demand for veterinary services. Regulations mandating regular pet vaccinations and disease control programs are strengthening preventive healthcare measures nationwide. Policies supporting local pharmaceutical production are reducing dependence on imports, making veterinary drugs more affordable. Initiatives promoting veterinary education and training are increasing the availability of skilled professionals in pet healthcare. The introduction of pet insurance guidelines is encouraging pet parents to seek advanced treatments without financial burden.

To get more information on this market, Request Sample

Growing Awareness About Pet Healthcare

Pet parents are becoming more conscious of preventive care, leading to higher vaccination rates and routine check-ups. Awareness campaigns by veterinary organizations and pet care companies are educating pet parents about common pet diseases. Rising social media influence is spreading information on pet nutrition, grooming, and overall well-being among pet parents. Increased access to veterinary information online is encouraging timely medical intervention and better disease management for pets. Besides this, the growing concerns about zoonotic diseases are making pet parents more responsible about vaccinations and deworming. Expansion of pet wellness programs by veterinary clinics is promoting early diagnosis and preventive healthcare measures. Awareness about dietary supplements and functional foods is encouraging healthier pet nutrition choices among pet parents. The pet food market is also expanding, with Avanti Pet Care, a subsidiary of Avanti Feeds, introducing its Avant Furst cat food brand in the country. The company plans to launch dry, wet, and treat formats for cats and dogs by late 2025, addressing the rising demand for high-quality pet nutrition. Additionally, a modern pet food manufacturing facility is set to be established in Hyderabad, India, further supporting pet healthcare advancements. Educational initiatives by government and NGOs are promoting responsible pet adoption and better healthcare practices, strengthening the overall India companion animal health market growth.

India Companion Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033 Our report has categorized the market based on type, product, distribution channel, and end use.

Type Insights:

- Dogs

- Equine

- Cats

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dogs, equine, cats, and others.

Product Insights:

- Vaccines

- Pharmaceuticals

- OTC

- Prescription

- Feed Additives

- Diagnostics

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes vaccines, pharmaceuticals (OTC and prescription), feed additives, diagnostics, and others.

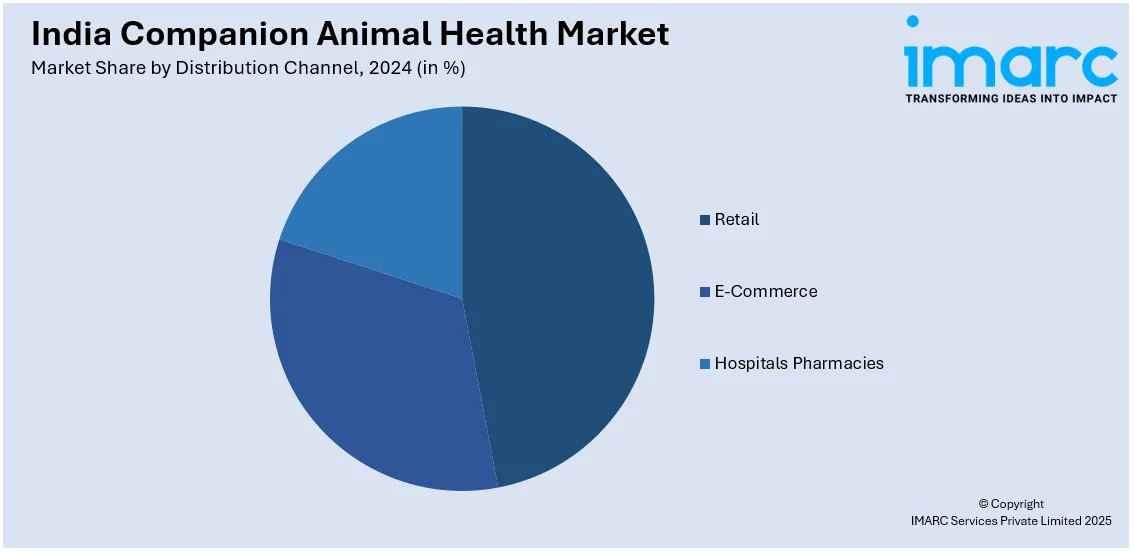

Distribution Channel Insights:

- Retail

- E-Commerce

- Hospitals Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail, e-commerce, and hospitals pharmacies.

End Use Insights:

- Point-of-care/In-house testing

- Hospitals and Clinics

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes point-of-care/in-house testing, hospitals and clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Companion Animal Health Market News:

- In September 2024, Bioveta, in partnership with Vetina Healthcare, introduced Biocan NOVEL canine vaccines in India, strengthening the companion animal health market. These vaccines protect dogs against rabies, distemper, parvovirus, and leptospirosis, enhancing preventive healthcare. This launch enhances veterinary care, pet wellness, and zoonotic disease control, advancing India's companion animal vaccination and pharmaceutical sector.

- In September 2024, Growel Group launched Carniwel, a premium pet food brand in India, offering high-protein and vegetarian options. The formulations include chicken, lamb, fish, Antarctic krill, algal oil, and spirulina for optimal pet nutrition. This expansion aligns with India's growing demand for premium pet food, strengthening the companion animal health market.

India Companion Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dogs, Equine, Cats, Others |

| Products Covered |

|

| Distribution Channels Covered | Retail, E-Commerce, Hospitals Pharmacies |

| End Uses Covered | Point-of-care/In-house testing, Hospitals and Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India companion animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the India companion animal health market on the basis of type?

- What is the breakup of the India companion animal health market on the basis of product?

- What is the breakup of the India companion animal health market on the basis of distribution channel?

- What is the breakup of the India companion animal health market on the basis of end use?

- What are the various stages in the value chain of the India companion animal health market?

- What are the key driving factors and challenges in the India companion animal health?

- What is the structure of the India companion animal health market and who are the key players?

- What is the degree of competition in the India companion animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India companion animal health market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India companion animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India companion animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)